iux 2025 Review: Everything You Need to Know

Executive Summary

This iux review looks at a competitive forex broker that has grown popular in the global trading market since 2016. iux offers low spreads and high leverage options, which attracts traders of all experience levels. The platform executes trades quickly and supports multiple asset classes, including forex, commodities, stocks, and cryptocurrencies.

Over 180,000 traders worldwide use iux. The broker serves beginners who want easy entry points and experienced traders who need advanced trading tools. iux operates under regulation from the South African Financial Sector Conduct Authority (FSCA) and has earned a 4.72 TrustScore rating from users. Key features include spreads starting from 0.0 pips, leverage up to 1:3000, and a minimum deposit of just $10.

The platform offers 138 tradeable instruments across various markets through the MT5 trading platform. Customer service covers 10 languages, including Thai, showing the broker's commitment to serving traders worldwide.

Important Notice

Regional Entity Differences: iux operates under different rules in various countries. Trading conditions and available services may change based on your location and which iux entity serves your region. The rules in South Africa, where the main entity has its license, may differ from other places where the broker operates.

Review Methodology: This evaluation uses user feedback, regulatory information, and public data about iux's trading conditions and services. The assessment provides a balanced view of the trading experience, covering both positive aspects and potential concerns. All information reflects current available data and may change if the broker updates its terms and conditions.

Rating Framework

Broker Overview

iux started in the forex trading market in 2016. The company set up its headquarters in Cyprus with a clear goal to provide accessible forex trading services worldwide. iux works as a market maker, which means it provides liquidity and matches trading orders for its clients.

The broker has grown steadily and now serves over 180,000 traders worldwide. This growth shows the company's commitment to meeting different trading needs across various markets and experience levels. iux combines traditional forex trading with modern technology, aiming to bridge the gap between institutional-grade trading conditions and retail trader access.

The platform specializes in CFD trading alongside traditional forex pairs. It offers access to multiple asset classes including commodities, indices, stocks, and cryptocurrencies. iux operates mainly through the MetaTrader 5 platform, giving traders professional-grade tools and analytical capabilities. The broker follows regulations through its registration with the South African Financial Sector Conduct Authority (FSCA), ensuring it meets financial service standards and client protection measures.

Regulatory Jurisdiction: iux operates under the South African Financial Sector Conduct Authority (FSCA). This authority provides a regulatory framework for financial services and ensures compliance with industry standards.

