Is BOART safe?

Pros

Cons

Is Boart Safe or Scam?

Introduction

Boart is a relatively recent entrant in the forex trading market, claiming to provide a range of trading services to clients worldwide. As with any forex broker, it is crucial for traders to evaluate the safety and legitimacy of Boart before committing their funds. The forex market is notorious for attracting both legitimate brokers and unscrupulous scams, making it imperative for traders to perform thorough due diligence. This article employs a multi-faceted approach to assess whether Boart is safe or a potential scam. Our evaluation framework includes regulatory compliance, company background, trading conditions, client fund safety, customer experiences, platform performance, and risk assessment.

Regulatory Compliance and Legitimacy

One of the primary indicators of a broker's trustworthiness is its regulatory status. Boart has been identified as an unregulated broker, which raises significant concerns for potential clients. Regulatory oversight is essential in ensuring that brokers adhere to industry standards and protect their clients' interests. The lack of regulation can expose traders to various risks, including fraud and mismanagement of funds.

| Regulatory Body | License Number | Regulating Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of a regulatory license signifies that Boart does not operate under the scrutiny of a recognized financial authority. This lack of oversight can lead to a higher likelihood of unethical practices, making it crucial for traders to approach Boart with caution. Furthermore, historical data on regulatory compliance shows no record of Boart being sanctioned or investigated, but this is likely due to its unregulated status rather than a clean compliance history.

Company Background Investigation

Boart's history and ownership structure are also critical in evaluating its legitimacy. Established in 2015, the company claims to be based in the United Kingdom. However, there is limited information available regarding its founding members or management team. A transparent company should provide information about its leadership, including their backgrounds and expertise in the forex industry. Unfortunately, Boart lacks this transparency, which raises further red flags regarding its legitimacy.

The management teams experience is a vital factor in determining the broker's credibility. Established brokers often have seasoned professionals at the helm, ensuring that clients receive informed and reliable service. The opacity surrounding Boart's management team suggests a potential lack of industry expertise, which could compromise the quality of service provided to traders.

Analysis of Trading Conditions

The trading conditions offered by Boart are another area of concern. An analysis of the fee structure reveals that while the broker may advertise competitive spreads and commissions, the actual costs can be opaque. Traders must be wary of hidden fees that may not be immediately disclosed.

| Fee Type | Boart | Industry Average |

|---|---|---|

| Main Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

A lack of clarity in the fee structure can lead to unexpected costs, which is a common tactic employed by scam brokers to siphon funds from unsuspecting traders. Therefore, it is essential for potential clients to thoroughly investigate and understand the fee structure before engaging with Boart.

Client Fund Safety

The safety of client funds is paramount in any trading environment. Boarts lack of regulatory oversight raises questions about its fund safety measures. Reliable brokers typically implement strict protocols for fund segregation and investor protection. However, Boart has not provided any information regarding its policies on fund segregation or negative balance protection.

Historically, unregulated brokers have been known to misuse client funds, leading to significant financial losses for traders. This history of malpractice makes it crucial for potential clients to consider whether they are willing to take such risks with their capital. The absence of any reported fund safety issues related to Boart may not be a positive sign; rather, it could indicate a lack of operational transparency.

Customer Experience and Complaints

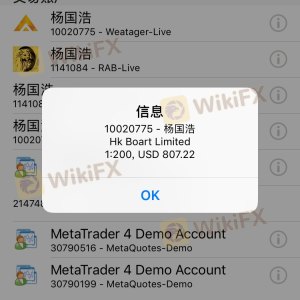

Customer feedback and experiences are invaluable in assessing whether Boart is safe or a scam. Reviews from clients indicate a pattern of complaints, particularly regarding withdrawal issues and lack of responsive customer support. Many users have reported difficulties in accessing their accounts and withdrawing funds, which is a significant red flag.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

Several users have expressed frustration over the slow response times from Boart's support team, indicating a lack of adequate customer service. This unresponsiveness can exacerbate issues related to fund withdrawals, leading to a negative trading experience.

Platform and Execution

The performance of a trading platform is crucial for successful trading. Boart's platform has received mixed reviews regarding its stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The absence of a robust trading platform can indicate a lack of investment in technology, further questioning the broker's commitment to providing a quality trading experience. Traders should be cautious of platforms that exhibit signs of manipulation or technical issues, as these can be indicative of deeper operational problems.

Risk Assessment

Using Boart as a trading platform presents various risks that potential clients must consider. The unregulated status of the broker, combined with client complaints and operational transparency issues, paints a concerning picture.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases fraud risk. |

| Operational Risk | Medium | Complaints about platform reliability and execution. |

| Fund Safety Risk | High | Lack of clarity on fund protection measures. |

To mitigate these risks, traders should consider diversifying their investments and not committing significant capital to unregulated brokers like Boart. Engaging with regulated brokers can provide an additional layer of security and peace of mind.

Conclusion and Recommendations

In conclusion, the evidence suggests that Boart is not a safe broker for forex trading. The lack of regulatory oversight, transparency issues, and negative customer experiences indicate that traders should exercise extreme caution. While there are no outright allegations of fraud against Boart, the combination of its unregulated status and customer complaints raises significant concerns.

For traders seeking a safe and reliable trading environment, it is advisable to consider established brokers that are regulated by reputable financial authorities. Options such as brokers regulated by the FCA or ASIC can offer a safer trading experience with better customer support and fund protection measures. Ultimately, potential clients should weigh the risks carefully and prioritize their financial safety when selecting a broker.

Is BOART a scam, or is it legit?

The latest exposure and evaluation content of BOART brokers.

BOART Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BOART latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.