DELPA Review 1

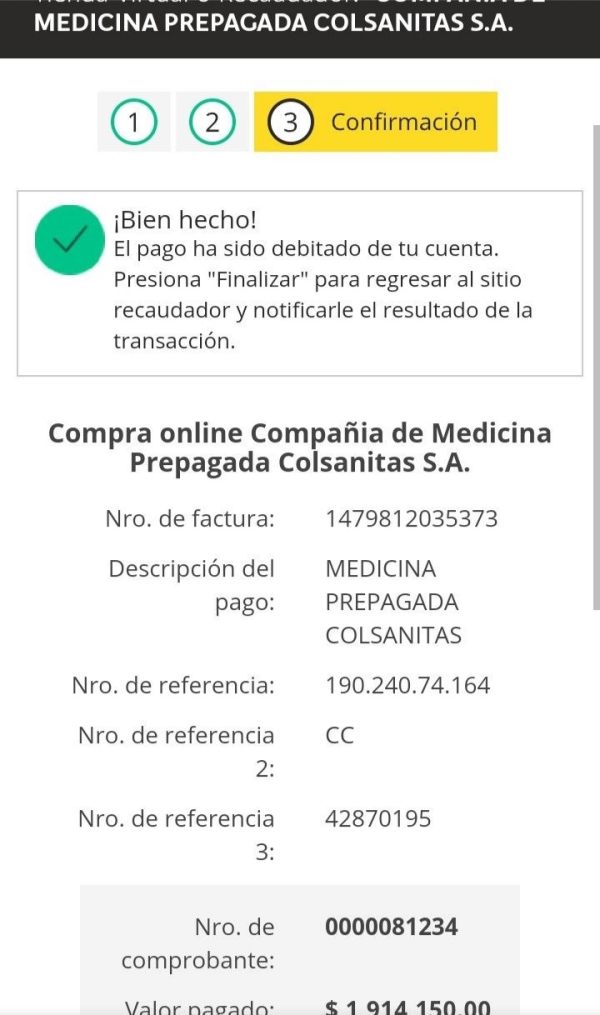

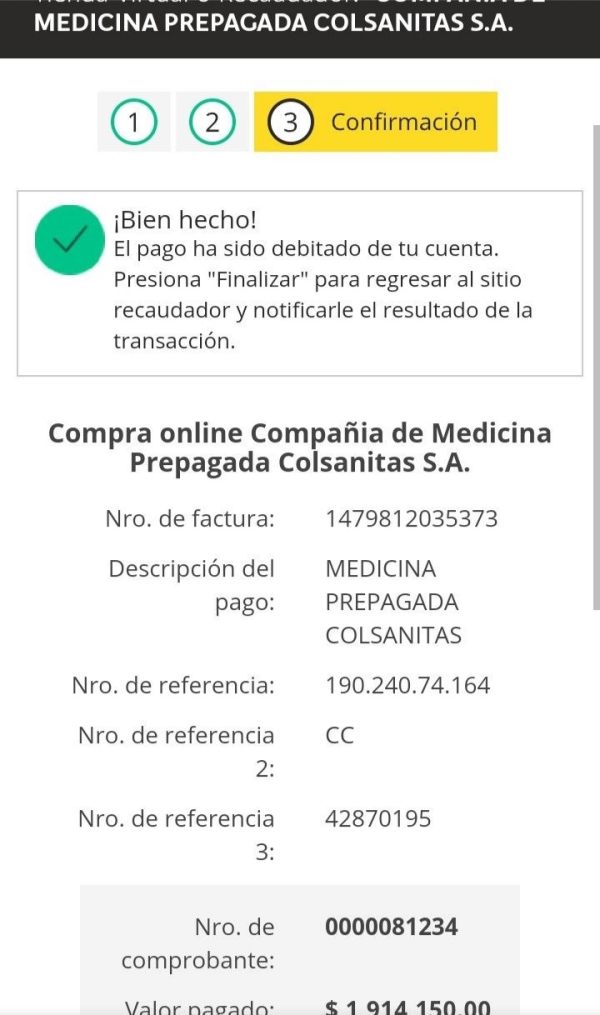

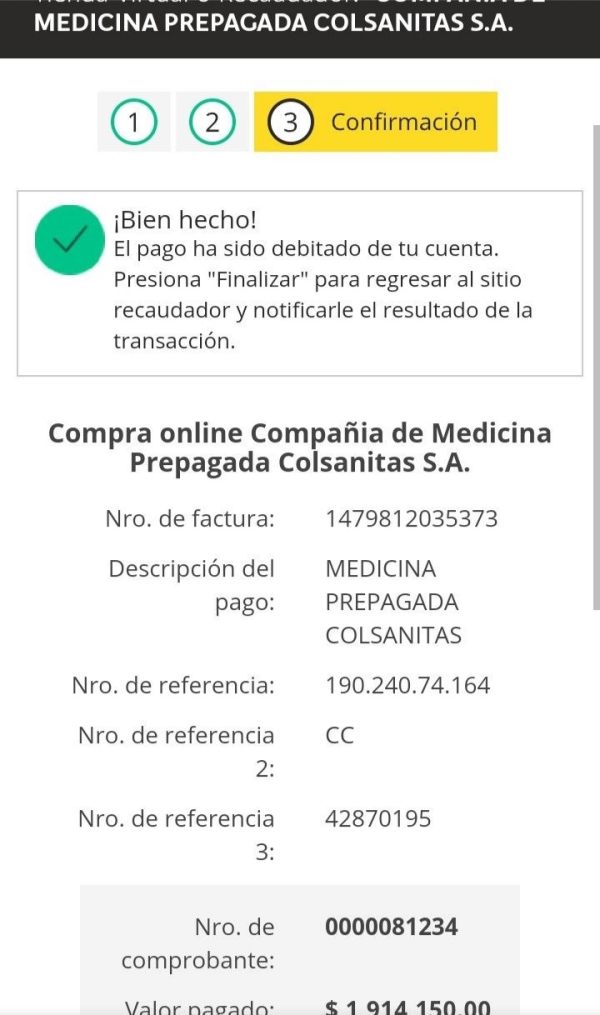

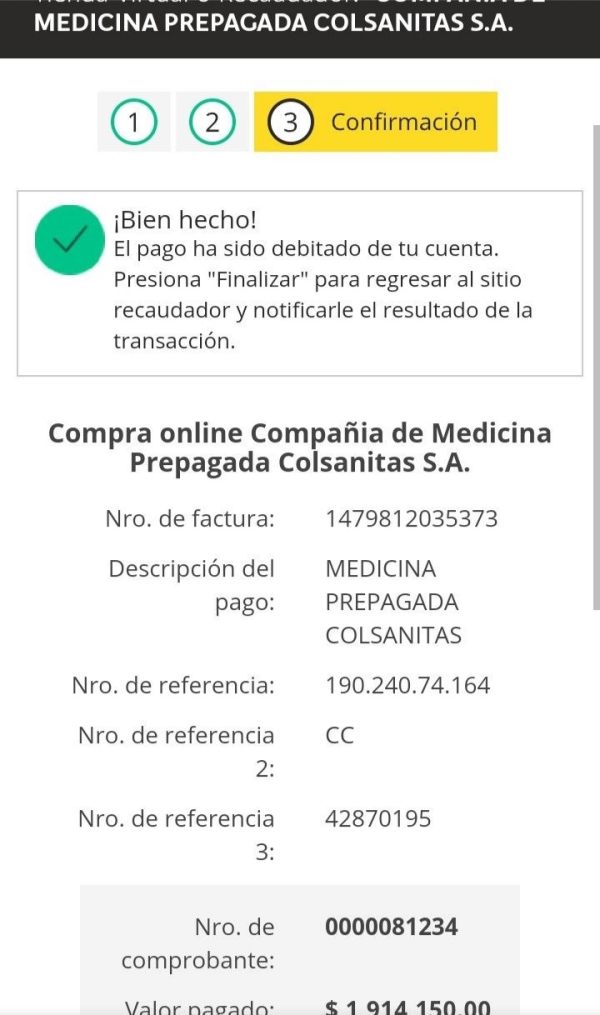

They do not want to pay me because I am paying for myself in the name of pharmacy. I need a solution.

DELPA Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They do not want to pay me because I am paying for myself in the name of pharmacy. I need a solution.

In the realm of online trading, Delpa has emerged as a broker offering various financial instruments, including forex, cryptocurrencies, and CFDs. However, a thorough examination of user experiences and expert opinions reveals a concerning picture. Overall, Delpa is often labeled as an unregulated and potentially unsafe broker, with numerous complaints about its reliability and withdrawal processes.