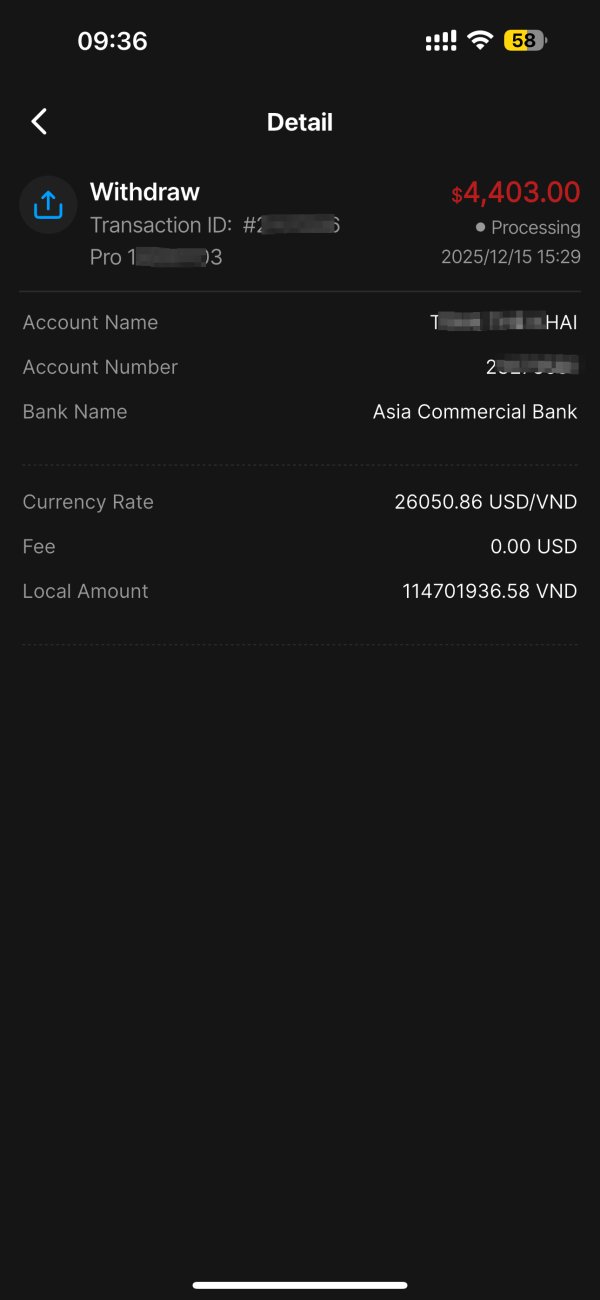

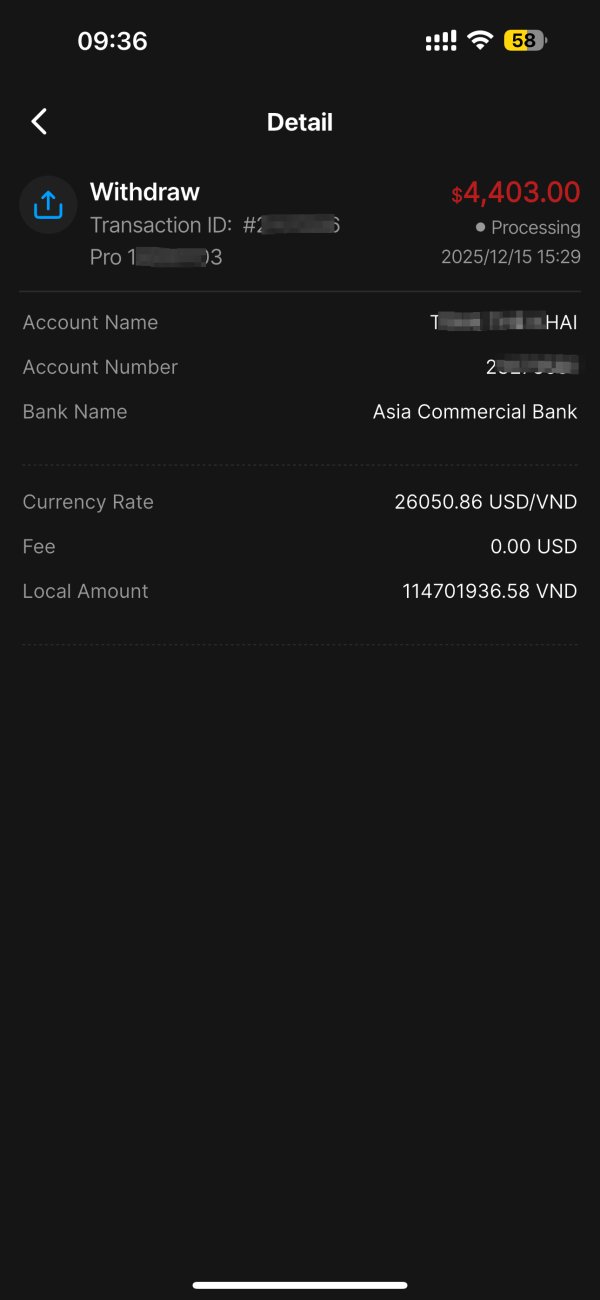

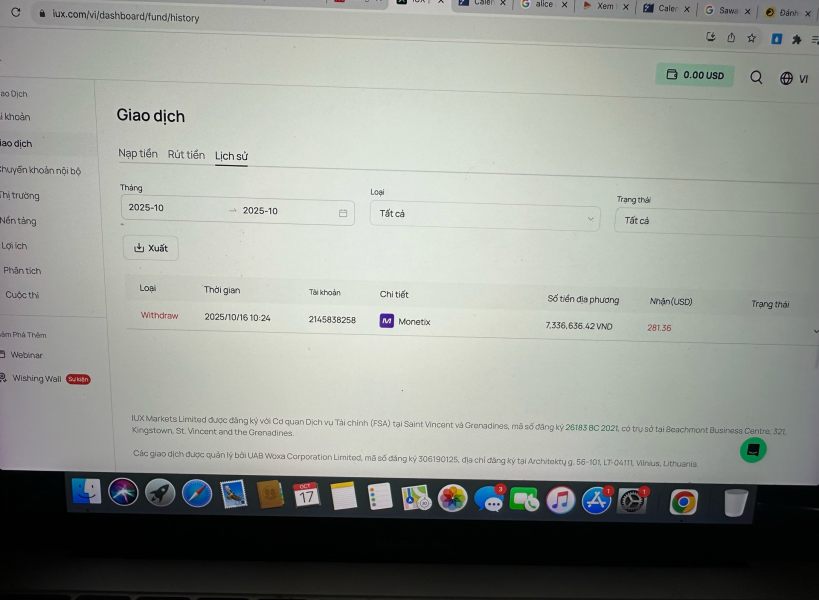

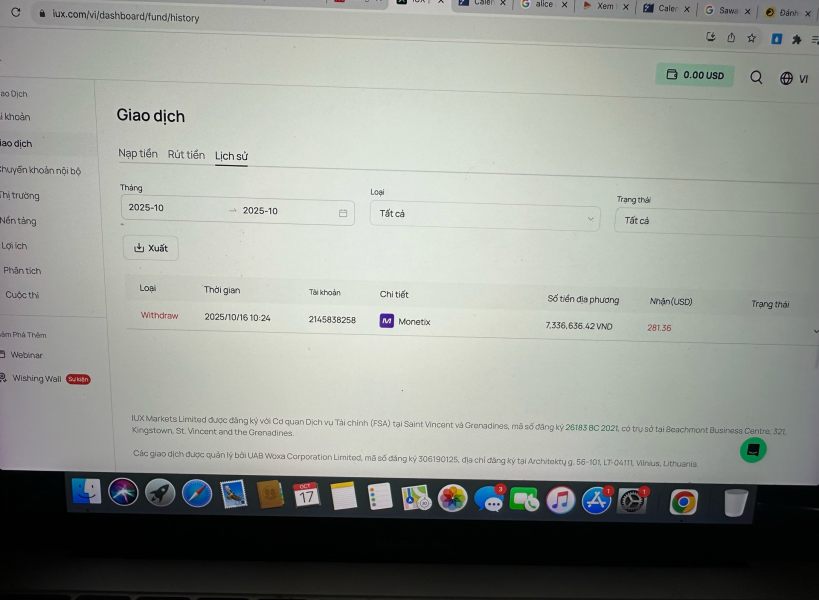

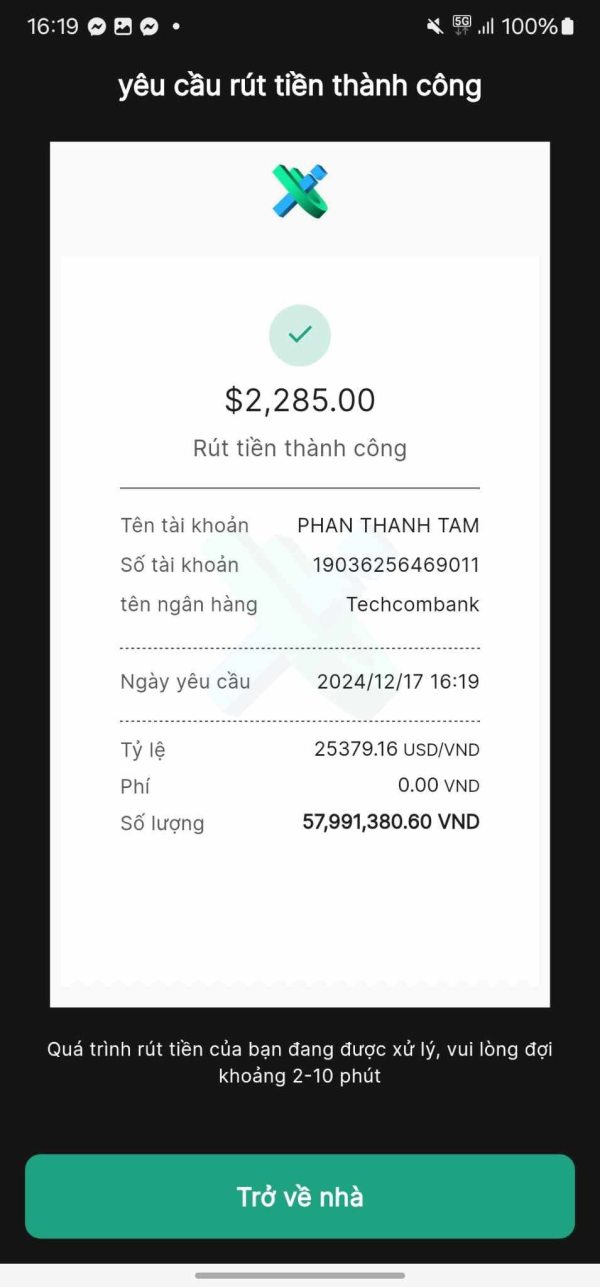

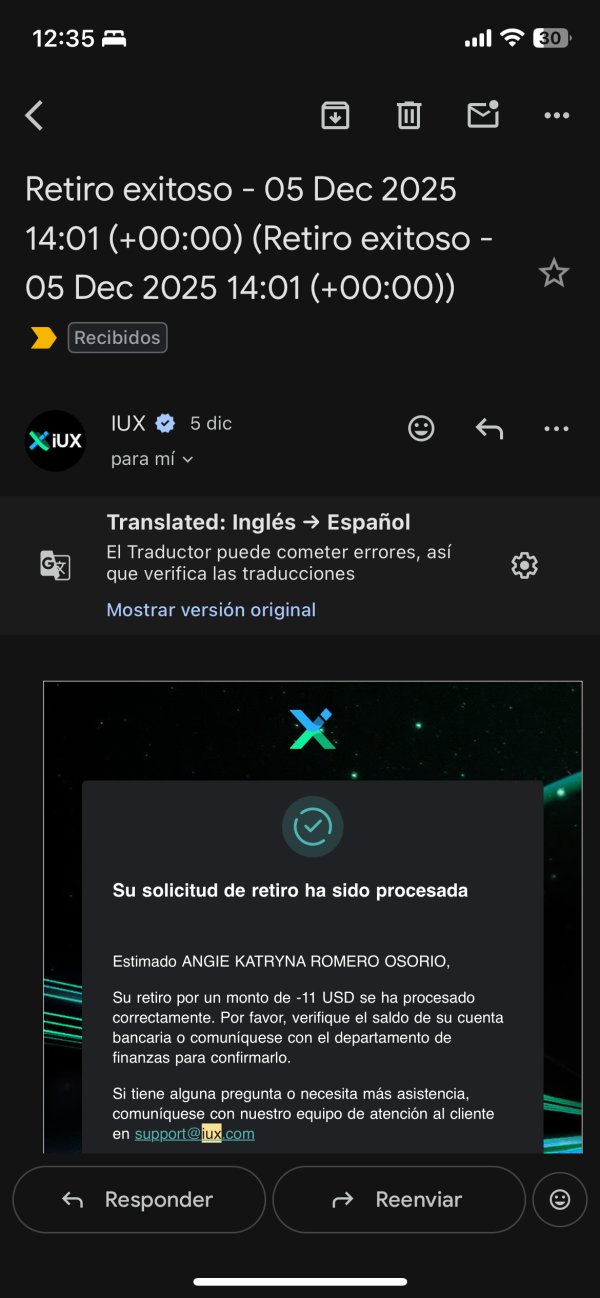

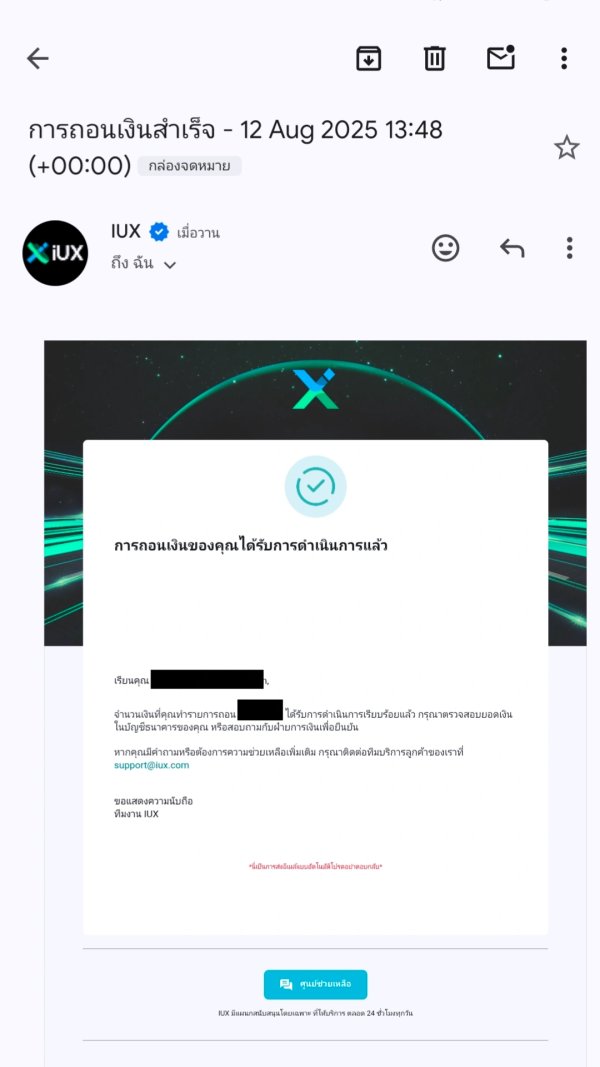

Deposit and Withdrawal Methods: The broker maintains standard industry practices for fund transfers and account management. Specific payment methods are not detailed in available sources.

Minimum Deposit Requirements: The platform requires a minimum deposit of $10. This makes it highly accessible for new traders and those looking to test the platform with minimal initial investment.

Bonus and Promotional Offers: Current promotional offerings and bonus structures are not specifically detailed in available documentation. Traders should ask directly for current incentive programs.

Tradeable Assets: iux provides access to 138 different trading instruments across multiple markets. These include major and minor forex pairs, commodities such as gold and oil, global stock indices, individual equities, and popular cryptocurrencies.

Cost Structure: The broker offers competitive spreads starting from 0.0 pips on major currency pairs. Most account types operate on a commission-free basis, though specific fee schedules for different services require direct confirmation.

