Regarding the legitimacy of IUX forex brokers, it provides ASIC, FSCA and WikiBit, (also has a graphic survey regarding security).

Is IUX safe?

Pros

Cons

Is IUX markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

IUX MARKETS AU PTY LTD.

Effective Date:

2021-07-22Email Address of Licensed Institution:

support@iux.com.auSharing Status:

No SharingWebsite of Licensed Institution:

https://www.iux.com.auExpiration Time:

--Address of Licensed Institution:

'6 04' L 6 10 BRIDGE ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0440131395Licensed Institution Certified Documents:

FSCA Forex Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

IUX MARKETS ZA (PTY) LTD

Effective Date: Change Record

2023-08-18Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

18 CAVENDISH ROADCLAREMONTCAPE TOWN7708Phone Number of Licensed Institution:

021 0201540Licensed Institution Certified Documents:

Is IUX A Scam?

Introduction

IUX, a forex and CFD broker, has positioned itself as a competitive player in the online trading landscape since its inception in 2016. Headquartered in Cyprus, IUX offers various trading instruments, including forex, commodities, indices, and cryptocurrencies, catering to both novice and experienced traders. However, as the financial trading environment becomes increasingly saturated, it is crucial for traders to carefully assess the credibility of brokers before committing their funds. This article aims to provide an objective analysis of IUX's legitimacy, focusing on its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The investigation is based on a comprehensive review of multiple sources, including user feedback, regulatory disclosures, and expert analyses.

Regulation and Legitimacy

Regulation is a key factor in determining the safety and reliability of a forex broker. A regulated broker is subject to strict oversight by financial authorities, which helps protect traders from fraud and malpractice. IUX operates under several regulatory frameworks, which adds to its credibility. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 529610 | Australia | Verified |

| FSCA | 53103 | South Africa | Verified |

| FSA | 26183 | Saint Vincent and the Grenadines | Verified |

| FSC | T2023172 | Comoros | Processing |

IUX is regulated by the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Financial Services Authority (FSA) in Saint Vincent and the Grenadines. The presence of ASIC, a tier-1 regulator, is particularly noteworthy, as it mandates stringent compliance measures. However, while the FSCA is considered a reputable body, the FSA is often seen as less stringent, as it operates in an offshore jurisdiction.

The regulatory history of IUX appears to be clean, with no significant compliance issues reported. This regulatory oversight ensures that IUX adheres to high standards of financial conduct, safeguarding client funds and promoting fair trading practices. However, potential clients should remain vigilant and conduct their own due diligence, as the regulatory landscape can change.

Company Background Investigation

IUX was established in 2016 and has since evolved into a multi-faceted trading platform catering to a global clientele. The company operates under the umbrella of IUX Markets Limited, which is incorporated in Saint Vincent and the Grenadines. This jurisdiction is often chosen by brokers due to its lenient regulatory framework, which allows for more flexible operational practices.

The management team at IUX comprises individuals with extensive experience in the financial services sector, although specific details about their backgrounds are not widely disclosed. This lack of transparency can be a red flag for potential investors, as it raises questions about the company's accountability and governance.

In terms of information disclosure, IUX provides a reasonable amount of data regarding its services and trading conditions. However, more comprehensive insights into its financial health and operational strategies would enhance investor confidence. Overall, while IUX has a solid foundation, the opacity surrounding its management can be a concern for traders seeking a trustworthy broker.

Trading Conditions Analysis

The trading conditions offered by IUX are a critical aspect of its appeal to potential clients. The broker provides a competitive fee structure, which is essential for maximizing profits. Below is a comparison of IUX's core trading costs against industry averages:

| Cost Type | IUX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 1.2 pips |

| Commission Model | $0 - $6 per lot | $6 - $12 per lot |

| Overnight Interest Range | Varies | Varies |

IUX offers spreads starting from 0.2 pips for its standard accounts, which is significantly lower than the industry average. Additionally, the broker does not impose deposit or withdrawal fees, enhancing its appeal to cost-conscious traders. However, the commission for the raw account type can reach up to $6 per lot, which may deter high-frequency traders.

One potential area of concern is the broker's overnight interest policy. While IUX does provide a competitive environment, the lack of clarity regarding overnight fees can lead to unexpected costs for traders who hold positions overnight. This ambiguity warrants careful consideration, especially for those employing swing trading strategies.

Client Funds Security

Client fund security is paramount in the trading industry, and IUX has implemented several measures to ensure the safety of its clients' assets. The broker employs segregated accounts, which means that client funds are kept separate from the company's operational funds. This practice minimizes the risk of mismanagement or loss of client funds in case of financial difficulties faced by the broker.

Moreover, IUX provides negative balance protection, which ensures that traders cannot lose more than their initial deposit. This feature is particularly beneficial for inexperienced traders who may be more susceptible to market volatility. However, it is essential to note that the level of investor protection can vary based on the regulatory jurisdiction under which the client is trading.

