TeleTrade 2025 Review: Everything You Need to Know

Summary: TeleTrade is generally regarded as a reliable broker with a solid range of trading instruments and competitive trading conditions. However, concerns regarding its regulatory status and user experiences highlight the need for caution. Key features include access to the popular MetaTrader platforms and a variety of asset classes.

Note: Its important to be aware that TeleTrade operates under different entities across regions, which may affect regulatory oversight and user experiences. This review aims for fairness and accuracy by considering multiple sources.

Ratings Overview

How We Rated the Broker: Ratings are based on a comprehensive analysis of user reviews, expert opinions, and factual data regarding the broker's offerings.

Broker Overview

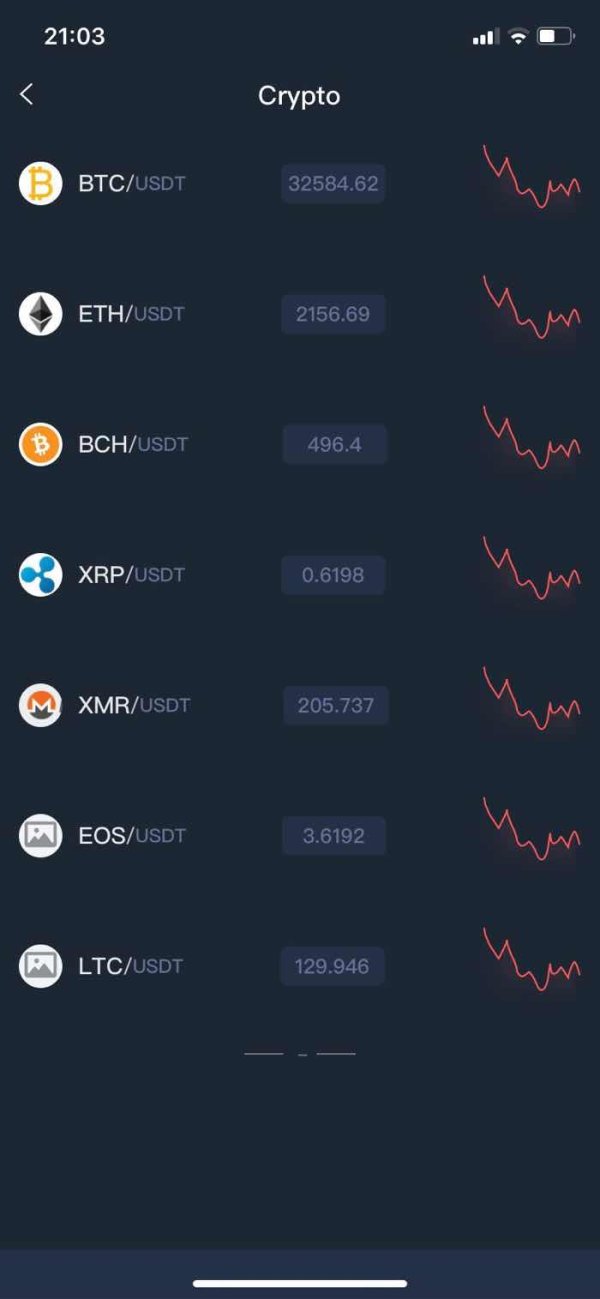

Founded in 1994, TeleTrade is a Cyprus-based online broker regulated by the Cyprus Securities and Exchange Commission (CySEC). The broker provides access to both MetaTrader 4 and MetaTrader 5 platforms, catering to a wide range of traders from beginners to experienced professionals. TeleTrade offers trading in various asset classes, including forex, commodities, indices, stocks, and cryptocurrencies.

Detailed Breakdown

Regulated Geographies/Regions:

TeleTrade is primarily regulated by CySEC in Cyprus, which provides a certain level of investor protection. However, it has faced scrutiny for operating in offshore jurisdictions, raising questions about its transparency and trustworthiness.