Leverage Options: Maximum leverage available reaches 1:3000. This provides significant amplification potential for experienced traders while requiring careful risk management.

Platform Selection: Trading happens through the MetaTrader 5 platform. It offers comprehensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors.

Geographic Restrictions: Specific regional limitations are not detailed in current iux review materials. Potential clients need to verify availability in their area.

Customer Support Languages: The platform provides customer service in 10 different languages, including Thai. This shows commitment to international market accessibility.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

iux performs well in account conditions, mainly because of its accessible entry requirements and competitive trading terms. The $10 minimum deposit requirement is one of the lowest barriers to entry in the current forex market. This makes the platform particularly attractive to new traders who want to experience live trading without significant initial capital commitment. It also appeals to experienced traders looking to test the platform's capabilities before committing larger amounts.

The broker's spread structure starts from 0.0 pips on major currency pairs, positioning it competitively within industry standards. User feedback shows that these tight spreads help reduce overall trading costs significantly. This is particularly beneficial for high-frequency traders and scalping strategies. The commission-free structure on most account types adds another layer of cost efficiency by removing additional transaction fees that many brokers charge.

However, the lack of detailed information about different account tiers and their specific features shows where transparency could improve. While the basic conditions are attractive, traders seeking premium services or institutional-level accounts may need additional clarification about available options and their benefits.

The iux review data suggests that account opening procedures are straightforward. However, specific verification requirements and processing times are not extensively documented in available sources.

The platform excels in providing comprehensive trading tools and resources. The 138 available trading instruments represent one of the more diverse offerings in the retail forex market. This extensive selection spans traditional forex pairs, commodities including precious metals and energy products, major global indices, individual stock CFDs, and cryptocurrency pairs. Traders get ample diversification opportunities within a single platform.

