Regarding the legitimacy of WeTrade forex brokers, it provides CYSEC, ASIC, FSA, LFSA and WikiBit, .

Is WeTrade safe?

Pros

Cons

Is WeTrade markets regulated?

The regulatory license is the strongest proof.

CYSEC Derivatives Trading License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

Wetrade International Cy Limited

Effective Date:

2025-02-17Email Address of Licensed Institution:

info@wetradeeu.comSharing Status:

No SharingWebsite of Licensed Institution:

www.wetradeeu.comExpiration Time:

--Address of Licensed Institution:

Agias Fylaxeos & Zinonos Rossidi 2, 2nd Floor, 3082, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 325 355Licensed Institution Certified Documents:

ASIC Inst Market Making (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Inst Market Making (MM)

Licensed Entity:

WETRADE CAPITAL (AUSTRALIA) PTY LTD

Effective Date:

2023-03-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

'ANGEL PLACE' L 17 123 PITT ST SYDNEY NSW 2000 AUSTRALIAPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

WeTrade Capital (Seychelles) Limited

Effective Date:

--Email Address of Licensed Institution:

support@wevaluetrade.comSharing Status:

No SharingWebsite of Licensed Institution:

www.wetradesc.comExpiration Time:

--Address of Licensed Institution:

Office 10B, 3rd Floor, IMAD Complex, Ile Du Port, SeychellesPhone Number of Licensed Institution:

+248 4327668Licensed Institution Certified Documents:

LFSA Forex Transmission License (RTO)

Labuan Financial Services Authority

Labuan Financial Services Authority

Current Status:

RegulatedLicense Type:

Forex Transmission License (RTO)

Licensed Entity:

WeTrade Capital Limited

Effective Date:

--Email Address of Licensed Institution:

theo@wetradefx.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

2nd Floor, Lot 7, Block A, Lazenda Phase III Shophouse, Off Jalan OKK Abdullah, 87008, , F.T., LabuanPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is WeTrade A Scam?

Introduction

WeTrade is a relatively new player in the forex market, aiming to provide traders with a diverse range of financial instruments, including forex, commodities, and cryptocurrencies. Established in 2022, the broker operates under the name WeTrade International LLC and claims to offer competitive trading conditions. However, with the rise of online trading, it is crucial for traders to carefully evaluate the reliability and legitimacy of brokers before committing their funds. The forex market is rife with scams, and choosing the wrong broker can lead to significant financial losses. This article investigates WeTrades regulatory status, company background, trading conditions, and customer experiences to determine whether it is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. Regulation provides a layer of oversight and protection for traders, ensuring that brokers adhere to specific operational standards. WeTrade's claims of regulation are questionable, as it is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. Furthermore, there are reports indicating that the broker's claimed licenses may be linked to clone operations, which raises significant concerns.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| LFSA | MB/22/0100 | Saint Vincent | Suspicious Clone |

| FSA | Not Available | Mauritius | Not Verified |

The lack of valid regulation from a reputable authority means that traders using WeTrade may not have any recourse in the event of disputes or misconduct. The absence of oversight from recognized regulatory bodies such as the FCA (UK) or ASIC (Australia) amplifies the risk associated with trading with WeTrade. Without stringent regulatory frameworks, traders are left vulnerable to potential fraud and mismanagement of their funds.

Company Background Investigation

WeTrade International LLC presents itself as a modern trading platform catering to the needs of various traders. However, the companys background raises several red flags. Established in 2022, WeTrade lacks a long operational history, making it difficult to assess its reliability. The ownership structure and management team are not clearly disclosed, which is often a sign of a less transparent operation. Reliable brokers typically provide detailed information about their management teams, including their backgrounds and experience in the financial industry.

Moreover, the companys website offers limited information about its operational history and regulatory compliance. Transparency is essential in the financial services sector, and the lack of detailed disclosures about the company's ownership and management could indicate a potential lack of accountability. As a result, traders should exercise caution and consider whether they are comfortable investing with a broker that does not provide adequate information about its leadership and operational history.

Trading Conditions Analysis

WeTrade claims to offer competitive trading conditions, including low spreads and high leverage. However, a closer examination of its fee structure reveals some concerning practices. The broker offers various account types, each with different minimum deposit requirements and associated costs. It is essential for traders to understand the overall cost of trading, including spreads, commissions, and overnight fees.

| Fee Type | WeTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | None (STP account) | Varies by broker |

| Overnight Interest Range | Not specified | Varies by broker |

The spreads offered by WeTrade are higher than the industry average, particularly for major currency pairs. Additionally, the lack of clarity regarding overnight interest rates raises further concerns. Traders should be wary of any hidden fees or unexpected costs that could impact their overall profitability. It is crucial to fully understand the fee structure before committing to a broker, as unexpected costs can erode trading profits significantly.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. WeTrade's approach to fund security is concerning, as it operates without robust regulatory oversight. The broker claims to implement fund segregation practices, which is a standard measure that ensures client funds are kept separate from the company's operational funds. However, without a regulatory body overseeing these practices, there is no guarantee that they are being followed.