While there have been no significant reports of fund security issues associated with IUX, potential clients should remain cautious and stay informed about the broker's policies and practices regarding fund management.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability and service quality. Reviews of IUX reveal a mixed bag of experiences.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

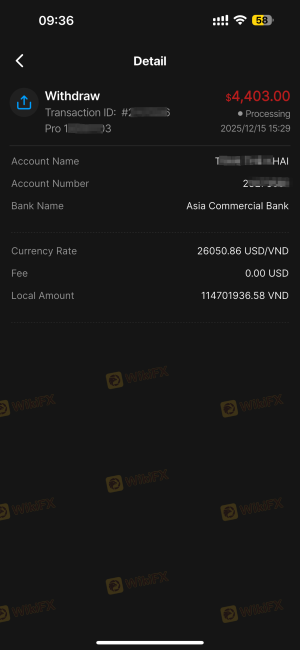

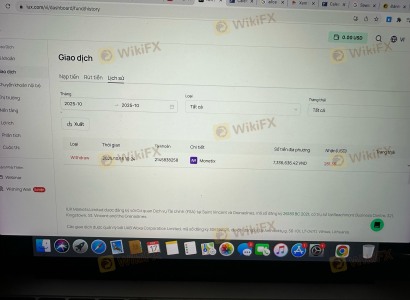

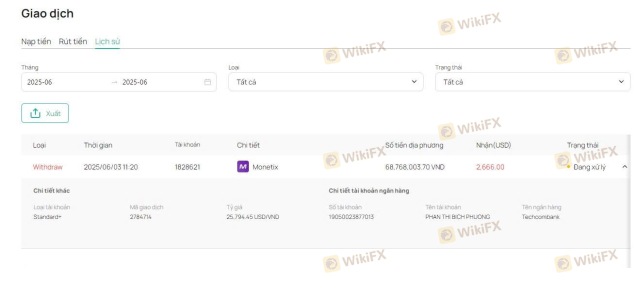

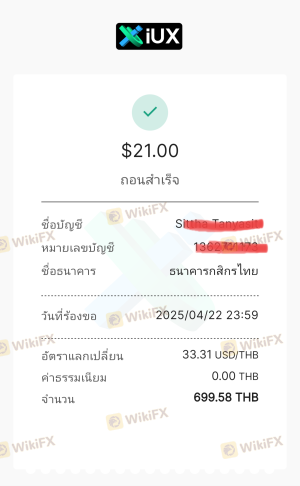

| Withdrawal Issues | High | Slow response |

| Customer Support Quality | Medium | Generally responsive |

| Platform Stability | Medium | Occasional issues |

Common complaints include difficulties with the withdrawal process and the perceived quality of customer support. Some users have reported delays in fund transfers and a lack of responsiveness from the support team. However, others have praised the broker for its low spreads and user-friendly trading platform.

Two notable case studies highlight these issues. One trader reported an unsuccessful withdrawal attempt, leading to frustration and concerns about the broker's reliability. Conversely, another trader shared a positive experience, emphasizing the ease of trading and timely execution of orders. This dichotomy in user experiences underscores the importance of thorough research and due diligence before selecting a broker.

Platform and Trade Execution

The performance of a trading platform is integral to a trader's overall experience. IUX offers the widely-used MetaTrader 5 (MT5) platform, known for its advanced charting capabilities and user-friendly interface. The platform is available on desktop, web, and mobile versions, providing traders with flexibility and convenience.

In terms of execution quality, IUX claims to deliver fast order execution speeds, averaging around 62 milliseconds. However, some users have reported occasional slippage and order rejections, which can be detrimental to trading performance. While the platform generally performs well, the presence of these issues should be taken into account, especially for high-frequency traders.

Risk Assessment

Using IUX comes with its own set of risks, which traders must evaluate before committing to the platform. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Varies by jurisdiction; some entities are less stringent. |

| Fund Security | Low | Segregated accounts and negative balance protection provided. |

| Withdrawal Difficulties | Medium | Reports of delays and slow responses from customer support. |

| Trading Costs | Low | Competitive spreads and no deposit/withdrawal fees. |

To mitigate these risks, traders should thoroughly read the broker's terms and conditions, understand the fee structure, and maintain open communication with customer support. Additionally, employing sound risk management practices in trading can help minimize potential losses.

Conclusion and Recommendations

In conclusion, IUX presents itself as a viable option for traders seeking a competitive trading environment with low costs and a variety of instruments. The broker is regulated by multiple authorities, including ASIC, which enhances its credibility. However, potential clients should remain cautious due to the mixed reviews regarding customer support and withdrawal processes.

While there are no glaring signs of fraud, the lack of transparency regarding management and certain operational practices warrants careful consideration. Therefore, IUX may be more suitable for experienced traders who can navigate the complexities of the trading environment.

For those seeking alternatives, brokers like FXTM, AvaTrade, and IG Markets offer robust regulatory frameworks, comprehensive educational resources, and reliable customer support, making them worthy of consideration for both novice and seasoned traders.

Is IUX a scam, or is it legit?

The latest exposure and evaluation content of IUX brokers.

IUX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IUX latest industry rating score is 6.08, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.08 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.