Regarding the legitimacy of Acetop FINANCIAL LIMITED forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is Acetop FINANCIAL LIMITED safe?

Software Index

Risk Control

Is Acetop FINANCIAL LIMITED markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Acetop Financial Limited

Effective Date:

2017-09-11Email Address of Licensed Institution:

cerri-anne@acetop.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.acetop.ukExpiration Time:

--Address of Licensed Institution:

13 St. Swithin's Lane London EC4N 8AL UNITED KINGDOMPhone Number of Licensed Institution:

+448009551710Licensed Institution Certified Documents:

Is Acetop Financial Safe or Scam?

Introduction

Acetop Financial is an online forex broker that has positioned itself as a player in the global trading market, providing services such as forex trading, CFDs, and spread betting. With its headquarters located in the United Kingdom, Acetop claims to offer competitive trading conditions and access to various financial instruments. However, the forex market is notoriously filled with both legitimate and fraudulent entities, making it crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to analyze the safety and legitimacy of Acetop Financial, using a structured framework that includes regulatory compliance, company background, trading conditions, client fund security, and customer experiences.

Regulation and Legitimacy

Regulatory compliance is a critical factor in assessing the safety of any forex broker. Acetop Financial claims to be regulated by several authorities, including the Financial Conduct Authority (FCA) in the UK. However, the existence of multiple regulatory claims raises questions about the broker's legitimacy. The table below summarizes the core regulatory information for Acetop Financial:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 767154 | United Kingdom | Verified |

| Securities Commission of the Bahamas (SCB) | SIA-F198 | Bahamas | Verified |

| Chinese Gold & Silver Exchange Society (CGSE) | 145 | Hong Kong | Verified |

The FCA is known for its stringent regulations, requiring brokers to maintain client funds in segregated accounts and adhere to strict operational standards. However, there are allegations that Acetop may operate under a "clone" license, which is a common tactic used by fraudulent brokers to mislead clients. This duality in regulatory status necessitates a careful examination of the broker's compliance history.

Company Background Investigation

Acetop Financial was established in 2017 and claims to have grown significantly since its inception. The company operates under the ownership of Acetop Global Markets Limited, which is registered in both the UK and offshore jurisdictions. While the management team is said to have extensive experience in the financial sector, details about their professional backgrounds are limited. Transparency regarding the ownership structure is crucial for building trust, and Acetop's limited disclosures could be a red flag for potential investors. The lack of detailed information about the company's history and management raises concerns about its operational integrity and commitment to regulatory compliance.

Trading Conditions Analysis

When evaluating whether Acetop Financial is safe, one must consider the overall trading costs associated with the broker. Acetop claims to offer competitive spreads and no commission fees, but it is essential to scrutinize any potential hidden costs. The table below compares the core trading costs associated with Acetop Financial:

| Cost Type | Acetop Financial | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 0.8 - 1.5 pips |

| Commission Model | None | Varies (often present) |

| Overnight Interest Range | Not disclosed | Varies |

While the spreads appear competitive, the lack of transparency regarding overnight interest and potential fees for withdrawals is concerning. The industry average suggests that many brokers disclose these fees upfront, which may indicate that Acetop is not fully transparent about its cost structure. This lack of clarity can be a significant factor in determining whether Acetop Financial is safe for trading.

Client Fund Security

The security of client funds is paramount in the forex trading landscape. Acetop Financial claims to maintain client funds in segregated accounts, which would typically provide a layer of protection for traders. However, the effectiveness of this measure is contingent on the broker's adherence to regulatory standards. Additionally, Acetop has not provided clear information regarding investor protection schemes or negative balance protection policies, which are essential for safeguarding traders against unforeseen market events. The absence of historical issues related to fund security is a positive sign, but the lack of information raises questions about the broker's commitment to protecting client assets.

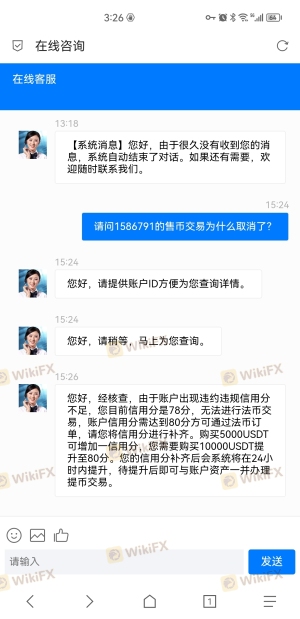

Customer Experience and Complaints

Analyzing customer feedback is vital in assessing whether Acetop Financial is safe. Reviews from traders reveal a mixed bag of experiences. Common complaints include difficulty in withdrawing funds and unresponsive customer service. The table below summarizes the main types of complaints received about Acetop Financial:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Unhelpful |

| Transparency Concerns | High | No clear answers |

One typical case involved a trader who reported significant delays in fund withdrawals, leading to frustration and a loss of trust in the broker. Such experiences suggest that while Acetop may offer competitive trading conditions, the overall customer experience may not meet the expectations of many traders.

Platform and Trade Execution

The performance of the trading platform is another critical factor in determining whether Acetop Financial is safe. Acetop offers the widely-used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are generally well-regarded for their user-friendly interfaces and robust functionality. However, issues related to order execution quality, slippage, and potential rejections of orders have been reported by users. These issues can significantly impact a trader's ability to execute strategies effectively, raising concerns about the reliability of Acetop's trading infrastructure.

Risk Assessment

Using Acetop Financial carries certain risks that traders must consider. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Mixed regulatory status raises concerns. |

| Fund Security | Medium | Segregated accounts in place, but lack of transparency exists. |

| Customer Service | High | Numerous complaints about unresponsiveness. |

To mitigate these risks, traders should conduct thorough due diligence, consider using smaller amounts for initial trades, and remain vigilant about the broker's practices.

Conclusion and Recommendations

In conclusion, while Acetop Financial presents itself as a legitimate forex broker, several factors raise concerns about its overall safety. The mixed regulatory status, limited transparency regarding fees, and numerous customer complaints suggest that traders should exercise caution. It is advisable for potential investors to explore alternative, well-regulated brokers with a proven track record in customer service and fund security. For those considering trading with Acetop, starting with a small investment and maintaining a close watch on trading conditions and customer support interactions is recommended. Ultimately, the question remains: Is Acetop Financial safe? The evidence suggests that while it may operate legally, the risks involved warrant careful consideration.

Is Acetop FINANCIAL LIMITED a scam, or is it legit?

The latest exposure and evaluation content of Acetop FINANCIAL LIMITED brokers.

Acetop FINANCIAL LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Acetop FINANCIAL LIMITED latest industry rating score is 7.22, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.22 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.