Is Capital Markets safe?

Pros

Cons

Is Capital Markets Safe or a Scam?

Introduction

Capital Markets is a brokerage firm that positions itself within the forex market, claiming to offer a wide range of trading services across various financial instruments. As the trading landscape becomes increasingly crowded, traders must exercise caution and conduct thorough evaluations of brokers before committing their funds. This is particularly critical in the forex sector, where the presence of unregulated and potentially fraudulent entities poses significant risks to investors. In this article, we will analyze the safety and legitimacy of Capital Markets by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk factors. Our investigation is based on data gathered from multiple reputable sources, including regulatory databases and user reviews, ensuring a comprehensive assessment of whether Capital Markets is safe for traders.

Regulation and Legitimacy

The regulatory environment is a fundamental aspect that determines the safety of a brokerage. A regulated broker is subject to stringent oversight, which helps protect traders interests and ensures fair trading practices. In the case of Capital Markets, it has been noted that the broker lacks regulation from any top-tier financial authority. This absence of oversight raises significant concerns about its legitimacy and operational practices.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The importance of regulation cannot be overstated. Brokers regulated by reputable authorities, such as the UKs Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC), are held to high standards of conduct. They must maintain segregated accounts for client funds, provide transparent fee structures, and adhere to strict operational guidelines. The lack of regulatory oversight for Capital Markets suggests that traders may not have access to the same level of protection, increasing the risk of encountering unfair practices or even fraud. Furthermore, without a regulatory body to oversee its operations, Capital Markets may not be held accountable for any misconduct, making it imperative for traders to approach this broker with caution.

Company Background Investigation

Capital Markets claims to have been established with the intention of providing comprehensive trading solutions; however, details surrounding its history and ownership structure remain vague. The company appears to be registered in multiple jurisdictions, including the United States, but lacks clear documentation regarding its operational framework and management team.

The management team‘s background is crucial in assessing the reliability of a brokerage. A team with extensive experience in finance and trading can enhance a broker’s credibility. Unfortunately, information about the key personnel at Capital Markets is limited, which raises questions about the firm's transparency and operational integrity.

In terms of information disclosure, Capital Markets has not provided adequate insights into its business practices or financial health. This lack of transparency can be a red flag for potential investors, as it may indicate that the broker is not forthcoming about its operations or any potential risks involved. Given these factors, the overall assessment of Capital Markets company background suggests a need for caution, prompting traders to question whether Capital Markets is safe for their investments.

Trading Conditions Analysis

An essential aspect of evaluating any brokerage is its trading conditions, including fees, spreads, and commission structures. Capital Markets presents itself as offering competitive trading conditions; however, the specifics of its fee structure are not readily available or transparent.

| Fee Type | Capital Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads and commission models is concerning. Industry standards typically dictate that reputable brokers provide comprehensive fee schedules to inform traders of potential costs. Traders may encounter unexpected fees or unfavorable trading conditions if they do not have access to this information upfront. Moreover, any unusual fees or hidden charges can significantly affect a trader's profitability, leading to concerns about whether Capital Markets is safe for trading.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker. This involves examining the measures in place to protect client deposits, such as fund segregation and investor protection schemes. Capital Markets has not provided sufficient details regarding its fund security protocols, which raises alarms about the safety of traders investments.

In regulated environments, brokers are often required to maintain segregated accounts for client funds, ensuring that these funds are protected in the event of the broker's insolvency. Additionally, many regulatory authorities offer compensation schemes that protect investors up to a certain limit should the broker fail. However, since Capital Markets operates without regulation, it is unclear what measures, if any, are in place to safeguard client funds. This lack of clarity poses a significant risk for traders, as they may be vulnerable to losing their investments without any recourse. Consequently, the absence of robust fund protection mechanisms raises serious questions about whether Capital Markets is safe for trading.

Customer Experience and Complaints

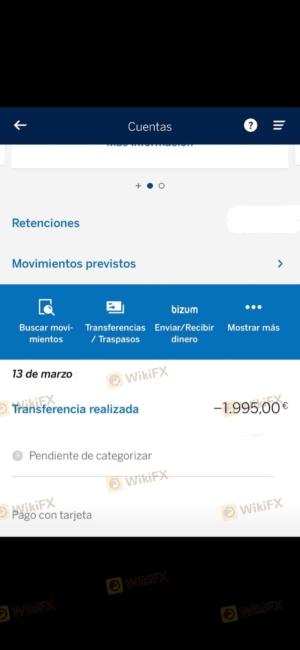

Customer feedback is a valuable indicator of a brokerage's reliability and operational integrity. Reviews and testimonials from users of Capital Markets reveal a mixed bag of experiences, with numerous complaints regarding withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Limited Response |

| Poor Customer Service | Medium | Slow Response |

| Misleading Information | High | No Clear Response |

Common complaints from users include difficulties in withdrawing funds, with some traders reporting that their requests were either ignored or met with unreasonable delays. Such issues can severely impact a trader's experience and raise concerns about the broker's operational practices. Additionally, the lack of timely and effective responses from Capital Markets further exacerbates these concerns, leading to a perception that the broker may not prioritize customer satisfaction or transparency. Given these factors, potential investors should carefully consider the overall customer experience when assessing whether Capital Markets is safe for their trading activities.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for any trader. Capital Markets offers a trading platform that claims to provide access to various financial instruments, but there is limited information available regarding its performance, stability, and user experience.

Traders have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes. A reliable broker should ensure that orders are executed promptly and at the expected prices. Any signs of manipulation or subpar execution can indicate deeper issues within the brokerage's operational practices.

In summary, potential users should be cautious about the platform's reliability, as any deficiencies in execution can lead to substantial financial losses. As such, it is essential to consider whether Capital Markets is safe based on its platform performance and execution quality.

Risk Assessment

Engaging with any brokerage carries inherent risks, and Capital Markets appears to present several concerning factors that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation in place |

| Withdrawal Risk | High | Difficulties reported in fund withdrawals |

| Transparency Risk | Medium | Lack of clear information on fees and policies |

Given these risks, traders should approach Capital Markets with caution. To mitigate potential risks, it is advisable to conduct thorough research, consider using smaller amounts for initial trades, and monitor the broker's practices closely. If significant issues arise, it may be prudent to withdraw funds and seek alternative trading options.

Conclusion and Recommendations

In conclusion, the evidence suggests that Capital Markets presents several red flags that warrant concern. The absence of regulatory oversight, coupled with customer complaints regarding withdrawal issues and a lack of transparency, raises significant doubts about whether Capital Markets is safe for trading.

For traders seeking a reliable brokerage, it is advisable to consider alternative options that are regulated by reputable authorities and have established a positive track record in customer service and fund protection. Brokers that comply with strict regulatory standards provide a safer trading environment and better protection for investors' funds.

In summary, while Capital Markets may offer attractive trading conditions, the associated risks and lack of oversight make it a less favorable choice for traders prioritizing safety and reliability in their trading activities.

Is Capital Markets a scam, or is it legit?

The latest exposure and evaluation content of Capital Markets brokers.

Capital Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Capital Markets latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.