Tradeo 2025 Review: Everything You Need to Know

Executive Summary

Tradeo stands out as a reliable and innovative broker. This broker particularly appeals to users interested in social trading platforms. This tradeo review examines a Cyprus-based brokerage that has carved a niche in the competitive CFD and social trading space. The broker offers multiple trading platform options, including Web-based solutions, MetaTrader 4, and specialized social trading platforms that enable traders to follow and copy successful strategies from other market participants.

The platform caters primarily to traders interested in social trading features. This makes it especially suitable for beginners and intermediate-level traders who want to learn from experienced market participants. Tradeo provides access to diverse asset classes including currencies, cryptocurrencies, indices, precious metals, energies, and stocks. The broker operates under the regulatory oversight of the Cyprus Securities and Exchange Commission, which provides a solid foundation for trader protection and operational standards.

While Tradeo demonstrates innovation in social trading technology and maintains regulatory compliance, traders should carefully evaluate the platform's cost structure and terms before committing to trading activities. The broker's focus on social trading represents both an opportunity for learning and a unique approach to market participation that distinguishes it from traditional brokerage offerings.

Important Notice

Traders should be aware that Tradeo's regulatory framework and available services may vary across different jurisdictions. The broker operates under CySEC regulation. However, specific terms, conditions, and available features might differ depending on the trader's location and local regulatory requirements. This review is based on publicly available information and user feedback collected from various sources.

The evaluation presented in this analysis reflects the broker's offerings as reported through official channels and third-party review platforms. Potential clients should verify current terms, conditions, and regulatory status directly with Tradeo before opening trading accounts. Broker policies and market conditions can change over time.

Rating Framework

Broker Overview

Tradeo operates as a Cyprus-based financial services provider specializing in social trading and Contract for Difference trading solutions. The company has positioned itself within the innovative segment of the forex and CFD industry by emphasizing social trading capabilities. These capabilities allow traders to interact, share strategies, and potentially copy successful trading approaches from other platform users.

The broker's business model centers on providing accessible trading solutions through multiple platform options while fostering a community-driven trading environment. This approach appeals particularly to traders who value collaborative learning and strategy sharing as part of their trading journey. Tradeo's headquarters in Cyprus positions the company within the European Union regulatory framework. This provides access to EU markets while maintaining compliance with established financial regulations.

The platform supports an extensive range of tradeable assets across multiple markets, including traditional forex pairs, cryptocurrency instruments, major global indices, precious metals like gold and silver, energy commodities, and individual stock CFDs. This comprehensive asset selection enables traders to diversify their portfolios and explore various market opportunities through a single trading account. The broker operates under regulatory supervision from the Cyprus Securities and Exchange Commission, which enforces strict operational standards and client fund protection requirements.

Regulatory Coverage: Tradeo operates under the regulatory authority of the Cyprus Securities and Exchange Commission. This commission provides comprehensive oversight of the broker's operations, client fund handling, and business practices within the European regulatory framework.

Deposit and Withdrawal Methods: Specific information regarding available funding methods, processing times, and associated fees was not detailed in available sources. This requires direct inquiry with the broker for comprehensive payment options.

Minimum Deposit Requirements: Current minimum deposit requirements are not specified in available documentation. This indicates that potential traders should contact Tradeo directly for account opening requirements and initial funding obligations.

Bonus and Promotional Offers: Information regarding current promotional campaigns, welcome bonuses, or ongoing trading incentives was not available in reviewed sources. This suggests that such offers may be limited or communicated directly to prospective clients.

Available Trading Assets: The platform provides access to currencies, cryptocurrencies, global indices, precious metals, energy commodities, and individual stocks through CFD instruments. This offers substantial diversification opportunities across multiple market sectors.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs requires further investigation. Specific pricing details were not comprehensively covered in available materials. This tradeo review notes that cost transparency could be improved.

Leverage Options: Maximum leverage ratios and margin requirements were not specified in available sources. This indicates that these critical trading parameters need direct clarification from the broker based on account type and regulatory jurisdiction.

