Is DELPA safe?

Pros

Cons

Is Delpa Safe or a Scam?

Introduction

Delpa is a forex broker that has recently emerged in the online trading landscape, offering a range of trading options including forex, cryptocurrencies, and CFDs. With the growing number of online trading platforms, it becomes crucial for traders to conduct thorough evaluations of brokers before committing their funds. This is particularly important in an industry where scams and fraudulent activities are not uncommon. In this article, we will delve into the various aspects of Delpa to determine whether it is a safe trading option or if it poses risks to potential investors. Our investigation is based on a comprehensive analysis of regulatory information, company background, trading conditions, customer feedback, and security measures.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that influences its legitimacy and trustworthiness. A regulated broker is generally subject to strict oversight, which provides a layer of protection for traders. In the case of Delpa, however, there are significant concerns regarding its regulatory compliance.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | Unregulated |

Delpa does not appear to be regulated by any recognized financial authority, which raises serious red flags. The absence of regulation means that traders have little recourse in the event of disputes or issues with the broker. Furthermore, the lack of transparency regarding the company's operational jurisdiction only adds to the concerns. In a market where regulatory bodies like the FCA, ASIC, and SEC enforce strict compliance, the lack of oversight for Delpa suggests that it may not adhere to industry standards, making it a risky option for traders.

Company Background Investigation

Understanding a broker's history and ownership structure is crucial in assessing its reliability. Delpa, operating under the name Delta Parity LLC, has limited publicly available information regarding its establishment and ownership. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their management teams and corporate structures.

The company's website does not disclose its physical location, and the names of its owners remain unknown. Such opacity is often indicative of a broker that may not have the best interests of its clients at heart. Furthermore, the absence of a clear operational history raises questions about the broker's stability and reliability. Without a well-documented background, it is challenging for traders to trust Delpa as a legitimate trading partner.

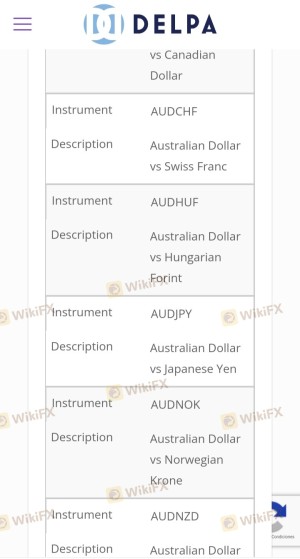

Trading Conditions Analysis

When evaluating a broker, it is essential to consider the overall trading conditions they offer. Delpa claims to provide competitive trading costs, including leverage of up to 1:100 and various account types. However, the lack of transparency regarding fees and spreads is troubling.

| Fee Type | Delpa | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0-2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific information about spreads, commissions, and overnight fees makes it difficult to assess the competitiveness of Delpa's trading conditions. Traders should be wary of brokers that do not clearly outline their fee structures, as this could lead to unexpected costs and reduced profitability in trading endeavors.

Client Fund Safety

The safety of client funds is paramount when selecting a broker. Delpa's lack of regulation raises concerns about how it manages and protects client funds. A reputable broker typically employs measures such as segregated accounts and investor protection schemes to safeguard clients' investments.

Unfortunately, there is no information available regarding Delpa's policies on fund segregation or negative balance protection. This lack of clarity puts traders at risk, as they may not have adequate protections in place should the broker face financial difficulties. Additionally, any historical issues regarding fund safety or disputes have not been publicly disclosed, further contributing to the uncertainty surrounding Delpa's operations.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. In the case of Delpa, numerous complaints have surfaced regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Service | Medium | Slow Response |

Common complaints include difficulties in withdrawing funds and lack of communication from the support team. These issues are serious and indicate a lack of commitment to customer satisfaction. Traders should be cautious of brokers with a history of unresolved complaints, as this can be a sign of deeper systemic issues within the organization.

Platform and Execution

The performance and reliability of a trading platform are critical for a successful trading experience. Delpa claims to offer a modern trading platform; however, without user testimonials or third-party reviews, it is challenging to assess its performance accurately.

Concerns about order execution quality, slippage, and potential manipulation are prevalent in the trading community. The absence of transparent information about these aspects further complicates the decision-making process for potential clients. A broker that does not provide clear details about its trading infrastructure may be attempting to obscure underlying issues.

Risk Assessment

Evaluating the risks associated with a broker is essential for traders looking to protect their investments. Delpa presents several risk factors that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Safety Risk | High | Lack of information on fund protection |

| Customer Service Risk | Medium | History of complaints |

Given the high regulatory risk and concerns surrounding fund safety, traders should approach Delpa with caution. To mitigate these risks, it is advisable to conduct thorough due diligence, consider starting with a small investment, and seek alternative brokers with robust regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that Delpa is not a safe option for traders. The lack of regulation, transparency, and poor customer feedback raises significant concerns about the broker's legitimacy and reliability. Traders should be particularly wary of the potential for withdrawal issues and inadequate customer support.

For those seeking a reliable trading experience, it is advisable to consider brokers that are well-regulated and have a proven track record of positive customer experiences. Alternatives may include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer a higher level of security and trustworthiness. Always prioritize safety and conduct comprehensive research before committing funds to any trading platform.

Is DELPA a scam, or is it legit?

The latest exposure and evaluation content of DELPA brokers.

DELPA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DELPA latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.