Note: It is important to recognize that Delpa may operate under different entities across regions, which could affect its regulatory compliance and user experience. The analysis presented here aims for fairness and accuracy based on available data.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 4 |

| Tools and Resources | 5 |

| Customer Service and Support | 3 |

| Trading Experience | 4 |

| Trustworthiness | 2 |

| User Experience | 3 |

We evaluate brokers based on user feedback, expert reviews, and factual data from multiple sources.

Founded approximately 2-5 years ago, Delpa operates under the name Delta Parity LLC, although specific details about its establishment year and regulatory status remain vague. The broker does not mention being regulated by any authoritative body, raising red flags for potential investors. Delpa utilizes its proprietary trading platform, allowing access to various asset classes, including forex, cryptocurrencies, and CFDs. However, the absence of well-known regulatory oversight significantly impacts its credibility.

Delpa is notably unregulated, with no clear information regarding its operational jurisdictions. According to multiple sources, including BFC and WikiFX, the broker lacks valid regulatory licenses. This absence of oversight raises serious concerns about the safety of client funds and the overall integrity of the trading environment.

Delpa offers a low minimum deposit requirement, which may attract novice traders. However, reports indicate that users frequently encounter issues when attempting to withdraw funds. Many reviews highlight difficulties in accessing their money, leading to frustration and distrust among clients. Such experiences suggest that while the initial entry into trading with Delpa may be easy, the exit could be fraught with challenges.

While specific figures for the minimum deposit are not consistently reported, sources indicate that it is relatively low, which can be appealing for new traders. However, the low barrier to entry does not compensate for the lack of trustworthiness associated with the broker.

Delpa currently does not offer any bonuses or promotions. The lack of incentives may be a strategic choice to avoid complications typically associated with bonus withdrawals, which can often lead to disputes between brokers and traders.