MetaTrader 5 integration ensures access to professional-grade analytical tools. These include advanced charting capabilities, technical indicators, and automated trading functionality through Expert Advisors. The platform supports multiple order types and risk management tools essential for implementing sophisticated trading strategies. User feedback consistently highlights the platform's reliability and the comprehensive nature of available trading instruments.

The multi-asset approach allows traders to capitalize on various market conditions and implement cross-market strategies. This is particularly valuable during periods of forex market consolidation. The inclusion of cryptocurrency trading reflects the broker's adaptation to evolving market demands and provides exposure to this rapidly growing asset class.

While the tool selection is impressive, the availability of proprietary research resources, market analysis, and educational materials is not extensively detailed in current documentation. This represents a potential area for enhancement to support trader development and decision-making processes.

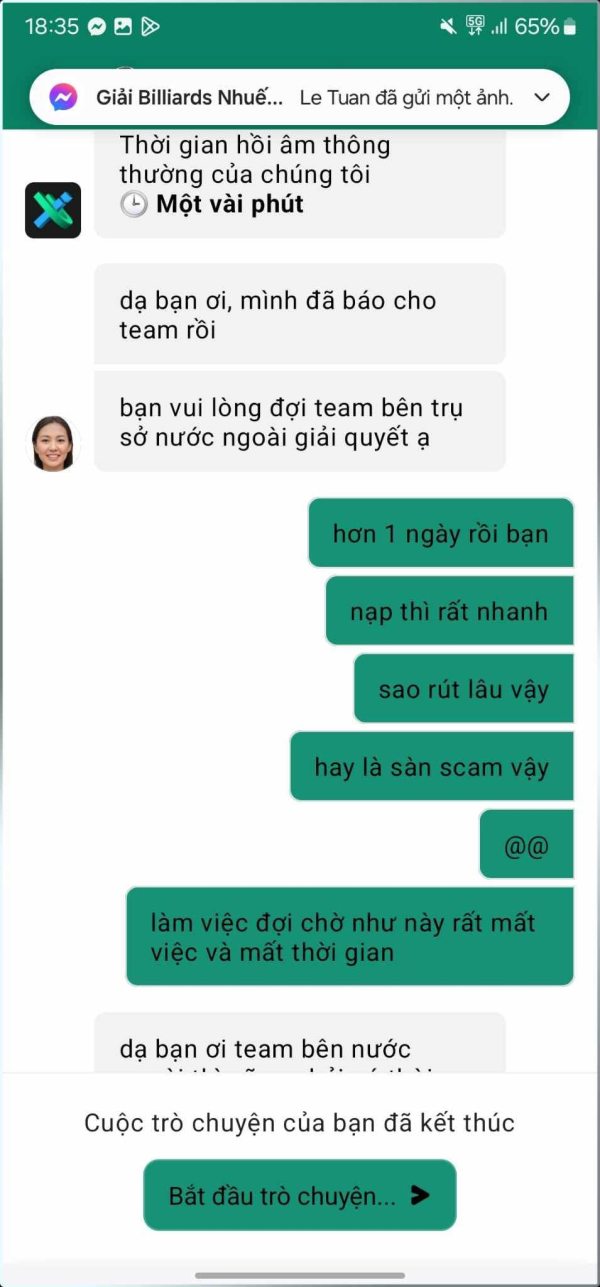

