DS Review 2

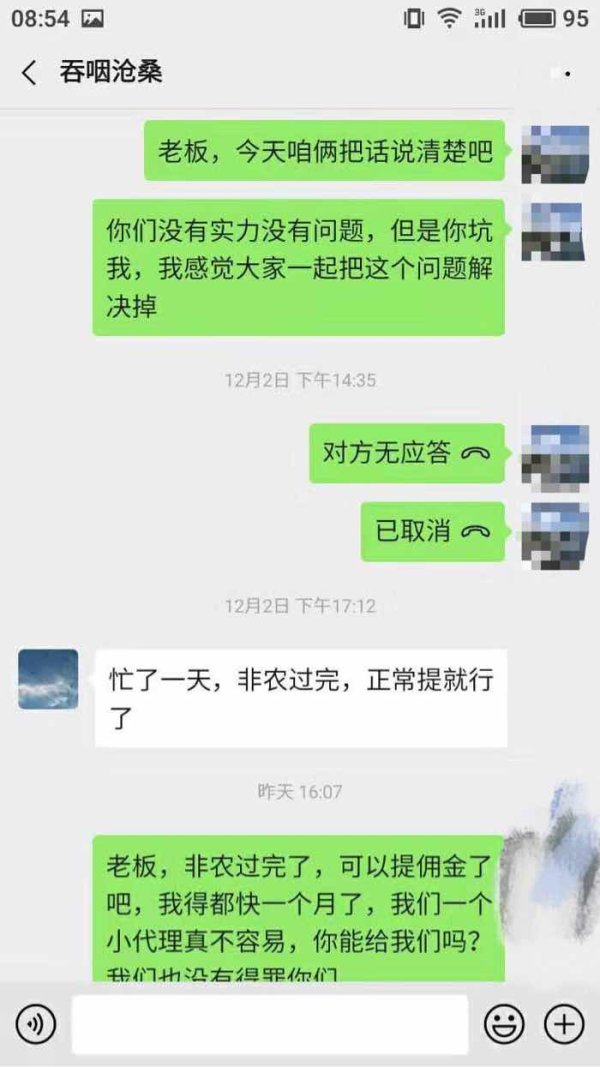

I asked customer service several questions because my deposit did not arrive. When I wanted to withdraw, it was blocked and I had to pay taxes.

The withdrawal in DLS is unavailable. It will set another scam platform DS .

DS Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

I asked customer service several questions because my deposit did not arrive. When I wanted to withdraw, it was blocked and I had to pay taxes.

The withdrawal in DLS is unavailable. It will set another scam platform DS .

DS Broker is one of the oldest investment brokerage firms in the financial industry. Its roots go back to 1901, making it a company with over 120 years of experience in the market. This comprehensive ds review looks at a broker that has survived more than a century of market changes. The company evolved from its original foundation to become part of larger financial networks over time.

DS operates as part of the Willis Towers Watson network. This network focuses on sharing experience and helping members grow their businesses. The broker's headquarters sit in Toronto's Royal Bank Plaza, Ontario, Canada. This location puts the company in one of North America's major financial centers.

DS Broker has an impressive history spanning more than 120 years. However, potential clients should know that specific regulatory information remains unclear in available documents. This long time in the market suggests the company is stable. Investors seeking established financial partners for long-term investment strategies may find this appealing.

The firm's business model focuses on investment brokerage services. Detailed information about specific trading conditions, platform offerings, and regulatory oversight needs further investigation. This ds review will explore all available aspects of the broker's services. We will also note areas where information transparency could be better.

This review uses publicly available information about DS Broker as of 2025. The current documentation shows limited regulatory information. Potential clients should exercise due diligence when considering this broker. This is especially important for cross-border trading activities.

Different regional entities may operate under varying regulatory frameworks. Clients should verify applicable regulations in their jurisdiction. Our evaluation methodology relies on accessible data sources. It does not include direct user experience testing.

