Is CA safe?

Pros

Cons

Is CA Markets Safe or Scam?

Introduction

CA Markets, an emerging player in the forex trading arena, has garnered attention since its establishment in 2015. Based in Australia and regulated by the Australian Securities and Investments Commission (ASIC) and the Vanuatu Financial Services Commission (VFSC), it offers a variety of trading instruments including forex, commodities, and cryptocurrencies. However, as with any broker, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with risks, and the presence of unregulated or poorly regulated brokers can lead to significant financial losses. This article aims to evaluate the safety of CA Markets by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk profile. The analysis is based on a review of multiple sources, including regulatory filings, user feedback, and industry standards.

Regulation and Legitimacy

Regulatory Overview

The regulatory framework surrounding a broker is one of the most critical factors in determining its legitimacy and safety. CA Markets operates under the auspices of two regulatory bodies, which provide varying levels of oversight. ASIC is recognized as a tier-1 regulator, offering stringent protections for traders, while the VFSC is classified as a tier-3 regulator, providing less rigorous oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 523351 | Australia | Verified |

| VFSC | 700714 | Vanuatu | Verified |

The importance of regulation cannot be overstated; it ensures that brokers adhere to specific operational standards, including the segregation of client funds, regular audits, and transparency in trading practices. CA Markets claims to adhere to these regulations, maintaining segregated accounts to protect client funds and offering negative balance protection. However, the lack of a compensation scheme under the VFSC raises questions about the extent of trader protection in the event of financial distress.

Company Background Investigation

CA Markets is owned by Corporate Alliance Group Pty Ltd, which operates multiple entities under the CA Markets brand. The company has a relatively short history, having been established in 2015. However, its growth trajectory has been notable, particularly in the realm of online trading. The management team comprises individuals with backgrounds in finance and trading, contributing to the company's operational expertise.

In terms of transparency, CA Markets provides essential information about its services and regulatory compliance on its website. However, the depth of information regarding its ownership structure and management team is limited, which could be a concern for potential traders seeking to understand the brokers reliability fully. Overall, while the company has made strides in establishing a presence in the forex market, its relatively short operational history may warrant caution among traders.

Trading Conditions Analysis

CA Markets offers several account types, including Standard, Pro, and Ace accounts, each with varying trading conditions and fee structures. The broker's fee structure is competitive, particularly for the Ace account, which offers spreads starting from 0 pips. However, the commission model for this account is relatively high at $3.5 per lot, which could impact profitability for high-frequency traders.

| Fee Type | CA Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | $3.5 per lot | $6.0 per lot |

| Overnight Interest Range | Low | Average |

While CA Markets' spreads are attractive, the high commission on the Ace account may deter some traders. Additionally, the broker does not charge inactivity fees, which is a positive aspect for traders who may not trade frequently. Understanding the overall cost structure is essential for traders to evaluate the profitability of their trading strategies.

Customer Fund Security

The safety of client funds is paramount for any trading broker. CA Markets has implemented several measures to ensure the security of client funds. The broker claims to maintain segregated accounts, which means that client funds are kept separate from the companys operational funds. This practice is crucial in protecting traders in case of the broker's insolvency.

Furthermore, CA Markets offers negative balance protection, which ensures that traders cannot lose more than their initial investment. However, it is worth noting that the absence of a compensation scheme under the VFSC may limit the recourse available to traders in the event of a broker failure. Despite these measures, potential clients should remain vigilant and consider the risks associated with trading with a broker regulated by a tier-3 authority.

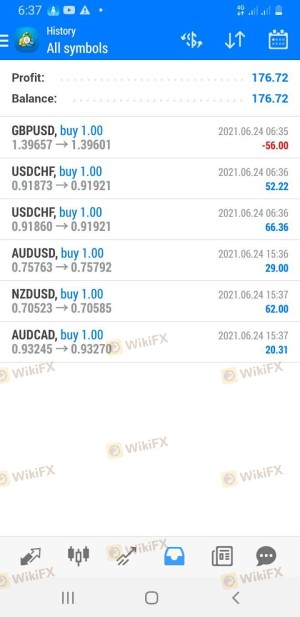

Customer Experience and Complaints

User feedback is a vital component in assessing the reliability of any broker. Reviews of CA Markets reveal a mixed bag of experiences. While some users praise the broker for its low spreads and efficient execution, others have raised concerns regarding withdrawal processes and customer support responsiveness.

Common complaints include delays in withdrawal processing and difficulties in reaching customer support during peak trading hours. The following table summarizes the primary complaint types associated with CA Markets:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Customer Support Issues | Medium | Generally responsive |

One notable case involved a trader who reported significant delays in accessing funds after submitting a withdrawal request. The trader expressed frustration over the lack of communication from customer support, which ultimately led to a negative perception of the broker. Such issues highlight the importance of assessing not only the trading conditions but also the quality of customer service.

Platform and Execution

CA Markets utilizes the popular MetaTrader 5 (MT5) platform, known for its user-friendly interface and advanced trading features. The platform supports various trading styles, including automated trading and copy trading, which can benefit both novice and experienced traders.

In terms of execution quality, CA Markets claims to offer fast order execution speeds, averaging between 46-56 milliseconds. However, some users have reported instances of slippage and order rejections during high volatility periods, raising concerns about the broker's execution reliability. Overall, while the platform provides essential tools for traders, the execution quality during volatile market conditions is an area that warrants further scrutiny.

Risk Assessment

Using CA Markets presents several risks that traders should consider before opening an account. The regulatory environment, while partially robust due to ASIC oversight, is still complemented by the VFSC's less stringent regulations. This duality creates a mixed risk profile for potential clients.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Mixed regulation with tier-3 oversight |

| Withdrawal Risk | High | Complaints regarding delays and issues |

| Execution Risk | Medium | Reports of slippage during volatility |

To mitigate these risks, traders should ensure they fully understand the brokers terms and conditions, maintain realistic expectations regarding withdrawal timelines, and consider using risk management tools such as stop-loss orders.

Conclusion and Recommendations

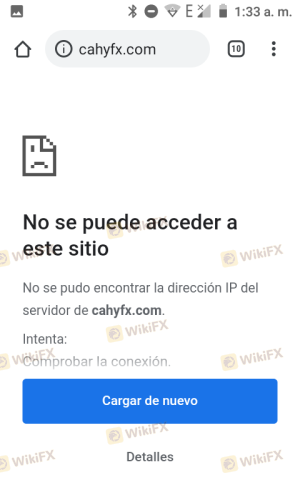

In conclusion, while CA Markets presents itself as a legitimate forex broker with several attractive features, there are significant areas of concern that potential traders should consider. The mixed regulatory environment, coupled with user complaints regarding withdrawals and execution quality, suggests that traders should approach with caution.

For those who are experienced and can conduct their own research, CA Markets may offer some competitive advantages. However, beginners or risk-averse traders may want to explore alternative brokers with stronger regulatory oversight and proven track records.

In summary, while CA Markets is not outright a scam, it does present certain risks that warrant careful consideration. Traders seeking safety should prioritize brokers with robust regulatory frameworks, transparent operations, and positive user experiences.

Is CA a scam, or is it legit?

The latest exposure and evaluation content of CA brokers.

CA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CA latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.