Is CMMCI safe?

Business

License

Is CMMCI Safe or Scam?

Introduction

CMMCI, also known as CMMCI Securities Information Company Ltd, positions itself as an online trading broker primarily targeting the forex market. Operating through a user-friendly interface, CMMCI claims to offer a range of trading services, including forex trading, commodities, and indices. However, the proliferation of unregulated brokers in the forex market necessitates that traders exercise caution when selecting a broker. This is especially true for CMMCI, which has garnered attention for its questionable practices. In this article, we will investigate whether CMMCI is safe or a scam by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory status of a trading broker is crucial in determining its legitimacy and safety for traders. CMMCI claims to be based in the UK, but investigations reveal a troubling lack of regulatory oversight. The broker is not listed in the UKs Financial Conduct Authority (FCA) register, raising red flags about its legitimacy. Below is a summary of the regulatory information for CMMCI:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that CMMCI operates without the oversight that protects traders from fraud and malpractice. Regulated brokers are required to adhere to strict standards, including maintaining client funds in segregated accounts and providing clear avenues for dispute resolution. Without such protections, traders using CMMCI are at significant risk, as they have no regulatory body to turn to in case of issues. The lack of a regulatory license not only undermines the broker's credibility but also raises concerns about its operational practices. Therefore, it is imperative to approach CMMCI with caution, as the absence of regulation suggests higher risks for traders.

Company Background Investigation

CMMCI Securities Information Company Ltd has a murky corporate history, with limited publicly available information. The company claims to be based in the UK, but attempts to verify its existence through the UK company register yield no results. This lack of transparency is indicative of potential fraudulent activity. The management team behind CMMCI is not well-documented, making it difficult for traders to assess their qualifications and experience in the financial sector.

Transparency is a fundamental aspect of a trustworthy brokerage, and CMMCI falls short in this regard. The company does not provide adequate information about its ownership structure or the backgrounds of its executives. This lack of disclosure raises concerns about accountability and the potential for misconduct. Given the opaque nature of CMMCI's operations, traders should be wary of engaging with this broker, as it is challenging to ascertain the legitimacy of its claims without clear and verifiable information.

Trading Conditions Analysis

CMMCI advertises competitive trading conditions, including a minimum deposit requirement of $1,000 and a maximum leverage of 1:100. However, the overall fee structure remains unclear, with many traders reporting unexpected costs and challenges when attempting to withdraw funds. Heres a comparison of key trading costs associated with CMMCI:

| Fee Type | CMMCI | Industry Average |

|---|---|---|

| Spread on Major Pairs | 0.1 pips | 1.0 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | Not disclosed | 0.5% - 2.0% |

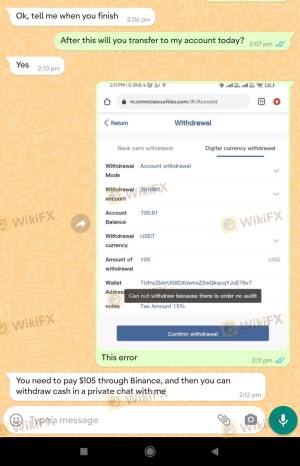

While the advertised spread of 0.1 pips may appear attractive, the lack of transparency regarding commission structures and overnight interest rates raises concerns. Traders have reported issues with fund withdrawals, suggesting that the broker may impose hidden fees or complicated processes to access their funds. This lack of clarity in trading conditions is a significant warning sign, as it can lead to unexpected financial losses for traders. Given these factors, it is crucial to evaluate whether CMMCI's trading conditions align with industry standards and if they truly provide a fair trading environment.

Customer Funds Security

The security of customer funds is a paramount concern for any trading broker. CMMCI claims to implement measures to safeguard client funds, but the lack of regulation raises serious questions about the effectiveness of these measures. Unregulated brokers often do not provide the same level of security as their regulated counterparts, which can include features such as segregated accounts and investor protection schemes.