Readers should consider this review as informational guidance rather than personalized financial advice. We recommend consulting with financial professionals before making investment decisions.

| Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific information not detailed in available materials |

| Tools and Resources | N/A | Platform and tool specifications not mentioned in source materials |

| Customer Service | N/A | Support details not specified in available documentation |

| Trading Experience | N/A | Trading platform information not detailed in source materials |

| Trust Factor | N/A | Regulatory information not clearly specified in available materials |

| User Experience | N/A | User interface details not mentioned in available documentation |

DS Broker established its presence in the financial markets on March 18, 1901. This makes it one of the oldest continuously operating investment brokerage firms in North America. The company's headquarters at Royal Bank Plaza in Toronto, Ontario, positions it within Canada's primary financial district.

This location provides access to major market infrastructure and regulatory frameworks. Throughout its extensive operational history, DS has focused on investment brokerage services. The company adapted its offerings to meet evolving market demands and client needs over time.

The firm's association with the Willis Towers Watson network represents a strategic approach to knowledge sharing and business development. This network affiliation suggests a collaborative business model. It emphasizes experience exchange and growth facilitation among member organizations.

The longevity of DS Broker's operations spans multiple economic cycles and market transformations. This indicates institutional resilience and adaptability. However, this ds review must note that specific details about trading platforms, asset classes, and regulatory oversight are not clearly detailed in available source materials.

The absence of comprehensive platform information and regulatory specifications in current documentation presents challenges. Potential clients seeking detailed operational transparency may find this concerning. Prospective users should directly contact the firm for current platform specifications and regulatory compliance details.

Specific information about regulatory oversight and compliance frameworks is not detailed in available materials. Given the firm's Canadian headquarters location, potential regulatory oversight would likely involve Canadian financial authorities. Explicit regulatory numbers and jurisdictional details require direct confirmation from the broker.

Current documentation does not specify available funding methods, processing times, or associated fees for client account transactions. This information gap represents a significant consideration for potential clients. They need to evaluate operational convenience before choosing a broker.

Specific minimum deposit thresholds for account opening and maintenance are not mentioned in available source materials. Account funding requirements would need direct verification with the broker.

Information about current bonus structures, promotional campaigns, or new client incentives is not available in reviewed documentation. Any promotional offerings would require direct inquiry with DS Broker.

The range of tradeable instruments is not specified in current materials. This includes forex pairs, commodities, indices, or other financial products. Asset availability represents crucial information for trading strategy development.

Details about spreads, commissions, overnight fees, and other trading costs are not provided in available documentation. Cost transparency is essential for informed broker selection. This information gap is particularly significant for potential clients.

Maximum leverage ratios and margin requirements are not specified in reviewed materials. These represent important considerations for risk management and trading strategy implementation.

Information about trading platform options is not detailed in current documentation available for this ds review. This includes whether the broker offers proprietary or third-party solutions like MetaTrader.

Specific geographical limitations or restricted territories are not mentioned in available materials.

Supported languages for client communication and assistance are not specified in current documentation.

The evaluation of DS Broker's account conditions faces significant limitations. This is due to insufficient detailed information in available source materials. Traditional account condition assessment would examine factors such as account type variety, minimum deposit requirements, account opening procedures, and specialized offerings.

Islamic accounts for Sharia-compliant trading would also be part of this assessment. Without specific documentation about account tiers, deposit thresholds, or opening requirements, potential clients cannot adequately assess whether DS Broker's account structure aligns with their needs. They also cannot determine if the structure fits their financial capabilities.

The absence of clear account condition information in this ds review highlights the importance of direct communication with the broker. Prospective clients need this direct contact to get the information they need. Account opening procedures, verification requirements, and ongoing account maintenance conditions represent fundamental considerations for any trading relationship.

The lack of transparency in these areas suggests that interested parties should prioritize obtaining comprehensive account documentation directly from DS Broker. This should happen before proceeding with account establishment. Professional traders and institutional clients typically require detailed account specifications to evaluate operational fit.

The current information gap makes informed decision-making particularly challenging.

Assessment of DS Broker's trading tools and educational resources cannot be completed comprehensively. This is due to limited information availability. Modern trading environments typically offer various analytical tools, market research capabilities, educational materials, and automated trading support.

These features enhance client trading effectiveness. The absence of specific information about charting capabilities, technical analysis tools, fundamental analysis resources, or educational content represents a significant evaluation challenge. Contemporary brokers generally provide comprehensive tool suites.

These include real-time market data, economic calendars, trading signals, and educational webinars or tutorials. Without detailed specifications about available tools and resources, potential clients cannot assess whether DS Broker provides the analytical and educational support necessary for their trading strategies. This information gap particularly affects newer traders.

