Regarding the legitimacy of GTCFX forex brokers, it provides FCA, ASIC, CMA, VFSC and WikiBit, (also has a graphic survey regarding security).

Is GTCFX safe?

Pros

Cons

Is GTCFX markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Global Markets Group Limited

Effective Date: Change Record

2016-09-12Email Address of Licensed Institution:

info@gmgmarkets.co.uk, compliance_team@gmgmarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.gmgmarkets.co.ukExpiration Time:

--Address of Licensed Institution:

The Jellicoe 5, Beaconsfield Street Kings Cross London N1C 4EW UNITED KINGDOMPhone Number of Licensed Institution:

+442038653306Licensed Institution Certified Documents:

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

GTC GLOBAL (AUSTRALIA) PTY LTD

Effective Date: Change Record

2017-07-07Email Address of Licensed Institution:

hy@gtcau.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SE 73 L 1 8 CLUNIES ROSS CT EIGHT MILE PLAINS QLD 4113 AUSTRALIAPhone Number of Licensed Institution:

0433412271Licensed Institution Certified Documents:

CMA Derivatives Trading License (EP)

Capital Market Authority

Capital Market Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

GTC MULTI TRADING DMCC

Effective Date: Change Record

2017-09-19Email Address of Licensed Institution:

dgb.compliance@dgbx.aeSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

1501, 1 Lake Plaza, Cluster T, Jumeirah lakes towers, Dubai, UAEPhone Number of Licensed Institution:

971-43991737Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

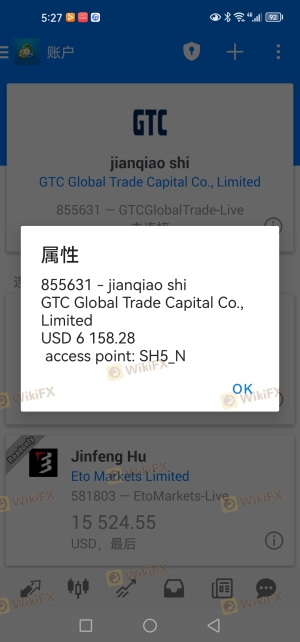

GTC GLOBAL TRADE CAPITAL CO. LIMITED

Effective Date:

2023-06-02Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is GTCFX A Scam?

Introduction

GTCFX is a forex and CFD broker that has made a name for itself in the online trading industry since its establishment in 2012. Positioned as a global player in financial derivatives, GTCFX offers a wide range of trading instruments, including forex pairs, commodities, indices, and more. As the forex market continues to grow, traders must exercise caution when selecting brokers, as the potential for scams and fraudulent activities is ever-present. Therefore, it is vital for traders to carefully evaluate the legitimacy and reliability of any broker before committing their funds. This article aims to provide a comprehensive analysis of GTCFX, utilizing a variety of sources and an evaluation framework that encompasses regulatory status, company background, trading conditions, customer experience, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. GTCFX claims to operate under multiple regulatory authorities, including the Financial Services Commission (FSC) of Mauritius, the Vanuatu Financial Services Commission (VFSC), and the Securities and Commodities Authority (SCA) of the United Arab Emirates. However, the quality of regulation varies significantly among these bodies.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FSC Mauritius | GB 22200292 | Mauritius | Verified |

| VFSC | 40354 | Vanuatu | Verified |

| SCA | 20200000007 | UAE | Verified |

While GTCFX is regulated, it is important to note that both the VFSC and FSC are considered tier-3 regulators, which means they offer less stringent oversight compared to major financial authorities like the FCA or ASIC. This raises concerns about the level of investor protection available to clients. Moreover, the lack of a compensation fund for investors in the event of broker insolvency is another red flag for potential clients. Historical compliance records and any previous regulatory issues also play a crucial role in assessing the broker's reliability.

Company Background Investigation

GTCFX was founded in 2012 and operates under the umbrella of Global Trade Capital, which has its headquarters in Dubai, UAE. The company has expanded its operations to various regions, including Mauritius and Vanuatu, and claims to serve over 895,000 clients globally. However, the ownership structure and management team details are not readily available, which can hinder transparency.

