Regarding the legitimacy of CLC forex brokers, it provides SFC, SFC and WikiBit, (also has a graphic survey regarding security).

Is CLC safe?

Pros

Cons

Is CLC markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RevokedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

CLC Futures Limited

Effective Date:

2014-10-29Email Address of Licensed Institution:

info@clchk.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.clchk.comExpiration Time:

--Address of Licensed Institution:

香港中環干諾道中88號南豐大廈13樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RevokedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

CLC Securities Limited

Effective Date:

2008-06-16Email Address of Licensed Institution:

tracy.kung@clchk.comSharing Status:

No SharingWebsite of Licensed Institution:

www.clchk.comExpiration Time:

--Address of Licensed Institution:

香港九龍柯士甸道西1號環球貿易廣場85樓8506B室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is CLC Safe or a Scam?

Introduction

In the rapidly evolving world of forex trading, brokers play a crucial role in connecting traders with the financial markets. Among these brokers, CLC has made its mark, particularly in the Asian markets. However, with the rise of online trading platforms, traders must exercise caution and conduct thorough evaluations of any broker they consider engaging with. This is especially true for CLC, as questions about its legitimacy and regulatory compliance have surfaced. In this article, we will explore whether CLC is safe for traders or if it raises red flags that warrant concern. Our investigation is based on a comprehensive review of regulatory information, customer feedback, and industry standards.

Regulation and Legitimacy

The regulatory status of a broker is a key determinant of its credibility and safety. A well-regulated broker is generally considered safer for traders, as it adheres to strict guidelines designed to protect clients. CLC's regulatory situation has been a point of contention.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC (Securities and Futures Commission) | AQF 520 | Hong Kong | Revoked |

The above table highlights that CLC was previously regulated by the SFC in Hong Kong, but its license has been revoked. This revocation raises significant concerns about the broker's operational integrity and compliance with regulatory standards. The SFC is known for its stringent regulations, and being unregulated or having a revoked license can lead to a lack of investor protection.

Historically, CLC has faced scrutiny due to allegations of fund withdrawal difficulties and other compliance issues. While regulatory oversight does not guarantee safety, it serves as a critical indicator of a broker's commitment to maintaining industry standards. Given the revoked status, potential clients should be wary and consider the implications of trading with a broker that lacks robust regulatory oversight.

Company Background Investigation

Understanding a broker's history and ownership structure is essential for assessing its trustworthiness. CLC was established in Hong Kong and has operated for several years. However, detailed information about its ownership and management team is somewhat opaque.

The management team's qualifications and experience can significantly influence a broker's operations. Unfortunately, CLC does not provide comprehensive information about its executives or their backgrounds, which can be a red flag for potential investors. Transparency in management is crucial for building trust, and the lack of this information can lead to concerns regarding the company's legitimacy.

Moreover, CLC's website has faced issues with accessibility, which further complicates the transparency of its operations. For any broker, especially one in the forex market, having a reliable and informative online presence is vital for client trust and engagement. The absence of clear information regarding its operational practices and company structure raises questions about CLC's commitment to transparency.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is paramount. CLC's fee structure and trading policies are essential components of this evaluation.

Overall, CLC's trading conditions appear to be competitive, but there are nuances that traders should be aware of.

| Fee Type | CLC | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.4% |

The comparison table illustrates that while CLC's spreads are slightly above the industry average, its commission model remains variable, which can lead to unexpected costs for traders. Additionally, the overnight interest rates are marginally higher than the average, which could impact longer-term trading strategies.

Traders should be cautious of any unusual fee structures or hidden charges that may not be immediately apparent. The variability in commissions can lead to higher trading costs, especially for active traders. It is advisable for potential clients to fully understand the fee structure before committing to CLC, as these costs can significantly impact overall profitability.

