Boart 2025 Review: Everything You Need to Know

Executive Summary

This Boart review shows a mixed picture of the company. It reveals big differences between employee satisfaction and user experience. Based on data from multiple review platforms, Boart shows excellent internal company culture with employees rating the organization 4.9 out of 5 stars on AmbitionBox. This indicates strong workplace satisfaction and management practices.

However, the user experience tells a different story. InHerSight users provide a concerning 1.9-star rating, suggesting major challenges in customer service delivery and user satisfaction. The data from Comparably shows that 72% of reviews are positive, which provides some balance to the overall assessment.

This creates an interesting situation where Boart appears to excel at maintaining employee satisfaction and internal operations. However, they struggle with external customer relations and user experience delivery. For potential clients considering Boart's services, this suggests the company may be more suitable for those prioritizing working with well-managed organizations rather than those seeking premium user experience.

The significant gap between internal and external satisfaction ratings indicates potential areas for improvement in customer-facing operations. They also need to improve service delivery mechanisms.

Important Notice

When evaluating Boart's services, potential clients should know that different regional entities may operate under varying regulatory frameworks and service standards. Specific regulatory information and jurisdictional details were not detailed in available materials. This means traders should conduct additional due diligence regarding compliance and oversight in their respective regions.

This evaluation is based on publicly available user feedback, employee reviews, and accessible company information. Given the limited scope of detailed operational data available, prospective clients are advised to verify specific trading conditions, regulatory status, and service offerings directly with the company before making any commitment to their services.

Rating Framework

Broker Overview

Boart operates as a broker service. The available information indicates their primary function involves bringing buyers and sellers together while assisting in negotiating transactions on behalf of clients for commission or fees. The company's business model appears to follow traditional brokerage principles.

They facilitate connections between market participants rather than acting as a principal in transactions. The specific founding year, detailed company background, and comprehensive operational history were not detailed in available materials. However, the significant employee satisfaction ratings suggest an established organizational structure with developed internal processes and management systems.

The company appears to have invested considerably in creating a positive workplace environment. This typically indicates organizational maturity and structured operations. Regarding trading platforms, asset classes, and regulatory oversight, specific information was not detailed in available materials.

This Boart review must note that while employee satisfaction metrics are strong, the lack of detailed operational information combined with poor user ratings suggests potential clients should seek additional clarification. They should verify trading conditions, platform capabilities, and regulatory compliance before engaging with their services.

Regulatory Jurisdictions: Specific regulatory information was not detailed in available materials. Prospective clients need to verify compliance status independently.

