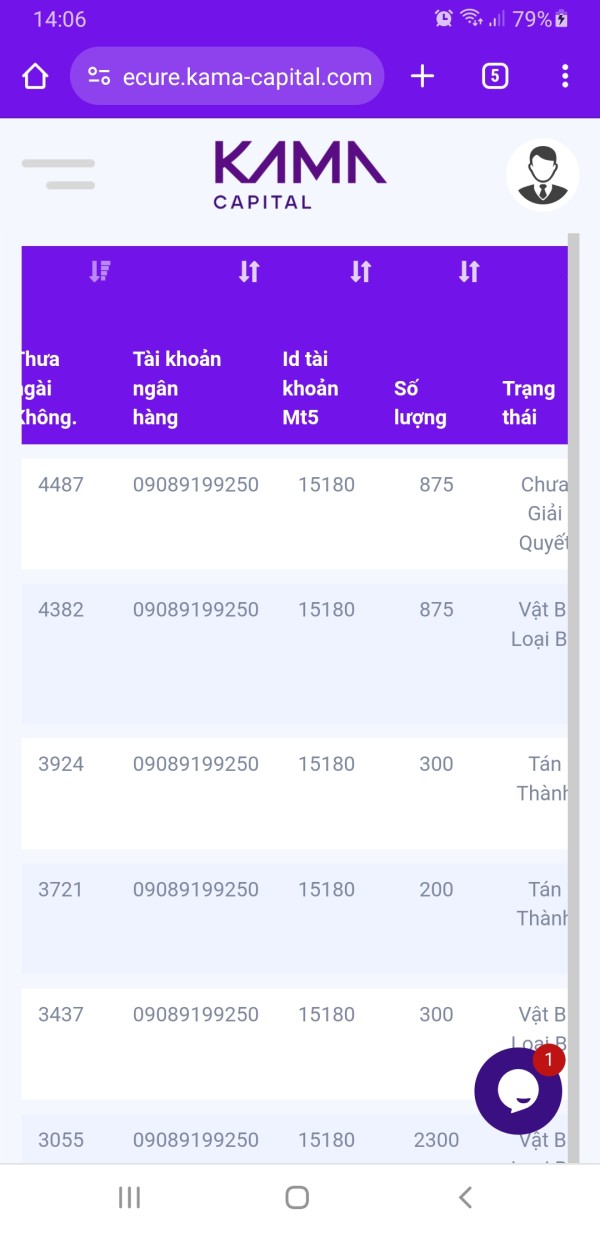

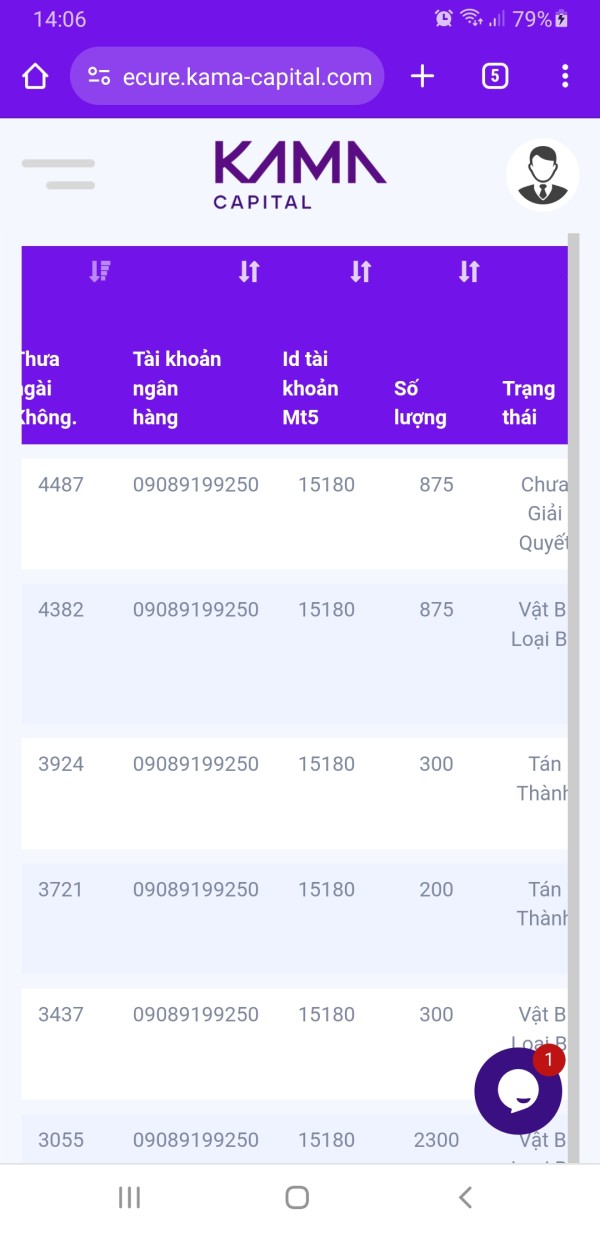

Kama Capital 2025 Review: Everything You Need to Know

Executive Summary

Kama Capital review shows a new forex broker that started in 2022. The trading community has mixed feelings about this company. This detailed analysis looks at a broker that follows UAE Securities and Commodities Authority (SCA) rules and offers STP and ECN trading models for forex markets.

The broker wants to attract forex traders and clients who need investment help and financial planning services. It competes with other brokers in the Middle East. Kama Capital has offices in both the UAE and Saint Vincent and the Grenadines, so it serves traders from many countries.

User reviews show very different opinions about the company. About 68% of users gave 5-star ratings while 28% gave only 1-star ratings. This shows that customer happiness varies a lot. The broker offers leverage up to 1:100 and needs a minimum deposit of $500 USD, which puts it in the middle range for account access.

The UAE Securities and Commodities Authority provides regulatory oversight, which gives the company some legitimacy. However, users have complained about service quality and customer support problems. The broker focuses on forex trading with about 40 currency pairs, which shows it specializes rather than offering many different trading options.

Important Notice

Kama Capital works in multiple countries and has headquarters in the United Arab Emirates and Saint Vincent and the Grenadines. Future clients should think carefully about the different legal and regulatory rules in each place. Terms of service, investor protections, and regulatory oversight can be very different between these locations.

This review uses detailed analysis of user feedback and public company information to give potential clients objective market insights. All assessments show available data from early 2025 and should be considered with current market conditions and individual trading needs. Readers should do their own research and think about their specific financial situations before making any trading decisions.

Rating Framework

Broker Overview

Kama Capital started in the forex brokerage business in 2022. The company set up operations in two key places - the United Arab Emirates and Saint Vincent and the Grenadines. The company says it specializes in forex trading and focuses mainly on currency markets while offering investment management and financial planning services along with its main trading operations.

The broker uses an STP (Straight Through Processing) and ECN (Electronic Communication Network) business model. This approach aims to give clients clear and efficient trading execution. This method should ensure that client orders go directly to liquidity providers without dealer interference, which could reduce conflicts of interest between the broker and its clients.

