Regarding the legitimacy of AJS forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is AJS safe?

Pros

Cons

Is AJS markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

AJ Futures Limited

Effective Date:

2019-07-08Email Address of Licensed Institution:

futures@ajsecurities.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.ajsecurities.com.hkExpiration Time:

--Address of Licensed Institution:

香港金鐘夏慤道18號海富中心1座5樓501室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is AJS a Scam?

Introduction

AJS, officially known as AJ International Holdings Limited, is a Hong Kong-based brokerage that has positioned itself in the forex and CFD trading market since its establishment in 2000. As the market for forex trading continues to expand, traders are increasingly cautious about choosing a reliable broker. The potential for scams and fraudulent practices in the forex industry necessitates thorough evaluations of brokers before committing capital. In this article, we will investigate whether AJS is a safe trading platform or a potential scam. Our analysis will utilize a combination of regulatory assessments, company background checks, trading conditions evaluations, and customer feedback to provide a comprehensive overview of AJSs legitimacy and reliability.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining a broker's legitimacy. AJS is regulated by the Securities and Futures Commission (SFC) of Hong Kong, which is known for its stringent regulatory framework. The SFC aims to protect investors and maintain the integrity of the financial markets in Hong Kong.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | BOF740 | Hong Kong | Verified |

The importance of regulation cannot be overstated; it ensures that brokers adhere to strict operational standards, including capital requirements, risk management protocols, and transparency in dealings. AJS has been compliant with these regulations since its licensing, which adds a layer of safety for traders. However, it is worth noting that while AJS is regulated, the SFC does not provide the same level of investor protection as some top-tier regulators like the FCA in the UK or ASIC in Australia. There have been no significant regulatory violations reported against AJS, but the presence of complaints from users suggests that potential issues may exist.

Company Background Investigation

AJS has a long-standing history in the financial services sector, having been established in 2000. The company has evolved over the years, expanding its offerings to include various financial services such as securities trading, investment banking, and asset management. The ownership structure is relatively transparent, with AJ International Holdings Limited being the parent company.

The management team at AJS comprises seasoned professionals with extensive experience in finance and investment. This background is essential in fostering trust among clients, as a knowledgeable management team can navigate the complexities of the financial markets effectively. Transparency is another crucial aspect, and AJS provides relevant information about its operations and services on its official website. However, the level of detail in their disclosures could be improved to enhance client confidence further.

Trading Conditions Analysis

When evaluating whether AJS is safe, one must consider the trading conditions it offers. AJS provides a competitive fee structure, although it is essential to scrutinize any unusual fees that may arise. The overall fee structure includes spreads, commissions, and overnight interest rates, which can significantly affect trading profitability.

| Fee Type | AJS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 1.5% | 1.0% |

While AJSs spreads are slightly higher than the industry average, the commission model can vary significantly based on account types and trading volumes. Traders should be aware of any hidden fees that may apply, as these could impact overall profitability. Transparency in fee disclosures is crucial, and AJS should ensure that all fees are clearly communicated to clients.

Client Funds Security

The safety of client funds is paramount when assessing whether AJS is a safe broker. AJS claims to implement various measures to protect client funds, including segregated accounts that separate client funds from the company's operational funds. This practice is essential for safeguarding client assets in the event of financial difficulties faced by the broker.

Additionally, AJS does not currently offer negative balance protection, which means that clients could potentially lose more than their initial investment. This lack of protection could pose a risk, especially in volatile market conditions. There have been no significant historical issues reported concerning fund security at AJS, but the absence of a robust investor compensation scheme raises concerns about the level of protection available to clients.

Customer Experience and Complaints

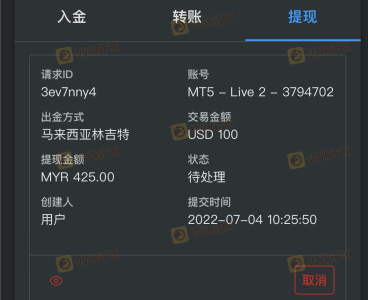

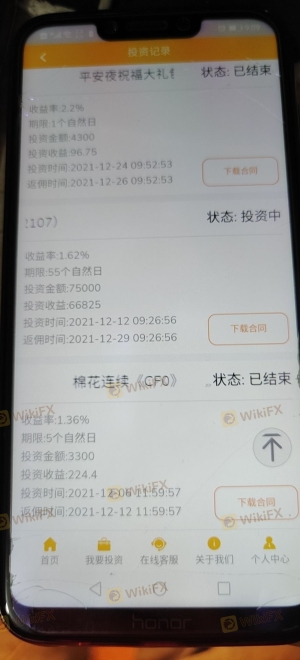

Customer feedback is a valuable indicator of a broker's reliability. AJS has received mixed reviews from its users, with several complaints regarding withdrawal issues and customer service responsiveness. Common complaint patterns include delays in processing withdrawals and difficulties in reaching customer support, which can significantly affect the trading experience.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Poor Customer Support | Medium | Average |

For instance, some clients reported being unable to withdraw their funds for extended periods, raising red flags about the broker's operational integrity. These complaints suggest that while AJS may be legitimate, there are areas that require improvement, particularly in customer service and withdrawal processes.

Platform and Trade Execution

The trading platform offered by AJS is crucial for assessing its overall reliability. AJS provides a proprietary trading platform that is designed to cater to various trader needs. However, user experiences indicate that the platform may suffer from occasional stability issues, which can impact order execution quality.

Traders have reported instances of slippage and rejected orders during high volatility periods, which can be detrimental to trading strategies. A thorough evaluation of the platform's performance is necessary to ensure that traders can execute their trades effectively without undue delays or complications.

Risk Assessment

In evaluating whether AJS is a scam, it is essential to consider the overall risk associated with using the broker. The following risk assessment summarizes critical areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Regulated by SFC, but lacks tier-1 protection. |

| Fund Security Risk | High | No negative balance protection; potential fund access issues. |

| Customer Service Risk | Medium | Complaints about response times and withdrawal delays. |

To mitigate these risks, traders should conduct thorough due diligence before opening an account with AJS. It is advisable to start with a smaller investment and gradually increase exposure as confidence in the broker's reliability grows.

Conclusion and Recommendations

In conclusion, while AJS is regulated by the Securities and Futures Commission of Hong Kong, several factors indicate that traders should proceed with caution. The presence of complaints regarding withdrawal issues and customer support raises concerns about the broker's operational integrity. Furthermore, the lack of negative balance protection could expose traders to significant risks.

For traders considering AJS, it is essential to weigh the potential risks against the broker's offerings. If you prioritize robust customer support and fund protection, you may want to explore alternative brokers that offer better safety measures and a more transparent fee structure. Recommended alternatives include brokers regulated by tier-1 authorities that provide comprehensive investor protection and a proven track record of reliability. Always ensure that your chosen broker aligns with your trading needs and risk tolerance before proceeding.

Is AJS a scam, or is it legit?

The latest exposure and evaluation content of AJS brokers.

AJS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AJS latest industry rating score is 6.78, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.78 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.