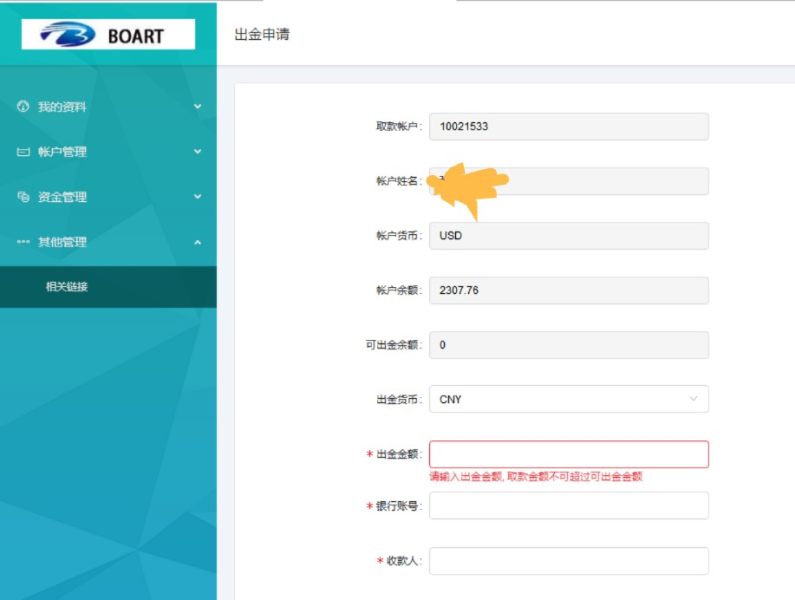

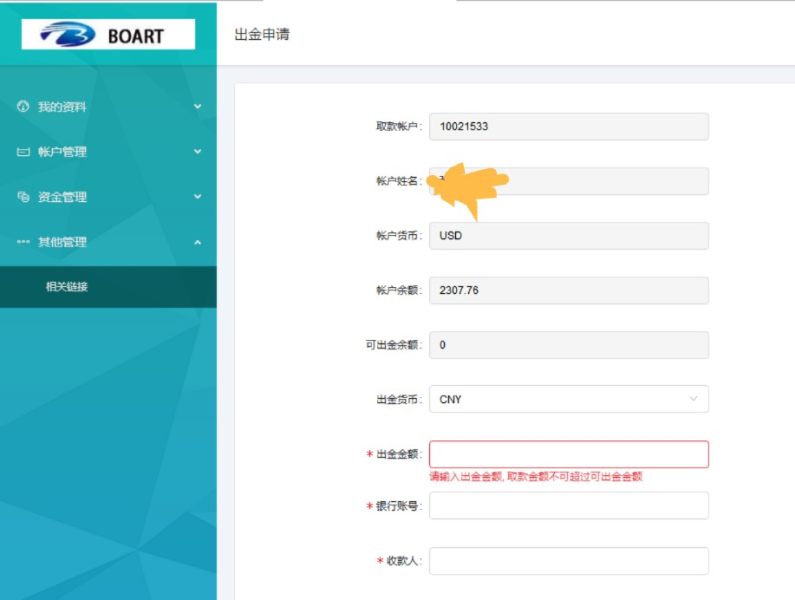

Deposit and Withdrawal Methods: Available funding options and processing procedures were not detailed in available materials.

Minimum Deposit Requirements: Specific minimum funding thresholds were not detailed in available materials.

Bonuses and Promotions: Current promotional offerings and bonus structures were not detailed in available materials.

Available Assets: The range of tradeable instruments and asset classes was not detailed in available materials.

Cost Structure: Detailed fee schedules, spreads, and commission structures were not detailed in available materials. However, the business model indicates commission-based operations.

