Regarding the legitimacy of KVB forex brokers, it provides BAPPEBTI, JFX and WikiBit, (also has a graphic survey regarding security).

Is KVB safe?

Software Index

Risk Control

Is KVB markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT KVB FUTURES INDONESIA

Effective Date:

--Email Address of Licensed Institution:

info@kvb.co.idSharing Status:

No SharingWebsite of Licensed Institution:

www.kvb.co.idExpiration Time:

--Address of Licensed Institution:

Menara Sun Life Lantai 21 Unit G, Jl. DR. Ide Anak Agung Gde Agung Blok 6.3, Kawasan Mega Kuningan, Kel. Kuningan Timur, Kec. Setiabudi, Kota Jakarta Selatan - DKI Jakarta 12950Phone Number of Licensed Institution:

(021) 21689063Licensed Institution Certified Documents:

JFX Derivatives Trading License (AGN)

Jakarta Futures Exchange

Jakarta Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

KVB Futures Indonesia

Effective Date:

--Email Address of Licensed Institution:

info@kvb.co.idSharing Status:

No SharingWebsite of Licensed Institution:

www.kvb.co.idExpiration Time:

--Address of Licensed Institution:

Menara Sun Life, Lantai 21 Unit G, Jl. DR. Ide Anak Agung Gde Agung Blok 6.3, Kawasan Mega Kuningan, Kel. Kuningan Timur, Kec. Setiabudi, Jakarta Selatan 12950Phone Number of Licensed Institution:

021-21689063Licensed Institution Certified Documents:

Is KVB Safe or Scam?

Introduction

KVB, also known as KVB Kunlun, is a forex broker that has positioned itself as a global player in the financial markets, offering a variety of trading services including forex, commodities, and indices. Established in 2001, KVB has expanded its operations across multiple jurisdictions, aiming to cater to a diverse clientele. However, as with any financial service provider, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with potential risks, and assessing the legitimacy and reliability of a broker is paramount in safeguarding investments. This article aims to provide an objective evaluation of KVB by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk profile.

Regulation and Legitimacy

KVB operates under a complex regulatory framework, which is essential for ensuring the safety and legality of its operations. Regulation serves as a safeguard for traders, providing a layer of oversight that can protect against fraud and malpractice. Below is a summary of KVB's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Anjouan Offshore Finance Authority (AOF) | L15626/KVB | Comoros | Valid |

| Financial Conduct Authority (FCA) | 1017430 | UK (Appointed Representative) | Valid |

KVB is regulated by the Anjouan Offshore Finance Authority (AOF) and is an appointed representative under the Financial Conduct Authority (FCA) in the UK. While the AOF is considered a less stringent regulator compared to others like the FCA, it still imposes certain requirements on KVB to ensure it operates within legal boundaries. The FCA's oversight adds an additional layer of credibility, as it is known for its rigorous standards. However, past regulatory issues, including the revocation of licenses in Hong Kong, raise concerns about KVB's compliance history. It is essential for potential clients to consider these factors when evaluating the broker's legitimacy.

Company Background Investigation

KVB Kunlun Financial Group Ltd has a history that dates back over two decades. Founded in 2001, the company has evolved from a regional player to a global financial services provider, establishing multiple offices across Asia, Oceania, and North America. The ownership structure of KVB is complex, with several subsidiaries operating under its umbrella, including KVB Kunlun Pty Ltd and KVB Global Capital Ltd.

The management team consists of experienced professionals with backgrounds in finance, trading, and technology, contributing to the broker's strategic direction. The company has made efforts to maintain transparency, providing information about its services and regulatory compliance on its website. However, the level of information disclosure could be improved, as some users have reported difficulties in obtaining clear answers to their queries.

Trading Conditions Analysis

KVB offers a competitive trading environment, but the overall fee structure deserves careful examination. The broker provides various account types, each with its own fee structure. Below is a comparison of KVB's core trading costs:

| Fee Type | KVB | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.0-2.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | Varies | Varies |

KVB's spread on major currency pairs starts at 1.3 pips, which is within the industry average but may not be the most competitive. The commission structure is variable, leading to potential unpredictability in trading costs. Additionally, the broker's overnight interest rates can vary, which may impact traders who hold positions overnight. Traders should be aware of these costs and read the fine print to avoid unexpected charges.

