Regarding the legitimacy of GMI forex brokers, it provides FSC and WikiBit, .

Is GMI safe?

Pros

Cons

Is GMI markets regulated?

The regulatory license is the strongest proof.

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

ActiveLicense Type:

Securities Trading License (EP)

Licensed Entity:

Global Market Index Limited

Effective Date:

2019-03-21Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

C/O CREDENTIA INTERNATIONAL MANAGEMENT LTD THE CYBERATI LOUNGE GROUND FLOOR, THE CATALYST 72201 EBENE SILICON AVENUE, 40 CYBERCITY, MauritiusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is GMI A Scam?

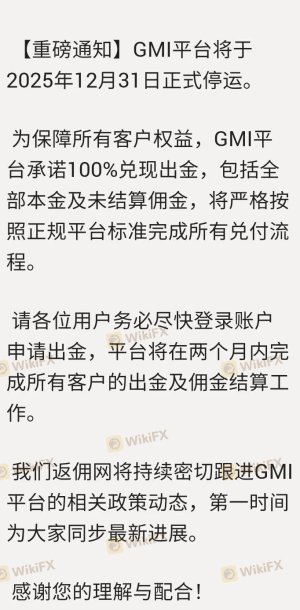

Introduction

GMI, short for Global Market Index, is a prominent player in the forex trading market, established in 2009 and headquartered in Shanghai, China. It has carved out a niche as a broker offering a range of trading services, including forex and CFDs, to a global clientele. Given the rapid growth of online trading and the increasing number of brokers entering the market, potential traders must exercise caution when selecting a forex broker. The importance of evaluating brokers cannot be overstated, as the wrong choice can lead to significant financial losses or even scams. This article aims to provide a comprehensive analysis of GMI, assessing its credibility, regulatory compliance, trading conditions, and overall safety for traders. The evaluation is based on a thorough examination of various sources, including regulatory information, customer reviews, and expert analyses.

Regulation and Legitimacy

A broker's regulatory status is crucial in determining its legitimacy and trustworthiness. GMI operates under several regulatory bodies, which can provide a level of assurance to traders regarding the safety of their funds and the overall integrity of the brokerage. Below is a summary of GMI's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 677530 | United Kingdom | Verified |

| VFSC | 14646 | Vanuatu | Verified |

| SFC | 2015853 | Hong Kong | Verified |

GMI is regulated by the Financial Conduct Authority (FCA) in the UK, which is known for its stringent regulatory framework. This regulation ensures that GMI adheres to high standards of operational conduct, including the segregation of client funds and the implementation of measures to protect traders. Additionally, the broker is also licensed by the Vanuatu Financial Services Commission (VFSC) and the Securities and Futures Commission (SFC) in Hong Kong. While the FCA provides a robust regulatory environment, the offshore licenses from VFSC may raise some concerns regarding the level of oversight, as these jurisdictions often have less stringent regulations.

Historically, GMI has maintained compliance with regulatory requirements, which adds to its credibility. However, potential clients should be aware of the implications of trading with a broker that operates in offshore jurisdictions, as it may expose them to higher risks. Overall, GMI's regulatory status, particularly its FCA authorization, suggests that it is not a scam but rather a legitimate broker that is held to high standards.

Company Background Investigation

GMI has a history dating back to 2009, when it was founded in Shanghai. The company has since expanded its operations and established several representative offices in major financial hubs, including Auckland and London. GMI is structured as a group of companies, with various entities registered in different jurisdictions, which allows it to cater to a broad international audience.

The management team at GMI comprises experienced professionals from the financial services industry, bringing a wealth of knowledge and expertise to the brokerage. This experience is crucial in navigating the complexities of the forex market and ensuring that the broker meets the diverse needs of its clients. The company has demonstrated transparency in its operations, providing clear information about its services, trading conditions, and regulatory compliance.

Despite its positive attributes, GMI's information disclosure could be improved. While it provides essential details about its services, some aspects, such as the specific ownership structure and detailed management profiles, are less transparent. This lack of comprehensive disclosure may lead to questions about the company's overall transparency and accountability.

Trading Conditions Analysis

GMI offers a range of trading conditions that cater to different types of traders. The brokers fee structure is designed to be competitive, particularly for active traders. However, understanding the cost structure is essential for evaluating the overall trading experience. Below is a summary of GMI's core trading costs:

| Fee Type | GMI | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 1.0 pips | 1.0 - 1.5 pips |

| Commission Model | $4 per lot (ECN) | $5 per lot (average) |

| Overnight Interest Range | Varies | Varies |

GMI provides tight spreads, especially on its ECN accounts, where traders can benefit from spreads starting as low as 0.0 pips. This is particularly advantageous for high-frequency traders looking to maximize their profits. However, the ECN account does incur a commission of $4 per lot, which is competitive compared to the industry average.