The management team's experience is crucial for the broker's credibility, yet there is limited information regarding their professional backgrounds. This lack of transparency may lead to questions about the company's operational integrity. Furthermore, GTCFXs commitment to ethical business practices and regulatory compliance is essential for building trust with clients. The absence of clear information regarding its corporate governance and operational policies can contribute to skepticism among potential traders.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is fundamental. GTCFX presents a varied fee structure that includes competitive spreads and commissions. However, there are reports of potential hidden fees, particularly concerning withdrawals and inactivity.

| Fee Type | GTCFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.3 pips | From 1.0 pips |

| Commission Model | $5 per lot (ECN) | $5 per lot (average) |

| Overnight Interest Range | Variable | Variable |

The spreads offered by GTCFX are competitive, especially for ECN accounts, which start from 0.0 pips. However, the commission structure may not be favorable for all traders, particularly those with lower trading volumes. Furthermore, some users have reported issues with withdrawal fees and the imposition of inactivity fees, which could deter potential clients.

It is essential for traders to scrutinize these conditions closely, as they can significantly impact overall trading profitability.

Client Funds Safety

The safety of client funds is paramount in the forex trading environment. GTCFX claims to implement various measures to protect client funds, including segregated accounts and negative balance protection. However, the level of protection offered by offshore regulators is generally lower than that provided by tier-1 regulatory bodies.

The lack of a compensation scheme is concerning. In case of insolvency, clients may not have recourse to recover funds. Furthermore, there have been historical complaints regarding withdrawal issues, which raises questions about the broker's commitment to ensuring that clients can access their funds promptly. Traders should be aware of these risks and consider them when deciding whether to engage with GTCFX.

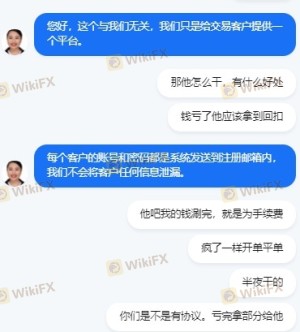

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reliability. Reviews for GTCFX reveal a mixed bag of experiences, with some clients praising the trading conditions and platform functionality, while others express dissatisfaction with customer service and withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Quality | Medium | Average response |

Common complaints include difficulties in withdrawing funds and unresponsive customer support during critical situations. For instance, some users have reported waiting extended periods for withdrawal approvals, leading to frustration and distrust.

A couple of notable cases involve clients who experienced significant delays in accessing their funds, prompting them to escalate issues to regulatory authorities. These incidents highlight the importance of reliable customer service and prompt resolution of client issues.

Platform and Trade Execution

GTCFX offers several trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader. These platforms are known for their robust functionality and user-friendly interfaces. However, the quality of trade execution can vary, with reports of slippage and order rejections in volatile market conditions.

The execution speed and reliability of the trading platform are crucial for traders, particularly those who engage in scalping or high-frequency trading. Users have reported mixed experiences regarding the stability of the platforms, with some experiencing issues during peak trading hours.

Risk Assessment

Using GTCFX involves several risks that traders should be aware of. The lack of strong regulatory oversight, potential hidden fees, and customer service issues contribute to an overall risk profile that is higher than many competitors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited investor protection. |

| Withdrawal Risk | Medium | Reports of delays and issues in fund access. |

| Customer Service Risk | Medium | Mixed reviews regarding support responsiveness. |

To mitigate these risks, traders are advised to conduct thorough research, utilize demo accounts to familiarize themselves with the platform, and consider diversifying their investments across multiple brokers to spread risk.

Conclusion and Recommendations

In summary, while GTCFX presents several appealing features, such as competitive trading conditions and a wide range of instruments, there are significant concerns regarding its regulatory status, customer service quality, and withdrawal processes. The absence of robust investor protection measures and mixed client feedback suggest that potential traders should exercise caution.

For those considering trading with GTCFX, it is advisable to start with a small investment and to remain vigilant regarding withdrawal procedures. Alternatively, traders seeking a more secure and reliable trading environment may want to explore other brokers that are regulated by tier-1 authorities, such as FCA or ASIC, which offer stronger investor protection and a proven track record of reliability.

Is GTCFX a scam, or is it legit?

The latest exposure and evaluation content of GTCFX brokers.

GTCFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GTCFX latest industry rating score is 9.23, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 9.23 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.