Is DIF Broker safe?

Pros

Cons

Is DIF Broker A Scam?

Introduction

DIF Broker, established in 1999 and headquartered in Lisbon, Portugal, has positioned itself as a significant player in the forex market, offering a wide range of trading instruments including forex, CFDs, stocks, and commodities. As a broker operating under various regulatory frameworks, it is essential for traders to exercise caution and thoroughly evaluate the legitimacy and trustworthiness of DIF Broker before committing their funds. The forex market is rife with opportunities but is also fraught with risks, making it crucial for traders to understand the regulatory environment, trading conditions, and the overall reputation of any broker they consider working with. This article investigates the safety and reliability of DIF Broker by analyzing its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory status of a broker is a key factor in determining its safety and reliability. DIF Broker claims to be regulated by several authorities, including the Financial Conduct Authority (FCA) in the UK, the Comisión Nacional del Mercado de Valores (CNMV) in Spain, and the Federal Financial Supervisory Authority (BaFin) in Germany. However, it is crucial to verify the current status of these licenses, as regulatory compliance can significantly impact a broker's credibility.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Revoked |

| CNMV | N/A | Spain | Revoked |

| BaFin | N/A | Germany | Suspicious Clone |

The quality of regulation is paramount, as it ensures that brokers adhere to strict operational standards. Unfortunately, the revocation of licenses from both the FCA and CNMV raises concerns about DIF Brokers compliance history and operational integrity. Regulatory bodies impose strict rules to protect traders, and a broker operating without valid licenses may expose clients to significant risks, including the potential loss of their funds.

Company Background Investigation

DIF Broker was founded in 1999, originally focusing on providing personalized financial services. Over the years, it has expanded its operations into various countries, including Spain and Poland. The company is owned by Sociedade Corretora, which has a history of offering diverse financial services. However, the lack of transparency regarding its ownership structure and management team raises questions about its operational integrity.

The management teams background is crucial in assessing the broker's reliability. A team with extensive experience in finance and trading can enhance a broker's credibility. While DIF Broker claims to provide a dedicated account manager for each client, the specific qualifications and expertise of these managers are not clearly disclosed, which may lead to uncertainty regarding the level of support and guidance clients can expect.

Trading Conditions Analysis

Understanding the trading conditions offered by DIF Broker is essential for potential clients. The broker employs a fixed spread model, which can sometimes be less favorable compared to variable spread models used by other brokers. The minimum deposit required to open an account with DIF Broker is €2,000, which is relatively high compared to industry standards.

| Fee Type | DIF Broker | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 3 pips | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The fee structure of DIF Broker may not be competitive, particularly regarding spreads on major currency pairs. High fixed spreads can significantly impact trading profitability, especially for active traders. Additionally, the absence of clear information regarding commissions and overnight interest rates adds to the opacity of the brokers cost structure, making it difficult for traders to assess the true cost of trading.

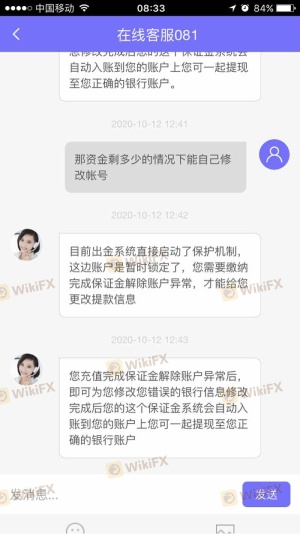

Client Fund Security

The security of client funds is a critical aspect of any broker's operations. DIF Broker claims to maintain strict measures to protect client funds, including segregating client accounts and using tier-1 banks for fund storage. However, the effectiveness of these measures can only be confirmed through regulatory compliance and consistent operational practices.

DIF Broker does not offer negative balance protection, which means clients can lose more than their initial deposit. This lack of protection can be particularly concerning for inexperienced traders who may not fully understand the risks associated with leveraged trading. Additionally, any historical issues related to fund security or disputes can further undermine client confidence.

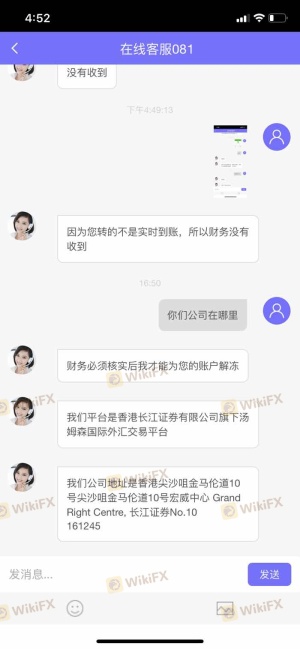

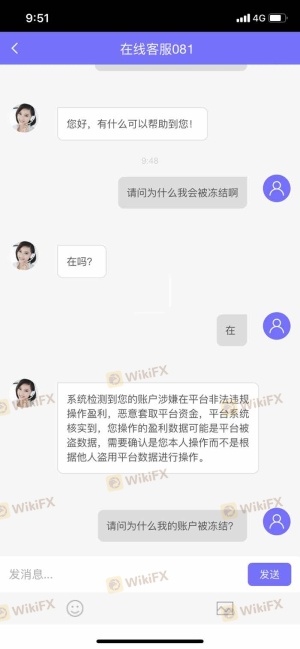

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing the broker's reputation and reliability. Reviews of DIF Broker reveal a mixed bag of experiences, with some clients praising customer service and platform usability, while others report issues related to withdrawal delays and lack of responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Platform Stability | Medium | Average |

| Customer Support Issues | High | Below Average |

Common complaints include withdrawal delays, which can significantly impact a trader's experience. In some instances, clients have reported being unable to access their funds or facing excessive delays in processing withdrawal requests. These issues raise questions about the brokers operational efficiency and responsiveness to client needs.

Platform and Trade Execution

The performance of the trading platform is a critical factor for traders. DIF Broker offers its proprietary platform, which is designed for ease of use and accessibility. However, user reviews indicate that the platform may experience stability issues, affecting order execution quality and increasing the likelihood of slippage.

Traders expect fast and reliable execution, but reports of slippage and order rejections have emerged, leading to frustration among users. Any signs of platform manipulation or inconsistencies in execution can severely impact a trader's experience and profitability.

Risk Assessment

Using DIF Broker presents several risks that traders should consider. The regulatory uncertainties, high minimum deposit requirements, and potential issues with fund security contribute to an overall higher-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Revoked licenses raise concerns. |

| Fund Security | Medium | Lack of negative balance protection. |

| Operational Efficiency | High | Reports of withdrawal delays and platform issues. |

To mitigate these risks, traders should conduct thorough due diligence, consider using a demo account to familiarize themselves with the platform, and stay informed about regulatory developments related to DIF Broker.

Conclusion and Recommendations

In conclusion, while DIF Broker has established itself as a player in the forex market, there are significant concerns regarding its regulatory status, transparency, and operational efficiency. The revocation of licenses from key regulatory bodies raises red flags about the broker's legitimacy. Potential clients should exercise caution and carefully evaluate whether to engage with DIF Broker.

For traders seeking a reliable broker, it may be prudent to consider alternatives with clearer regulatory oversight and a proven track record. Brokers such as AvaTrade or IG Group offer robust regulatory frameworks and competitive trading conditions. Ultimately, the decision to trade with DIF Broker should be made with a full understanding of the associated risks and the broker's current standing in the financial industry.

Is DIF Broker a scam, or is it legit?

The latest exposure and evaluation content of DIF Broker brokers.

DIF Broker Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DIF Broker latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.