LINE FX 2025 Review: Everything You Need to Know

Executive Summary

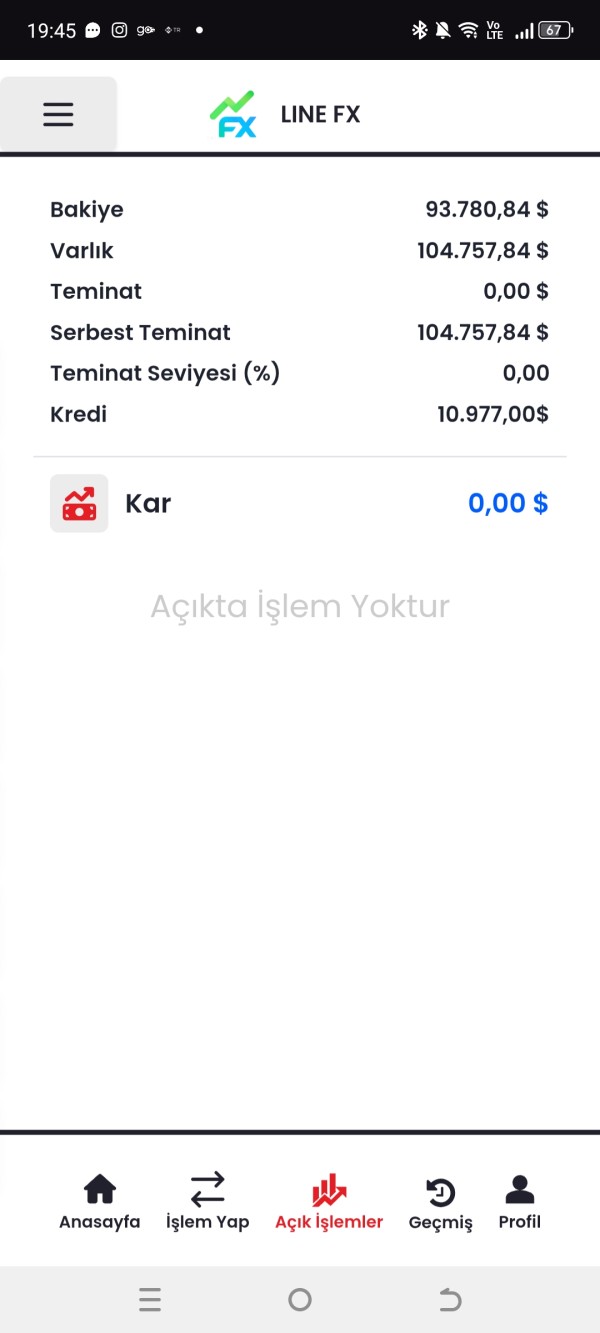

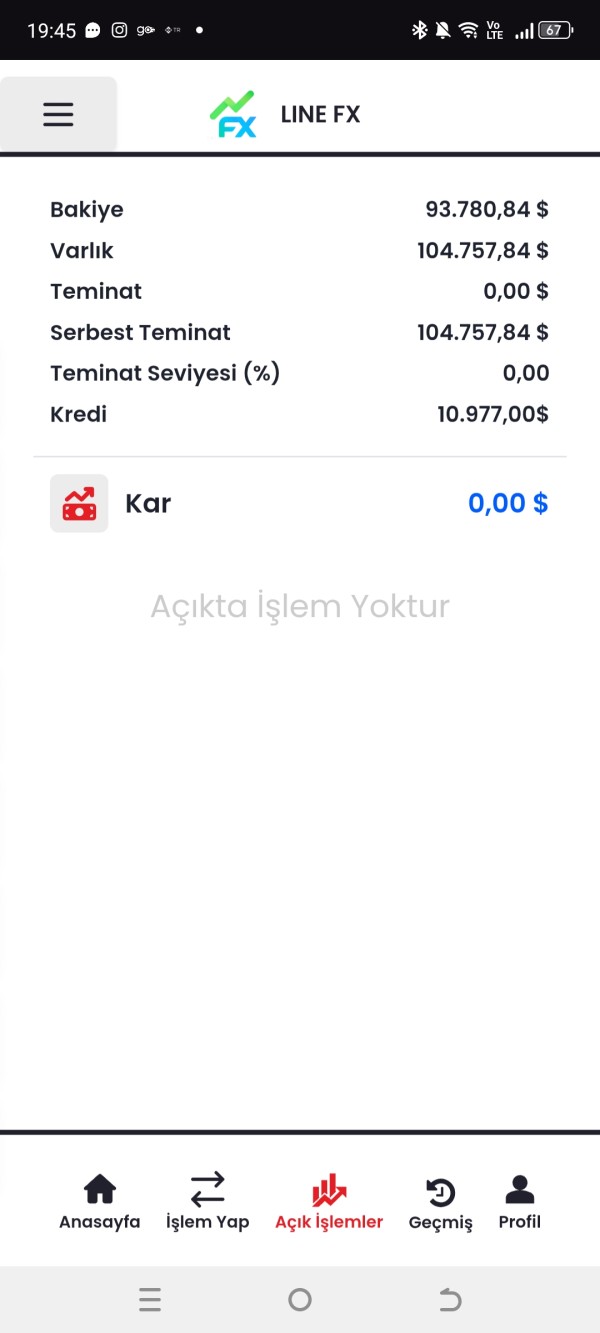

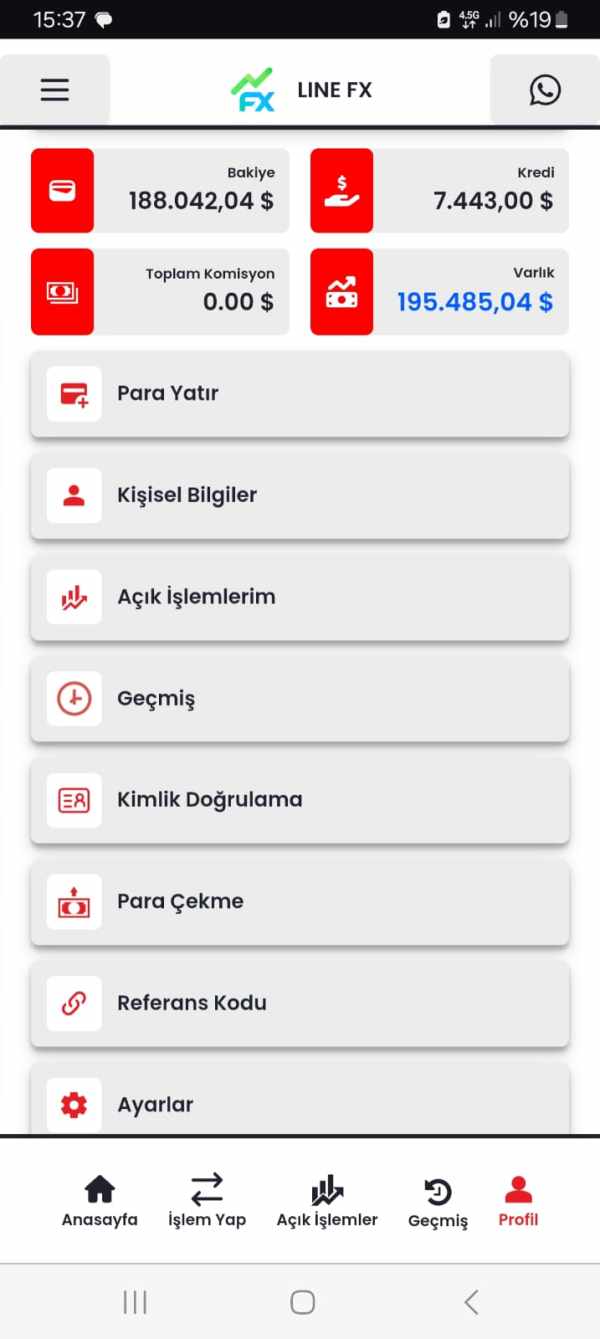

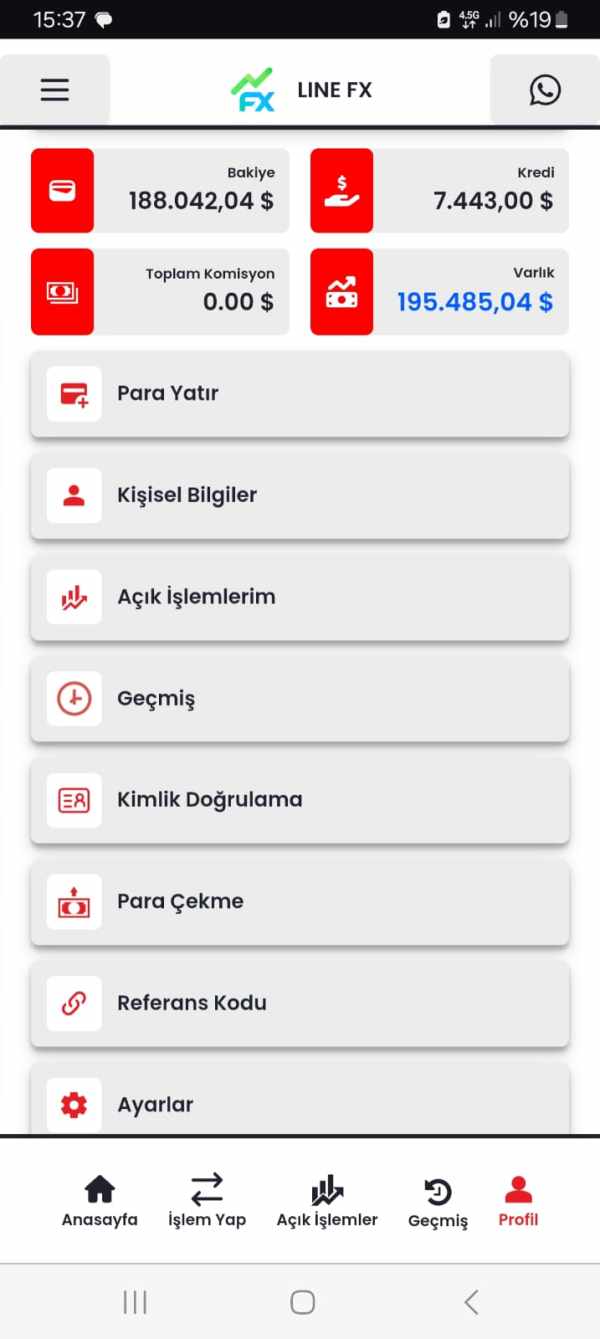

This complete line fx review looks at a forex trading service that started in December 2020. LINE FX says it is a professional team that gives forex trading signals and cryptocurrency trading signals through different channels like Telegram. The platform offers services across 23 currency pairs with no commission fees, targeting traders who want low-cost forex solutions.

LINE FX works mainly as a signal service provider rather than a traditional forex broker. The company focuses on forex trade signals, cryptocurrency trade signals, and live trade ideas. The company's domain registration shows it is valid through December 2025, which means operations are ongoing.