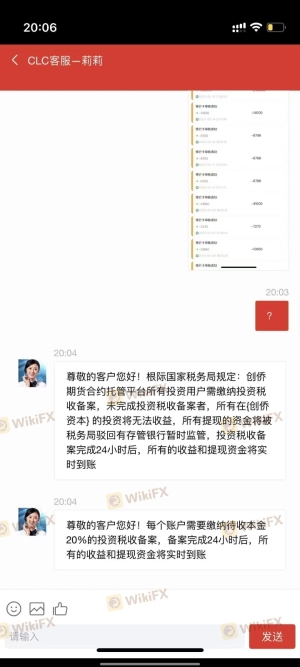

Client Fund Security

The safety of client funds is a critical concern for any forex trader. CLC claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. However, given the revoked status of its regulatory license, the effectiveness of these measures remains questionable.

Segregation of client funds is a standard practice among reputable brokers, ensuring that client deposits are kept separate from the broker's operational funds. This is crucial for protecting clients in the event of financial difficulties faced by the broker. However, without regulatory oversight, there is no guarantee that CLC adheres to these practices.

Furthermore, investor protection schemes, which provide compensation in case of broker insolvency, are typically enforced by regulatory bodies. With CLC's current unregulated status, clients may find themselves without any recourse or protection should issues arise regarding fund withdrawals or broker operations.

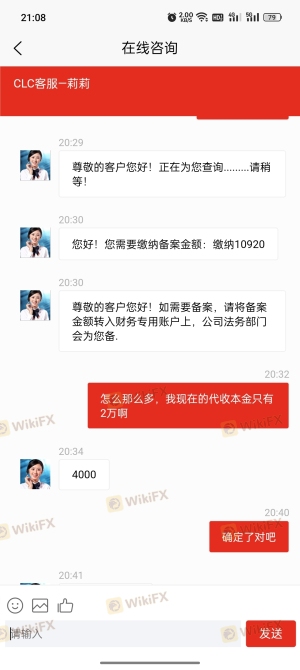

Customer Experience and Complaints

Customer feedback is invaluable in assessing the reliability of a broker. Unfortunately, CLC has received mixed reviews from its users, with several complaints highlighting issues related to fund withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Inconsistent |

| Platform Stability | High | Unresolved |

The table above summarizes the primary complaints associated with CLC. Many users have reported difficulties in withdrawing their funds, often citing slow or inadequate responses from customer service. Additionally, there have been concerns regarding platform stability, which can significantly affect trading performance.

One notable case involved a trader who attempted to withdraw funds after several months of trading. The withdrawal request was met with delays and vague responses from the support team, leading to frustration and loss of trust in the platform. Such experiences can deter potential clients and raise concerns about the overall reliability of CLC.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. CLC offers a trading platform that is generally user-friendly, but reports indicate issues with execution quality.

Traders have noted instances of slippage and rejected orders, which can significantly impact trading outcomes. The ability to execute trades promptly and at the desired price is essential, and any signs of manipulation or technical issues can erode trust in the broker.

Additionally, the platform's stability has been questioned, with users reporting frequent outages and connectivity problems. Such issues can be detrimental, especially in the fast-paced forex market, where timing is critical.

Risk Assessment

Engaging with CLC carries inherent risks that potential clients should carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Financial Risk | Medium | Potential for withdrawal difficulties |

| Operational Risk | High | Complaints about platform stability |

The table above summarizes the primary risks associated with trading with CLC. The high regulatory risk due to its revoked license is a significant concern, as it indicates a lack of oversight and protection for traders. Additionally, operational risks related to platform stability and withdrawal issues further exacerbate the potential dangers of engaging with this broker.

To mitigate these risks, traders are advised to conduct thorough due diligence and consider alternative brokers with robust regulatory oversight and positive user feedback.

Conclusion and Recommendations

In conclusion, while CLC presents itself as a forex trading platform, the evidence suggests that it may not be the safest option for traders. The revoked regulatory status, coupled with numerous complaints regarding fund withdrawals and platform stability, raises significant concerns about its legitimacy.

Traders should exercise caution when considering CLC, as there are clear indicators of potential risks and operational challenges. For those seeking reliable trading options, it may be prudent to explore alternative brokers that are well-regulated and have a proven track record of positive customer experiences.

In light of the analysis, it is clear that is CLC safe? The answer remains ambiguous, warranting a cautious approach for any potential investor.

Is CLC a scam, or is it legit?

The latest exposure and evaluation content of CLC brokers.

CLC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CLC latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.