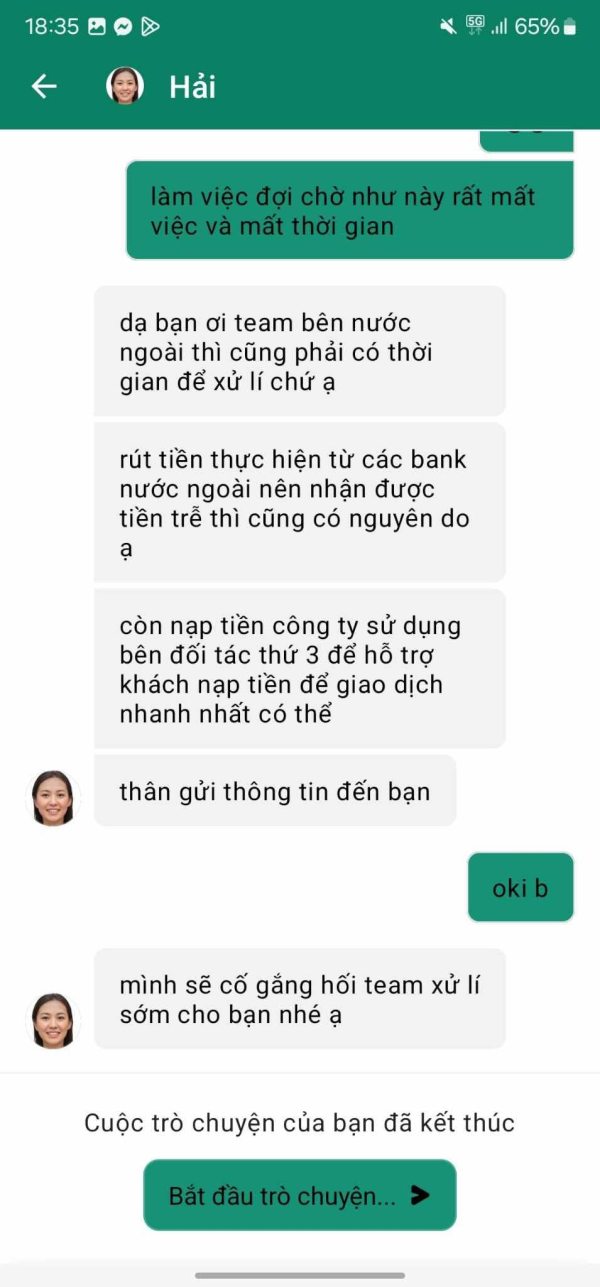

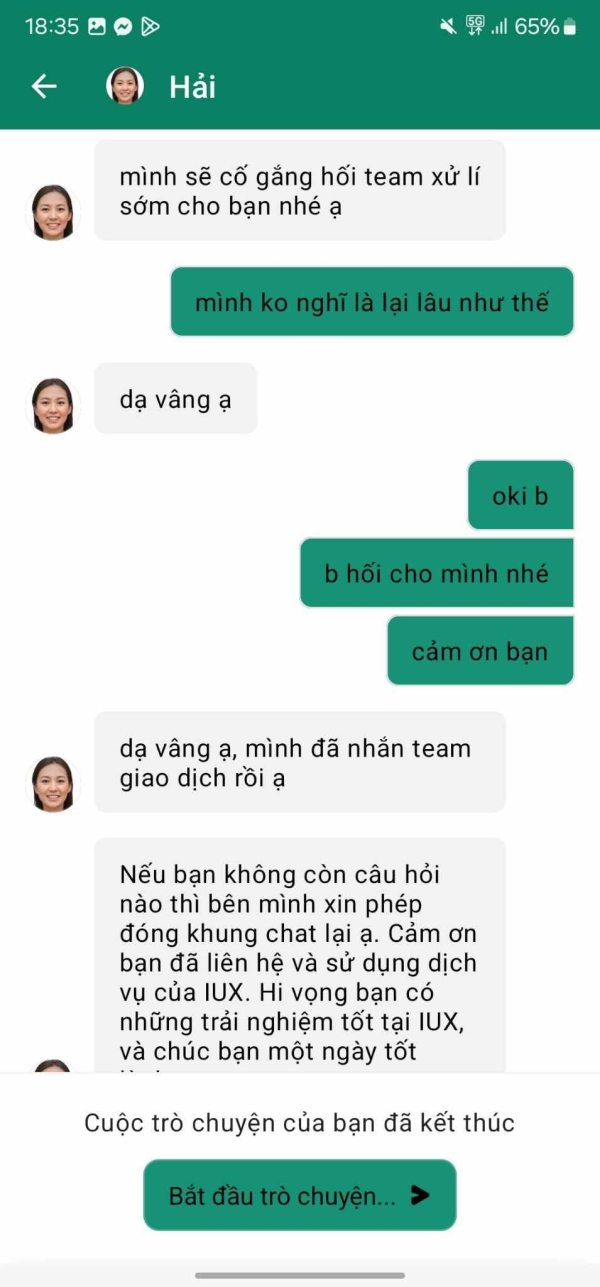

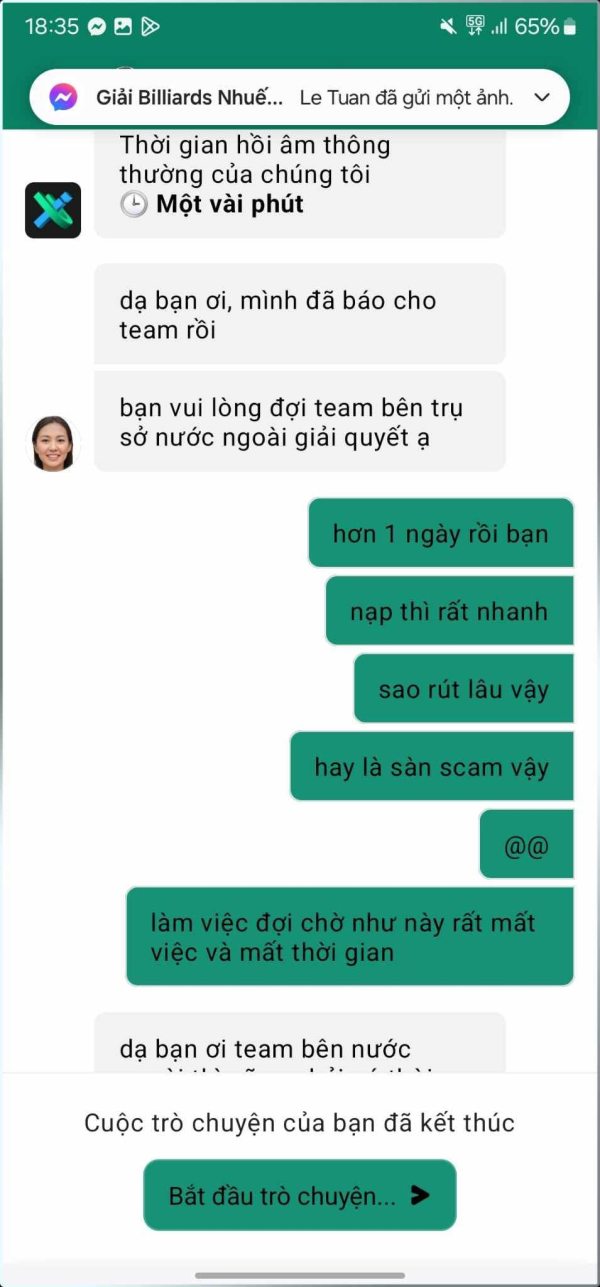

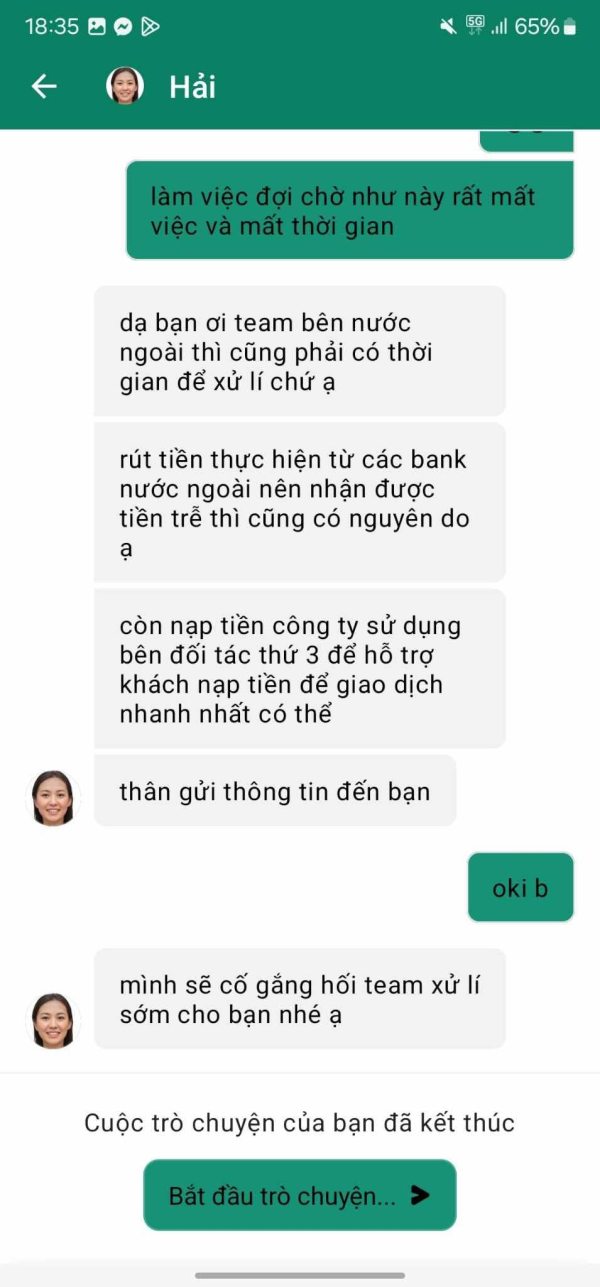

Customer Service and Support Analysis (7/10)

iux's customer support framework shows solid capabilities with multilingual service covering 10 languages. This indicates a genuine commitment to serving its international client base effectively. The inclusion of languages such as Thai alongside major European languages suggests targeted expansion into specific regional markets. It also shows understanding of local trader needs.

