Is MFF Financial safe?

Business

License

Is MFF Financial a Scam?

Introduction

MFF Financial, a broker operating in the forex market, has garnered attention since its inception in 2019. Positioned as a platform for both novice and experienced traders, MFF Financial promotes itself as a reliable option for those looking to engage in forex trading. However, the importance of thoroughly evaluating forex brokers cannot be overstated, especially given the prevalence of scams in the industry. Traders need to ensure that their chosen broker is trustworthy, regulated, and offers fair trading conditions. This article investigates MFF Financial's legitimacy by examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The analysis is based on a comprehensive review of various online sources, user testimonials, and expert evaluations.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy and safety for traders. MFF Financial operates without regulation from any recognized financial authority, which raises significant concerns about its credibility and the level of protection it offers to clients. Below is a summary of the regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Australia | Unverified |

The absence of regulation means that MFF Financial does not adhere to the stringent standards set by financial authorities, which are designed to protect investors. Regulated brokers are typically required to maintain a minimum capital, conduct regular audits, and keep client funds in segregated accounts. The lack of such oversight increases the risk of fraudulent activities, making it crucial for potential clients to approach MFF Financial with caution. Historically, unregulated brokers have been linked to numerous complaints and scams, which further emphasizes the importance of selecting a regulated entity for trading.

Company Background Investigation

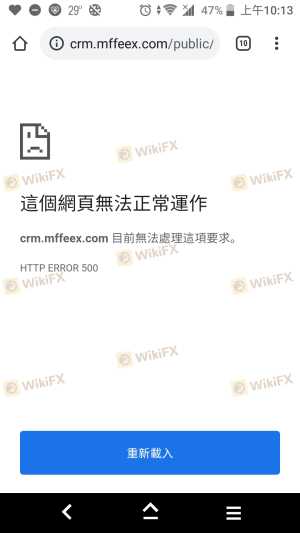

MFF Financial was established in 2019 and claims to operate out of Australia. However, the specifics of its ownership structure and management team remain unclear. This lack of transparency is concerning, as it makes it difficult for potential clients to assess the qualifications and experience of those behind the broker. A reliable broker typically provides detailed information about its founders and key personnel, including their professional backgrounds and expertise in the financial industry.

In terms of transparency, MFF Financial's website offers limited information about its operations, which is a red flag for potential investors. A trustworthy broker should be forthcoming with details about its business model, ownership, and regulatory compliance. The absence of such information can lead to skepticism regarding the broker's intentions and overall legitimacy.

Trading Conditions Analysis

MFF Financial's trading conditions are another crucial aspect to consider. The broker offers a variety of trading instruments through the popular MetaTrader 4 platform. However, the overall fee structure and any unusual charges require careful examination. Below is a comparison of core trading costs:

| Fee Type | MFF Financial | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.5 pips | 1.2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While MFF Financial claims to offer competitive spreads, the lack of clarity regarding commissions and overnight interest can lead to hidden costs that may not be immediately apparent to traders. Furthermore, it is essential to understand any unusual fees that may be imposed, as these can significantly impact trading profitability. Traders should be cautious of brokers with vague fee structures, as they may exploit this ambiguity to charge excessive fees.

Client Funds Safety

The safety of client funds is paramount in forex trading. MFF Financial's approach to safeguarding client money is a vital aspect of its overall trustworthiness. Unfortunately, the broker does not provide sufficient information regarding its client fund protection measures. A responsible broker typically maintains segregated accounts to ensure that client funds are kept separate from operational funds, thus providing an additional layer of security.

Moreover, the absence of investor protection schemes raises concerns about the potential loss of funds in the event of financial difficulties faced by the broker. Historical complaints regarding fund withdrawal issues further exacerbate these concerns, indicating a potential lack of accountability and reliability. Traders should be particularly wary of brokers that do not prioritize the safety of client funds, as this can lead to significant financial losses.

Customer Experience and Complaints

Analyzing customer feedback is essential to understanding a broker's reputation and reliability. Reviews for MFF Financial reveal a mixed bag of experiences, with several users expressing dissatisfaction regarding withdrawal delays and customer service responsiveness. Below is a summary of common complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Delays | Medium | Inconsistent |

| Account Access Problems | High | Unresolved |

Several users have reported being unable to withdraw their funds, with some waiting for months without any feedback from the broker. This pattern of complaints raises serious concerns about MFF Financial's commitment to customer service and the overall reliability of its operations. Additionally, the quality of the company's responses to complaints has been criticized, suggesting a lack of adequate support for traders facing issues.

Platform and Trade Execution

The performance of the trading platform is a critical factor for traders. MFF Financial utilizes the MetaTrader 4 platform, which is known for its user-friendly interface and robust features. However, concerns regarding order execution quality, slippage, and potential manipulation have been raised by users. Traders have reported experiencing significant slippage during high volatility periods, which can adversely affect trading outcomes.

Moreover, any signs of platform manipulation, such as artificially widening spreads or refusing to execute trades, can be detrimental to a trader's experience and financial success. A reliable broker should provide a stable and transparent trading environment, ensuring that traders can execute their strategies without undue hindrance.

Risk Assessment

Engaging with MFF Financial carries several inherent risks. Below is a concise risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Stability Risk | High | History of withdrawal issues |

| Customer Service Risk | Medium | Slow and inconsistent response times |

Given the high regulatory risk and the concerning history of financial stability issues, traders should proceed with caution when considering MFF Financial as a trading partner. It is advisable to conduct thorough due diligence and explore alternative options with better regulatory standing and customer support.

Conclusion and Recommendations

In conclusion, MFF Financial raises several red flags that warrant caution. The absence of regulation, combined with a lack of transparency regarding company operations and customer fund safety, suggests that this broker may not be a reliable choice for traders. The numerous complaints regarding withdrawal issues and customer service further reinforce concerns about its legitimacy.

For traders seeking a safer trading environment, it is recommended to consider regulated brokers that prioritize client protection and offer transparent trading conditions. Alternatives such as Trade Nation and other well-regulated entities can provide peace of mind and a more secure trading experience. Ultimately, conducting thorough research and choosing a reputable broker is essential for safeguarding investments and ensuring a positive trading experience.

Is MFF Financial a scam, or is it legit?

The latest exposure and evaluation content of MFF Financial brokers.

MFF Financial Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MFF Financial latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.