Capital Markets Review 1

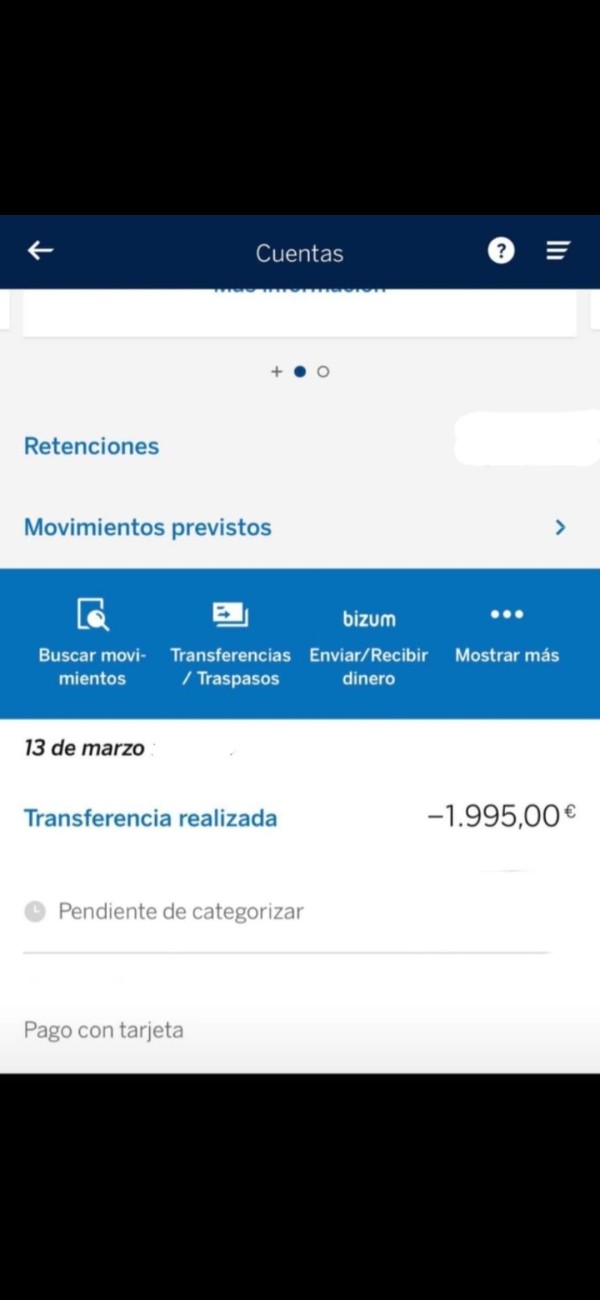

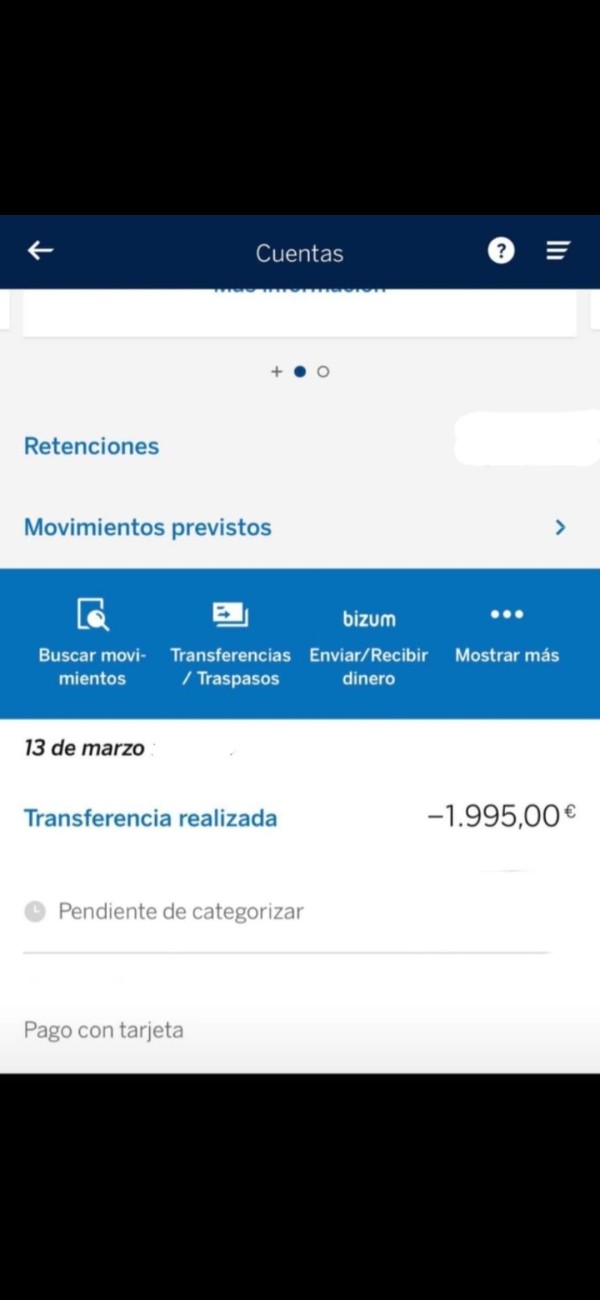

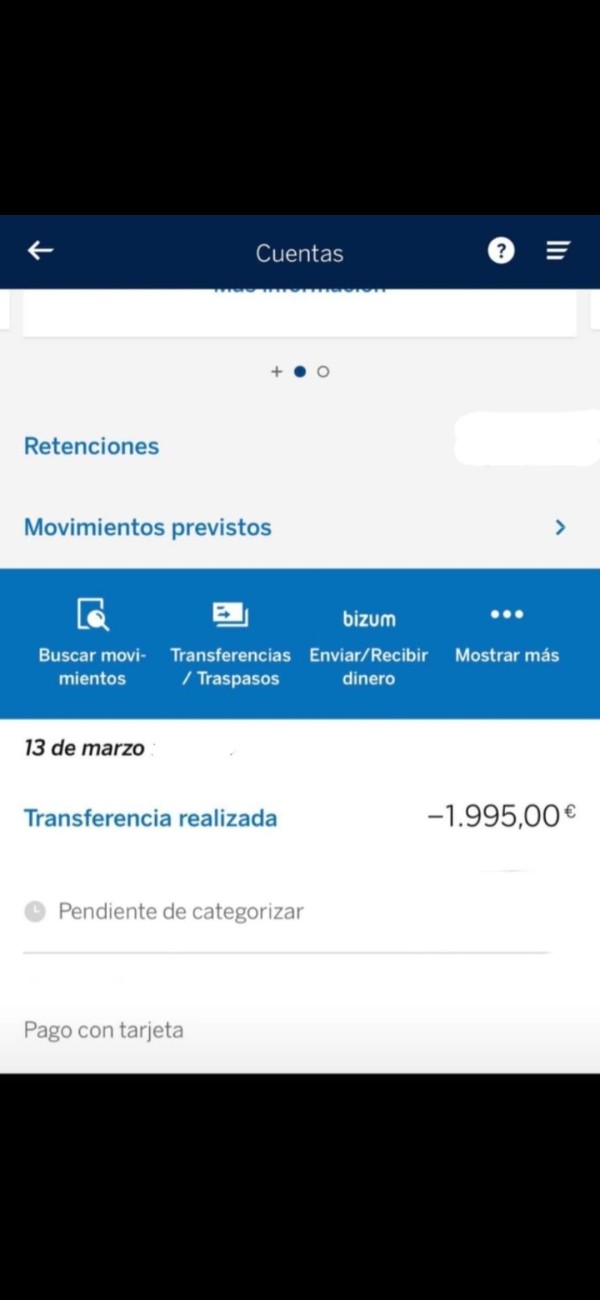

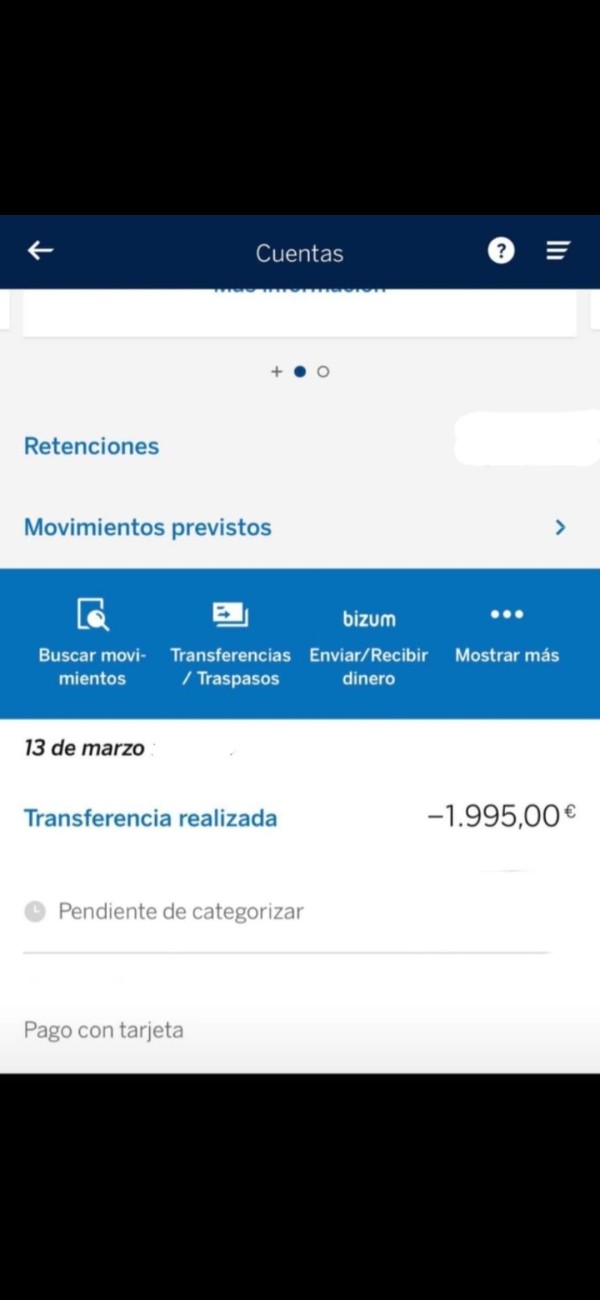

They called me and asked for $1995. I agreed and deposited. Two days later, the consultant prevented me. They replied me until today.

Capital Markets Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They called me and asked for $1995. I agreed and deposited. Two days later, the consultant prevented me. They replied me until today.

This capital markets review looks at the current state and future of capital markets as we enter 2025. According to PwC's analysis, US public markets are getting ready for a major comeback driven by interest rate cuts, built-up investor demand, and a large backlog of companies waiting to go public. Capital markets show amazing strength and potential for new ideas. SIFMA says that capital markets stay crucial to economic growth and citizen welfare.

Capital markets connect entities that need money with those who have money to invest. They drive job creation and economic growth in a basic way. The 2024 market showed strong recovery despite ups and downs, creating the base for 2025's expected growth. PwC stays hopeful about innovation and strength shaping a lively capital markets environment in the coming year.

This review targets investors who want opportunities during the recovery phase, institutional participants who evaluate market conditions, and professionals who need complete market intelligence for strategic decisions.

This capital markets assessment shows different rules and operating models across various regions. Regional differences in market structure, supervision standards, and investor protection may greatly impact market participation and results. The evaluation method relies on available industry reports, regulatory publications, and market data from established financial institutions.

