Regarding the legitimacy of BBH forex brokers, it provides SFC, FCA and WikiBit, (also has a graphic survey regarding security).

Is BBH safe?

Pros

Cons

Is BBH markets regulated?

The regulatory license is the strongest proof.

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Brown Brothers Harriman (Hong Kong) Limited

Effective Date:

2004-12-07Email Address of Licensed Institution:

francis.leong@bbh.comSharing Status:

No SharingWebsite of Licensed Institution:

www.bbh.comExpiration Time:

--Address of Licensed Institution:

香港中環德輔道中68號萬宜大廈13樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FCA Inst Forex Execution (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

BROWN BROTHERS HARRIMAN INVESTOR SERVICES LTD.

Effective Date: Change Record

2001-12-01Email Address of Licensed Institution:

ukdirectors@bbh.comSharing Status:

No SharingWebsite of Licensed Institution:

www.bbh.comExpiration Time:

--Address of Licensed Institution:

Floor 8 10 Exchange Square London EC2A 2BR UNITED KINGDOMPhone Number of Licensed Institution:

+442075886166Licensed Institution Certified Documents:

Is BBH A Scam?

Introduction

Brown Brothers Harriman (BBH) is a well-established financial institution that has been operating in the financial services sector for over 200 years. Known primarily for its wealth management, investment services, and private banking, BBH has carved a niche for itself in the competitive landscape of the financial industry. As a trader, it is crucial to evaluate the legitimacy and reliability of forex brokers like BBH, especially given the prevalence of scams in the trading industry. A thorough assessment not only helps in safeguarding investments but also ensures that traders are making informed decisions. This article aims to provide a comprehensive analysis of BBH, exploring its regulatory status, company background, trading conditions, customer experience, and overall risk assessment. The evaluation is based on a review of multiple credible sources, including regulatory filings, user reviews, and industry reports.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. BBH operates under the oversight of the Securities and Futures Commission (SFC) in Hong Kong, which is known for its strict regulatory framework. Regulatory oversight is essential, as it ensures that brokers adhere to industry standards and protect clients interests. Below is a summary of BBH's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | Not specified | Hong Kong | Verified |

The SFC's involvement provides an added layer of protection for traders, as it mandates regular audits and compliance checks. BBH has maintained a positive regulatory history, with no significant violations reported in recent years. However, some concerns have been raised regarding its operations in the United Kingdom, where it allegedly exceeded its investment advisory license scope. This raises questions about its compliance and operational integrity in regions outside its primary regulatory jurisdiction. Overall, BBH's regulatory status with the SFC indicates a commitment to maintaining standards, but traders should remain vigilant and conduct their own research.

Company Background Investigation

Founded in 1818, BBH has a rich history that reflects its evolution from a commodities merchant to a leading player in investment banking and wealth management. The company operates as a private partnership, which allows it to prioritize client interests over shareholder pressures. This structure fosters a long-term relationship with clients, enhancing trust and loyalty. BBH is headquartered in New York City, with a global presence that includes offices in major financial centers such as Hong Kong, London, and Tokyo.

The management team at BBH comprises seasoned professionals with extensive experience in finance and investment management. Their expertise contributes to the firm's reputation for providing high-quality, personalized services to high-net-worth individuals and institutions. Transparency is a key aspect of BBH‘s operations. The firm provides detailed information about its services and fees, although some users have noted that not all information is readily available on their website. Overall, BBH’s long-standing history and experienced management team lend credibility to its operations.

Trading Conditions Analysis

BBH's trading conditions are designed to accommodate a diverse clientele, including institutional investors and high-net-worth individuals. The firms fee structure is generally competitive, but there are some nuances that traders should be aware of. Below is a comparison of BBH's core trading costs:

| Fee Type | BBH | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Structure | None | 0.1 - 0.5% |

| Overnight Interest Range | Competitive | Varies widely |

BBH does not charge a commission on trades, which is advantageous for frequent traders. However, the spreads can be variable, depending on market conditions. Traders should also consider the overnight interest rates, which can impact long-term positions. While BBH's fee structure is competitive, it is essential for traders to fully understand the potential costs associated with their trading strategies.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading landscape. BBH implements several measures to protect client funds, including segregated accounts that ensure client money is kept separate from the company's operational funds. This practice is crucial for safeguarding investments in the event of financial difficulties. Additionally, BBH adheres to strict compliance standards set by the SFC, which includes maintaining sufficient capital reserves.

