Japan Bond 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive japan bond review examines the current landscape of Japanese government bond trading and investment opportunities in 2025. The review is based on available market information and shows that the Japanese bond market presents a complex investment environment with unique monetary policy dynamics and institutional leadership. Nomura Securities maintains its position as Japan's largest independent securities firm with approximately 30% market share. The firm serves as a key gateway for international investors seeking exposure to Japanese debt instruments.

The Bank of Japan recently decided to slow the pace of bond purchase reductions while maintaining the policy rate at 0.5%. This decision has created an interesting dynamic for both institutional and individual investors. This japan bond review provides a neutral assessment of the current market conditions. The review recognizes that specific trading terms and comprehensive user feedback remain limited in publicly available sources. The primary target audience includes institutional investors, sovereign wealth funds, and individual investors seeking diversification through Japanese government securities.

Nomura's market leadership provides some confidence in execution capabilities. However, the lack of detailed information about trading conditions, fees, and user experiences necessitates careful due diligence for potential investors.

Important Notice

This evaluation acknowledges significant regional differences in how Japanese bonds are accessed and traded across different jurisdictions. International investors should be aware that the Bank of Japan's monetary policy decisions may have varying impacts on overseas investment perspectives and access mechanisms. Cross-border regulatory frameworks can differ substantially. These differences affect everything from settlement procedures to tax implications.

This japan bond review is based on publicly available information and market analysis rather than direct platform testing or comprehensive user surveys. Readers should conduct independent verification of all trading terms, regulatory compliance, and operational details before making investment decisions. The assessment reflects market conditions as of early 2025. The review may not capture real-time developments in this rapidly evolving sector.

Rating Framework

Note: Scoring is suspended due to insufficient detailed information in available source materials for objective assessment.

Broker Overview

Nomura Securities stands as Japan's largest independent securities company. The firm commands approximately 30% of the domestic market share according to available market data. The firm's extensive history and market presence position it as a primary conduit for international investors seeking exposure to Japanese government bonds and related securities. As a major player in the Japanese financial services sector, Nomura has established comprehensive infrastructure for bond trading and settlement operations.

The company's business model centers on securities and bond brokerage services. The firm shows particular strength in Japanese government bond distribution and secondary market trading. This japan bond review recognizes Nomura's institutional capabilities while noting that specific operational details about retail investor access and trading conditions remain unclear in publicly available information.

The Japanese government bond market itself represents one of the world's largest sovereign debt markets. The market offers various maturity profiles and yield characteristics. However, detailed information about trading platforms, minimum investment requirements, and fee structures for individual investors accessing these instruments through major brokers like Nomura is not comprehensively detailed in current source materials.

Regulatory Environment

Specific regulatory oversight details are not mentioned in available source materials. Japanese financial services operate under the Financial Services Agency framework. International investors should verify applicable regulations in their jurisdictions.

