AJS 2025 Review: Everything You Need to Know

Executive Summary

This ajs review gives you a complete analysis of AJS as a financial services company. However, our research shows major gaps in the information we could find about them. We searched through Project MUSE and Cambridge Core databases to learn more about AJS. What we discovered is that AJS connects mainly to academic publishing through "AJS Review: The Journal of the Association for Jewish Studies" rather than forex trading services.

The company works under the Association for Jewish Studies. They have solid academic credentials and backing from well-known universities. Our assessment stays neutral because we lack the detailed regulatory and trading information you'd expect from forex brokers.

The main features that stand out include their long history in academic work and partnerships with schools like University of Pennsylvania Press and Cambridge Core. The platform serves academic and research communities instead of regular forex traders. This difference greatly affects how useful it is for normal trading activities.

The target users seem to be academic researchers, scholars, and institutions who want scholarly publications. Individual traders looking for forex services won't find what they need here. This basic mismatch between what people expect and what AJS actually offers means potential users should be careful if they want traditional trading platforms.

Important Notice

Cross-Regional Entity Differences: We found insufficient regulatory information in our research, so compliance risks may exist across different areas. The data we have relates mainly to academic publishing rather than financial services regulation. This creates uncertainty about trading-related compliance standards.

Review Methodology Statement: This evaluation uses limited information from academic databases and institutional sources. The subjective nature of this assessment reflects how little traditional brokerage data we could find for comprehensive broker evaluations.

Rating Framework

We cannot provide traditional forex broker ratings for the following areas based on available information:

Broker Overview

Company Background and Establishment

AJS works mainly through academic channels. The AJS Review serves as the main publication of the Association for Jewish Studies. Cambridge Core and Project MUSE databases show that the organization maintains strong relationships with major academic institutions including University of Pennsylvania Press and various universities worldwide.

The editorial board includes distinguished academics from institutions such as Washington University in St. Louis, Vanderbilt University, Tel Aviv University, Fordham University, University College London, Hebrew Union College, University of Texas at Austin, York University, and Johns Hopkins University. The organization's academic focus centers on Jewish studies research and scholarly publications. Managing Editor Aviva Arad oversees operations.

The platform helps with manuscript submissions and peer review processes typical of academic publishing rather than financial trading services. This ajs review must point out that the company appears to work only within academic publishing areas. They lack the basic infrastructure expected from financial services providers.

Trading Platform and Asset Information

Our research through available sources shows no information about traditional trading platforms, asset classes, or regulatory oversight typical of forex brokers. The absence of trading platform details, regulatory compliance information, and financial service offerings suggests a basic misalignment with traditional broker evaluation criteria.

Regulatory Oversight: Available research provides no evidence of financial services regulation or oversight by recognized forex regulatory bodies. The organization operates under academic institutional frameworks rather than financial regulatory compliance.