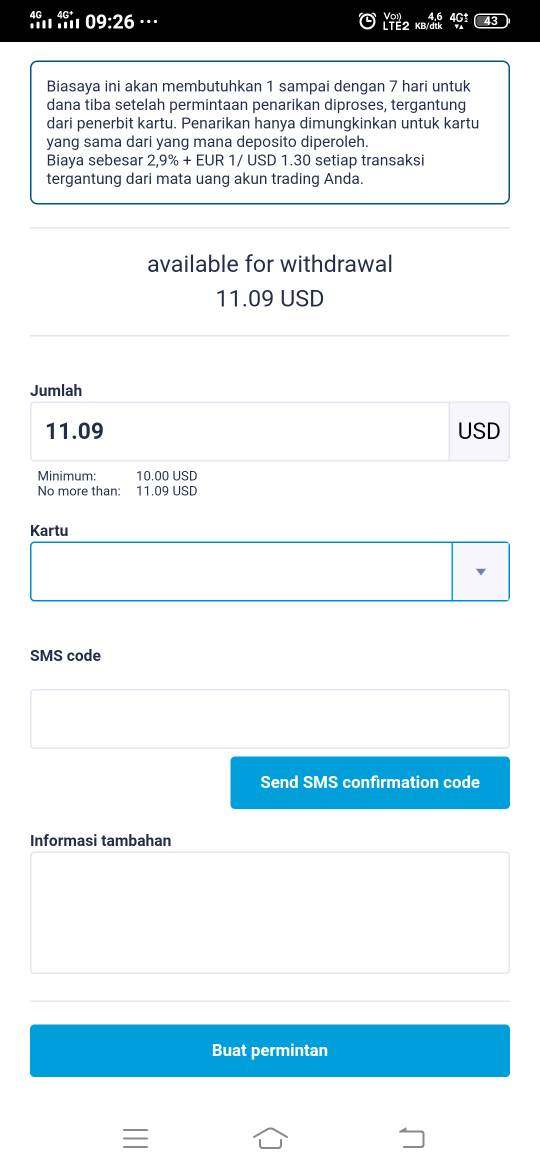

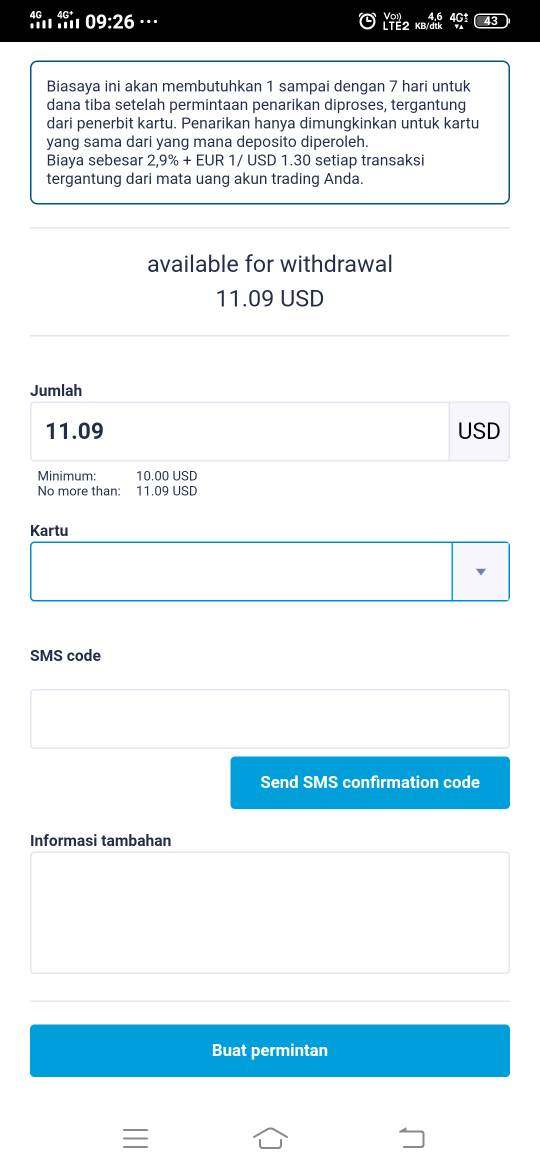

Deposit/Withdrawal Currencies/Cryptocurrencies:

The broker accepts deposits and withdrawals in USD and EUR, with various methods including credit cards, bank transfers, Neteller, and Skrill. However, it does not support PayPal, which may limit options for some users.