Platform Selection: Tradeo supports Web-based trading interfaces, the popular MetaTrader 4 platform, and proprietary social trading platforms. These platforms are designed specifically for community-based trading activities and strategy sharing.

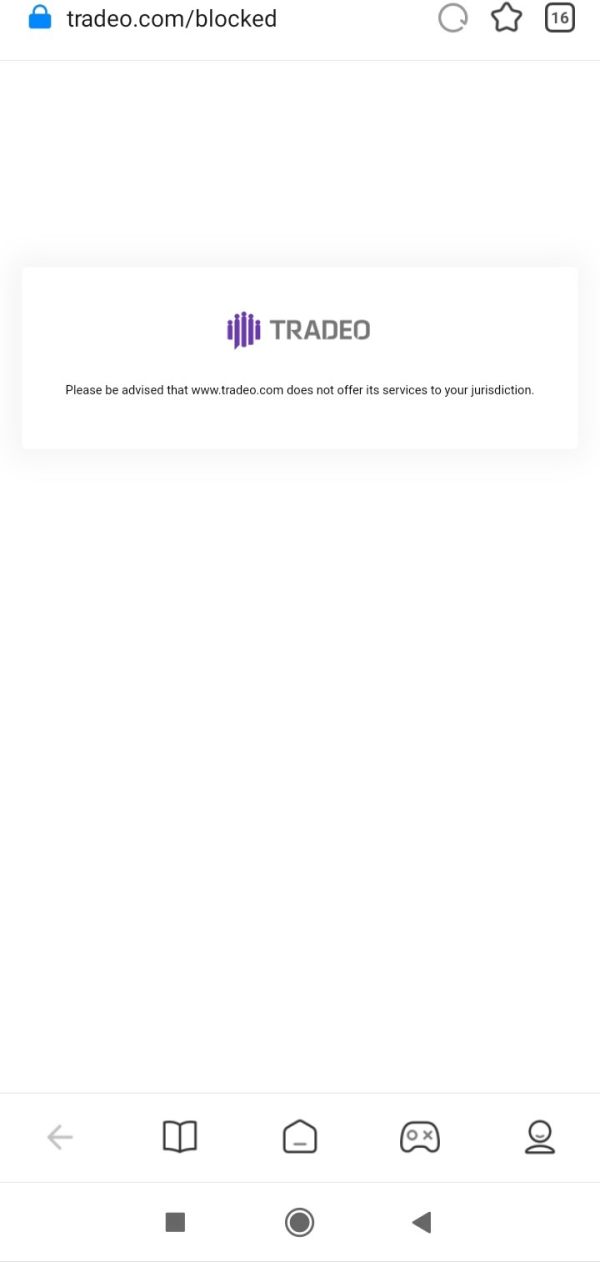

Geographic Restrictions: Specific information about restricted jurisdictions or regional limitations was not detailed in available sources.

Customer Support Languages: Available customer service languages and communication channels were not specified in reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Tradeo's account conditions receives a moderate score due to limited publicly available information about essential account features. Without clear details about account types, minimum deposit requirements, or specific account benefits, potential traders face uncertainty when comparing Tradeo to other market participants. This tradeo review finds that the lack of transparent account information significantly impacts the overall assessment.

Account opening procedures and verification requirements are not detailed in available sources. This makes it difficult to assess the efficiency and user-friendliness of the onboarding process. The absence of information about special account features, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, further limits the evaluation scope.

Competitive analysis becomes challenging when fundamental account parameters remain unclear. Industry-standard practice involves clearly communicating account types, features, and requirements to enable informed decision-making. The current lack of detailed account information suggests that Tradeo may benefit from improved transparency in communicating basic account conditions to prospective clients.

Tradeo demonstrates strength in platform diversity by offering multiple trading environments including web-based solutions, MetaTrader 4, and specialized social trading platforms. This variety suggests that the broker recognizes different trader preferences and technical requirements. However, specific details about advanced trading tools, analytical resources, and research capabilities remain limited in available documentation.