Kama Capital review data shows the company has offices in Dubai and Kingstown. This reflects its dual-location approach to serving international markets. The broker started recently, so it doesn't have the long track record of more established competitors, but its regulatory compliance shows it wants to operate within recognized frameworks.

The company focuses on about 40 forex currency pairs, which suggests a concentrated approach rather than the diverse asset offerings typical of larger brokers. This specialization might appeal to dedicated forex traders but could limit appeal for clients who want exposure to commodities, indices, or cryptocurrency markets. The lack of detailed information about additional asset classes in available materials suggests forex remains the main focus of their trading services.

Regulatory Jurisdiction: Kama Capital operates under the oversight of the UAE Securities and Commodities Authority (SCA) with license number 20200000239. This regulatory framework provides a recognized standard of oversight, though clients should verify current regulatory status directly with the authority.

Deposit and Withdrawal Methods: Specific deposit and withdrawal methods are not detailed in available information summaries. Potential clients need to contact the broker directly for complete payment processing details.

Minimum Deposit Requirements: The broker requires a minimum initial deposit of $500 USD. This puts it in the mid-range accessibility category compared to industry standards where minimums can range from $10 to $10,000 or more.

Bonus and Promotional Offers: Available information summaries do not mention specific bonus or promotional activities. This suggests either limited promotional strategies or lack of detailed public disclosure of such programs.

Tradeable Assets: The primary focus centers on forex trading with about 40 currency pairs available. Information about other asset classes such as CFDs, commodities, indices, or cryptocurrencies is not specified in available materials.

Cost Structure: Specific details about spreads and commission structures are not provided in the information summaries. This represents a significant information gap for potential clients evaluating trading costs.

Leverage Ratios: Maximum leverage is capped at 1:100. This aligns with many regulated jurisdictions' requirements for retail client protection while still providing meaningful trading flexibility.

Platform Options: Available information does not specify the trading platforms offered. This leaves questions about whether proprietary or third-party platforms like MetaTrader are used.