Minimum Deposit:

TeleTrade requires a minimum deposit of $100, which is competitive compared to many brokers in the industry.

Bonuses/Promotions:

Currently, TeleTrade does not offer any welcome bonuses or deposit bonuses, which may deter some potential clients looking for incentives to start trading.

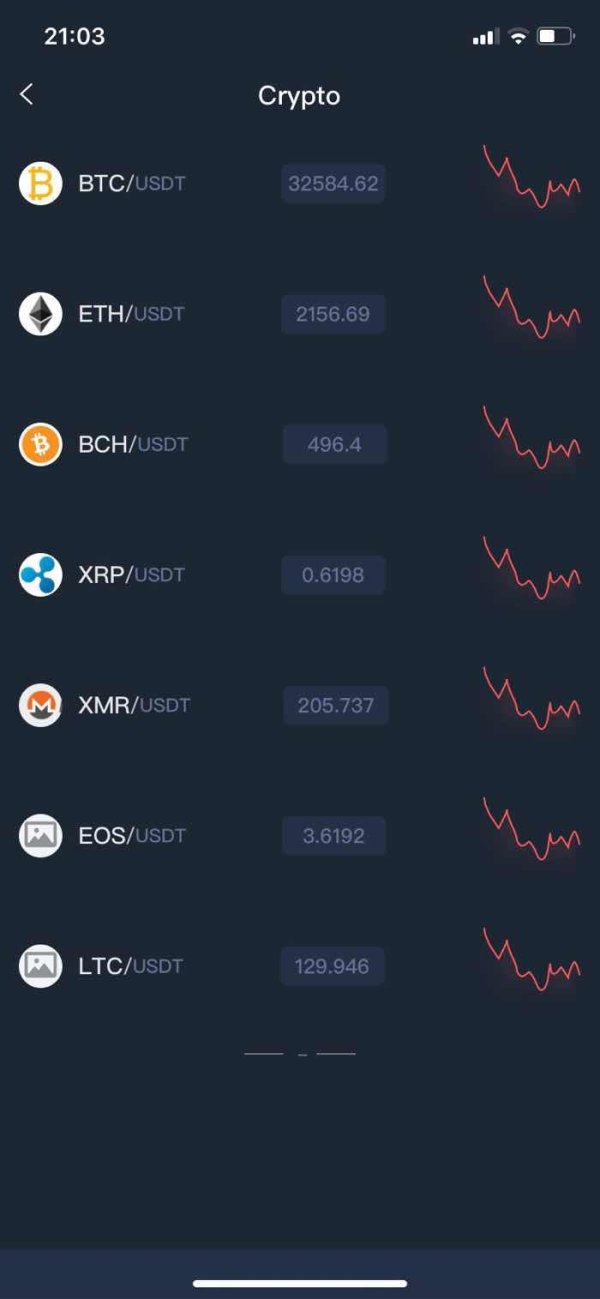

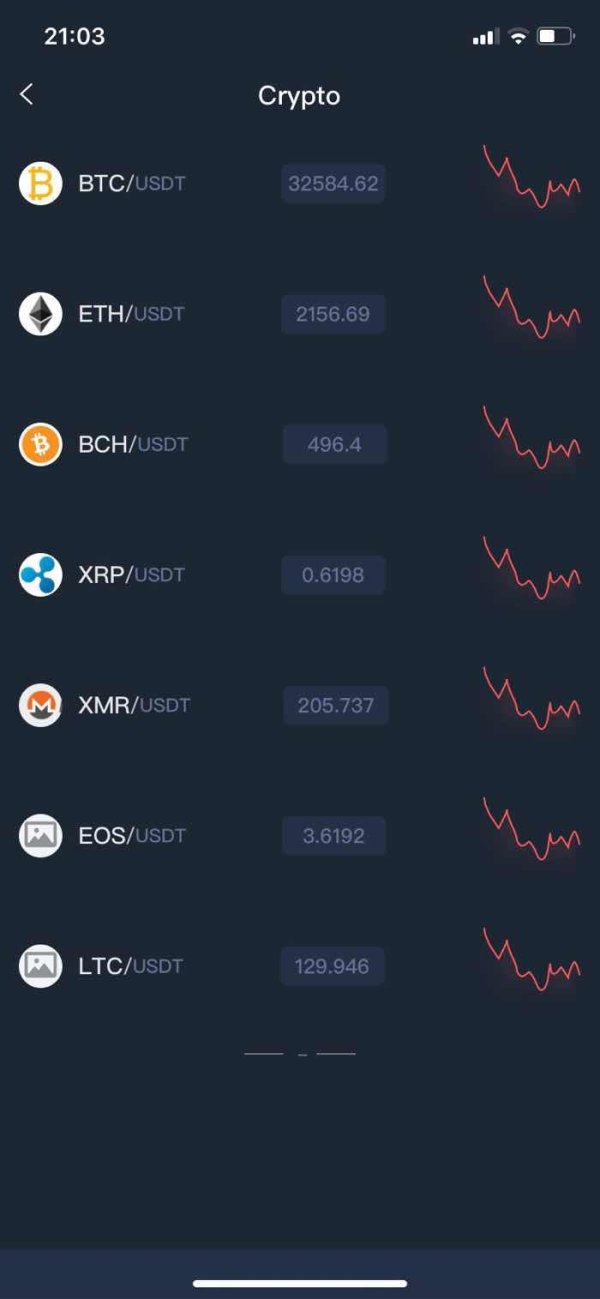

Tradeable Asset Classes:

The broker provides access to over 200 trading instruments across various categories, including 60+ forex pairs, commodities, indices, stocks, and cryptocurrencies. This diverse range allows traders to build a well-rounded portfolio.

Costs (Spreads, Fees, Commissions):

TeleTrade offers spreads starting from 0.2 pips on its ECN accounts. Commissions vary depending on the account type, with no deposit or withdrawal fees reported. However, some user reviews indicate potential issues with withdrawal processing times.

Leverage:

The maximum leverage offered by TeleTrade is up to 1:500 for professional clients, while retail clients may have lower leverage options due to regulatory restrictions.

Allowed Trading Platforms:

Traders can access both MetaTrader 4 and MetaTrader 5 platforms, which are known for their robust trading features and user-friendly interfaces. However, some reviews suggest that the platforms may lack advanced features that other brokers provide.

Restricted Regions:

TeleTrade does not accept clients from the United States, which may limit its accessibility for some traders.

Available Customer Support Languages:

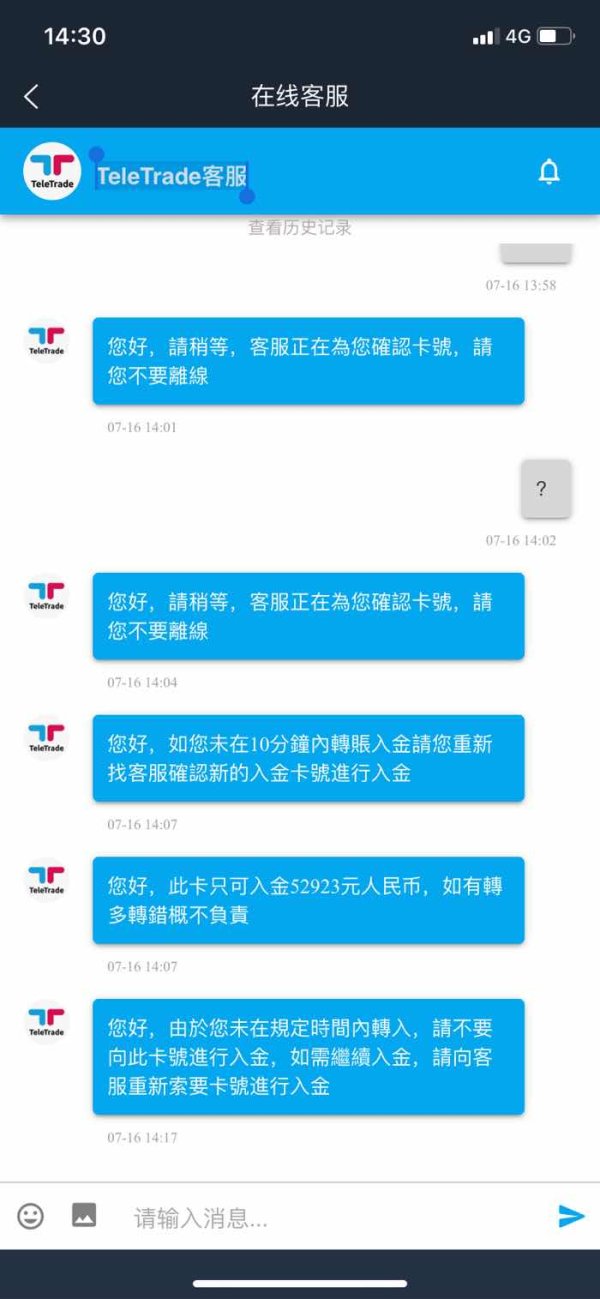

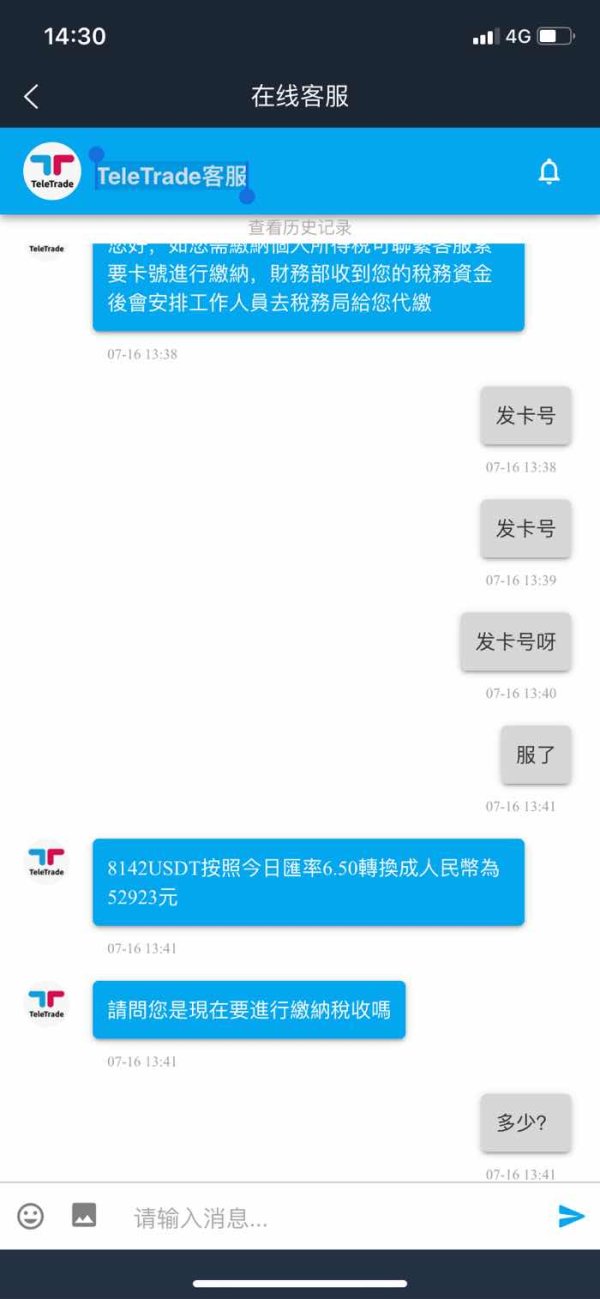

Customer support is available in multiple languages, including English, Chinese, Russian, and more. However, the availability of support may be limited outside of standard business hours, according to some user experiences.