The social trading component represents a significant differentiator. It potentially provides valuable learning resources for newer traders and strategy diversification opportunities for experienced participants. Yet without detailed information about research materials, market analysis, educational content, or automated trading support, the complete picture of available tools remains incomplete.

Educational resources and ongoing trader development support are crucial factors for broker evaluation. This is particularly true for platforms emphasizing social trading and community learning. The absence of specific information about these resources limits the ability to fully assess Tradeo's commitment to trader education and skill development.

Customer Service and Support Analysis

Customer service evaluation proves challenging due to limited user feedback and absence of detailed information about support channels, availability, and service quality. Effective customer support represents a critical component of trading operations. This is particularly important when technical issues or account questions arise during active trading sessions.

Response times, support channel availability, and problem resolution effectiveness cannot be adequately assessed without user testimonials or documented service standards. The lack of information about multilingual support capabilities may particularly concern international traders requiring assistance in their native languages.

Quality customer service typically includes multiple communication channels, extended availability hours, and knowledgeable staff capable of addressing both technical and account-related inquiries. Without specific data about these service aspects, traders cannot make informed decisions about expected support quality.

Trading Experience Analysis

The trading experience assessment focuses on platform performance, execution quality, and overall functionality. However, specific user feedback about these critical areas remains limited. Platform stability and execution speed directly impact trading outcomes, making these factors essential for broker evaluation.

Multiple platform options suggest flexibility in trading approaches. However, without detailed performance metrics or user experience reports, the actual quality of trading execution cannot be definitively assessed. Mobile trading capabilities, which have become increasingly important for active traders, are not specifically addressed in available information.

Order execution quality, including slippage rates and fill speeds, represents crucial factors for trading success. The absence of specific performance data or user testimonials about execution quality limits the ability to provide comprehensive trading experience evaluation. This tradeo review emphasizes the importance of execution quality for successful trading outcomes.

Trust and Reliability Analysis

Tradeo's regulatory status under CySEC supervision provides a foundational element of trust and operational oversight. CySEC regulation requires compliance with strict operational standards, client fund segregation, and regular reporting requirements that enhance trader protection and operational transparency.

However, specific information about fund protection measures, insurance coverage, and company financial stability is not detailed in available sources. Additional trust factors, such as company history, management background, and track record of handling client concerns, require further investigation for comprehensive reliability assessment.

Industry reputation and third-party evaluations contribute significantly to trust assessment. However, limited independent reviews and ratings make it difficult to gauge market perception and peer recognition. The absence of information about negative incident handling or dispute resolution procedures further limits trust evaluation capabilities.

User Experience Analysis

User experience evaluation relies heavily on the reported user rating of 60 points. This indicates moderate satisfaction levels among platform users. This mid-range score suggests that while Tradeo provides functional trading services, there may be areas for improvement in overall user satisfaction.

Interface design, navigation efficiency, and overall platform usability significantly impact daily trading operations. However, specific feedback about these user experience elements is not available in reviewed sources. Registration and verification processes, which form users' first impressions, lack detailed documentation about efficiency and user-friendliness.

Fund management operations, including deposit and withdrawal experiences, represent critical user touchpoints that affect overall satisfaction. Without specific user feedback about these processes, the complete user experience picture remains incomplete. The target user profile of social trading enthusiasts suggests that community features and interaction capabilities play important roles in overall satisfaction.

Conclusion

Tradeo presents itself as a specialized broker focusing on social trading innovation within the CFD and forex markets. While the platform demonstrates regulatory compliance through CySEC oversight and offers diverse trading assets across multiple platforms, significant information gaps limit comprehensive evaluation. The broker appears well-suited for traders interested in social trading features and community-based learning approaches.

The primary strengths include platform diversity, regulatory compliance, and innovative social trading focus. However, the lack of transparent cost structures, detailed user feedback, and comprehensive service information represents notable limitations. Potential traders should conduct thorough due diligence and direct inquiry with Tradeo to obtain essential details about trading conditions, costs, and service quality before committing to the platform.