BBH also offers negative balance protection, which is a significant advantage for traders. This feature ensures that clients cannot lose more than their invested capital, providing an added layer of security. Historically, there have been no significant incidents reported regarding the safety of client funds at BBH, which further enhances its credibility as a broker. Overall, BBH appears to have robust measures in place to protect customer funds.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of BBH reveal a mixed bag of experiences. While many clients appreciate the personalized service and expertise offered by the firm, there are also reports of dissatisfaction regarding customer support and response times. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

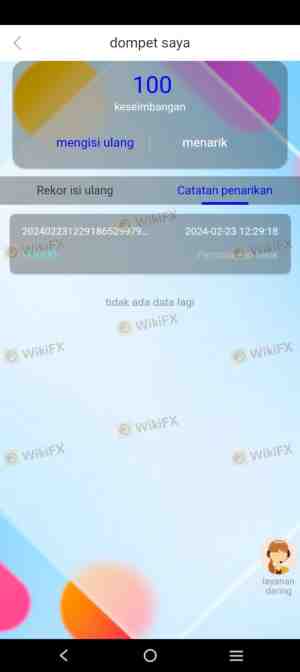

| Withdrawal Issues | High | Slow response |

| Customer Support Availability | Medium | Limited hours |

| Fee Transparency | Low | Generally clear |

Typical complaints include difficulties with fund withdrawals, where some clients have reported delays and complications. Additionally, there are concerns about the availability of customer support, particularly outside regular business hours. While BBH does provide contact options via email and phone, the lack of 24/7 support can be a drawback for traders requiring immediate assistance. A couple of notable cases involved clients who experienced prolonged delays in processing withdrawals, leading to frustration and dissatisfaction.

Platform and Execution

BBH does not function as a traditional forex broker, which means its trading platform may differ from those offered by competitors. The firm provides access to a proprietary trading platform designed for institutional clients, which may not be as user-friendly for casual traders. Overall, the platform's performance is generally stable, but users have reported occasional issues with order execution and slippage.

The quality of order execution is crucial for traders, especially in volatile markets. While BBH aims to provide competitive execution speeds, there have been instances where clients experienced slippage during high-impact news events. This can significantly affect trading outcomes, particularly for those employing high-frequency trading strategies. Traders should assess their individual needs and consider whether BBHs platform aligns with their trading style.

Risk Assessment

Using BBH as a trading partner comes with its own set of risks. The following risk assessment summarizes key risk areas associated with BBH:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Potential issues in the UK market |

| Customer Support | High | Limited availability of support |

| Trading Platform Reliability | Medium | Occasional execution issues |

Traders should be aware of the potential regulatory risks, especially if they operate in jurisdictions where BBH may not have clear oversight. Additionally, the limited customer support availability could pose challenges for traders who require immediate assistance. To mitigate these risks, it is advisable for traders to maintain open communication with the broker and to thoroughly understand the terms and conditions before engaging in trading activities.

Conclusion and Recommendations

In conclusion, BBH presents a mixed picture as a forex broker. While it boasts a long-standing reputation, regulatory oversight, and a range of financial services, there are areas of concern that potential clients should carefully consider. The lack of 24/7 customer support and occasional withdrawal issues may pose challenges for some traders. However, its solid regulatory framework and commitment to client fund safety are significant advantages.

For traders looking for a reliable broker, it is essential to weigh the benefits against the risks. If you are a high-net-worth individual or institutional trader seeking personalized service, BBH may be a suitable choice. Conversely, retail traders or those requiring more accessible customer support may want to explore alternative brokers with a more robust support system and user-friendly platforms. Ultimately, thorough research and due diligence are crucial in making an informed decision.

Is BBH a scam, or is it legit?

The latest exposure and evaluation content of BBH brokers.

BBH Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BBH latest industry rating score is 6.21, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.21 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.