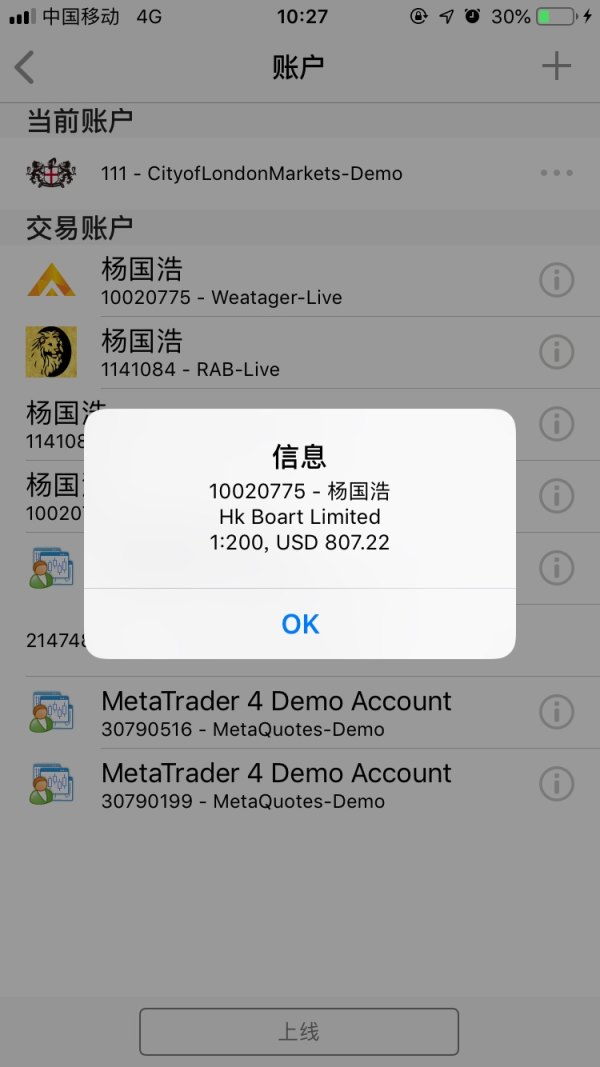

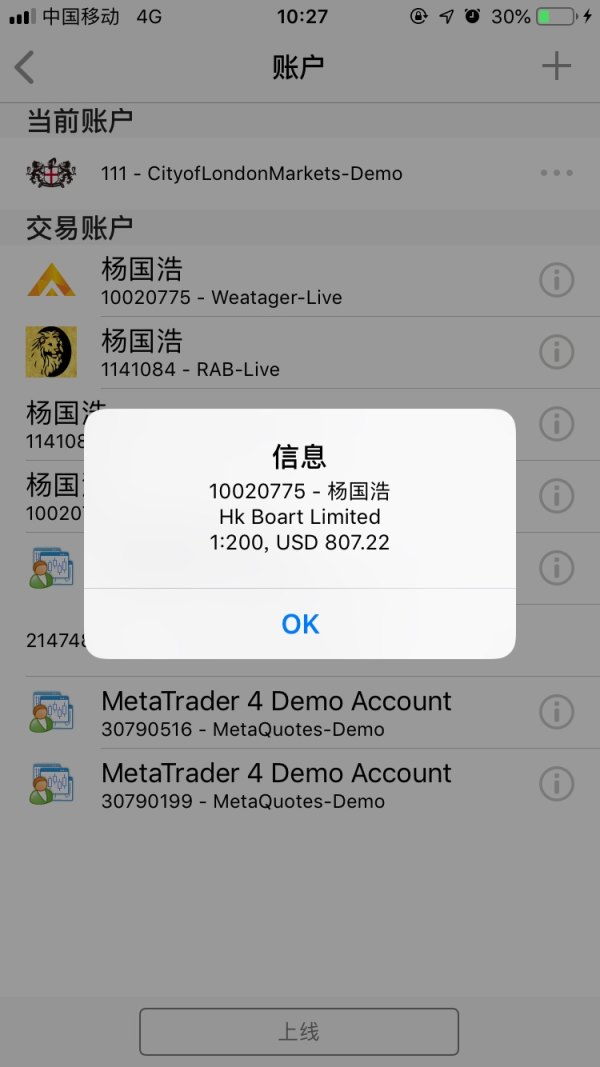

Leverage Ratios: Maximum leverage offerings were not detailed in available materials.

Platform Options: Specific trading platform technologies and features were not detailed in available materials.

Geographic Restrictions: Regional availability and access limitations were not detailed in available materials.

Customer Support Languages: Available language support options were not detailed in available materials.

This Boart review highlights the significant information gaps that potential clients should address through direct inquiry with the company.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Boart's account conditions faces significant limitations due to the lack of detailed information in available materials. Account type varieties, their specific features, and differentiation factors were not clearly outlined in accessible documentation. This absence of transparency regarding account structures raises concerns for potential clients who require clear understanding of their trading environment before committing to a broker.

Minimum deposit requirements and their reasonableness cannot be assessed without specific figures. However, the commission-based business model suggests standard industry practices may apply. The account opening process remains unclear from available sources, including verification requirements, documentation needs, and approval timeframes.

Special account features such as Islamic accounts, professional trader classifications, or institutional offerings were not detailed in available materials. This lack of comprehensive account information, combined with the poor user experience ratings, suggests that Boart review seekers should prioritize obtaining detailed account specifications directly from the company before proceeding with any registration process.

Assessment of Boart's trading tools and resources proves challenging given the limited information available in accessible materials. The range and quality of trading instruments, analytical tools, and platform capabilities remain undefined. This represents a significant concern for traders who rely on comprehensive toolsets for effective market participation.

Research and analysis resources were not detailed in available materials, including market commentary, economic calendars, technical analysis tools, and fundamental research capabilities. For modern traders who depend on robust analytical support, this information gap combined with poor user ratings suggests potential limitations in resource availability. Educational resources lack specific details in available documentation, including webinars, tutorials, trading guides, and skill development programs.

Automated trading support remains unspecified, including expert advisor compatibility, algorithmic trading capabilities, and API access. The absence of detailed tool and resource information, particularly when viewed alongside the 1.9-star user rating, indicates potential deficiencies in platform offerings that prospective clients should investigate thoroughly.