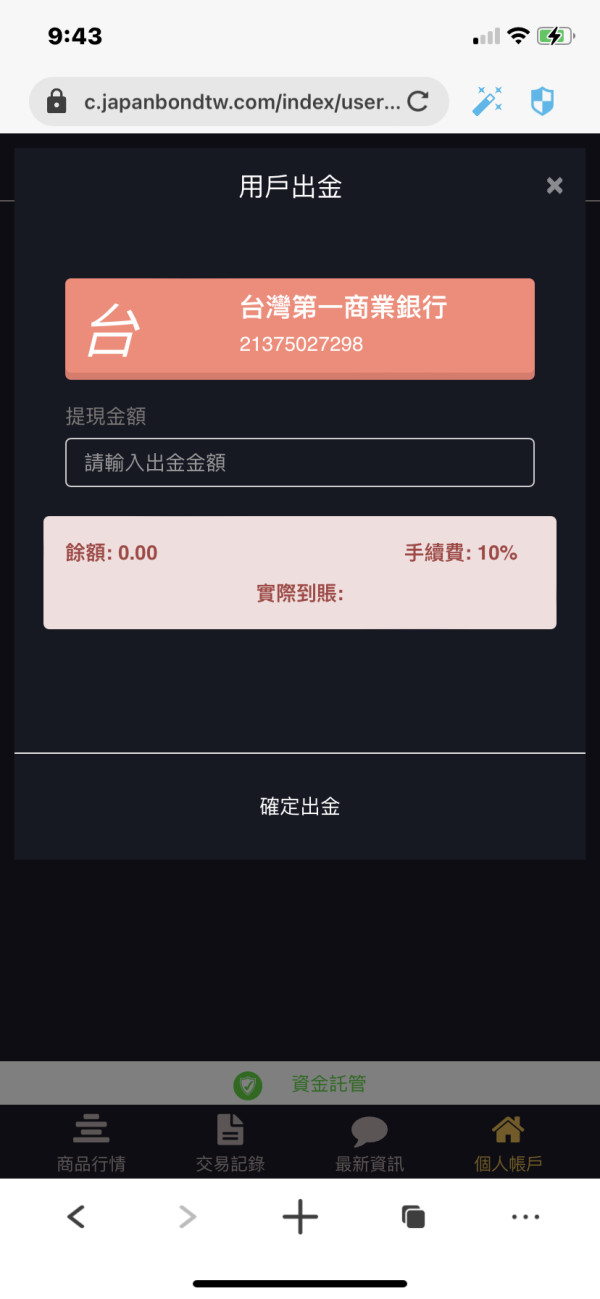

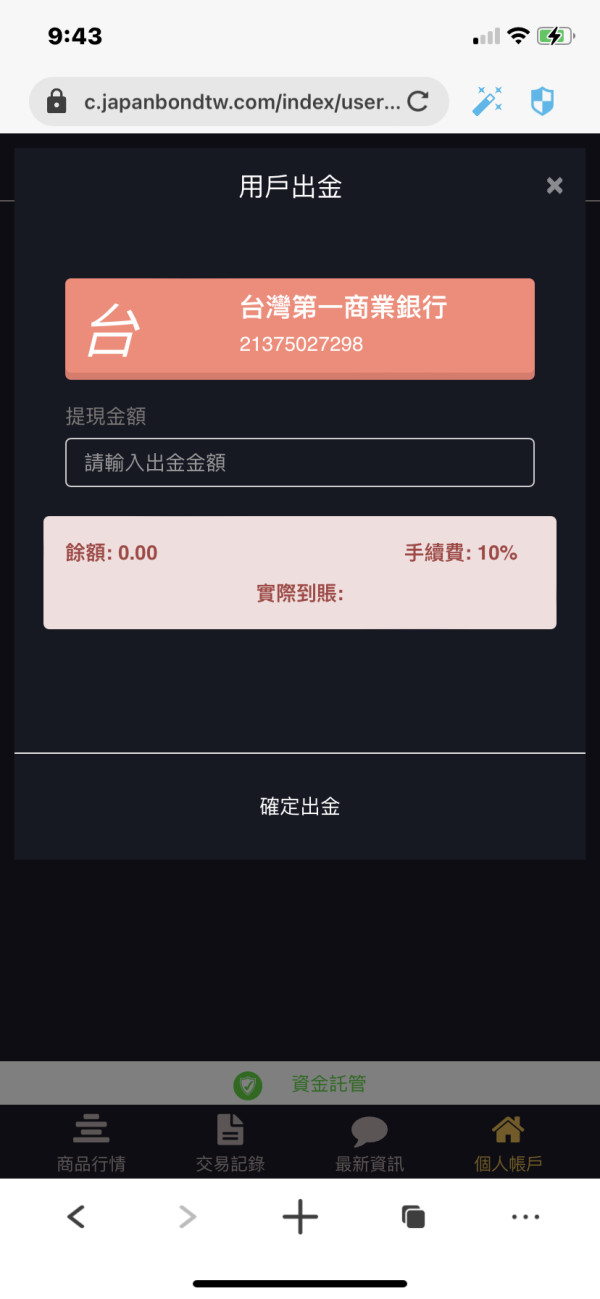

Deposit and Withdrawal Methods

Available sources do not specify the range of funding methods or withdrawal procedures for Japanese bond investments through major brokers.

Minimum Investment Requirements

Minimum deposit or investment thresholds are not detailed in the source materials reviewed for this analysis.

Current bonus structures or promotional incentives are not mentioned in available information sources.

Tradeable Assets

The primary focus centers on Japanese Government Bonds across various maturity periods. Specific instrument availability details are not comprehensively outlined in source materials.

Cost Structure

Fee schedules, commission rates, and other cost components are not specified in the available information. This represents a significant gap for potential investors.

Leverage Options

Leverage ratios and margin requirements for bond trading are not detailed in current source materials.

Trading platform specifications and technology infrastructure details are not mentioned in available sources.

Geographic Restrictions

Regional availability and access limitations are not specified in the source materials reviewed.

Customer Support Languages

Supported languages for customer service are not detailed in available information.

This japan bond review acknowledges these information gaps as areas requiring direct inquiry with service providers.

Account Conditions Analysis

The evaluation of account conditions for Japanese bond trading faces significant limitations due to insufficient detail in available source materials. Traditional institutional channels for Japanese government bond access typically involve substantial minimum investment thresholds. However, specific figures are not provided in current sources. Account opening procedures, documentation requirements, and verification processes remain unclear for both institutional and retail investors.

Different account types that may be available through major brokers like Nomura are not detailed in the source materials. This includes whether specialized international investor accounts, corporate accounts, or retail investor options exist with varying terms and conditions. The absence of information about Islamic-compliant account structures or other specialized offerings limits the scope of this assessment.

Settlement mechanisms, custody arrangements, and account maintenance requirements represent additional areas where specific information is lacking. International investors particularly need clarity on cross-border settlement procedures and any restrictions on fund repatriation. This japan bond review cannot provide definitive guidance on these crucial operational aspects due to source material limitations.

Potential investors must seek direct clarification from service providers regarding account structures, ongoing obligations, and any restrictions that may apply to their specific circumstances. This is necessary without access to detailed terms and conditions or user agreement documentation.

