Sable 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive sable review examines Sable International's performance as a financial services provider. It draws from customer feedback and industry analysis. Based on available data from Trustpilot, Sable International demonstrates strong customer satisfaction with a rating of 4.2 out of 5 stars. This rating indicates high levels of client trust and service quality. Notably, approximately 80% of customers provide 5-star ratings. This reflects exceptional service experiences across their client base.

The company's operational foundation appears solid. Leadership brings significant industry expertise - particularly Christine Sable's 31 years of experience in the real estate sector. Employee satisfaction ratings of 3.7 out of 5, with 70% of staff recommending the company as an employer, suggest internal stability and positive workplace culture. Sable International primarily targets investors interested in real estate and foreign exchange markets. It positions itself as a specialized service provider in these sectors.

However, this review must note limitations in available technical trading information. Specific platform details, regulatory frameworks, and detailed trading conditions are not comprehensively documented in accessible sources. The evaluation focuses primarily on customer service excellence and company reputation rather than technical trading specifications.

Important Disclaimers

Regional Entity Variations: Information available in this review may not reflect regulatory differences across various jurisdictions where Sable International operates. Users in different regions may encounter varying legal environments, compliance requirements, and service structures. Potential clients should verify local regulatory status and applicable terms before engaging services.

Review Methodology: This evaluation is based primarily on customer feedback data, company background information, and publicly available sources. The assessment does not include comprehensive analysis of specific trading conditions, detailed regulatory compliance, or real-time platform performance metrics. Readers should conduct independent due diligence and consider consulting with financial advisors before making investment decisions.

Rating Framework

Broker Overview

Sable International operates as a financial services provider with a particular focus on real estate and foreign exchange market services. The company benefits from substantial industry experience. Key leadership figure Christine Sable brings over three decades of real estate sector expertise to the organization. This extensive background provides a foundation of market knowledge and client relationship management that appears to translate into positive customer experiences.

The company's operational history includes 1,664 customer reviews. This suggests an established client base and sustained business operations. The mother company's independent operational background indicates a track record of autonomous business management and client service delivery. This operational independence may contribute to the company's ability to maintain focused service quality and responsive customer support.

From a business model perspective, Sable International appears to integrate real estate and foreign exchange services. This potentially offers clients diversified investment opportunities across these sectors. This sable review indicates that the company targets investors seeking exposure to both property markets and currency trading. However, specific service integration details are not comprehensively documented in available sources.

The company's positioning suggests specialization rather than broad-market coverage. This may appeal to clients seeking focused expertise in real estate and forex markets. However, potential clients should verify specific service offerings and availability in their jurisdiction. Regional variations may apply to service structures and regulatory compliance requirements.

Regulatory Framework: Specific regulatory jurisdictions and compliance details are not comprehensively documented in available sources. Potential clients should independently verify regulatory status in their region.

