Is DS safe?

Pros

Cons

Is DS Safe or Scam?

Introduction

In the vast landscape of the forex market, traders face numerous challenges, not least of which is identifying reliable brokers. One such broker is DS, which has garnered attention for its unique offerings and claims of extensive market access. However, the question remains: Is DS safe or a scam? This article aims to provide a thorough analysis of DSs legitimacy, regulatory status, trading conditions, and overall reputation. In doing so, we will utilize a mix of narrative storytelling and structured information to present a balanced perspective. Our investigation draws from various online resources, including regulatory databases, user reviews, and expert analyses, ensuring a comprehensive evaluation of DS.

Regulation and Legitimacy

The regulatory framework surrounding forex brokers is crucial for ensuring the safety of traders' funds. In the case of DS, it is imperative to examine its regulatory status carefully. An unregulated broker poses significant risks, as there are no legal protections in place for traders.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

As indicated in the table above, DS is not regulated by any reputable financial authority. This lack of oversight is concerning, as it suggests that the broker may not adhere to industry standards for transparency and client protection. Regulatory bodies such as the FCA (UK), ASIC (Australia), and CFTC (USA) enforce strict rules to safeguard traders, including capital requirements and regular audits. The absence of such regulation raises red flags about DS's operational integrity and the safety of client funds.

Moreover, historical compliance issues have been reported, with multiple reviews labeling DS as a "scam broker." This classification is often attributed to the broker's failure to provide adequate information regarding its operations and management, further amplifying concerns about its legitimacy. Therefore, when considering whether DS is safe, the overwhelming evidence points to a broker that lacks the necessary regulatory framework to protect its clients.

Company Background Investigation

Understanding the background of a broker is essential in assessing its reliability. DS has a limited history in the forex market, with scant information available regarding its formation and ownership structure. The absence of transparent data regarding the company's founders and management team raises questions about accountability and the broker's operational ethos.

The management teams background is a critical factor in evaluating the broker's credibility. A professional team with a proven track record in finance and trading can significantly enhance a broker's reputation. However, the anonymity surrounding DS's management suggests a lack of transparency, which is often a hallmark of less reputable firms. This opacity can lead to distrust among potential clients, making it challenging to ascertain whether DS is safe for trading.

Moreover, the company's information disclosure levels are concerning. A reputable broker typically provides comprehensive details about its operations, including financial reports, regulatory compliance documents, and customer service protocols. DS has not demonstrated such transparency, further solidifying its status as a dubious entity in the forex market.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is paramount. DS claims to offer competitive trading fees and a variety of trading instruments. However, an in-depth analysis reveals potential pitfalls that traders should be wary of.

The overall fee structure of DS appears to be convoluted, with hidden costs that may not be immediately apparent to new traders. Such practices can lead to unexpected financial burdens, making it essential for traders to scrutinize the fee schedule before committing any capital.

| Fee Type | DS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | 5% | 1-2% |

As shown in the table, the spreads offered by DS are significantly higher than the industry average, which can erode potential profits for traders. Additionally, the lack of a clear commission structure may indicate hidden fees that could further complicate trading costs. This lack of transparency raises concerns about whether DS is safe, as traders could face unexpected charges that diminish their trading capital.

Furthermore, the high overnight interest rates signal that traders may incur substantial costs for holding positions overnight, which is particularly detrimental for those employing swing trading strategies. Therefore, the trading conditions at DS do not align with the expectations of a reputable broker, suggesting that traders should exercise caution.

Client Funds Safety

The safety of client funds is a paramount concern for any trader. DSs lack of regulatory oversight raises significant questions about the security measures in place to protect clients' investments.

Typically, reputable brokers employ stringent measures to safeguard client funds, including segregating client accounts from operational funds and providing insurance coverage in case of insolvency. However, DS does not appear to offer such protections, leaving traders vulnerable to potential financial loss.