Market conditions and regulatory environments change continuously. Readers should verify current information before making investment decisions. This review represents market conditions as of late 2024 and early 2025 projections based on available data sources.

| Dimension | Score | Evaluation Basis |

|---|---|---|

| Market Access Conditions | N/A | Specific broker access conditions not detailed in available sources |

| Tools and Resources | N/A | Detailed platform tools and resources not specified in source materials |

| Service and Support | N/A | Customer service information not provided in available data |

| Trading Experience | N/A | Specific trading experience metrics not available in source materials |

| Trust and Reliability | N/A | Individual broker trust indicators not detailed in available sources |

| User Experience | N/A | Specific user experience data not provided in available materials |

According to SIFMA's 2024 Capital Markets Fact Book, capital markets represent the cornerstone of economic functionality. They help essential connections between capital seekers and investment providers. The organization says that vibrant and healthy capital markets emerge through ensuring high standards of market integrity and investor protection, enabling capital formation through savings and investment mechanisms, promoting financial literacy and robust retail investor culture, and balancing supervision and regulation with innovation and growth initiatives.

The 2024 market performance showed substantial recovery following previous volatile periods. PwC's analysis indicates that capital markets experienced significant strengthening throughout 2024. This established the groundwork for 2025's anticipated expansion. The combination of interest rate adjustments, accumulated investor demand, and substantial IPO pipeline creates favorable conditions for market participants.

Capital markets serve multiple critical functions including growth facilitation, risk allocation, and financial stability support. The Securities Industry and Financial Markets Association submitted over 140 regulatory comment letters, studies, and legislative proposals in 2024. This demonstrates active engagement in market development and regulatory refinement processes.

Regulatory Environment: Available sources do not specify particular regulatory jurisdictions or oversight mechanisms for individual market participants. SIFMA emphasizes the importance of balanced supervision and regulation with innovation and growth objectives.

Access Methods: Specific deposit and withdrawal methods are not detailed in the available source materials.

Minimum Requirements: Particular minimum deposit or participation requirements are not specified in the accessible information.

Promotional Offerings: Details regarding bonus structures or promotional incentives are not provided in the available data sources.

Available Assets: Specific tradeable asset categories are not listed in the source materials. However, the capital markets review indicates broad market participation opportunities.

Cost Structure: Detailed fee schedules, spread information, or commission structures are not specified in the available sources.

Leverage Options: Specific leverage ratios or margin requirements are not detailed in the accessible materials.

Platform Selection: Particular trading platform options are not described in the available source information.

Geographic Restrictions: Specific regional limitations are not outlined in the accessible data.

Language Support: Customer service language options are not specified in the available materials.

The available source materials do not provide specific information regarding account types, structures, or opening procedures for individual market participants. While SIFMA emphasizes the importance of enabling capital formation through savings and investment, particular account features such as minimum deposit requirements, account tiers, or specialized account options are not detailed in the accessible information.

The regulatory framework discussion indicates that market integrity and investor protection represent fundamental priorities. This suggests that account conditions would align with these principles. However, specific implementation details, verification processes, or account management features are not elaborated in the source materials.

The capital markets review indicates that 2025 market conditions may create more favorable environments for various participant types. This could potentially influence account condition structures. Nevertheless, concrete details regarding account opening procedures, maintenance requirements, or special account functionalities remain unspecified in the available data sources.

Market participants would benefit from direct verification of account conditions. The available materials focus primarily on broader market trends and regulatory frameworks rather than specific operational details.

The available source materials do not specify particular trading tools, analytical resources, or educational offerings for individual market participants. While the broader capital markets environment demonstrates innovation and technological advancement, specific platform capabilities, research tools, or automated trading support features are not detailed in the accessible information.

SIFMA's emphasis on promoting financial literacy suggests that educational resources would represent important market components. However, particular implementation methods, content types, or delivery mechanisms for educational materials are not specified in the available sources.

The market recovery trends identified by PwC indicate that sophisticated analytical tools and resources would likely support participant decision-making processes. Nevertheless, specific tool categories, research depth, or technical analysis capabilities remain undetailed in the source materials.

Professional development resources, market commentary, or expert analysis availability are not specifically addressed in the accessible information. This is despite the apparent importance of these elements for effective market participation.

Specific customer service channels, availability schedules, or support quality metrics are not provided in the available source materials. While market integrity and investor protection represent stated priorities within the capital markets framework, particular service delivery methods, response timeframes, or support quality indicators are not detailed in the accessible information.