Assessment of trading tools and analytical resources for Japanese bond investment faces substantial constraints due to limited information in available sources. Major securities firms typically provide institutional-grade research and analysis capabilities. However, specific details about platform features, charting tools, or market data access are not outlined in current materials.

Research resources that might be available through established brokers could include economic analysis, yield curve modeling, and policy impact assessments. These capabilities are not specifically documented in source materials. Educational resources for investors new to Japanese bond markets are not detailed. This creates uncertainty about available learning materials and market guidance.

Automated trading support, algorithmic execution capabilities, and portfolio management tools represent additional areas where information is lacking. These features are increasingly important for institutional investors managing large bond portfolios. Yet their availability and sophistication levels are not addressed in available sources.

Risk management tools, scenario analysis capabilities, and hedging instrument access are not specified in current materials. The absence of detailed information about analytical tools and research resources represents a significant gap for investors seeking comprehensive market analysis and decision support systems.

Customer Service and Support Analysis

Evaluation of customer service quality and support infrastructure faces significant limitations due to absent user feedback and service level documentation in available sources. Major financial institutions typically maintain multiple communication channels including phone, email, and potentially digital platforms. However, specific availability is not confirmed in current materials.

Response time expectations, service hour coverage, and escalation procedures are not detailed in available information. International investors particularly require clarity about time zone coverage and language support capabilities. Yet these operational details are not specified in source materials.

Service quality metrics, customer satisfaction data, and problem resolution case studies are not available in current sources. This japan bond review cannot provide objective evaluation of support effectiveness or reliability without user testimonials or independent service assessments.

Specialized support for complex bond transactions, settlement issues, or regulatory compliance questions represents another area lacking detailed information. The sophistication of support staff knowledge and their ability to address technical questions about Japanese bond markets remains unclear based on available materials.

Trading Experience Analysis

Platform stability, execution speed, and overall trading environment assessment faces substantial constraints due to limited technical performance data in available sources. Major securities firms typically maintain robust trading infrastructure. However, specific platform capabilities and performance metrics are not detailed in current materials.

Order execution quality, including fill rates, slippage characteristics, and market access during volatile periods, is not documented in available sources. These factors are crucial for bond trading where timing and execution precision can significantly impact returns. Yet specific performance data is absent.

Platform functionality completeness, including order types, portfolio management features, and real-time market data access, is not specified in current materials. Mobile trading capabilities and cross-device synchronization represent increasingly important features that are not addressed in available information.

The overall trading environment, including market depth visibility, liquidity access, and institutional-quality execution, remains unclear based on source materials. This japan bond review cannot provide definitive assessment of trading experience quality without access to platform demonstrations or user performance feedback.

Trust and Security Analysis

Regulatory compliance and financial security assessment faces limitations due to insufficient regulatory detail in available source materials. Major Japanese securities firms operate under established regulatory frameworks. However, specific license numbers, regulatory standing, and compliance history are not detailed in current sources.

Fund security measures, including segregation policies, insurance coverage, and custody arrangements, are not specified in available materials. These protections are fundamental for institutional investors managing substantial bond portfolios. Yet their implementation details remain unclear.

Company transparency regarding financial reporting, operational procedures, and risk management practices is not addressed in available sources. Public disclosure quality and regulatory filing accessibility represent additional areas where specific information is lacking.

Industry reputation assessment requires access to peer evaluations, regulatory actions, and historical performance data not available in current source materials. Negative event handling, crisis management capabilities, and operational resilience during market stress periods are not documented in available information.

User Experience Analysis

Overall user satisfaction assessment faces significant constraints due to absent user feedback and experience documentation in available sources. Interface design quality, platform usability, and navigation efficiency cannot be evaluated without access to platform demonstrations or user testimonials.

Registration and verification process complexity, including documentation requirements and approval timeframes, is not detailed in available materials. These procedural aspects significantly impact user experience. This is particularly true for international investors navigating cross-border compliance requirements.

Fund operation experience, including deposit processing, withdrawal procedures, and transaction confirmation systems, is not specified in current sources. User complaint patterns, common issues, and resolution effectiveness remain unclear based on available information.

User demographic analysis and satisfaction surveys are not available in source materials. This limits understanding of client experience across different investor types and geographic regions. Interface customization options, personal preference settings, and accessibility features are not addressed in available information.

Conclusion

This japan bond review provides a neutral assessment of the Japanese government bond investment landscape in 2025. The review recognizes significant information gaps that limit comprehensive evaluation. While Nomura's market leadership position and the Bank of Japan's current monetary policy stance provide some market context, the absence of detailed operational information, user feedback, and specific trading terms necessitates careful due diligence.

The review is most suitable for investors seeking preliminary market orientation rather than definitive broker selection guidance. Institutional investors and individuals interested in Japanese bond exposure should conduct direct inquiries with service providers. This will help them obtain specific terms, conditions, and operational details not available in public sources.

Primary advantages include access to a major sovereign bond market through established institutional channels. Significant disadvantages center on information transparency limitations and unclear access conditions for different investor categories.