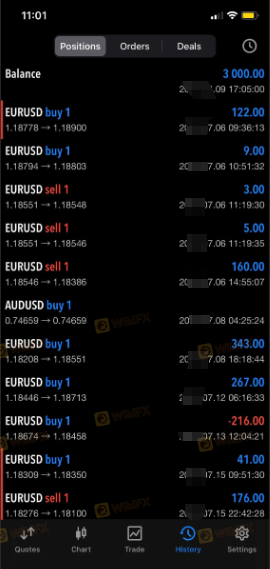

Customer Fund Safety

Safety of client funds is a critical aspect of any brokerage. KVB claims to employ robust measures to ensure the security of client deposits. Funds are held in segregated accounts, which means that client money is kept separate from the broker's operational funds. This practice is designed to protect traders in case of the broker's insolvency.

KVB also offers negative balance protection, which is a significant advantage for traders, as it prevents them from losing more than they have deposited. However, there have been historical concerns regarding fund safety, with reports of delayed withdrawals and difficulties in accessing funds. It is vital for potential clients to consider these factors when assessing the safety of their investments with KVB.

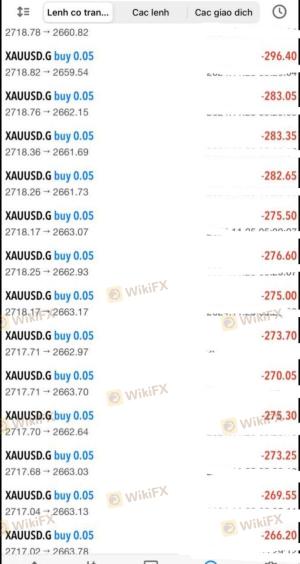

Customer Experience and Complaints

Customer feedback provides valuable insights into the reliability of a broker. User experiences with KVB have been mixed, with some traders reporting positive interactions, while others have raised serious concerns. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response, unresolved |

| Slippage and Execution Delays | Medium | Mixed responses |

| Customer Support Quality | Medium | Inconsistent |

Many users have expressed frustration over withdrawal delays and lack of effective communication from customer support. A significant number of complaints revolve around difficulties in accessing funds, which can be a red flag for potential clients. On the other hand, some users have reported satisfactory experiences, particularly regarding the trading platform's functionality and ease of use.

Platform and Execution

KVB offers multiple trading platforms, including MetaTrader 4 (MT4) and its proprietary platform. The performance of these platforms is generally stable, but issues such as slippage and order execution delays have been reported. Traders should be aware that the quality of execution can significantly impact their trading outcomes.

The order execution quality appears to vary, with some users experiencing significant slippage during volatile market conditions. This inconsistency can be detrimental, particularly for scalpers and day traders who rely on precise execution. There have also been allegations of platform manipulation, which warrant further investigation.

Risk Assessment

Engaging with KVB presents several risks that traders should consider. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Potential issues with compliance history. |

| Fund Safety Risk | High | Historical withdrawal issues and delayed access to funds. |

| Execution Risk | Medium | Reports of slippage and execution delays. |

To mitigate these risks, traders should conduct thorough research, maintain realistic expectations, and consider diversifying their investments. Additionally, utilizing risk management tools such as stop-loss orders can help safeguard against potential losses.

Conclusion and Recommendations

In conclusion, KVB presents a mixed picture. While it is regulated and offers a variety of trading options, historical issues related to fund safety and customer service raise concerns. Traders should approach KVB with caution, particularly if they are new to the forex market or require high levels of customer support. It may be wise to explore alternative brokers with stronger reputations and more robust customer service records.

For those considering KVB, it is essential to stay informed about potential risks and to ensure that the broker's offerings align with your trading needs and risk tolerance. Alternative brokers worth considering include those with a proven track record of reliability and customer satisfaction.

Is KVB a scam, or is it legit?

The latest exposure and evaluation content of KVB brokers.

KVB Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KVB latest industry rating score is 6.16, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.16 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.