The regulatory emphasis on investor protection suggests that adequate customer support would represent essential market infrastructure. However, specific implementation approaches, multi-language support capabilities, or service hour coverage are not specified in the available sources.

Problem resolution procedures, escalation mechanisms, or customer satisfaction measurement systems are not addressed in the source materials. The broader market focus on integrity and protection implies that effective support systems would be necessary. However, operational details remain unspecified.

Communication channel options, technical support availability, or specialized assistance for different participant categories are not elaborated in the accessible information. This is despite their apparent relevance for market participation effectiveness.

The available source materials do not provide specific information regarding platform stability, execution quality, or user interface characteristics for individual market participants. While the broader capital markets review indicates strong market recovery and technological advancement, particular platform performance metrics, order execution speeds, or system reliability indicators are not detailed in the accessible sources.

Mobile platform capabilities, advanced order types, or specialized trading features are not specified in the available information. The market innovation emphasis suggests that technological sophistication would be important. However, specific implementation details remain unaddressed in the source materials.

Trading environment characteristics, market access methods, or execution venue options are not elaborated in the accessible data. The regulatory focus on market integrity implies that execution quality would be prioritized. However, particular measurement criteria or performance standards are not specified.

Real-time data availability, charting capabilities, or analytical tool integration within trading platforms are not detailed in the available sources. This is despite their apparent importance for effective market participation and decision-making processes.

While SIFMA emphasizes high standards of market integrity and investor protection as fundamental capital markets principles, specific regulatory credentials, fund security measures, or transparency indicators for individual participants are not detailed in the available source materials. The broader regulatory framework discussion suggests robust oversight mechanisms. However, particular implementation details remain unspecified.

Company transparency requirements, financial reporting standards, or disclosure obligations are not elaborated in the accessible information. The market integrity emphasis indicates that transparency would be prioritized. However, specific compliance mechanisms or verification procedures are not addressed in the available sources.

Industry reputation indicators, third-party assessments, or independent verification systems are not specified in the source materials. The regulatory focus on investor protection suggests that reputation monitoring would be important. However, particular evaluation criteria or assessment methodologies remain undetailed.

Negative event handling procedures, dispute resolution mechanisms, or regulatory compliance monitoring systems are not addressed in the available information. This is despite their apparent relevance for maintaining market participant trust and confidence.

Specific user satisfaction metrics, interface design characteristics, or usability features are not provided in the available source materials. While the capital markets framework emphasizes accessibility and participation, particular user experience elements such as registration procedures, verification processes, or platform navigation features are not detailed in the accessible information.

Overall participant satisfaction indicators, user retention metrics, or experience quality measurements are not specified in the available sources. The market development focus suggests that positive user experiences would be prioritized. However, specific evaluation criteria or improvement mechanisms remain unaddressed.

Fund operation procedures, transaction processing experiences, or account management interfaces are not elaborated in the source materials. The regulatory emphasis on enabling capital formation implies that user-friendly processes would be important. However, operational details are not provided in the accessible information.

Common user concerns, feedback incorporation mechanisms, or experience enhancement initiatives are not addressed in the available data. This is despite their apparent relevance for maintaining effective market participation and user satisfaction levels.

This capital markets review reveals a market environment positioned for significant growth and recovery in 2025. It is driven by favorable economic conditions and regulatory frameworks that prioritize market integrity and investor protection. While specific operational details for individual market participants remain limited in available sources, the broader market trends indicate substantial opportunities for various investor categories.

The combination of interest rate adjustments, accumulated investor demand, and robust regulatory oversight creates a foundation for market expansion. However, potential participants should conduct thorough due diligence regarding specific service providers. Detailed operational information requires direct verification beyond the scope of available industry-wide analysis.

The emphasis on innovation, resilience, and market integrity suggests that 2025 capital markets will offer enhanced opportunities for informed participants while maintaining appropriate investor protection standards.

FX Broker Capital Trading Markets Review