Our analysis shows big gaps in regulatory transparency and limited user feedback data. This affects the overall assessment of this service provider. The platform seems best for traders interested in signal services and those seeking commission-free trading opportunities.

Potential users should be careful because limited regulatory information is available.

Important Notice

This line fx review uses publicly available information and domain registration data. LINE FX has limited regulatory information available, so traders in different regions should be very careful and check compliance with local trading regulations before using this service.

Our evaluation method uses available public information, domain analysis, and service descriptions. Some data points may be incomplete because the service provider has limited transparency. Traders should do additional research before making any trading decisions.

Rating Framework

Broker Overview

LINE FX started its online presence on December 17, 2020, as shown by WHOIS registration data. The service says it is "one of the leading and most professional teams in providing Forex trading signals and trade." The company works in both traditional forex trading and cryptocurrency markets, offering signal services for both types of assets.

The platform's business model focuses on signal provision rather than direct brokerage services. LINE FX provides forex signals, cryptocurrency trading signals, bitcoin trade signals, and live trade signals mainly through Telegram channels. The service emphasizes its professional approach to trade idea generation and signal distribution.

LINE FX maintains an SSL certificate issued by Sectigo Limited, which shows basic security measures for their web presence. The domain registration shows a four-year operational timeline with renewal scheduled for December 2025, suggesting ongoing business operations and commitment to service continuity.

Regulatory Status: Available information does not specify regulatory oversight from recognized financial authorities. This is a big concern for potential users seeking regulated trading environments.