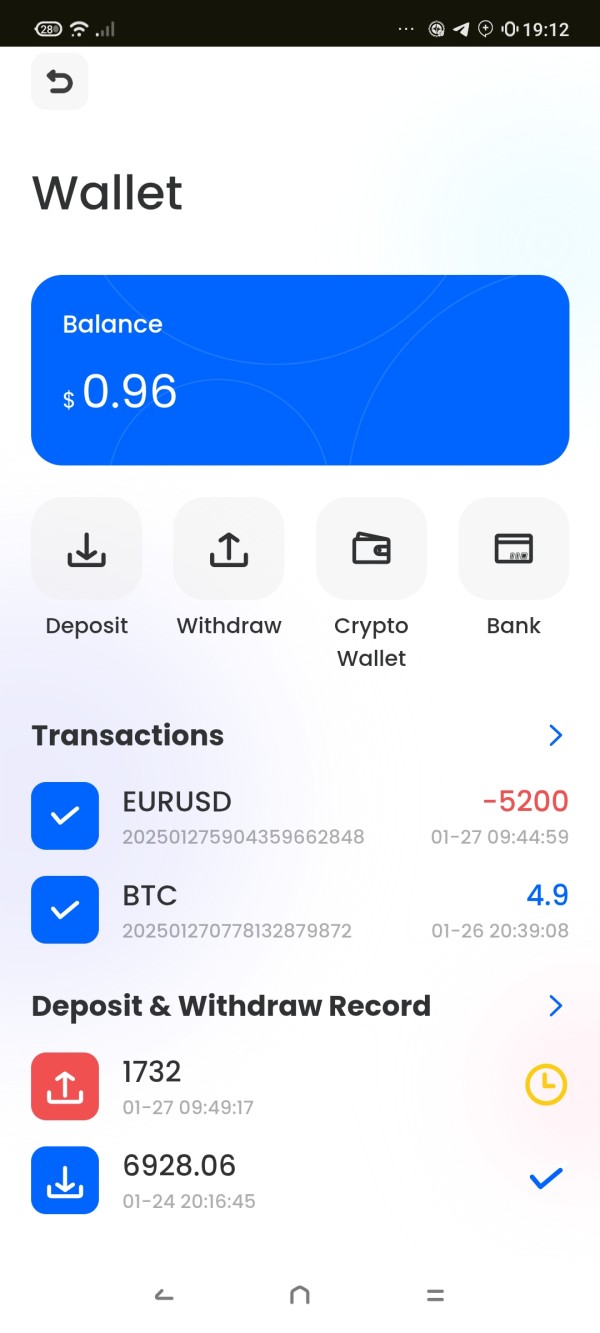

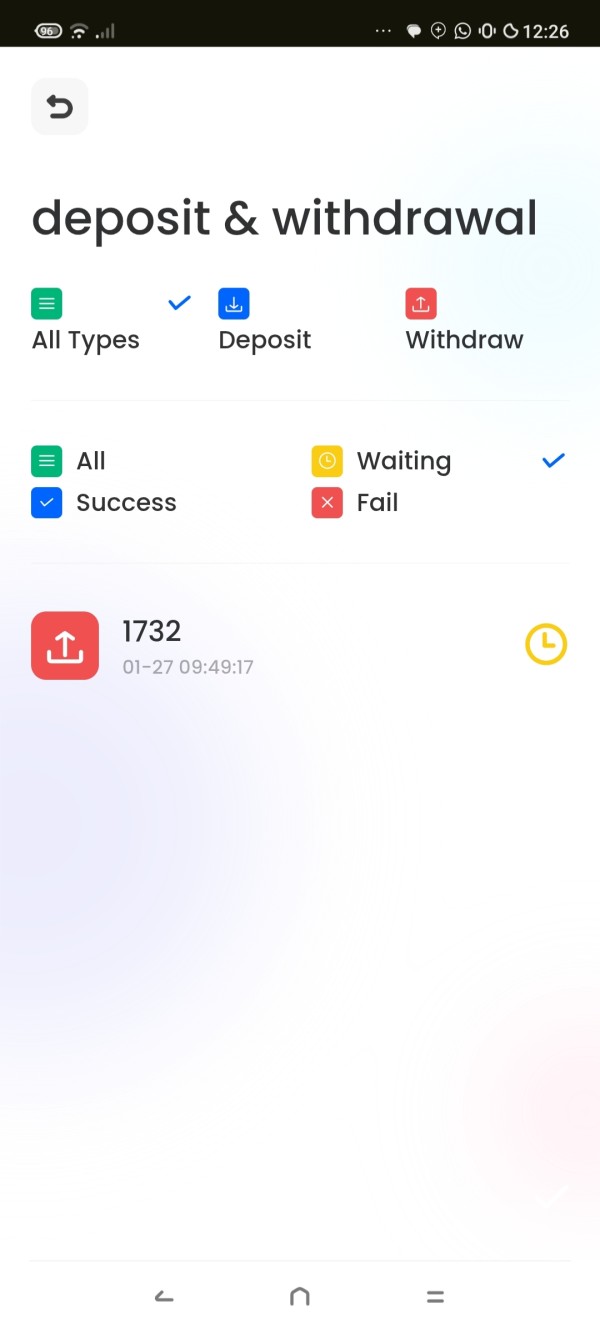

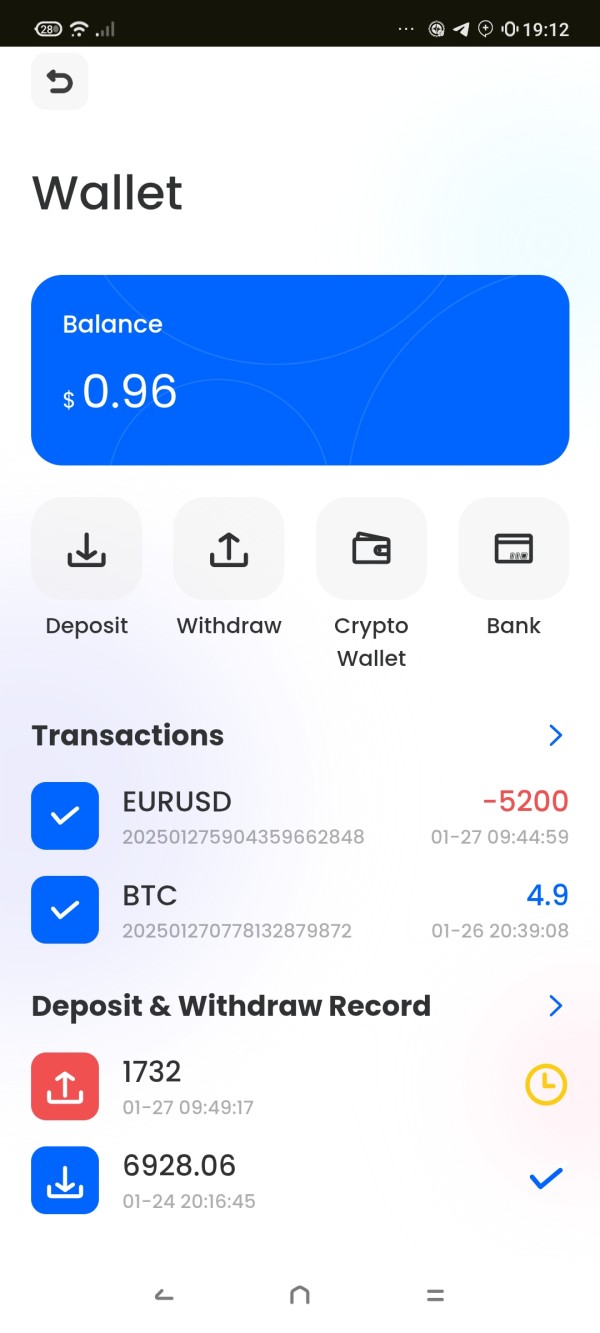

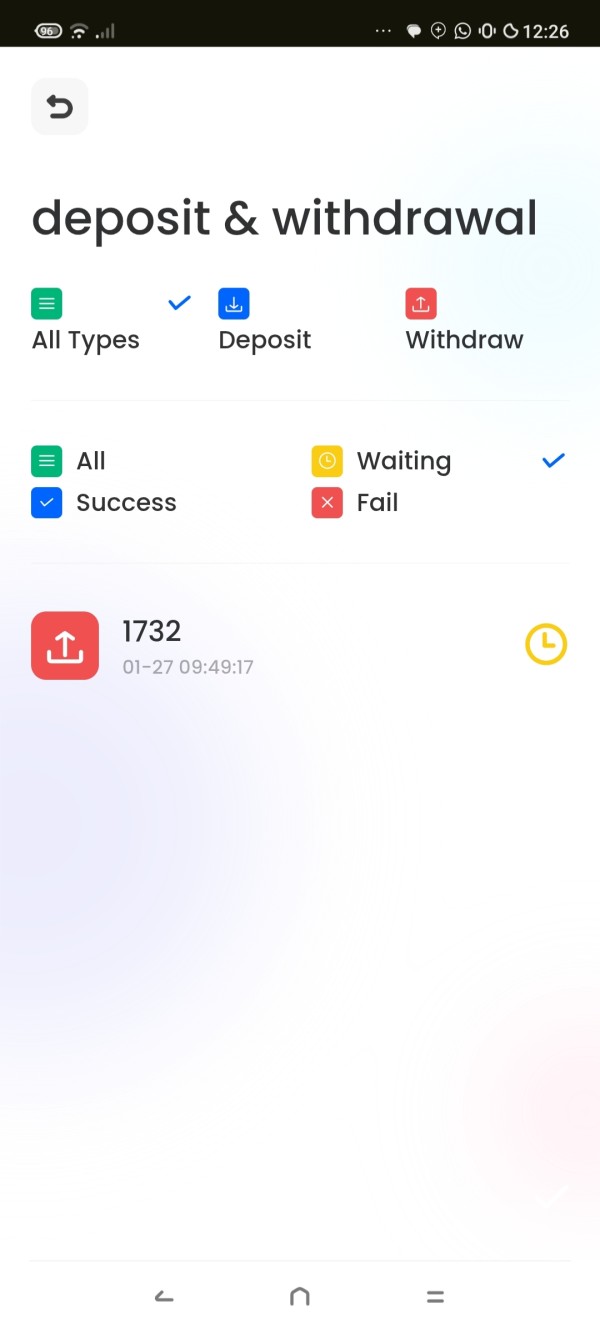

Deposit and Withdrawal Methods: Payment processing options and procedures are not detailed in accessible documentation.

Minimum Deposit Requirements: Entry-level funding requirements are not specified in available sources.

Promotional Offers: Current bonus structures or promotional incentives are not documented in reviewed materials.

Tradeable Assets: Specific instrument categories and market coverage details require verification through direct company contact.

Cost Structure: Commission rates, spreads, and fee schedules are not comprehensively outlined in available documentation.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in accessible sources.

Platform Selection: Trading software options and technical capabilities require direct verification with the company.

Geographic Restrictions: Regional service limitations are not detailed in this sable review based on available sources.

Customer Service Languages: Multi-language support availability requires confirmation through direct inquiry.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Sable International's account conditions faces limitations due to insufficient detailed information in available sources. While the company demonstrates strong customer satisfaction metrics, specific account structures, minimum deposit requirements, and tiered service levels are not comprehensively documented. This information gap represents a significant consideration for potential clients seeking transparent account specifications.