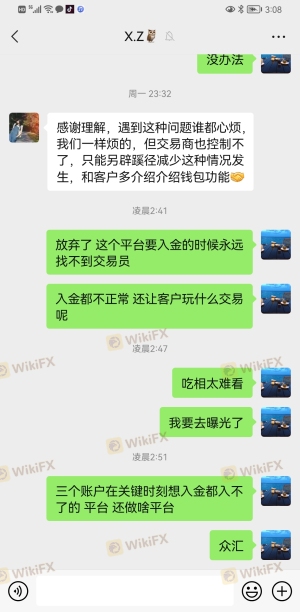

Moreover, the absence of investor protection schemes, such as those provided by regulators in more stringent jurisdictions, further increases the risk for traders. Historical complaints regarding fund withdrawals and the inability to access funds have been reported, indicating potential issues with the broker's financial practices. Traders should be cautious and consider the implications of using a broker without solid fund security measures in place.

Customer Experience and Complaints

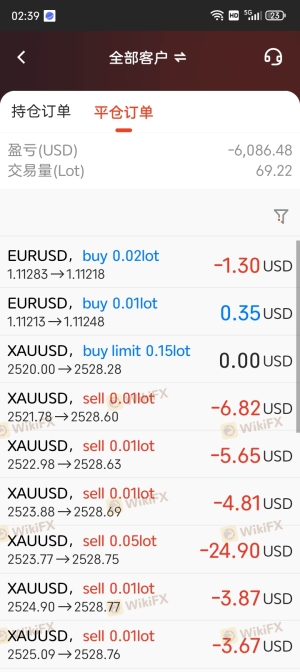

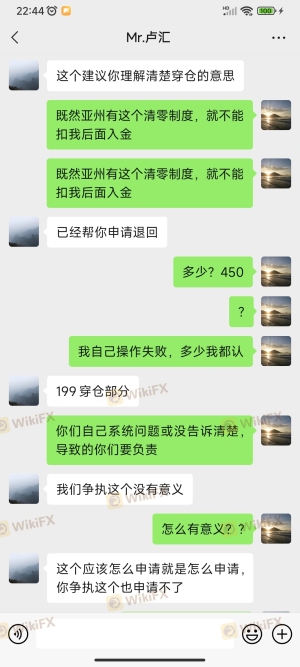

Customer feedback is a vital component of evaluating a broker's reliability. Reviews for WeTrade indicate a mixed bag of experiences, with many users expressing dissatisfaction with the brokers customer service and withdrawal processes. Common complaints include difficulty in withdrawing funds, lack of responsive customer support, and high-pressure tactics to deposit more money.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response time |

| Poor Customer Support | Medium | Limited assistance |

| Misleading Promotions | High | No clear resolution |

One notable case involved a trader who reported being unable to withdraw their funds despite multiple requests. The broker allegedly responded slowly and failed to provide clear communication regarding the issue. Such experiences raise significant concerns about the reliability of WeTrade and its commitment to customer satisfaction.

Platform and Trade Execution

The trading platform offered by WeTrade is primarily based on the popular MetaTrader 4 (MT4), which is known for its user-friendly interface and robust features. However, the performance of the platform, including order execution quality, slippage, and rejection rates, is critical for traders. Reports suggest that users have experienced issues with order execution, including high slippage and rejections during volatile market conditions.

The potential for platform manipulation is another concern, especially given the lack of regulatory oversight. Traders should be vigilant and assess whether the platform operates fairly, as any signs of manipulation could lead to significant financial losses.

Risk Assessment

Using WeTrade comes with several risks that potential traders should consider. The lack of regulation, combined with customer complaints and issues related to fund withdrawals, creates a high-risk environment for traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No legitimate regulatory oversight. |

| Fund Security Risk | High | Concerns about fund segregation and protection. |

| Customer Support Risk | Medium | Limited responsiveness to inquiries. |

| Execution Risk | High | Reports of high slippage and order rejections. |

To mitigate these risks, traders are advised to conduct thorough research before investing. It is essential to consider alternative brokers with solid regulatory backgrounds and positive customer feedback to ensure a safer trading experience.

Conclusion and Recommendations

In conclusion, WeTrade raises several red flags that suggest it may not be a reliable broker. The lack of legitimate regulation, combined with numerous customer complaints and questionable trading conditions, indicates a potential risk for traders. While the broker offers a range of financial instruments and competitive spreads, the overall risk associated with trading through WeTrade is considerable.

For traders seeking reliable options, it is advisable to consider well-regulated brokers with established reputations, such as IG Markets, OANDA, or Forex.com. These alternatives provide a safer trading environment, robust customer support, and transparent fee structures. Ultimately, traders should prioritize their financial security and carefully assess their options before committing to any broker.

Is WeTrade a scam, or is it legit?

The latest exposure and evaluation content of WeTrade brokers.

WeTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WeTrade latest industry rating score is 7.98, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.98 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.