Geographic Restrictions: Specific geographic limitations are not detailed in available information summaries.

Customer Service Languages: The range of languages supported by customer service is not specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

Kama Capital review of account conditions shows a mixed picture that puts the broker in the average category. The $500 USD minimum deposit requirement represents a moderate entry barrier. This may exclude some new traders while remaining accessible to serious retail participants. This threshold sits comfortably in the middle range of industry standards, neither particularly restrictive nor exceptionally accessible.

The 1:100 maximum leverage ratio shows compliance with modern regulatory standards while providing enough flexibility for most trading strategies. This conservative approach to leverage may disappoint traders used to higher ratios but reflects responsible risk management practices aligned with regulatory expectations.

However, significant information gaps about account types, specific features, and opening procedures limit the ability to provide a complete assessment. The absence of details about Islamic accounts, professional trading accounts, or specialized features represents a transparency concern for potential clients requiring specific account configurations.

User feedback suggests some concerns about minimum deposit requirements. Several traders noted the threshold as higher than preferred for initial market entry. The lack of detailed account tier information makes it difficult for potential clients to understand progression opportunities or enhanced features available at higher deposit levels.

The tools and resources evaluation for this Kama Capital review shows concerning gaps in available information that significantly impact the assessment. The absence of detailed information about trading tools, analytical resources, and educational materials suggests either limited offerings or inadequate transparency in communicating available resources.

Research and analysis capabilities appear limited based on available information. There is no mention of market analysis, economic calendars, or professional research reports. For traders who rely heavily on fundamental and technical analysis, this represents a significant limitation compared to full-service brokers offering comprehensive research departments.

Educational resources are not detailed in available materials. This potentially disadvantages new traders who require guided learning experiences. The modern forex market increasingly expects brokers to provide educational content, webinars, and training materials as standard offerings.

Automated trading support capabilities remain unclear. There is no specific information about Expert Advisor compatibility, copy trading features, or algorithmic trading infrastructure. This uncertainty may deter systematic traders or those seeking to implement automated strategies.

User feedback indicates disappointment with the limited range of available tools. Several traders noted the absence of advanced charting capabilities and analytical resources typically expected from contemporary forex brokers.

Customer Service and Support Analysis (Score: 4/10)

Customer service represents a significant weakness in this Kama Capital review. User feedback indicates substantial inconsistencies in support quality and responsiveness. The polarized user ratings - 68% five-star versus 28% one-star - suggest highly variable service experiences that may depend on individual circumstances or timing.

Response times appear problematic based on user testimonials. Multiple reports show delayed responses to customer inquiries. In the fast-paced forex market, slow customer service can significantly impact trading outcomes and client satisfaction, representing a critical operational weakness.

Service quality inconsistency emerges as a recurring theme in user feedback. Some clients report excellent support while others describe frustrating experiences with unresolved issues. This variability suggests potential training or resource allocation problems within the customer service department.

Available information does not specify customer service channels, operating hours, or multilingual support capabilities. This creates uncertainty about accessibility and convenience for international clients. Modern traders expect multiple contact methods including live chat, phone support, and email assistance with clearly defined response time commitments.

The absence of detailed information about customer service infrastructure, combined with negative user feedback about responsiveness, contributes to below-average performance in this critical area of broker operations.

Trading Experience Analysis (Score: 6/10)

The trading experience assessment for this Kama Capital review faces significant limitations due to insufficient specific information about platform performance, execution quality, and user interface design. Without detailed platform specifications, it becomes challenging to evaluate the core trading environment that clients will encounter.

Platform stability and execution speed data are not available in the information summaries. This leaves questions about system reliability during high-volatility periods when consistent performance becomes critical. The STP and ECN business model suggests potential for good execution quality, but without specific performance metrics, this remains theoretical.

Order execution quality information is notably absent. There are no details about slippage rates, rejection frequencies, or execution speeds. These factors significantly impact trading profitability and user satisfaction, making their absence a substantial information gap for potential clients.

Mobile trading capabilities are not detailed in available materials. This represents a significant oversight given the importance of mobile access in contemporary trading. Most serious traders require robust mobile platforms for market monitoring and trade management while away from their primary trading stations.

User feedback about trading experience varies considerably. Some clients report satisfactory performance while others indicate areas requiring improvement. This mixed response pattern suggests inconsistent platform performance or varying user expectations and experience levels.