Industry best practices typically include multiple account categories designed for different investor profiles. These range from basic retail accounts to premium services for high-net-worth individuals. However, without detailed documentation of Sable International's specific offerings, this sable review cannot provide definitive assessment of their account structure competitiveness.

The account opening process efficiency can be inferred from positive customer feedback. This suggests streamlined procedures that contribute to overall client satisfaction. However, verification requirements, documentation needs, and timeline expectations require direct confirmation with the company.

Special account features such as Islamic-compliant trading options, corporate account structures, or managed account services are not detailed in available sources. Potential clients with specific account requirements should engage directly with Sable International to verify availability and terms.

Assessment of Sable International's trading tools and analytical resources is limited by insufficient technical documentation in available sources. Modern forex and investment services typically provide comprehensive analytical suites, market research, and educational resources to support client decision-making. However, specific details about Sable International's tool offerings are not accessible for detailed evaluation.

Professional trading platforms generally include charting capabilities, technical indicators, economic calendars, and market analysis features. The quality and comprehensiveness of these tools significantly impact trading effectiveness and client satisfaction. While customer satisfaction ratings suggest positive overall experiences, technical tool specifics require direct verification.

Educational resources represent crucial support elements for client development and market understanding. Many brokers provide webinars, tutorials, market commentary, and educational materials. Sable International's educational offerings and research support capabilities are not detailed in available documentation.

Automated trading support represents increasingly important service elements. This includes expert advisor compatibility and algorithmic trading infrastructure. However, these technical capabilities are not documented in accessible sources for evaluation.

Customer Service and Support Analysis

Customer service excellence emerges as a significant strength in this evaluation. Trustpilot ratings of 4.2 out of 5 provide strong evidence of service quality. The 80% five-star rating distribution indicates consistently positive client interactions and effective problem resolution. This performance level suggests well-trained support staff and efficient service delivery systems.

Response time efficiency, while not specifically documented with exact metrics, can be inferred as satisfactory based on positive customer feedback patterns. Effective customer service typically requires prompt response times across multiple communication channels. This contributes to overall client satisfaction scores.