Ratings Overview (Repeated)

Detailed Ratings Breakdown

Account Conditions (7.5/10): TeleTrade offers several account types, including standard, NDD, and ECN accounts, all requiring a minimum deposit of $100. The variety of accounts caters to different trading strategies, but the lack of micro accounts may deter some traders.

Tools and Resources (6.5/10): The broker provides basic educational resources and market analysis tools, but many users feel that the educational content is lacking in depth, especially for beginners.

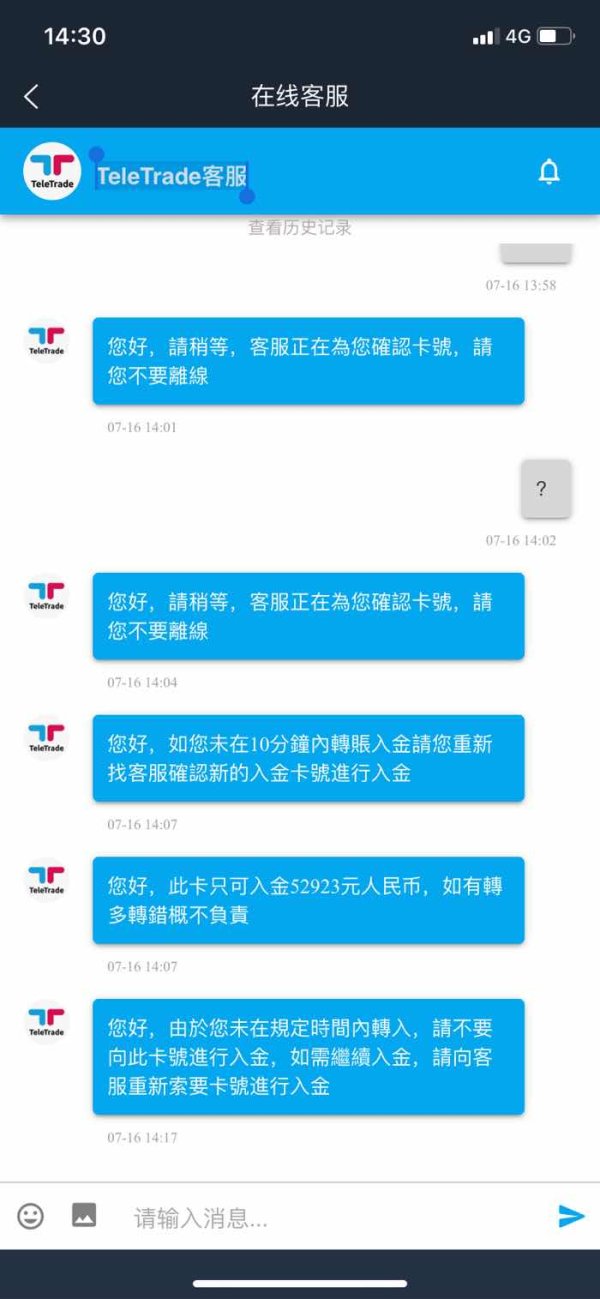

Customer Service and Support (6.0/10): Customer support is generally responsive, but there are reports of slow response times and limited availability outside business hours. Users have expressed concerns about the effectiveness of support during critical trading times.

Trading Experience (7.0/10): The trading experience is enhanced by the use of popular platforms like MT4 and MT5. However, the lack of advanced features on these platforms compared to competitors may limit some traders' effectiveness.