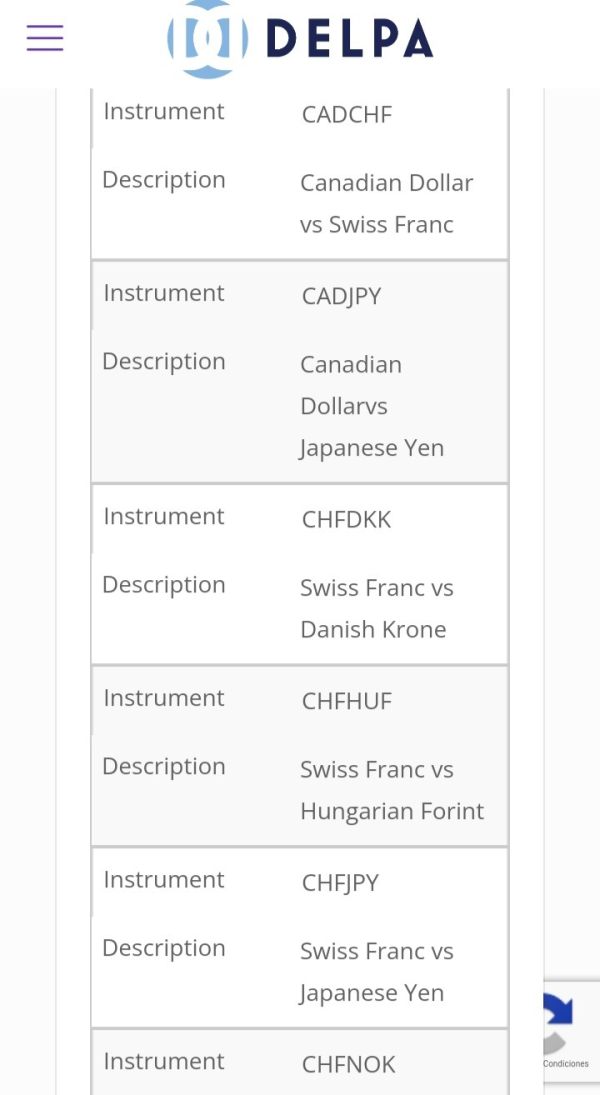

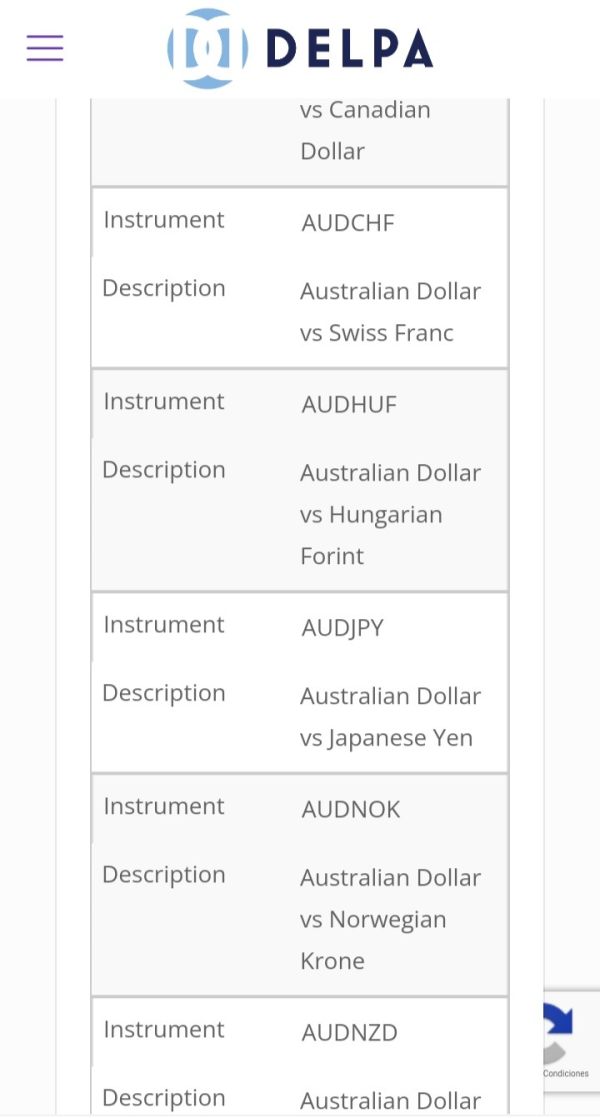

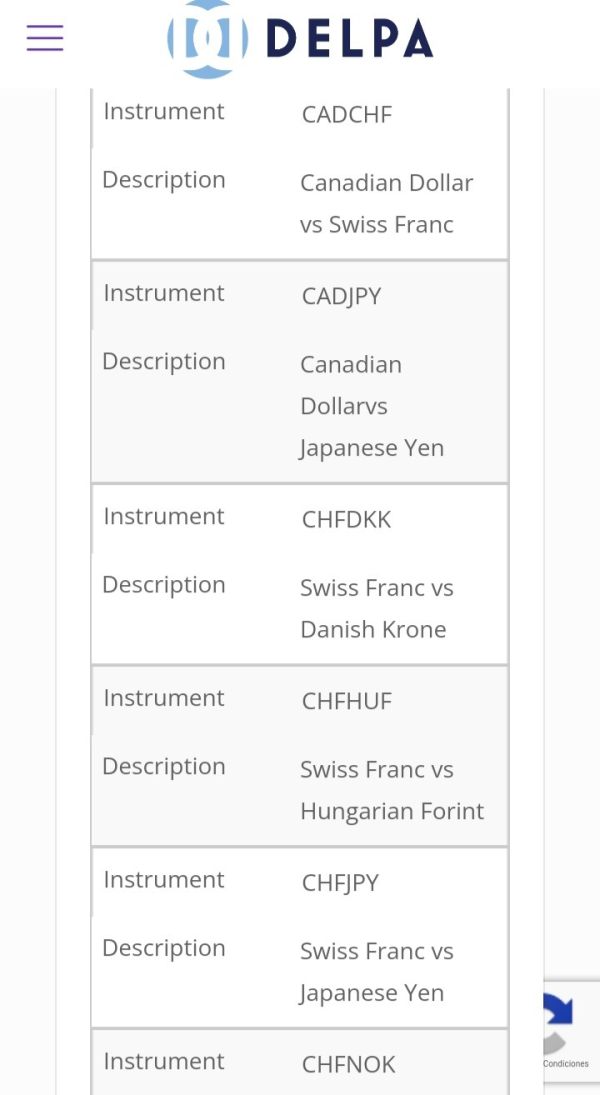

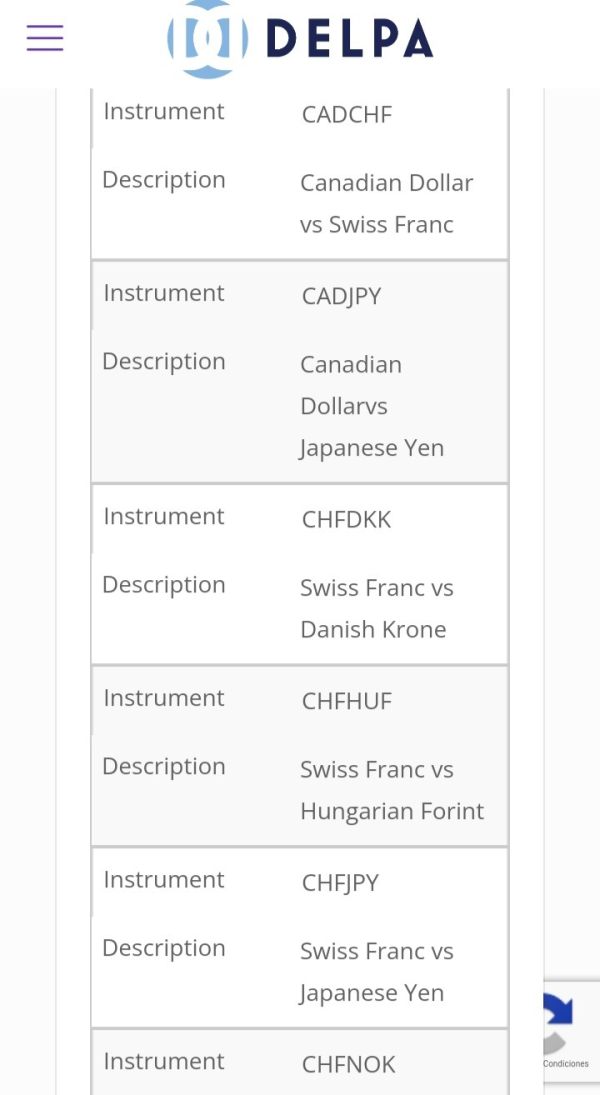

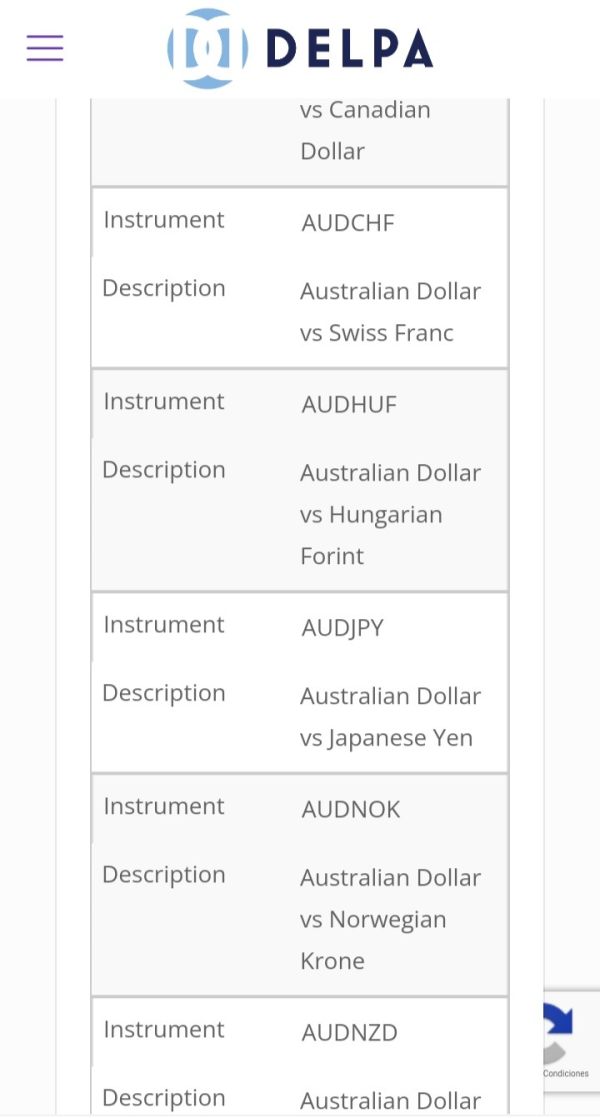

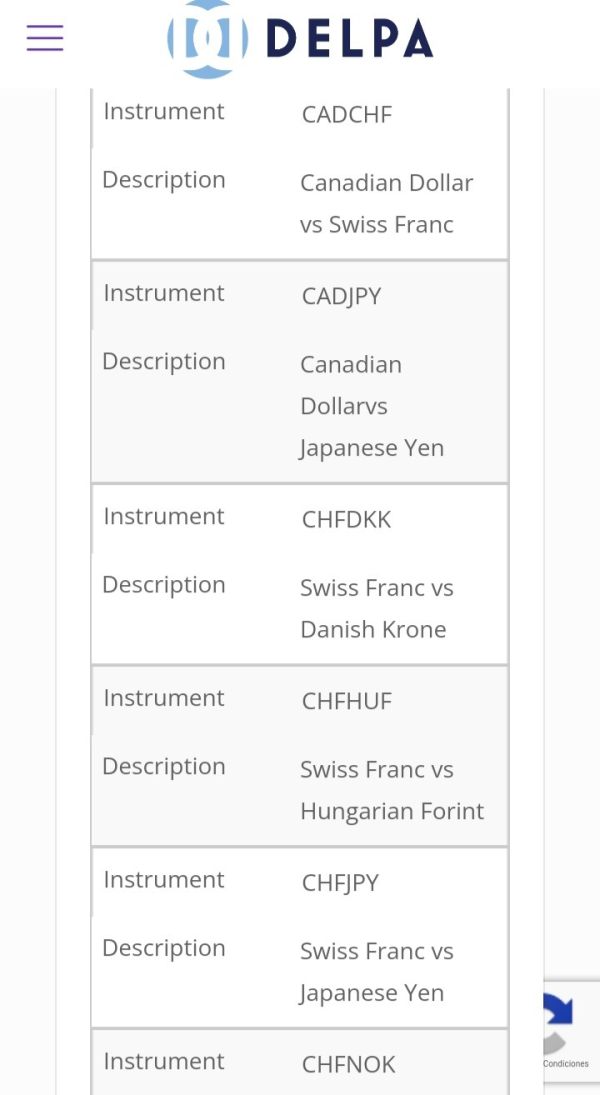

Traders can access a range of asset classes, including forex, cryptocurrencies, and CFDs. However, the quality and execution of trades are often questioned due to the broker's unregulated status and limited transparency.

The specific costs associated with trading on Delpa's platform, including spreads and commissions, are not well-documented. However, the general sentiment among users suggests that the trading conditions may not be competitive, especially when compared to regulated brokers offering similar services.

Delpa offers leverage up to 1:100, which is relatively standard in the industry. However, the risks associated with high leverage trading should be carefully considered, especially given the broker's lack of regulation.