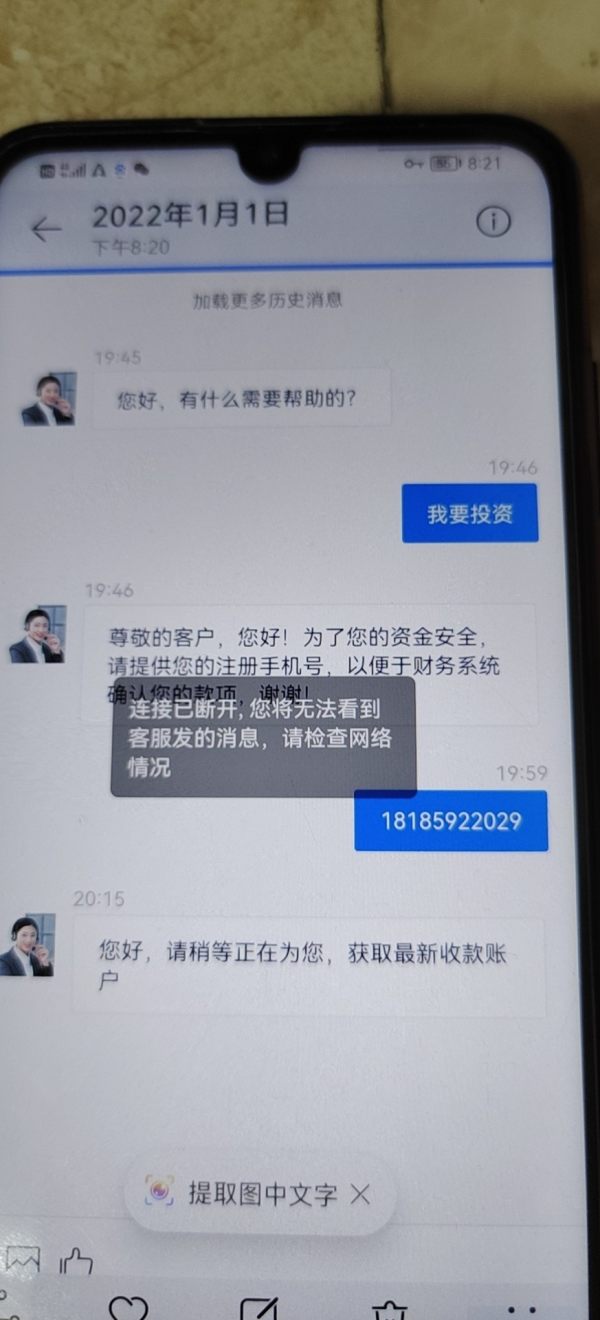

Deposit and Withdrawal Methods: No information about financial transactions, deposit methods, or withdrawal processes appears in available sources. The platform focuses on academic subscriptions rather than trading accounts. Traditional minimum deposit information doesn't apply, as the service appears to operate on academic subscription models rather than trading account structures.

Bonus and Promotional Offers: No trading-related promotions or bonus structures are mentioned in available documentation. This reflects the academic rather than commercial trading focus. Research reveals no information about forex pairs, commodities, indices, or other tradeable instruments typically offered by brokers.

Cost Structure: While specific trading costs are unavailable, the platform operates on academic subscription models through institutional partnerships. This is fundamentally different from spread-based or commission trading structures. No leverage information is available in researched sources, as trading services do not appear to be offered.

Platform Options: The primary platform appears to be web-based academic databases accessed through Cambridge Core and Project MUSE rather than trading terminals like MetaTrader or proprietary trading software. This ajs review highlights significant gaps in traditional broker information. Potential users should seek clarification about actual services offered.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions for AJS cannot be evaluated using traditional forex broker criteria. This is due to the basic absence of trading account structures in available research. Cambridge Core and Project MUSE databases indicate subscription-based access models typical of academic publishing rather than margin trading accounts.

No information exists regarding account types, minimum balance requirements, or trading-specific account features that would enable proper evaluation. The platform appears to operate institutional subscription models through university partnerships. This differs significantly from individual trader accounts offered by conventional brokers.

Account opening processes, if applicable to trading, remain undocumented in available sources. Special account features such as Islamic accounts, VIP tiers, or demo accounts are not mentioned in research materials. This ajs review must conclude that traditional account condition evaluation is not feasible given the apparent focus on academic rather than trading services.

Potential users seeking trading accounts should request specific clarification about available financial services beyond academic publishing.

Research through available databases reveals no trading tools, technical analysis resources, or market research materials typically associated with forex brokers. The AJS platform appears to provide academic research tools and scholarly resources related to Jewish studies rather than financial market analysis.

No evidence exists of chart packages, economic calendars, market news feeds, or automated trading support. Educational resources appear limited to academic manuscript submission guidelines and scholarly publication processes rather than trading education or market analysis training. The platform lacks the fundamental trading infrastructure including real-time quotes, market data feeds, or analytical tools essential for forex trading activities.

