Is IQ OPTION BROKER safe?

Pros

Cons

Is IQ Option Broker Safe or a Scam?

Introduction

IQ Option is a well-known online trading platform that has gained significant traction in the forex market since its inception in 2013. With over 40 million registered users, IQ Option offers a diverse range of trading instruments including forex, cryptocurrencies, stocks, and options. However, the increasing popularity of trading platforms like IQ Option necessitates a cautious approach from traders. Evaluating the credibility and safety of a broker is crucial to protect ones investment and ensure a secure trading environment. In this article, we will explore various aspects of IQ Option, including its regulatory status, company background, trading conditions, customer fund safety, user experiences, and overall risk assessment to determine whether IQ Option is safe or potentially a scam.

Regulation and Legitimacy

Understanding the regulatory framework under which a broker operates is essential for assessing its legitimacy. IQ Option is regulated by the Cyprus Securities and Exchange Commission (CySEC), which provides a level of oversight that can enhance trader confidence. Below is a summary of its regulatory details:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 247/14 | Cyprus | Verified |

The CySEC regulation implies that IQ Option must adhere to strict guidelines concerning client fund protection, transparency, and fair trading practices. However, it is important to note that while IQ Option is regulated in Cyprus, its operations outside the European Economic Area (EEA) are conducted through an unregulated entity, which raises concerns about the safety of funds for international clients. The lack of top-tier regulation in major financial markets like the USA and UK further complicates the assessment of IQ Option's safety.

Company Background Investigation

IQ Option was founded in 2013 and is operated by IQ Option Ltd, based in Saint Vincent and the Grenadines. The company has experienced rapid growth, positioning itself as one of the leading online brokers in the industry. The management team consists of experienced professionals with backgrounds in finance and technology, which contributes to the platform's innovative features and user-friendly interface. However, the company's transparency regarding its ownership structure and management team has been criticized, with limited publicly available information.

The level of transparency is a critical factor for traders when choosing a broker. A reputable broker should provide clear information about its operations, management, and financial health. In the case of IQ Option, while it has made strides in improving its user experience, the lack of detailed disclosures about its ownership and operational structure may raise red flags for potential investors.

Trading Conditions Analysis

IQ Option offers competitive trading conditions, including a low minimum deposit of $10 and a wide range of tradable assets. However, the fee structure can be complex and may include hidden costs. Below is a comparison of core trading costs:

| Fee Type | IQ Option | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 0.6 - 1.0 pips | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.01% - 0.5% | 0.1% - 0.3% |

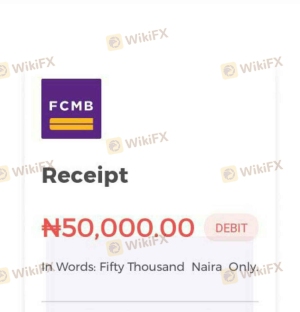

While IQ Option claims to have no commission on trades, the spreads can vary significantly based on market conditions. Additionally, users have reported high fees associated with bank wire withdrawals and inactivity fees of €10 after 90 days of inactivity, which may not be standard across other brokers. The complexity of the fee structure could potentially lead to unexpected costs for traders, making it essential to fully understand the terms before committing funds.

Customer Fund Safety

The safety of customer funds is paramount when evaluating whether IQ Option is safe. The broker employs several measures to protect client funds, including segregated accounts, which ensure that trader funds are kept separate from the company's operational funds. This practice is crucial in the event of financial difficulties faced by the broker.

Moreover, IQ Option is a member of the Investor Compensation Fund (ICF), which provides additional security for traders in the event of insolvency. However, there have been historical concerns regarding fund withdrawals and account verifications, with some users reporting delays and complications when trying to access their funds. Such issues can significantly impact the perceived safety of a trading platform.

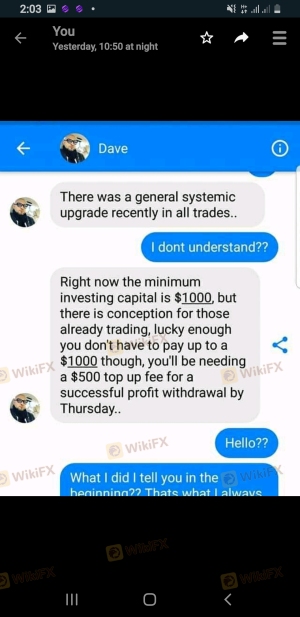

Customer Experience and Complaints

User feedback plays a vital role in assessing the overall reputation and safety of a broker. Reviews of IQ Option reveal a mixed bag of experiences. While many users praise the platform for its user-friendly interface and extensive educational resources, others have voiced concerns regarding withdrawal delays and customer service responsiveness. Below is a summary of common complaint types:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Account Verification Issues | Medium | Moderate |

| Customer Support Responsiveness | High | Varies |

For instance, one user reported waiting over two weeks for a withdrawal request to be processed, raising concerns about the platform's reliability. Such complaints highlight the importance of customer service and the need for prompt and effective responses to user inquiries.

Platform and Trade Execution

The IQ Option trading platform is known for its modern design and functionality. It offers a range of trading tools and features, including advanced charting options and various order types. However, the execution quality has come under scrutiny, with some users reporting issues such as slippage and rejected orders.

The platform's performance is generally considered stable, but users have noted that it can lag during periods of high market volatility. This can affect the overall trading experience, particularly for those relying on timely execution for their strategies.

Risk Assessment

Using IQ Option comes with inherent risks that traders should be aware of. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Regulated by CySEC, but with concerns about unregulated operations internationally. |

| Fund Safety | Medium | Segregated accounts and ICF membership provide some protection, but withdrawal issues persist. |

| Customer Support | High | Mixed reviews regarding responsiveness and effectiveness in resolving issues. |

| Trading Costs | Medium | Potential hidden fees and complex fee structure can lead to unexpected costs. |

To mitigate these risks, traders are advised to conduct thorough research, utilize the demo account for practice, and maintain realistic expectations regarding potential returns and losses.

Conclusion and Recommendations

In conclusion, the question of whether IQ Option is safe or a scam requires careful consideration of various factors. While the broker is regulated by CySEC and offers a user-friendly platform with a wide range of trading instruments, concerns regarding withdrawal delays, customer service responsiveness, and the complexities of its fee structure cannot be overlooked.

For traders considering IQ Option, it is essential to weigh the pros and cons carefully. If you are a beginner looking for a low-cost entry into the trading world, IQ Option may offer a suitable option. However, for more experienced traders or those requiring extensive support and a broader range of assets, it may be prudent to explore alternative brokers with a stronger regulatory standing and better customer feedback.

Ultimately, while IQ Option is not classified as a scam, potential users should approach with caution and ensure they are fully informed before committing any funds.

Is IQ OPTION BROKER a scam, or is it legit?

The latest exposure and evaluation content of IQ OPTION BROKER brokers.

IQ OPTION BROKER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IQ OPTION BROKER latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.