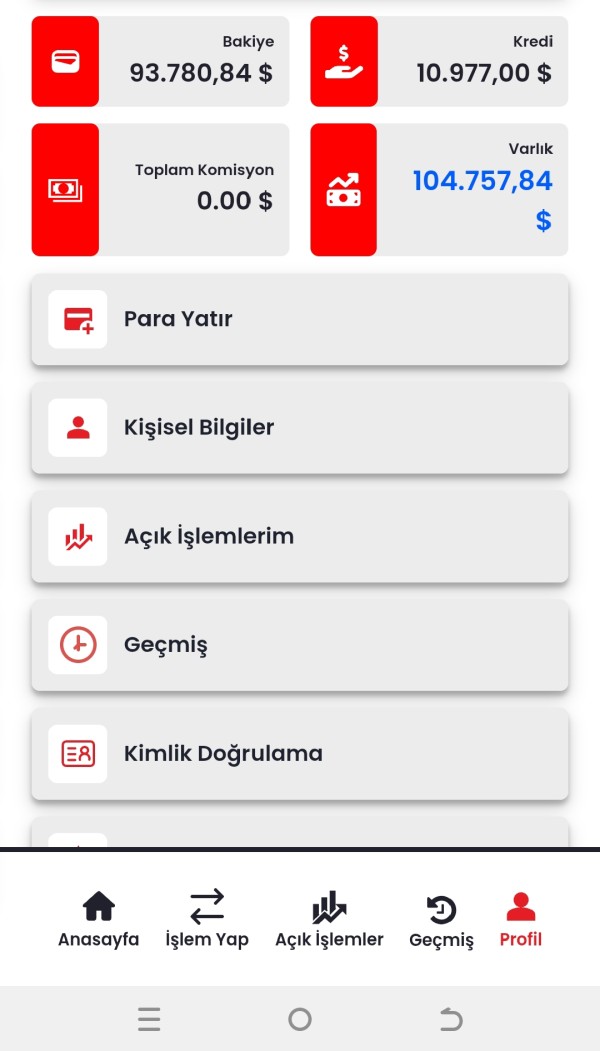

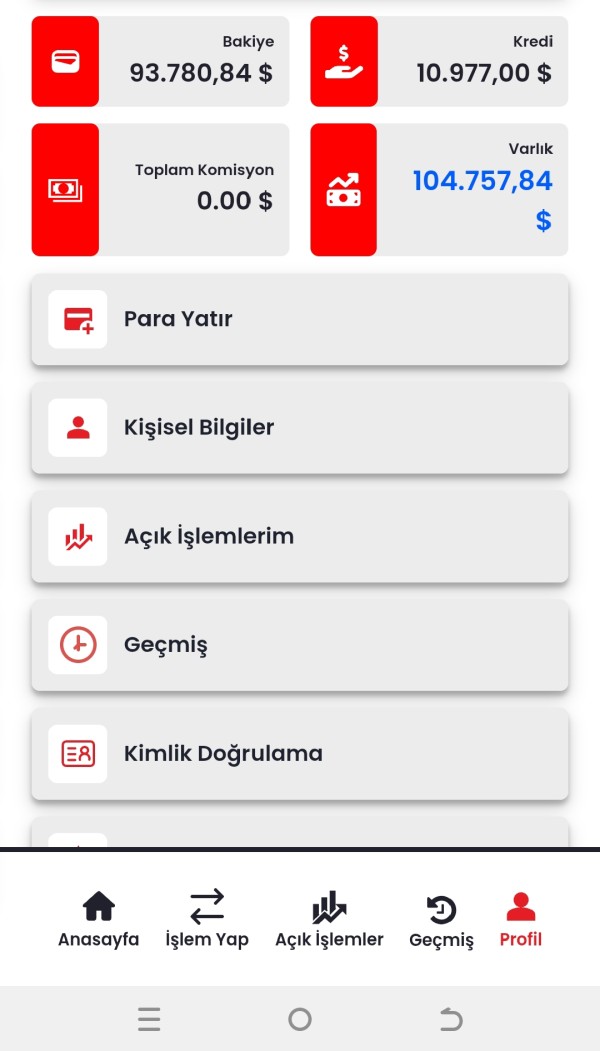

Deposit and Withdrawal Methods: Specific information about funding methods is not detailed in available sources. The platform mentions coinpayment in its service keywords, suggesting potential cryptocurrency payment options.

Minimum Deposit Requirements: Minimum deposit information is not specified in available documentation. This makes it difficult to assess accessibility for different trader segments.

Promotions and Bonuses: No specific promotional offers or bonus structures are mentioned in available materials about LINE FX services.

Tradeable Assets: The service covers 23 currency pairs for forex trading signals, along with cryptocurrency trading signals and bitcoin trade signals. This line fx review notes the focus on major currency pairs and popular cryptocurrency assets.

Cost Structure: LINE FX advertises commission-free trading, though specific details about spreads, signal subscription costs, or other fees are not clearly outlined in available information.

Leverage Ratios: Leverage information is not specified in available documentation about LINE FX services.

Platform Options: The service appears to operate primarily through Telegram for signal distribution. Specific trading platform partnerships are not detailed.

Regional Restrictions: Geographic limitations or restrictions are not specified in available service information.

Customer Support Languages: Language support information is not detailed in available materials.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

LINE FX's account conditions get a good rating mainly because of the commission-free structure advertised for their services. The platform offers access to 23 currency pairs, providing reasonable diversity for forex signal services. However, the lack of detailed account type information limits a complete assessment of the service structure.