The absence of proprietary research, third-party analysis providers, or trading signal services further reinforces the academic rather than financial services orientation. Expert advisors, algorithmic trading support, or API access for automated trading systems are not mentioned in available documentation.

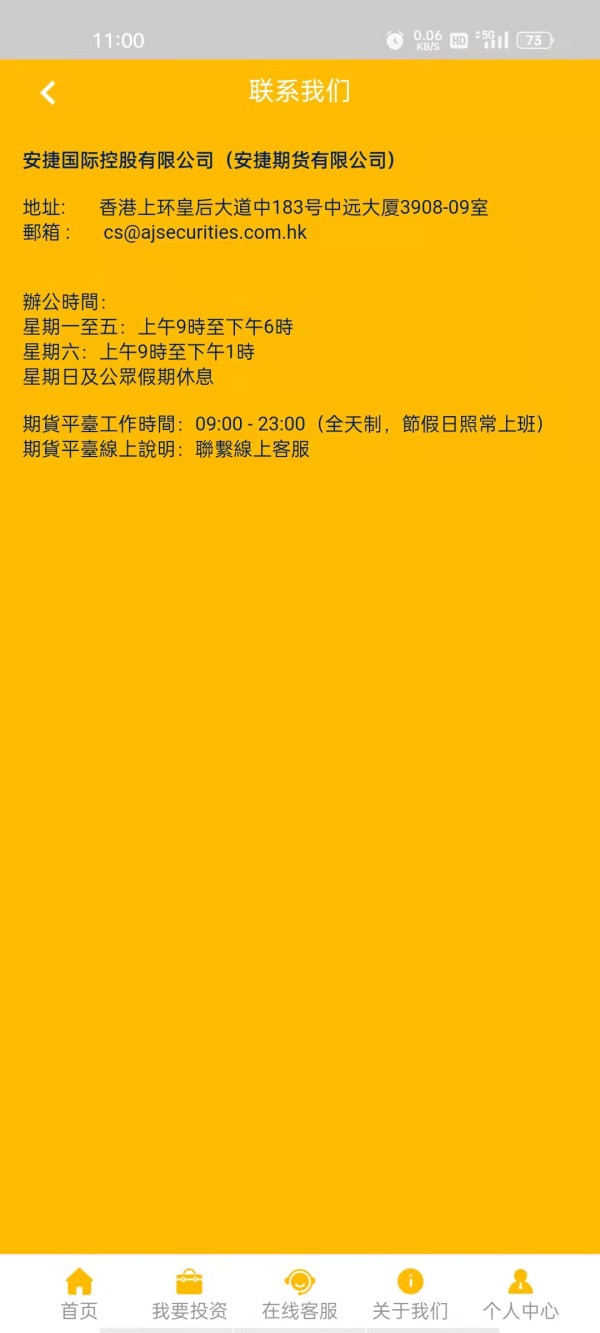

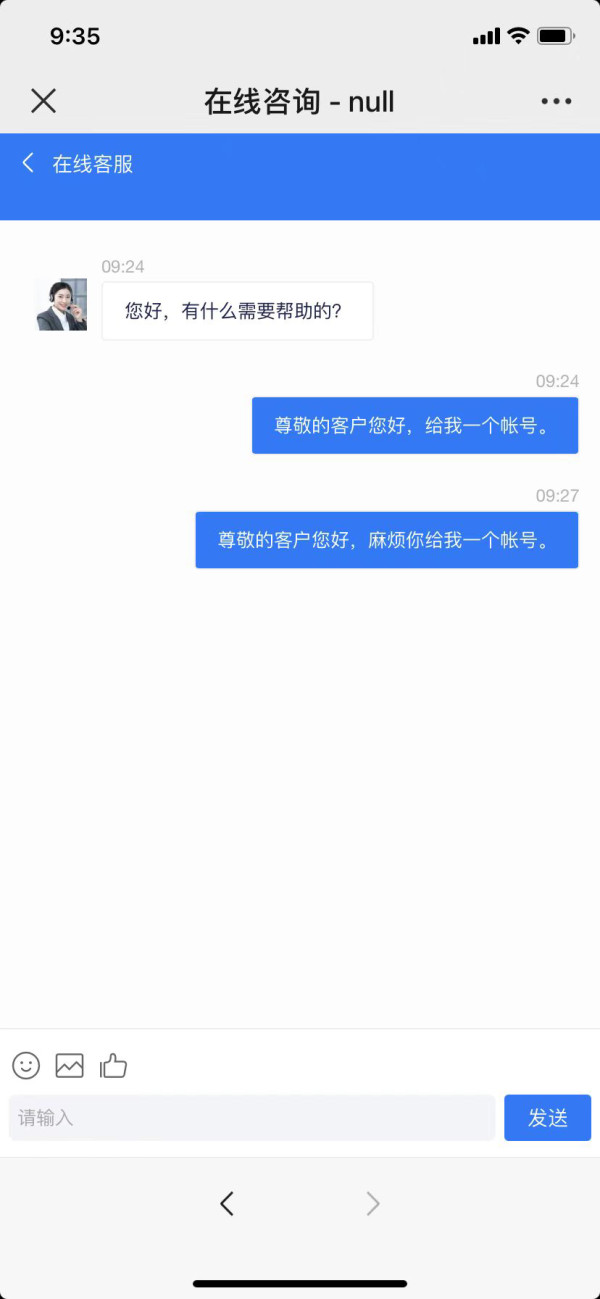

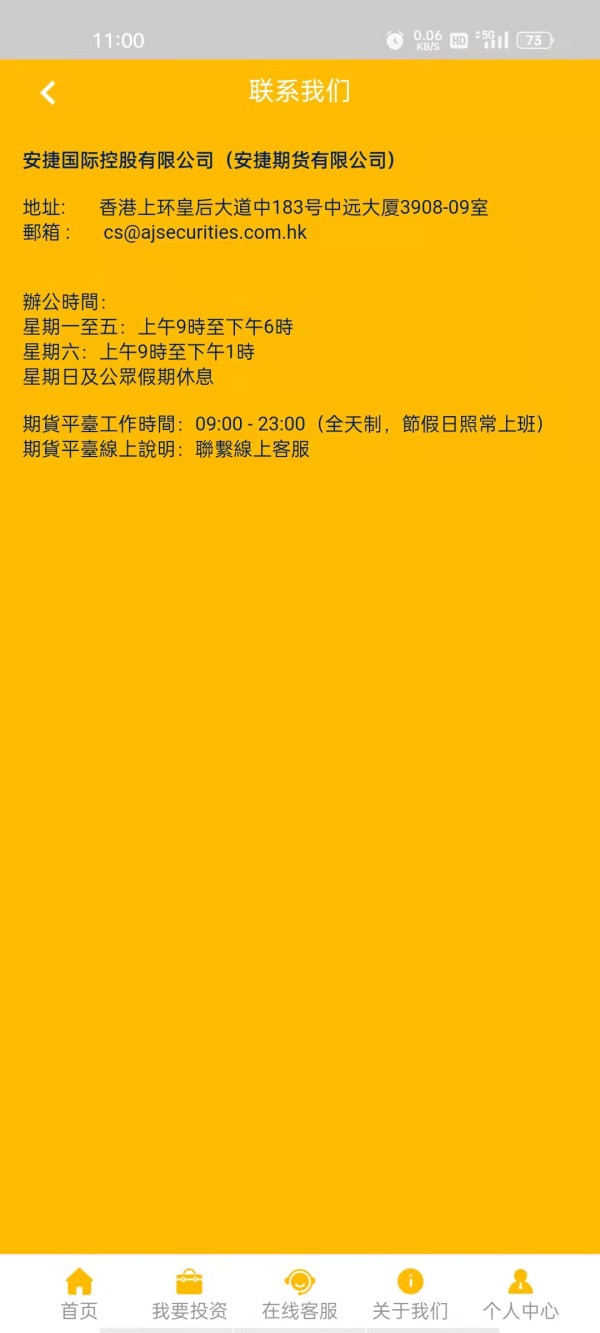

Customer Service and Support Analysis

Available research provides limited insight into customer service capabilities. Contact information is primarily oriented toward academic inquiries and manuscript submissions. The Managing Editor Aviva Arad appears to oversee editorial operations, though specific customer service channels, response times, or service quality metrics are not documented in available sources.

Multi-language support capabilities remain unclear, though the international editorial board suggests potential for diverse language assistance within academic contexts. However, this does not necessarily translate to trading-related customer support in multiple languages or 24/7 availability expected from forex brokers. Service quality assessment is not possible based on available information, as user feedback relates primarily to academic publishing experiences rather than trading support.

Problem resolution capabilities, dispute handling procedures, and escalation processes typical of financial services remain undocumented in researched sources.

Trading Experience Analysis

Platform stability, execution speed, and order processing quality cannot be evaluated as no trading platform infrastructure is evident in available research. The academic database access through Cambridge Core and Project MUSE represents the primary user interface. This operates differently from trading terminals requiring real-time market connectivity and order execution capabilities.