Customer Service and Support Analysis

Customer service evaluation reveals concerning patterns when examining available feedback data. The stark contrast between employee satisfaction and user experience suggests significant disconnects between internal operations and customer-facing service delivery. Available customer service channels were not detailed in available materials, including live chat, email support, phone assistance, and response time commitments.

This lack of transparency regarding support accessibility raises questions about service availability. This is particularly concerning given the poor user ratings that suggest customer service challenges. Service quality metrics remain unclear from available sources, including first-contact resolution rates, escalation procedures, and satisfaction tracking.

Multi-language support capabilities and coverage hours were not specified. This may impact international clients seeking comprehensive assistance. The significant gap between internal employee satisfaction and external user experience suggests systemic issues in customer service delivery that potential clients should carefully investigate before committing to Boart's services.

Trading Experience Analysis

The trading experience evaluation encounters substantial limitations due to insufficient technical and operational details in available materials. Platform stability, execution speed, and overall performance metrics remain unspecified. This represents critical information gaps for traders who require reliable trading infrastructure.

Order execution quality was not detailed in available materials, including fill rates, slippage statistics, and execution speed benchmarks. Platform functionality completeness lacks specific documentation, covering charting capabilities, order types, risk management tools, and customization options. Mobile trading experience remains undefined, including app availability, feature parity, and user interface quality.

Trading environment factors were not comprehensively detailed, such as market access, instrument availability, and trading conditions. The poor user experience rating of 1.9 stars on InHerSight, when considered alongside these information gaps, suggests potential deficiencies in trading infrastructure and execution quality. This Boart review emphasizes the critical need for prospective traders to thoroughly test platform capabilities and verify execution quality before committing significant capital.

Trust and Reliability Analysis

Trust assessment faces significant challenges due to limited regulatory and transparency information in available materials. Specific regulatory licenses, oversight authorities, and compliance certifications were not detailed. This represents fundamental information gaps for traders prioritizing regulatory protection and broker accountability.

Fund safety measures remain unspecified in accessible documentation, including segregated account policies, investor compensation schemes, and financial reporting transparency. Company transparency lacks comprehensive details that would typically support trust evaluation, regarding ownership structure, financial stability, and operational history. Industry reputation and third-party recognition were not detailed in available materials, including awards, certifications, and peer acknowledgment.

Negative event handling remains unclear, including dispute resolution procedures, regulatory actions, and crisis management capabilities. The combination of limited regulatory transparency and poor user ratings suggests potential trust and reliability concerns that prospective clients should address through independent verification and direct inquiry with relevant regulatory authorities.

User Experience Analysis

User experience analysis reveals the most concerning aspects of Boart's service delivery. The 1.9-star rating on InHerSight indicates substantial user dissatisfaction. This poor rating suggests significant challenges in interface design, service delivery, and overall customer satisfaction that potential clients must carefully consider.

Overall user satisfaction metrics show a troubling pattern when comparing employee satisfaction with user experience. This indicates that while the company maintains excellent internal operations, customer-facing services fall significantly short of expectations. Interface design and usability factors appear to contribute to user dissatisfaction based on available ratings, including navigation efficiency, feature accessibility, and visual design quality.

Registration and verification processes, fund operation experiences, and common user complaints were not specifically detailed in available materials. However, the poor ratings suggest systematic issues across multiple touchpoints. User demographic analysis and feedback patterns indicate that current clients experience substantial challenges that outweigh any potential benefits.

The significant disparity between internal employee satisfaction and external user experience suggests that Boart may prioritize internal operations over customer service delivery. This represents a critical consideration for prospective clients.

Conclusion

This comprehensive evaluation reveals a complex picture where Boart demonstrates exceptional internal management and employee satisfaction while struggling significantly with customer experience and service delivery. The stark contrast between the 4.9/5 employee rating and 1.9-star user rating indicates fundamental disconnects between internal operations and customer-facing services.

Boart may be more suitable for employment opportunities rather than client services, given the strong employee satisfaction metrics. However, for traders and clients seeking reliable broker services, the poor user experience ratings combined with limited transparency regarding trading conditions, regulatory status, and operational details present significant concerns. Prospective clients should conduct thorough due diligence, verify regulatory compliance, and carefully test services before committing to Boart's offerings.