Regarding the legitimacy of Invesco forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is Invesco safe?

Risk Control

Software Index

Is Invesco markets regulated?

The regulatory license is the strongest proof.

FSA Inst Deriv Trading License (AGN)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Inst Deriv Trading License (AGN)

Licensed Entity:

インベスコ・アセット・マネジメント株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都港区六本木6-10-1 六本木ヒルズ森タ ワー14階Phone Number of Licensed Institution:

03-6447-3000Licensed Institution Certified Documents:

Is Invesco Safe or Scam?

Introduction

Invesco is a broker that has positioned itself in the forex market, claiming to offer a range of trading services to both novice and experienced traders. However, the legitimacy of such brokers is often a matter of concern for potential investors. In the volatile world of forex trading, where scams are prevalent, it is crucial for traders to rigorously evaluate the brokers they intend to engage with. This article aims to investigate whether Invesco is a safe trading option or if it raises red flags that suggest it may be a scam. Our investigation is based on a comprehensive review of various sources, including customer feedback, regulatory status, and trading conditions, allowing us to provide a balanced and thorough analysis.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. A regulated broker is typically subject to stringent oversight, which helps protect clients' interests. Invesco claims to have regulatory licenses; however, upon investigation, it appears that these claims may not hold up under scrutiny.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Unverified |

| ASIC | N/A | Australia | Unverified |

| CySEC | N/A | Cyprus | Unverified |

The absence of valid regulatory information raises significant concerns about Invesco's legitimacy. It has been reported that the broker operates without proper licenses, which is a primary red flag for traders. Furthermore, the lack of regulatory oversight means that clients have limited recourse in the event of disputes or fund mismanagement. Regulatory bodies are crucial as they enforce laws designed to protect investors, and the absence of such oversight suggests that Invesco may not be a safe option for trading.

Company Background Investigation

Invesco's history and ownership structure also play a vital role in assessing its credibility. The firm claims to have a long-standing presence in the market; however, many reviews indicate that it operates as an offshore entity, which often raises concerns about transparency and accountability.

The management teams background is another critical aspect to consider. A reputable broker typically has a team with extensive experience in finance and trading. However, information regarding Invesco's management is sparse, and there are no clear details about their qualifications or professional backgrounds. This lack of transparency can be alarming for potential clients who seek assurance that their funds will be managed by capable professionals.

Moreover, the company's information disclosure level is inadequate. Legitimate brokers usually provide comprehensive details about their operations, including their business model, fees, and risk disclosures. Invesco's failure to provide such information raises further doubts about its integrity and safety.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its reliability. Invesco presents itself as a competitive broker, but the details regarding its fee structure are often vague or misleading.

| Fee Type | Invesco | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 2% - 5% |

The lack of clarity surrounding fees is concerning. Many brokers that operate without regulation often hide fees to maximize their profits at the expense of traders. Moreover, if a broker's fees are not transparent, it can lead to unexpected costs that can erode trading profits. Invescos apparent lack of a standard commission structure and the absence of information on spreads suggest that traders may encounter hidden costs, making it a risky choice.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Invesco claims to implement various measures to protect clients' investments, but the effectiveness of these measures is questionable.

Invesco does not appear to have robust fund segregation policies, which means that client funds may not be kept separate from the company's operational funds. This lack of segregation increases the risk of losing funds in the event of the broker's insolvency. Additionally, there is no evidence of investor protection schemes being in place, which are typically offered by regulated brokers to safeguard clients' funds up to a certain amount.

Furthermore, there have been no reported incidents of fund security breaches with Invesco, but the absence of a history does not guarantee future safety. The lack of transparency regarding their fund security measures raises serious concerns about whether Invesco is genuinely a safe broker.

Customer Experience and Complaints

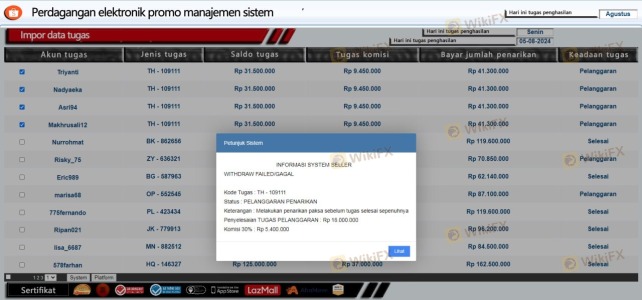

Customer feedback is invaluable in assessing a broker's reliability. Reviews of Invesco reveal a mix of experiences, with many users reporting issues related to withdrawals and customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow |

| Poor Customer Support | Medium | Inconsistent |

| Account Blocking | High | Unresponsive |

Common complaints include delayed withdrawals, which is a significant red flag for any broker. Traders have reported that once they request withdrawals, the process is often met with unnecessary delays or outright denials. Additionally, the quality of customer service has been criticized, with many users claiming that their inquiries go unanswered for extended periods. These issues indicate that Invesco may not prioritize client satisfaction, further questioning its safety.

Platform and Trade Execution

The trading platform provided by a broker is a critical component of the trading experience. Invesco claims to offer a user-friendly platform; however, feedback suggests that the platform may not be as reliable as advertised.

Many users have reported issues with order execution, including slippage and rejections. Such problems can significantly impact trading outcomes, especially for those using high-frequency trading strategies. Furthermore, the lack of transparency regarding platform performance metrics raises concerns about potential manipulation or unfair practices. Traders should be wary of brokers that do not provide clear information about their platform's reliability, as this could indicate underlying issues.

Risk Assessment

When evaluating the overall safety of a broker, it is essential to consider the associated risks.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Risk | Medium | Lack of fund segregation |

| Operational Risk | High | Poor customer service and execution issues |

The overall risk associated with trading through Invesco is considerable. The absence of regulatory oversight and the lack of transparency regarding fund safety measures present significant dangers to traders. To mitigate these risks, it is advisable for potential clients to conduct thorough research and consider alternative brokers that are properly regulated and have a proven track record of reliability.

Conclusion and Recommendation

In conclusion, the evidence suggests that Invesco may not be a safe trading option. The lack of regulatory oversight, transparency issues, and numerous complaints from clients indicate that there are significant risks involved with this broker. While there are no definitive claims of fraud, the red flags present in Invesco's operations warrant caution.

For traders, especially those who are inexperienced, it is crucial to prioritize safety and choose brokers that are regulated and have a solid reputation. If you are considering trading with Invesco, it may be wise to explore alternative options that provide greater assurance of safety and reliability. Recommended alternatives include brokers with strong regulatory frameworks and positive customer feedback, ensuring a more secure trading experience.

Is Invesco a scam, or is it legit?

The latest exposure and evaluation content of Invesco brokers.

Invesco Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Invesco latest industry rating score is 6.85, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.85 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.