Mobile trading experience assessment is not applicable, as the platform appears to focus on academic content delivery rather than mobile trading applications. Trading environment evaluation including spreads, slippage, and execution quality is impossible due to the absence of actual trading services in available documentation. This ajs review emphasizes that traditional trading experience metrics cannot be applied to an entity that appears to operate exclusively within academic publishing frameworks rather than financial markets.

Trust and Regulation Analysis

Regulatory credentials typical of forex brokers are absent from available research. However, the organization maintains academic credibility through university partnerships and scholarly publishing standards. The Association for Jewish Studies operates under academic institutional frameworks rather than financial regulatory oversight by bodies such as FCA, CySEC, or ASIC.

Fund safety measures, segregated account protection, and investor compensation schemes are not mentioned in available sources. These protections are specific to financial services rather than academic publishing. Company transparency exists within academic contexts through editorial board disclosure and institutional affiliations, though this differs from financial services transparency requirements.

Industry reputation appears strong within academic circles based on university partnerships and scholarly credibility. However, this does not translate to forex industry recognition or regulatory compliance. No negative events or regulatory actions are documented in available research.

User Experience Analysis

Overall user satisfaction assessment is limited to academic user feedback, which is not readily available in researched sources. Interface design evaluation focuses on academic database navigation rather than trading platform usability. This represents fundamentally different user experience requirements.

Registration processes appear oriented toward academic access rather than account verification procedures required for financial services. Fund operation experience is not applicable, as the platform operates on subscription models rather than deposit and withdrawal systems typical of brokers. User complaints or satisfaction metrics specific to trading activities are unavailable, as the platform serves academic rather than trading communities.

The user base appears to consist of researchers, scholars, and academic institutions rather than individual traders seeking forex services.

Conclusion

This ajs review concludes with a neutral assessment due to substantial information limitations regarding traditional forex brokerage services. The available research indicates AJS operates primarily as an academic publishing platform through the Association for Jewish Studies rather than a conventional financial services provider.

The organization's established academic credentials and university partnerships represent strengths within scholarly contexts. However, these do not translate to forex trading capabilities. The platform appears most suitable for academic researchers, scholars, and institutions seeking access to Jewish studies publications rather than individual traders requiring forex brokerage services.

The fundamental disconnect between expected trading services and actual academic offerings necessitates careful consideration by potential users seeking financial market access. Major limitations include the absence of regulatory oversight, trading platforms, market access, and financial services infrastructure typically required for forex operations.