Regarding the legitimacy of Japan Bond forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is Japan Bond safe?

Pros

Cons

Is Japan Bond markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

日本相互証券株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都千代田区外神田1-18-13Phone Number of Licensed Institution:

03-6260-7676Licensed Institution Certified Documents:

Is Japan Bond Safe or Scam?

Introduction

Japan Bond has positioned itself as a notable player in the foreign exchange market, particularly focusing on bond trading. Established in 1973, the company aims to serve both individual and institutional clients by offering a range of financial services. However, with the proliferation of online trading platforms, it is essential for traders to exercise caution and thoroughly evaluate the legitimacy and safety of their chosen brokers. This article investigates whether Japan Bond is a safe option or a potential scam, utilizing a comprehensive framework that includes regulatory status, company background, trading conditions, client fund security, customer experiences, and risk assessment.

Regulatory and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety and legitimacy. Japan Bond is regulated by the Financial Services Agency (FSA) of Japan, which is known for its stringent oversight of financial institutions. This regulatory framework is designed to protect investors and ensure that brokers adhere to strict operational standards. Below is a summary of the core regulatory information for Japan Bond:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Agency (FSA) | 136号 | Japan | Verified |

The FSA's oversight is crucial because it mandates regular audits and compliance checks, ensuring that brokers like Japan Bond maintain high standards of transparency and accountability. Additionally, Japan Bond has not reported any significant regulatory infractions, which further supports its credibility. However, it is important to note that not all regulatory bodies have the same level of strictness, and traders should always do their due diligence when selecting a broker. In the case of Japan Bond, its long-standing relationship with the FSA adds a layer of security, making it less likely to engage in fraudulent practices.

Company Background Investigation

Japan Bond Trading Co., Ltd. has a rich history in the financial sector, having been founded over 50 years ago. The company has evolved significantly, adapting to market demands and technological advancements. The ownership structure of Japan Bond is transparent, with clear documentation available regarding its operations and management. The management team consists of experienced professionals with backgrounds in finance and trading, which contributes to the firm's credibility.

However, the level of transparency regarding the companys financial health and operational specifics could be improved. While Japan Bond provides some information about its services, potential clients may find it challenging to access detailed financial statements or performance reports. This lack of disclosure could be a red flag for some investors, as transparency is a key indicator of a broker's legitimacy. Overall, Japan Bond's long history and regulatory compliance suggest that it is a legitimate company, but the transparency of information could be enhanced.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. Japan Bond offers a range of trading services, including bond trading, but the specifics of its fee structure are not always clearly outlined. The overall cost structure, including spreads and commissions, can significantly impact a trader's profitability. Below is a comparison of core trading costs:

| Fee Type | Japan Bond | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.5 pips | 1.0 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | 0.2% | 0.3% |

Japan Bond's spreads appear competitive compared to industry averages, which is a positive aspect for traders. However, the absence of a clear commission structure raises questions. Some users have reported unexpected fees, which could indicate a lack of clarity in the broker's policies. It's essential for traders to read the fine print and understand all potential costs before committing to trading with Japan Bond.

Client Fund Safety

The safety of client funds is paramount in evaluating a broker's reliability. Japan Bond maintains stringent measures to protect client investments, including segregating client funds from the company's operational funds. This practice ensures that even in the event of financial difficulties, client capital remains secure. Furthermore, Japan Bond adheres to investor protection guidelines established by the FSA, which adds another layer of security.

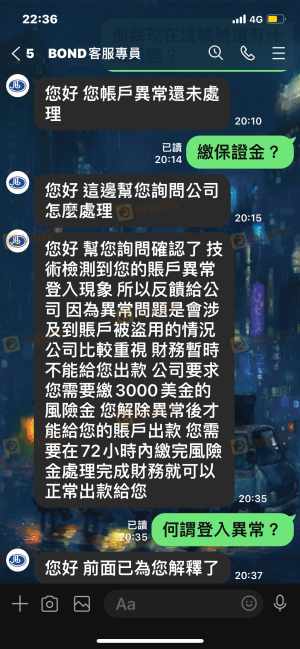

However, there have been isolated incidents where clients reported difficulties in withdrawing funds, raising concerns about the broker's operational integrity. These issues highlight the importance of transparency and effective communication between the broker and its clients. Overall, while Japan Bond has established protocols to safeguard client funds, the reported withdrawal issues suggest that potential clients should proceed with caution.

Customer Experience and Complaints

Customer feedback plays a significant role in assessing a broker's reputation. Reviews of Japan Bond are mixed, with some clients praising its services while others have raised concerns about withdrawal processes and customer support. Common complaints include difficulties in accessing funds and slow response times from customer service. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow |

| Customer Service | Medium | Average |

One notable case involved a client who reported being unable to withdraw funds after multiple attempts, claiming that the platform indicated incorrect account details. This experience raises questions about the reliability of Japan Bond's operational processes. While some clients have had positive experiences, the recurring nature of withdrawal complaints necessitates caution for potential investors.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Japan Bond utilizes its proprietary trading platform, which has been designed to facilitate efficient bond trading. Users have reported that the platform is generally stable and user-friendly; however, there have been instances of slippage and order rejections, which can be detrimental to traders.

The quality of order execution is a critical aspect of trading, and Japan Bond's platform aims to provide quick and reliable trade execution. However, any signs of potential manipulation or systematic issues should be closely monitored by users. Overall, while the platform appears to function well for most users, the reported issues raise concerns that potential traders should consider.

Risk Assessment

Using Japan Bond involves various risks that traders should be aware of. Below is a risk assessment summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Regulated by FSA |

| Operational Risk | Medium | Withdrawal issues reported |

| Market Risk | High | Bond market volatility |

To mitigate these risks, traders should conduct thorough research, utilize risk management strategies, and consider starting with a demo account to familiarize themselves with the platform. Additionally, maintaining open communication with customer support can help address any concerns promptly.

Conclusion and Recommendations

In conclusion, while Japan Bond is regulated by the FSA and has a long-standing presence in the financial market, potential clients should remain vigilant. The mixed customer feedback, particularly regarding withdrawal issues, raises concerns about the broker's reliability. Therefore, it is crucial for traders to exercise caution and conduct their own due diligence.

For those considering trading with Japan Bond, it may be beneficial to start with smaller investments and closely monitor the trading experience. Additionally, traders may want to explore alternative brokers with a stronger reputation for customer service and fund safety. Some recommended alternatives include brokers regulated by more stringent authorities or those with a proven track record in customer satisfaction.

Is Japan Bond a scam, or is it legit?

The latest exposure and evaluation content of Japan Bond brokers.

Japan Bond Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Japan Bond latest industry rating score is 7.87, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.87 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.