Is HK South China International safe?

Business

License

Is HK South China International Safe or a Scam?

Introduction

HK South China International is a forex broker that has garnered attention in the trading community. Operating primarily in the Asian markets, it positions itself as a platform for traders looking to engage in foreign exchange trading. However, the importance of thoroughly assessing the credibility and safety of forex brokers cannot be overstated. The forex market is rife with opportunities, but it also harbors risks, particularly when it comes to unregulated or poorly regulated brokers. In this article, we will investigate whether HK South China International is safe or if it exhibits characteristics of a scam. Our investigation will rely on various sources, including user reviews, regulatory information, and market analysis, to provide a comprehensive assessment.

Regulation and Legitimacy

When evaluating the safety of any forex broker, regulatory oversight is a critical factor. Brokers that are regulated by reputable authorities are generally held to strict standards, which can provide a level of assurance to traders regarding the safety of their funds and the integrity of the trading environment. Unfortunately, HK South China International has been flagged for lacking proper regulation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | No valid regulation |

The absence of regulation raises significant concerns about the legitimacy of HK South China International. Without oversight from a recognized regulatory body, traders may find themselves vulnerable to malpractice, including issues related to fund security and fair trading practices. Furthermore, the lack of a regulatory framework means that there are no established protocols for resolving disputes or ensuring compliance with industry standards.

Company Background Investigation

HK South China International, while claiming to offer a robust trading platform, lacks transparency regarding its ownership structure and history. The company has not provided sufficient information about its founding, operational history, or the individuals behind its management. This lack of transparency is a red flag for potential investors. In the world of finance, companies that are open about their operations and management tend to inspire more confidence among traders.

Moreover, the absence of a clear operational history may indicate that the broker is relatively new or has undergone significant changes that have not been disclosed. The management team's background, including their experience in the forex market, is another crucial factor. A management team with a strong track record in financial services can be a positive indicator of a broker's reliability. Unfortunately, in the case of HK South China International, this information is either sparse or entirely missing, making it difficult to assess the broker's credibility.

Trading Conditions Analysis

Understanding the trading conditions offered by HK South China International is essential for potential traders. The broker claims to provide competitive spreads and trading fees, but the lack of transparency in their fee structure is concerning.

| Fee Type | HK South China International | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | N/A |

| Commission Model | N/A | N/A |

| Overnight Interest Range | N/A | N/A |

The absence of specific figures for spreads, commissions, and overnight interest rates indicates a lack of clarity that traders should be wary of. In a well-regulated environment, brokers typically provide detailed information on their fees, allowing traders to make informed decisions. The potential for hidden fees or unexpected charges is a significant risk factor for anyone considering trading with HK South China International.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. HK South China International has not provided clear information regarding its fund security measures. In a well-regulated environment, brokers are required to implement measures such as segregating client funds from operational funds, providing investor protection schemes, and offering negative balance protection.

Unfortunately, without regulatory oversight, it is unclear whether HK South China International adheres to such best practices. Historical issues related to fund safety can also provide insight into a broker's reliability. Reports from users indicate difficulties in withdrawing funds, which raises concerns about the broker's financial stability and operational integrity.

Customer Experience and Complaints

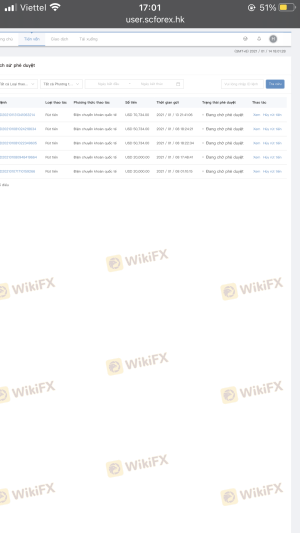

User feedback is an invaluable resource for assessing the reliability of any broker. In the case of HK South China International, numerous complaints have surfaced regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Poor |

Many users have reported that their withdrawal requests were either delayed or denied, often accompanied by vague explanations or demands for additional fees. This pattern of complaints suggests systemic issues within the broker's operations and raises serious questions about whether HK South China International is safe for traders.

Platform and Trade Execution

The trading platform offered by HK South China International is another critical aspect to evaluate. A reliable trading platform should provide a stable and user-friendly experience, enabling traders to execute their trades efficiently. However, reports of technical glitches and slow execution times have been noted by users.

Furthermore, any signs of order manipulation or slippage can indicate a lack of integrity in trade execution. Without a transparent review process or feedback from a regulatory authority, it is challenging to ascertain the platform's reliability fully.

Risk Assessment

Using HK South China International carries inherent risks that potential traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases vulnerability. |

| Fund Safety Risk | High | Unclear fund security measures raise concerns. |

| Service Quality Risk | Medium | Numerous complaints about customer service and withdrawals. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers with established regulatory frameworks and positive user feedback.

Conclusion and Recommendations

In conclusion, the investigation into HK South China International raises significant concerns about its safety and legitimacy. The absence of regulatory oversight, coupled with numerous user complaints regarding withdrawal issues and poor customer service, suggests that this broker may not be a safe option for traders.

For those considering trading in the forex market, it is advisable to seek out brokers that are regulated by reputable authorities and have a proven track record of reliability. Some alternative brokers that are recognized for their safety and transparency include [insert reliable brokers here]. In summary, while HK South China International may present itself as an option, the risks associated with trading through this broker warrant caution and thorough consideration.

Is HK South China International a scam, or is it legit?

The latest exposure and evaluation content of HK South China International brokers.

HK South China International Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HK South China International latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.