One notable aspect of GMI's fee structure is the potential for hidden costs, such as inactivity fees for dormant accounts. If there is no trading activity for a specified period, a fee may be deducted from the account balance. This policy can be a concern for traders who may not be active consistently, as it can erode their funds over time.

Overall, GMI's trading conditions are generally favorable, especially for experienced traders who can navigate the commission-based model effectively. However, potential clients should carefully review the fee structure to ensure it aligns with their trading strategies and preferences.

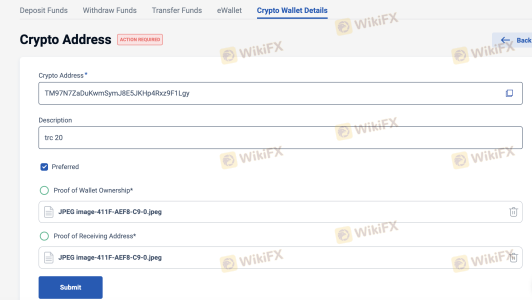

Client Fund Safety

The safety of client funds is a paramount concern for any trader. GMI implements several measures to ensure the security of its clients' funds. Client deposits are held in segregated accounts at leading banks, which helps to protect traders' capital in the event of the broker's insolvency. Additionally, GMI is covered by compensation schemes under the FCA regulations, providing an extra layer of protection for clients.

Moreover, GMI offers negative balance protection, which means that traders cannot lose more than their deposited funds. This feature is particularly important in the volatile forex market, where sudden price movements can lead to significant losses. However, traders should remain vigilant and assess their risk tolerance when trading with high leverage, as it can amplify both gains and losses.

While GMI has not reported any significant historical issues regarding fund safety, potential clients should remain cautious and perform due diligence before depositing funds. Overall, GMI appears to prioritize client fund safety, but it is essential for traders to be aware of the risks associated with trading in leveraged markets.

Client Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability and service quality. GMI has received mixed reviews from users, with some praising its trading conditions and platform performance, while others have raised concerns regarding customer support and transparency.

Common complaints about GMI include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Slow customer support | Medium | Mixed reviews |

| Withdrawal delays | High | Addressed |

| Lack of educational resources | Medium | No response |

One typical case involved a trader who experienced delays in withdrawing funds, leading to frustration. While GMI addressed the issue, the response time was longer than expected, highlighting a potential area for improvement in customer service.

Overall, while many traders report positive experiences with GMI, the recurring complaints regarding customer support and withdrawal processes suggest that the broker could enhance its service quality. Prospective clients should consider these factors when deciding whether to engage with GMI.

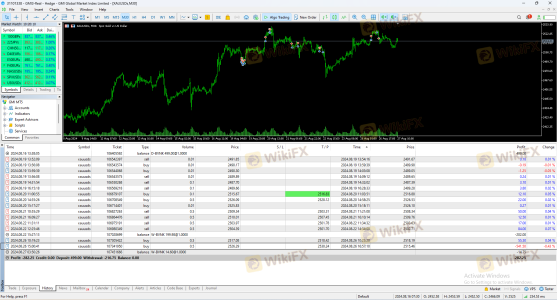

Platform and Trade Execution

The trading platform is a critical component of the trading experience, and GMI provides access to popular platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are known for their user-friendly interfaces, robust analytical tools, and support for automated trading strategies.

However, the performance of the trading platform can vary based on factors such as market conditions and server stability. GMI claims to offer low latency and high execution speeds, which are essential for traders looking to capitalize on market movements. Nevertheless, some users have reported instances of slippage and order rejections, which can impact trading outcomes.

In summary, while GMI's platform offers many features that cater to different trading styles, traders should remain aware of potential execution issues and assess whether the platform meets their specific needs.

Risk Assessment

Trading with GMI, like any broker, comes with inherent risks. Below is a summary of the key risk areas associated with using GMI:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulations may provide less oversight. |

| Execution Risk | Medium | Instances of slippage and order rejections reported. |

| Customer Service Risk | Medium | Mixed reviews on response times and support quality. |

To mitigate these risks, traders should conduct thorough research before trading, utilize demo accounts to familiarize themselves with the platform, and maintain a cautious approach to leverage.

Conclusion and Recommendations

In conclusion, GMI is not a scam but rather a regulated broker with a solid reputation in the forex market. Its regulatory status with the FCA provides a level of assurance regarding the safety of client funds. However, potential traders should remain cautious due to the broker's offshore entities and the associated risks.

While GMI offers competitive trading conditions and a variety of account types, the mixed feedback regarding customer service and the lack of educational resources could be a concern, particularly for novice traders. Therefore, it is recommended that inexperienced traders consider alternative brokers that offer more comprehensive support and resources.

For those who prioritize low spreads and are comfortable navigating the forex market, GMI could be a suitable choice. However, traders should ensure they are aware of the potential risks and conduct due diligence before committing to this broker.

Is GMI a scam, or is it legit?

The latest exposure and evaluation content of GMI brokers.

GMI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GMI latest industry rating score is 2.80, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.80 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.