Service quality consistency appears strong based on the high percentage of positive reviews. Maintaining 4.2/5 rating across 1,664 reviews suggests systematic service excellence rather than isolated positive experiences. This consistency indicates established service protocols and staff training programs.

Multi-language support capabilities and service hours are not specifically detailed in available sources. However, the company's international positioning suggests appropriate language accommodation. Clients requiring specific language support should verify availability directly with the company.

Trading Experience Analysis

Evaluation of trading experience quality faces limitations due to insufficient technical platform documentation in available sources. Trading experience encompasses platform stability, execution speed, order processing efficiency, and overall system reliability. All of these are crucial factors for client success and satisfaction.

Platform stability and system uptime represent fundamental requirements for effective trading operations. While customer satisfaction ratings suggest positive overall experiences, specific technical performance metrics are not documented in accessible sources. This sable review cannot provide detailed technical performance assessment based on available information.

Order execution quality significantly impacts trading outcomes and client satisfaction. This includes fill rates, slippage levels, and processing speed. However, these technical specifications are not detailed in available documentation for comprehensive evaluation.

Mobile trading capabilities and cross-platform functionality represent increasingly important service elements. Modern traders expect seamless experiences across desktop, mobile, and web-based platforms. Sable International's mobile trading support and platform integration require direct verification.

Trust and Reliability Analysis

Trust assessment reveals positive indicators through leadership experience and customer feedback patterns. Christine Sable's 31 years of industry experience provides substantial credibility and market knowledge foundation. This extensive background suggests deep understanding of market dynamics and client needs. It contributes to service quality and business stability.

The company's operational history, evidenced by 1,664 customer reviews, indicates sustained business operations and established client relationships. This track record suggests business continuity and operational reliability. These are important factors for client confidence and long-term service relationships.

Employee satisfaction ratings of 3.7 out of 5, with 70% staff recommendation rates, indicate positive internal culture and workplace stability. High employee satisfaction often correlates with better customer service quality and business continuity. Satisfied employees typically provide more effective client support.

However, specific regulatory compliance details and financial protection measures are not comprehensively documented in available sources. Potential clients should verify regulatory status, insurance coverage, and fund protection mechanisms directly with the company.

User Experience Analysis

Overall user satisfaction demonstrates strong performance with Trustpilot ratings of 4.2 out of 5. This indicates positive client experiences across service interactions. The 80% five-star rating distribution suggests that most clients find the service experience meets or exceeds expectations. This reflects effective user experience design and service delivery.

The user demographic appears to focus on investors interested in real estate and foreign exchange markets. This suggests specialized service delivery tailored to these specific investment sectors. This targeted approach may contribute to higher satisfaction levels by providing focused expertise rather than generalized services.

User feedback patterns, while not detailed with specific testimonials in available sources, can be inferred as positive based on the high rating distribution. Consistent positive feedback across a substantial review base suggests effective user experience management and responsive service adaptation.

Interface design, registration processes, and fund management experiences are not specifically detailed in available documentation. These operational elements significantly impact user satisfaction and require direct verification for comprehensive assessment. Potential clients should test platform usability and process efficiency through demo accounts or initial small-scale engagement.

Conclusion

This sable review reveals a financial services provider with strong customer satisfaction credentials but limited publicly available technical information. Sable International demonstrates excellence in customer service delivery. This is evidenced by 4.2/5 Trustpilot ratings and 80% five-star customer feedback. The company's foundation includes substantial industry experience and positive internal culture indicators.

The service appears well-suited for investors seeking specialized expertise in real estate and foreign exchange markets. This particularly applies to those who prioritize customer service quality and established industry experience. However, potential clients requiring detailed technical specifications, comprehensive platform analysis, or specific regulatory information should conduct direct due diligence with the company.

Primary strengths include exceptional customer satisfaction rates and experienced leadership. The main limitation involves insufficient publicly available technical and regulatory details. Prospective clients should engage directly with Sable International to verify specific service terms, platform capabilities, and regulatory compliance relevant to their jurisdiction and investment requirements.