New traders rely heavily on educational resources and analytical tools for market understanding. The evaluation of automated trading support, API availability, and third-party tool integration also remains incomplete. This is due to insufficient documentation in available materials.

Customer service evaluation for DS Broker cannot be thoroughly assessed based on available documentation. Comprehensive customer support analysis typically examines communication channels, response times, service quality metrics, multilingual support availability, and operational hours coverage. The absence of specific information about support channels prevents adequate service quality assessment.

These channels include live chat, telephone support, email assistance, or help desk ticketing systems. Modern brokers generally provide multiple communication options. They offer varying response time commitments across different service levels.

Without documented information about customer service hours, potential clients cannot evaluate whether support availability aligns with their needs. This is particularly important for international clients across different time zones. The lack of multilingual support information also affects international client considerations.

Service quality metrics, customer satisfaction data, and problem resolution case studies would typically inform customer service evaluation. Such information is not available in current documentation for this comprehensive assessment.

The evaluation of DS Broker's trading experience faces substantial limitations. This is due to insufficient platform and execution information in available source materials. Trading experience assessment typically focuses on platform stability, execution speed, order fulfillment quality, mobile trading capabilities, and overall trading environment characteristics.

Without specific information about trading platforms, potential clients cannot assess interface usability, feature comprehensiveness, or technical reliability. This applies whether the platforms are proprietary or established solutions like MetaTrader 4/5. Platform stability and execution speed represent crucial factors for active trading strategies.

This is particularly true in volatile market conditions. Order execution quality remains unspecified in current documentation. This includes factors like slippage rates, requote frequency, and execution speed metrics.

These technical performance indicators significantly impact trading profitability and strategy effectiveness. Their absence is particularly notable in this ds review. Mobile trading capabilities and cross-device synchronization features are not detailed in available materials.

This is concerning despite their increasing importance for contemporary trading flexibility and accessibility.

Trust assessment for DS Broker presents mixed considerations based on available information. The firm's establishment in 1901 provides substantial historical credibility. This suggests institutional longevity and market survival through various economic cycles.

This extensive operational history generally indicates business stability and client service continuity. However, the absence of clear regulatory information in available documentation creates transparency concerns. These concerns affect overall trust evaluation.

Modern financial services typically emphasize regulatory compliance and oversight as fundamental trust indicators. This makes the information gap significant for potential clients. The firm's association with the Willis Towers Watson network may provide additional institutional credibility.

This comes through network affiliation and shared industry expertise. However, specific details about this relationship and its implications for client protection are not elaborated in current materials. Without documented information about client fund protection measures, segregated account policies, or dispute resolution procedures, comprehensive trust assessment remains incomplete.

This is true despite the firm's historical presence in the market.

User experience evaluation for DS Broker cannot be comprehensively completed. This is due to limited information about interface design, registration processes, and operational workflows. Contemporary user experience assessment typically examines platform intuitiveness, registration simplicity, verification efficiency, and fund management convenience.

The absence of specific information about user interface design, navigation structure, and feature accessibility prevents adequate usability assessment. Modern trading platforms generally prioritize user-friendly design. They feature intuitive navigation and comprehensive functionality access.

Registration and account verification processes are not detailed in available materials. This includes required documentation, processing timeframes, and approval procedures. These onboarding experiences significantly impact initial user satisfaction and platform adoption.

Without documented user feedback, satisfaction surveys, or common user concern patterns, this evaluation cannot provide insights into actual user experiences. It also cannot identify potential improvement areas for platform development.

This comprehensive ds review reveals DS Broker as an established investment brokerage firm with impressive historical longevity dating back to 1901. The firm's century-plus operational history suggests institutional stability and market adaptability. This may appeal to investors seeking established financial partners with proven staying power.

However, the evaluation highlights significant information transparency limitations that affect comprehensive assessment. The absence of detailed regulatory information, platform specifications, and operational conditions creates evaluation challenges. Potential clients requiring comprehensive broker analysis before commitment will face these challenges.

DS Broker may suit investors prioritizing institutional history and stability over detailed operational transparency. Prospective clients should conduct direct due diligence to obtain missing operational details. These details are essential for informed decision-making.

FX Broker Capital Trading Markets Review