The absence of minimum deposit requirements in available documentation suggests potential accessibility. This cannot be confirmed without official clarification. The service appears designed for traders seeking signal-based trading assistance rather than traditional account management services.

This line fx review notes that while the commission-free approach is attractive, the lack of detailed account specifications and terms of service transparency affects the overall evaluation. Potential users should seek clarification on account opening procedures, verification requirements, and service terms before engagement.

The signal-focused business model may appeal to experienced traders who prefer to execute trades independently while receiving professional guidance. Novice traders might require more complete support structures.

The tools and resources category gets a below-average rating because of limited information about analytical tools, educational materials, or research resources. Available information suggests LINE FX focuses mainly on signal generation and distribution rather than complete trading tool provision.

The service mentions providing trade ideas and live trade signals. Specific details about analytical methods, market research capabilities, or educational content are not detailed in available materials. This limitation significantly affects the value proposition for traders seeking complete trading support.

Without detailed information about research capabilities, technical analysis tools, or educational resources, it's difficult to assess the depth of support available to users. The Telegram-based signal distribution suggests a streamlined approach, though this may limit the sophistication of available tools.

Traders seeking complete analytical tools, educational content, or advanced research capabilities may find LINE FX's offering insufficient based on available information.

Customer Service and Support Analysis (5/10)

Customer service evaluation gets an average rating because of limited information about support channels, response times, and service quality. The Telegram-based service model suggests real-time communication capabilities, though formal customer support structures are not detailed.

Available information does not specify customer service hours, multiple language support, or escalation procedures for user concerns. The professional team positioning suggests some level of support capability, though specific service level commitments are not outlined.

The lack of detailed customer service information makes it challenging to assess response quality, problem resolution capabilities, or user satisfaction levels. This represents a significant gap for potential users who value complete customer support.

Without user feedback data or customer service testimonials, this line fx review cannot provide detailed insights into actual support experience quality or effectiveness.

Trading Experience Analysis (6/10)

The trading experience gets an average rating based on the signal-focused service model and commission-free structure. Limited information about platform stability, execution quality, or user interface design affects the complete assessment.

The Telegram-based signal distribution may provide real-time communication and rapid signal delivery. This doesn't address traditional trading platform concerns such as order execution speed, platform stability, or advanced trading features.

Without specific information about trading platform partnerships, execution quality, or user interface design, it's difficult to assess the complete trading experience. The focus on signal provision rather than direct trading platform operation may limit traditional trading experience evaluation criteria.

Mobile accessibility through Telegram suggests some level of convenience for signal reception. Complete mobile trading capabilities are not specified in available information.

Trust and Regulation Analysis (3/10)

Trust and regulation get a poor rating because of the absence of regulatory information from recognized financial authorities. This represents the most significant concern in this line fx review, as regulatory oversight provides crucial investor protection.

The lack of regulatory disclosure raises questions about investor fund protection, dispute resolution mechanisms, and compliance with international trading standards. This significantly affects the trust assessment for potential users.

Domain registration and SSL certificate presence provide basic legitimacy indicators. These fall short of complete regulatory compliance verification. The four-year operational timeline offers some operational history, though this doesn't substitute for regulatory oversight.

Without regulatory compliance information, users cannot verify investor protection measures, fund segregation practices, or regulatory complaint procedures. This represents significant trust concerns.

User Experience Analysis (5/10)

User experience gets an average rating because of limited feedback data and user testimonials. The Telegram-based service model suggests straightforward signal access, though complete user experience evaluation requires more detailed user feedback.

Available information doesn't provide insights into user satisfaction levels, common user complaints, or interface usability feedback. This limits the ability to assess actual user experience quality and service effectiveness.

The signal-focused approach may appeal to users seeking streamlined service delivery. The lack of complete platform features might limit appeal for users seeking full-service trading environments.

Without detailed user testimonials or satisfaction surveys, this evaluation relies mainly on service model assessment rather than actual user experience data.

Conclusion

This line fx review reveals a service provider with some attractive features, particularly the commission-free structure and focus on signal provision across 23 currency pairs. Significant concerns about regulatory transparency and limited user feedback data affect the overall assessment.

LINE FX appears most suitable for experienced traders seeking signal services and cost-effective trading solutions. The lack of regulatory oversight requires careful consideration. The Telegram-based service model offers convenience for signal distribution but may not satisfy traders seeking complete trading platform features.

The main advantages include commission-free trading and signal service focus. Primary disadvantages center on regulatory transparency concerns and limited complete service information. Potential users should exercise caution and conduct additional research before engaging with LINE FX services.