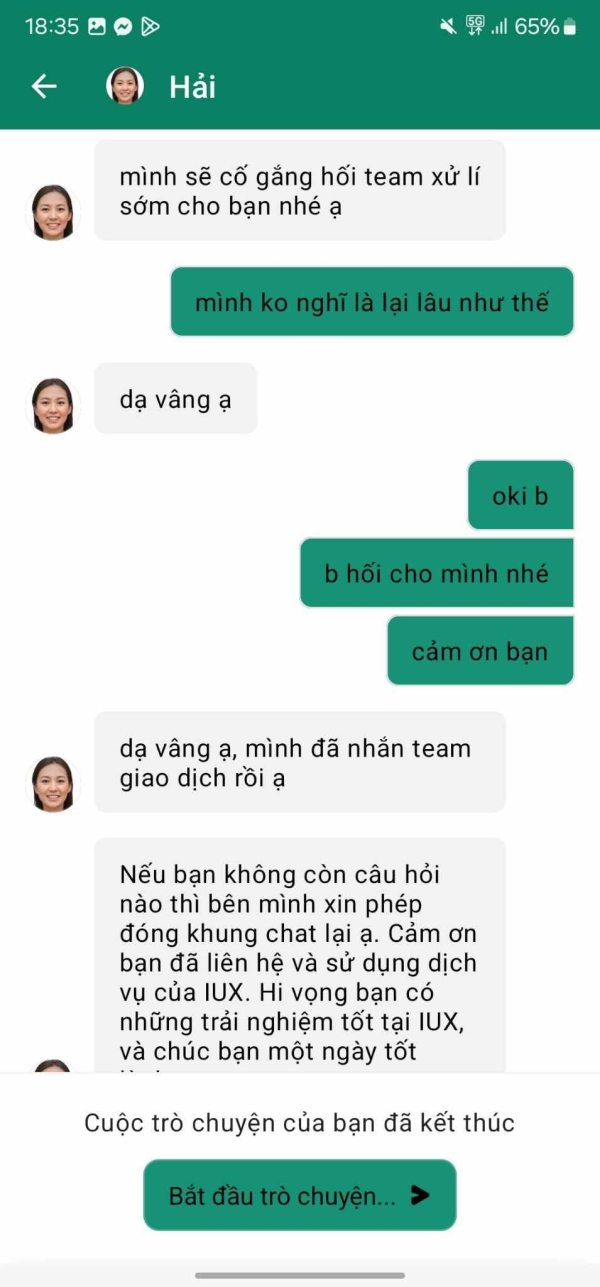

User feedback generally reflects positive experiences with customer service interactions. However, specific metrics regarding response times, availability hours, and resolution efficiency are not comprehensively documented in available sources. The absence of detailed complaints in user reviews suggests that major service issues are relatively uncommon. This contributes to the overall positive user experience reflected in the 4.72 TrustScore rating.

The support structure appears to handle routine inquiries effectively. However, the availability of specialized technical support for platform issues or advanced trading questions requires further clarification. The broker would benefit from providing more transparent information about support channels, including live chat availability, phone support hours, and email response time commitments.

Enhanced documentation of support capabilities and service level commitments would strengthen user confidence. It would also provide clearer expectations for assistance when needed.

Trading Experience Analysis (8/10)

The trading experience with iux receives consistently positive feedback from users. Users particularly praise execution speed and spread competitiveness. User testimonials frequently mention fast order execution, which is crucial for strategies requiring precise entry and exit timing, such as scalping or news trading. The low spread environment, starting from 0.0 pips on major pairs, contributes to reduced trading costs and improved profitability potential.

Platform stability appears robust based on user feedback. The MetaTrader 5 infrastructure provides reliable connectivity and comprehensive functionality. The platform's ability to handle various trading styles demonstrates versatility in meeting diverse trader requirements. These styles range from long-term position trading to high-frequency strategies.

The broker's liquidity provision seems adequate based on user reports of smooth order execution without significant slippage issues. However, specific data regarding execution statistics, average fill times, or slippage metrics are not publicly available. This information would provide more objective assessment of execution quality.

Mobile trading capabilities and cross-device synchronization are standard features through MT5. However, specific user feedback regarding mobile platform performance is limited in available sources. This iux review indicates that while the overall trading environment is positive, more detailed performance metrics would enhance transparency and user confidence.

Trust and Regulation Analysis (7/10)

iux operates under regulation from the South African Financial Sector Conduct Authority (FSCA). This provides a legitimate regulatory framework for its operations. The FSCA oversight ensures adherence to established financial service standards and provides some level of client protection through regulatory compliance requirements.

However, the regulatory profile could be strengthened through additional jurisdictional licenses or more comprehensive disclosure of regulatory compliance measures. While FSCA regulation provides basic oversight, traders from other regions might prefer brokers with regulation from their local authorities or additional major financial centers.

The broker's transparency regarding financial security measures, client fund segregation, and compensation schemes is not extensively detailed in available documentation. Enhanced disclosure of these critical trust factors would significantly strengthen the overall confidence profile. It would also provide users with clearer understanding of their fund security.

The absence of major regulatory violations or significant negative incidents in available records supports the broker's credible standing. However, continued monitoring of regulatory compliance and transparency improvements would benefit long-term trust building with the trading community.

User Experience Analysis (8/10)

The overall user experience with iux reflects positively in the 4.72 TrustScore rating. This indicates high satisfaction levels among the platform's user base. This strong rating suggests that the broker successfully meets user expectations across various aspects of the trading experience. These aspects range from account management to trade execution and customer service interactions.

User feedback consistently highlights the accessibility of the platform. Users particularly praise the low minimum deposit requirement that allows new traders to begin with minimal financial commitment. The straightforward account opening process and user-friendly interface contribute to positive first impressions and continued satisfaction.

The platform's appeal to both beginners and experienced traders indicates successful design and functionality that scales with user expertise. However, specific feedback regarding advanced features, customization options, or professional trader tools is limited in available sources.

Areas for potential improvement include enhanced educational resources, more detailed platform tutorials, and expanded research offerings. These would further support user development and trading success. The strong user satisfaction foundation provides an excellent base for continued platform enhancement and user experience optimization.

Conclusion

This comprehensive iux review reveals a broker that offers compelling value for traders seeking competitive conditions and reliable service. iux shows particular strength in providing accessible entry points through low minimum deposits and cost-effective trading through tight spreads and commission-free accounts. The platform's extensive asset selection and professional-grade MT5 integration make it suitable for diverse trading strategies and experience levels.

The broker appears most suitable for cost-conscious traders, beginners seeking accessible entry into forex markets, and experienced traders requiring competitive spreads and reliable execution. The strong user satisfaction rating and multilingual support indicate successful service delivery to its international client base.

While iux shows considerable strengths in trading conditions and user experience, areas for enhancement include greater regulatory transparency, more comprehensive disclosure of security measures, and expanded educational resources. These improvements would further support trader development and platform confidence.