Moreover, the absence of negative balance protection is another alarming factor. This policy ensures that traders cannot lose more than their deposited amount, providing an essential safety net in volatile market conditions. Without this safeguard, clients may find themselves in precarious financial situations, further underscoring the question: Is DS safe?

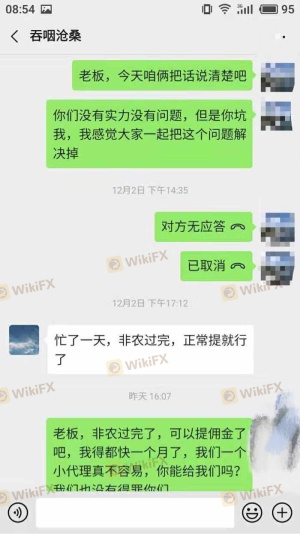

Historically, there have been numerous reports of clients facing difficulties in withdrawing their funds from DS. Such issues are often indicative of a broker's operational integrity and commitment to client care. If a broker is unable or unwilling to facilitate withdrawals, it raises significant concerns about the legitimacy of their operations.

Client Experience and Complaints

Analyzing client feedback is crucial in determining the overall reputation of a broker. For DS, the feedback has been overwhelmingly negative, with many users reporting significant issues related to their trading experience.

Common complaints include difficulties in withdrawing funds, unresponsive customer service, and unexpected fees. These issues paint a troubling picture of DS's operational practices and customer support quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow, Unresponsive |

| Customer Service | Medium | Unhelpful |

| Fee Transparency | High | Ignored |

The severity of these complaints indicates a pattern of user dissatisfaction that cannot be overlooked. For instance, one user reported being unable to withdraw their funds for months, while another highlighted the lack of support from customer service when attempting to resolve issues. Such experiences raise serious concerns about whether DS is safe for traders looking to invest their money.

Additionally, the company's response to these complaints has been lackluster, further exacerbating user frustrations. When a broker fails to address client concerns effectively, it undermines trust and raises red flags about its legitimacy.

Platform and Trade Execution

The performance of a trading platform is vital for a seamless trading experience. In the case of DS, users have reported various issues related to platform stability and order execution quality.

Many traders have experienced slippage and delays in order execution, which can significantly impact trading outcomes. A reliable broker should provide fast and efficient execution, especially during volatile market conditions. However, reports indicate that DS may not meet these expectations, raising additional concerns about its operational integrity.

Moreover, any signs of platform manipulation, such as frequent rejections of orders or unexplained discrepancies in pricing, can severely undermine a broker's credibility. Users have noted instances where their orders were not executed at the expected prices, leading to financial losses. This situation prompts the question: Is DS safe?

Risk Assessment

Using DS as a trading platform involves several risks that potential clients should carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation, high potential for fraud |

| Operational Risk | Medium | Issues with fund withdrawals and customer service |

| Market Risk | Medium | High spreads and overnight interest rates |

The high regulatory risk associated with trading through DS cannot be overstated. The absence of oversight from reputable authorities leaves traders exposed to potential fraud and financial loss. Additionally, operational risks related to customer service and fund withdrawals further complicate the trading experience.

To mitigate these risks, potential clients should conduct thorough research and consider starting with a minimal investment. Engaging with regulated brokers can also provide a safer trading environment, reducing exposure to potential scams.

Conclusion and Recommendations

In conclusion, the evidence suggests that DS is not safe for traders. The broker's lack of regulation, combined with a history of client complaints and questionable operational practices, paints a concerning picture.

For traders seeking to engage in forex trading, it is advisable to consider alternatives that offer robust regulatory oversight and transparent trading conditions. Brokers such as IG, CMC Markets, and XTB have established reputations for safety and reliability, making them more suitable options for those looking to invest in the forex market.

Ultimately, while the allure of potentially high returns may tempt traders to consider DS, the associated risks far outweigh the benefits. Conducting thorough research and choosing a regulated broker is essential for ensuring a safe and successful trading experience.

Is DS a scam, or is it legit?

The latest exposure and evaluation content of DS brokers.

DS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DS latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.