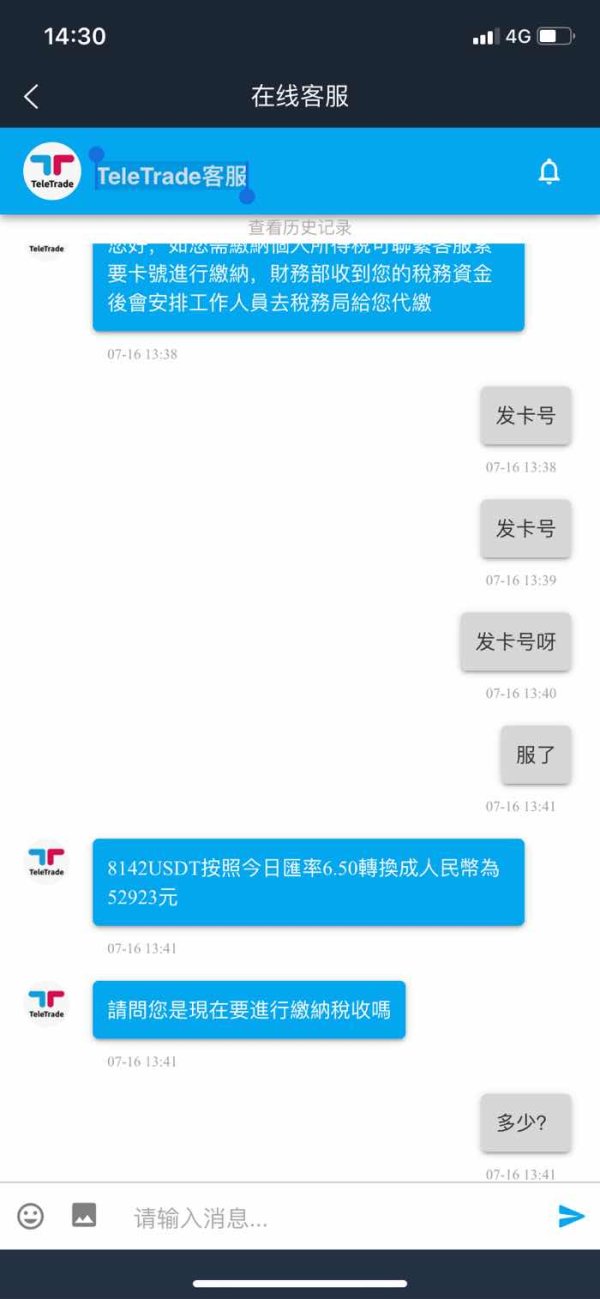

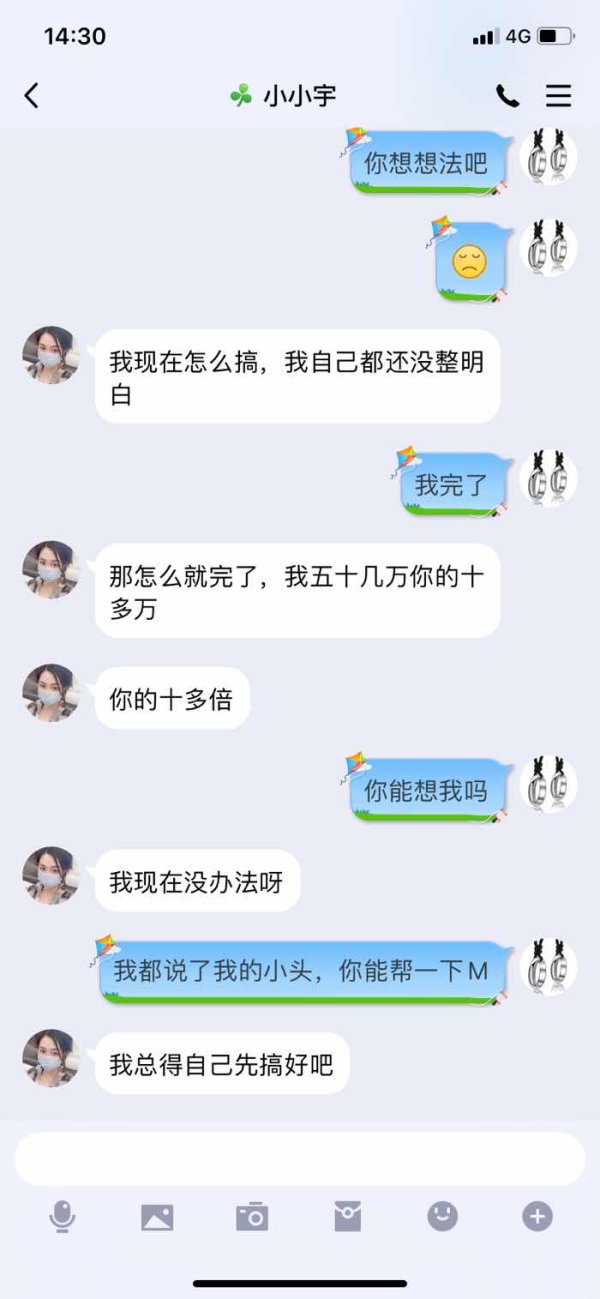

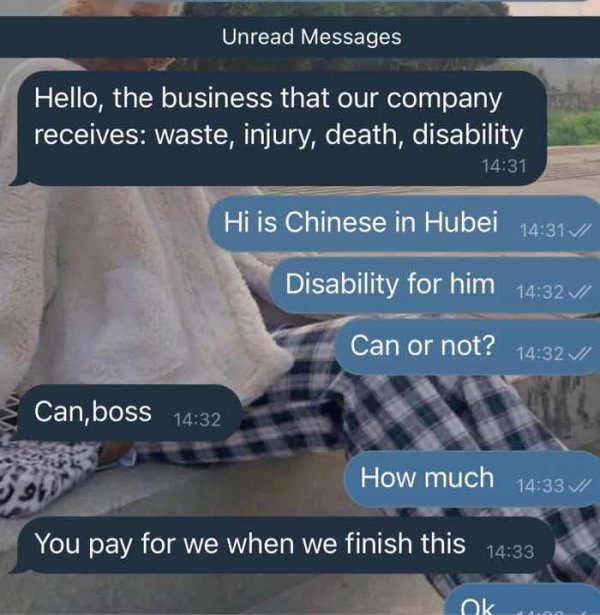

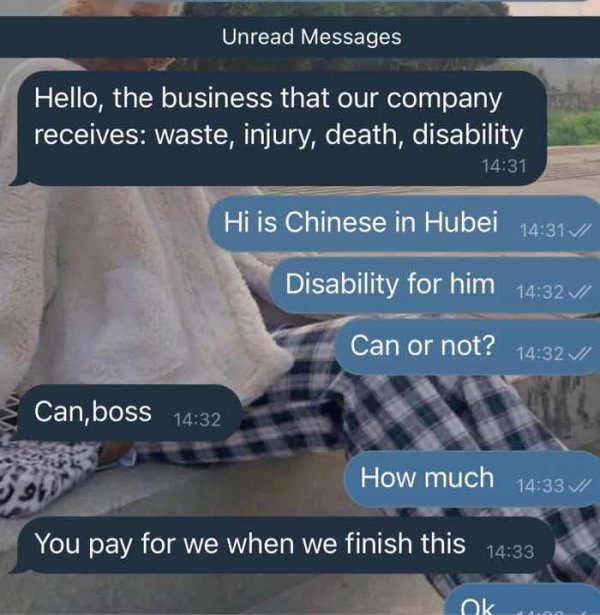

Trustworthiness (5.5/10): While TeleTrade is regulated by CySEC, its operations in offshore jurisdictions raise concerns about transparency and reliability. User reviews have highlighted issues with withdrawals and account management, which could affect trust.

User Experience (6.0/10): User experiences vary significantly, with some praising the platform's ease of use while others report issues with execution speed and order management.

In conclusion, while TeleTrade has established itself as a notable player in the online trading space, potential clients should weigh the benefits against the concerns raised in user reviews and expert analyses. Careful consideration of regulatory status and user experiences is advisable before committing funds.