Delpa operates on its proprietary trading platform, which may lack the advanced features and reliability found in more established platforms like MT4 or MT5. This limitation could hinder the trading experience for users accustomed to more robust trading tools.

There is no clear information regarding restricted areas for Delpa, but potential traders should be cautious and verify whether they can legally trade with this broker in their respective regions.

Delpa does not provide extensive information about its customer support options. Reports indicate that users have faced challenges in reaching out for assistance, with many expressing dissatisfaction regarding response times and the quality of support received.

| Category | Rating (out of 10) |

|---|---|

| Account Conditions | 4 |

| Tools and Resources | 5 |

| Customer Service and Support | 3 |

| Trading Experience | 4 |

| Trustworthiness | 2 |

| User Experience | 3 |

Account Conditions: The low minimum deposit is attractive, but the overall conditions are marred by a lack of regulatory oversight, leading to a score of 4.

Tools and Resources: Delpa's proprietary platform offers basic functionalities but lacks the advanced tools found in more established platforms, earning a score of 5.

Customer Service and Support: Users report significant challenges in contacting customer support, resulting in a low score of 3.

Trading Experience: While the trading experience can be straightforward, the lack of transparency and regulatory backing detracts from user confidence, leading to a score of 4.

Trustworthiness: Given the absence of regulation and numerous complaints, Delpa's trustworthiness is severely compromised, reflected in a score of 2.

User Experience: The overall user experience is tainted by withdrawal issues and customer service challenges, resulting in a score of 3.

In conclusion, while Delpa may present itself as an accessible option for traders, the overwhelming consensus from user reviews and expert opinions suggests that caution is warranted. The lack of regulation, combined with numerous complaints regarding withdrawal difficulties and customer support issues, positions Delpa as a broker that potential investors should approach with significant skepticism.

FX Broker Capital Trading Markets Review