Trust and Security Analysis (Score: 7/10)

Trust and security represent relative strengths in this Kama Capital review. This is primarily due to regulatory oversight by the UAE Securities and Commodities Authority (SCA) under license number 20200000239. This regulatory framework provides a foundation of legitimacy and suggests compliance with recognized operational standards.

The UAE regulatory environment offers reasonable investor protections. However, it may not match the comprehensive safeguards provided by top-tier jurisdictions like the UK's FCA or Australia's ASIC. Nevertheless, SCA oversight demonstrates commitment to operating within established regulatory frameworks rather than in unregulated environments.

However, specific fund safety measures are not detailed in available information. This leaves questions about segregated accounts, deposit insurance, and client fund protection protocols. Modern traders expect clear disclosure of how their funds are protected and what recourse exists in case of broker insolvency.

Company transparency appears limited based on available information. There is insufficient detail about corporate structure, ownership, and operational procedures. Enhanced transparency would strengthen client confidence and demonstrate commitment to open business practices.

While no major negative events are highlighted in available materials, the mixed user feedback suggests some clients have concerns about service delivery and operational consistency. However, these appear related to service quality rather than fundamental trust issues.

User Experience Analysis (Score: 5/10)

User experience evaluation for this Kama Capital review shows significant variability in client satisfaction. This is reflected in the stark contrast between positive and negative user ratings. The 68% five-star versus 28% one-star rating distribution suggests highly polarized experiences that may depend on individual circumstances or service delivery inconsistencies.

Interface design and usability information is not provided in available materials. This makes it impossible to assess the quality of user interfaces for both web and mobile platforms. Modern traders expect intuitive, responsive designs that facilitate efficient trade execution and account management.

Registration and verification processes are not detailed in available information. This leaves questions about onboarding efficiency and documentation requirements. Streamlined account opening procedures significantly impact initial user experience and can influence client acquisition success.