Traders should be particularly cautious about the absence of detailed information regarding how CMMCI manages client funds. Without clear policies on fund segregation and negative balance protection, traders risk losing their entire investment. Historical complaints about difficulties in withdrawing funds further exacerbate these concerns, indicating that CMMCI may not prioritize the security of its clients' investments. Therefore, potential investors should approach CMMCI with skepticism regarding the safety of their funds.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of CMMCI reveal a pattern of negative experiences, particularly concerning fund withdrawals and customer support. Below is a summary of common complaint types associated with CMMCI:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Inadequate |

| Customer Support Delays | High | Poor |

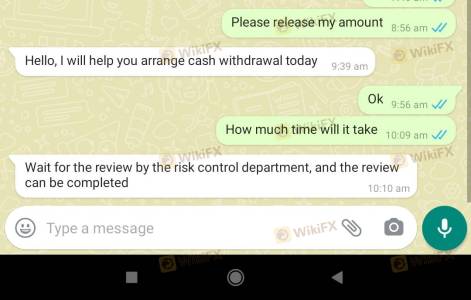

Many users have reported difficulties in accessing their funds, with some alleging that their accounts were blocked after making deposits. Additionally, customer support has been criticized for being unresponsive or unhelpful. These complaints highlight a concerning trend that suggests CMMCI may not be a trustworthy broker.

For example, one trader reported that after depositing funds, they faced numerous obstacles when attempting to withdraw their money, resulting in frustration and financial loss. Such experiences are alarming and further reinforce the need for caution when considering CMMCI as a trading partner.

Platform and Trade Execution

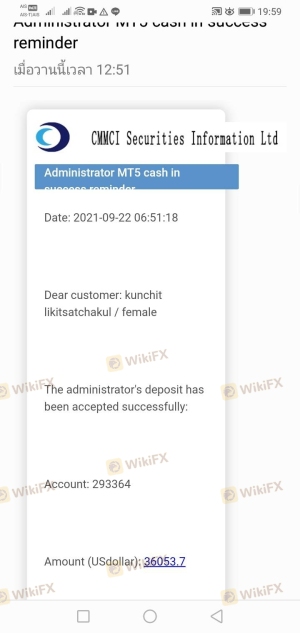

The trading platform offered by CMMCI is based on the popular MetaTrader 5 (MT5) interface, which is generally well-regarded in the trading community. However, the quality of execution and reliability of the platform are critical factors that can significantly impact a trader's experience. While MT5 is known for its stability, reports of slippage and order rejections have surfaced among CMMCI users.

Traders have expressed concerns about the speed of trade execution and the potential for manipulation, which can occur in unregulated environments. Any signs of platform manipulation, such as frequent slippage or unfulfilled orders, raise significant red flags. Therefore, it is essential for traders to investigate the execution quality thoroughly before committing to CMMCI.

Risk Assessment

Engaging with CMMCI presents several risks that potential traders should be aware of. Below is a risk scorecard summarizing the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | High | Lack of transparency in fees and withdrawals. |

| Operational Risk | Medium | Potential for platform manipulation and execution issues. |

To mitigate these risks, traders should conduct thorough research before engaging with CMMCI. Seeking regulated alternatives and ensuring a clear understanding of the trading conditions can help protect against potential losses.

Conclusion and Recommendations

In summary, the evidence suggests that CMMCI is a broker that should be approached with caution. The lack of regulatory oversight, combined with numerous complaints regarding fund withdrawals and customer support, raises significant concerns about its legitimacy. While the trading conditions may appear attractive at first glance, the underlying risks and transparency issues indicate that potential traders could be exposed to significant financial harm.

For traders seeking a safe and reliable trading environment, it is advisable to consider regulated alternatives that prioritize client protection and transparency. Brokers with established reputations and robust regulatory frameworks can offer a more secure trading experience. Ultimately, the question remains: Is CMMCI safe? The overwhelming evidence points to a resounding no, making it imperative for traders to seek out safer options in the forex market.

Is CMMCI a scam, or is it legit?

The latest exposure and evaluation content of CMMCI brokers.

CMMCI Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CMMCI latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.