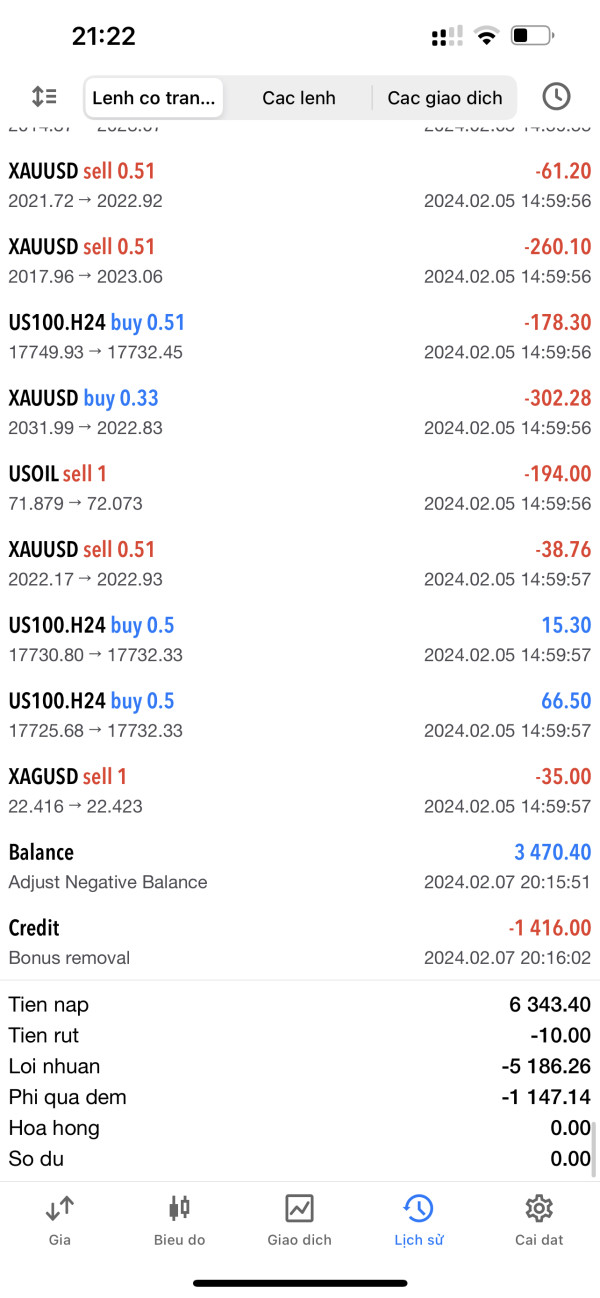

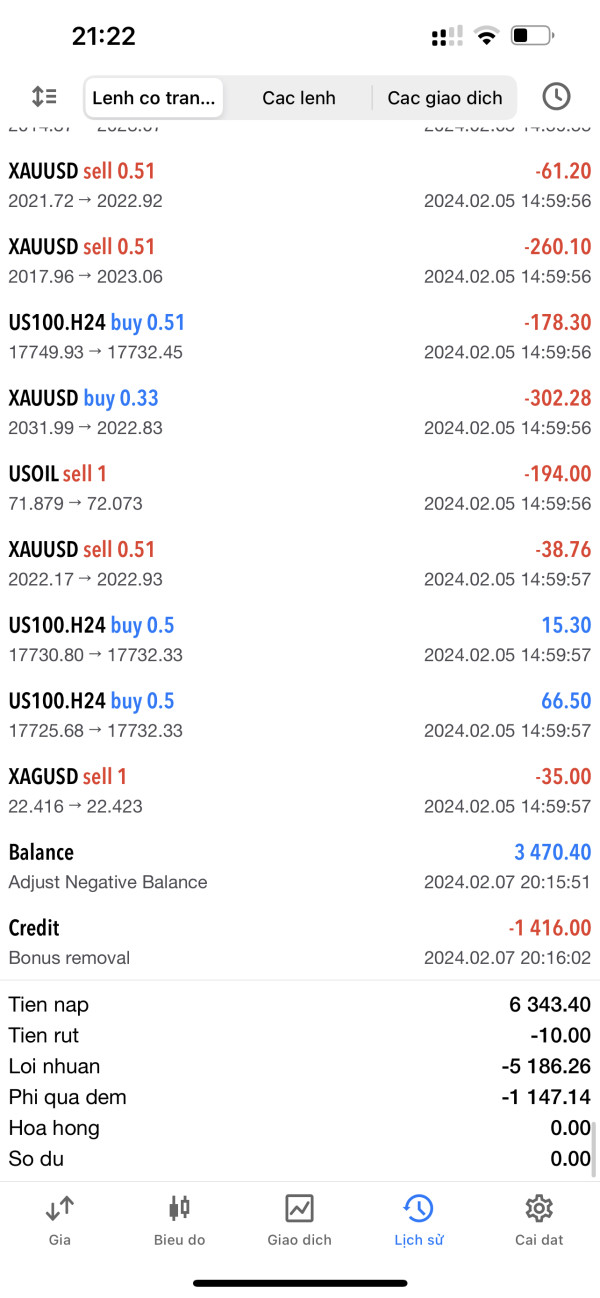

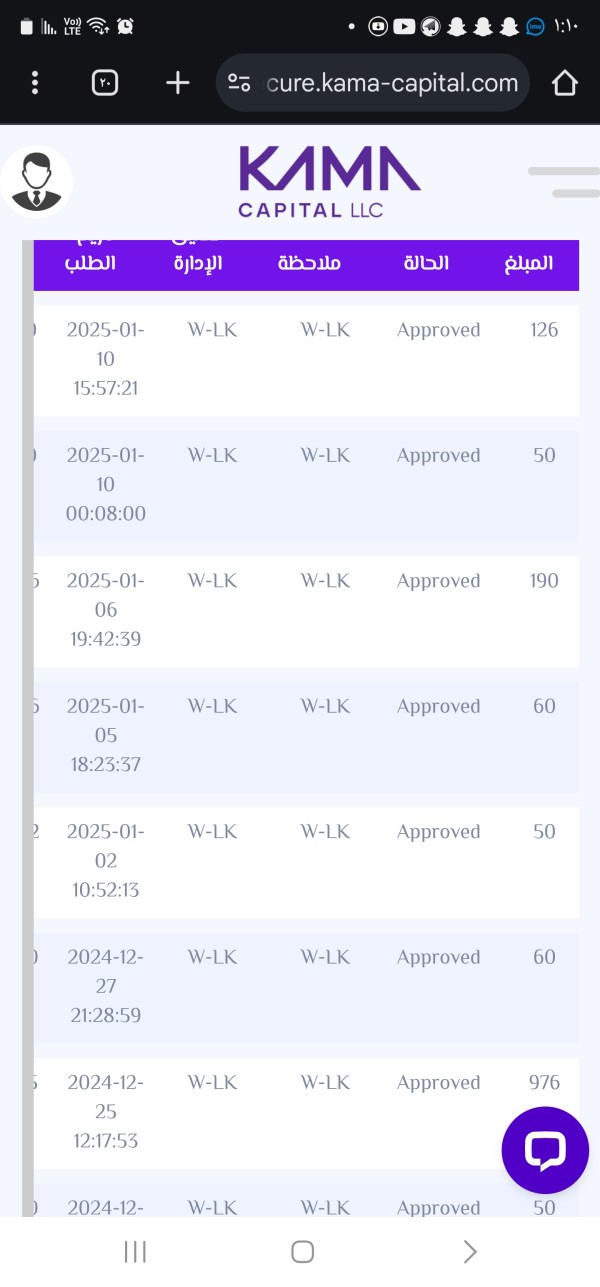

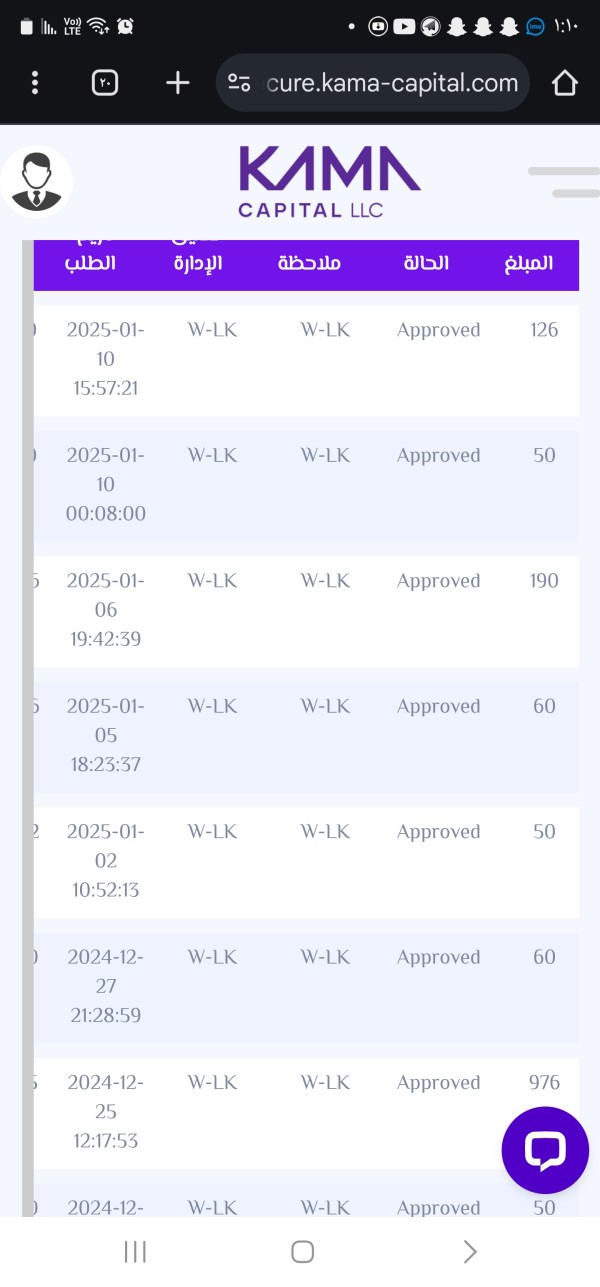

Fund operation experiences are not specifically addressed in available materials. However, this represents a critical component of overall user satisfaction. Efficient, transparent deposit and withdrawal processes are essential for maintaining positive client relationships.

Common user complaints center around service quality and response times. Multiple reports show frustration about customer support interactions. The polarized feedback suggests that while some clients receive satisfactory service, others encounter significant difficulties that substantially impact their overall experience.

The user profile appears to focus on forex traders and investment management clients. However, the mixed feedback indicates that service delivery may not consistently meet the expectations of these target demographics. This suggests operational improvements could enhance overall user satisfaction.

Conclusion

This comprehensive Kama Capital review shows a young forex broker with regulatory credentials but significant operational challenges that impact client satisfaction. While the UAE Securities and Commodities Authority oversight provides legitimacy, the mixed user feedback and information gaps suggest areas requiring substantial improvement.

The broker appears most suitable for forex traders comfortable with mid-range deposit requirements and basic trading services. However, the lack of detailed platform information and tools may disappoint more sophisticated traders. Clients seeking investment management and financial planning services may find value, but should carefully evaluate service quality expectations against reported user experiences.

Primary strengths include regulatory compliance and focused business model. Notable weaknesses include customer service consistency, transparency in operational details, and comprehensive tool offerings. Potential clients should conduct thorough due diligence and consider alternative options before committing significant capital to this relatively new market participant.