Interactive 2025 Review: Everything You Need to Know

Executive Summary

Interactive Brokers is a major player in the global financial services industry. The company offers complete trading solutions to many different types of clients, from individual investors to large institutional customers. This interactive review looks at the broker's current services, regulatory status, and overall performance in 2025. Based on available information and user feedback, Interactive Brokers keeps its position as a technology-focused brokerage with extensive market access and professional-grade tools.

The platform works especially well for active traders and sophisticated investors. These users care most about low costs, advanced trading capabilities, and access to global markets. However, the complexity of its platform may create challenges for new traders who want a simpler experience.

According to ForexBrokers.com reports, Interactive Brokers continues to lead in cost competitiveness and market access. Some aspects of user experience still need improvement. The broker's commitment to technological innovation and regulatory compliance across multiple jurisdictions strengthens its reputation as a serious competitor in the brokerage industry.

Important Notice

This review uses publicly available information, user feedback, and industry reports as of 2025. Interactive Brokers operates through multiple entities across different jurisdictions, so specific features, regulations, and offerings may vary by region. Traders should verify current terms, conditions, and regulatory status in their specific jurisdiction before making any trading decisions.

This evaluation does not constitute investment advice. Readers should conduct their own research. Some information may not reflect the most recent updates or may vary between different Interactive Brokers entities globally.

Rating Framework

Broker Overview

Interactive Brokers Group was established in 1978. The company has grown into one of the world's largest electronic trading platforms. Thomas Peterffy founded the company, and it pioneered electronic trading and market making, establishing itself as a technology leader in the financial services sector.

The broker operates as a global electronic trading platform. It serves individual and institutional clients across multiple asset classes and geographic markets. The company's business model centers on providing direct market access through sophisticated technology infrastructure, enabling clients to trade stocks, options, futures, forex, bonds, and funds across more than 150 markets in 33 countries.

Interactive Brokers is publicly traded on NASDAQ under the ticker symbol IBKR. The company maintains its headquarters in Greenwich, Connecticut. According to Wikipedia sources, Interactive Brokers operates through various regulated entities worldwide, ensuring compliance with local financial regulations while maintaining its core technology platform.

The broker's primary trading platforms include Trader Workstation, IBKR Mobile, and Client Portal. Each platform is designed to serve different trading needs and experience levels. This interactive review reveals that the broker's focus on institutional-quality tools and low-cost execution has attracted a diverse client base ranging from active day traders to large hedge funds.

Regulatory Oversight: Interactive Brokers operates under multiple regulatory jurisdictions including SEC and FINRA in the United States, FCA in the United Kingdom, and other regional authorities. The broker maintains strong regulatory compliance across all operating territories.

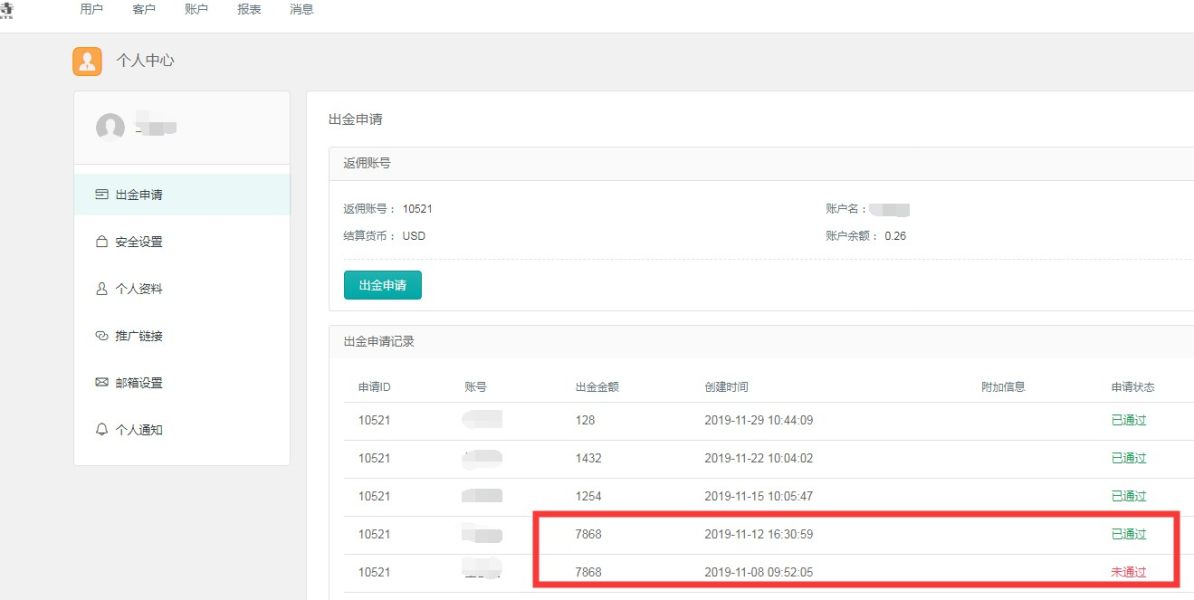

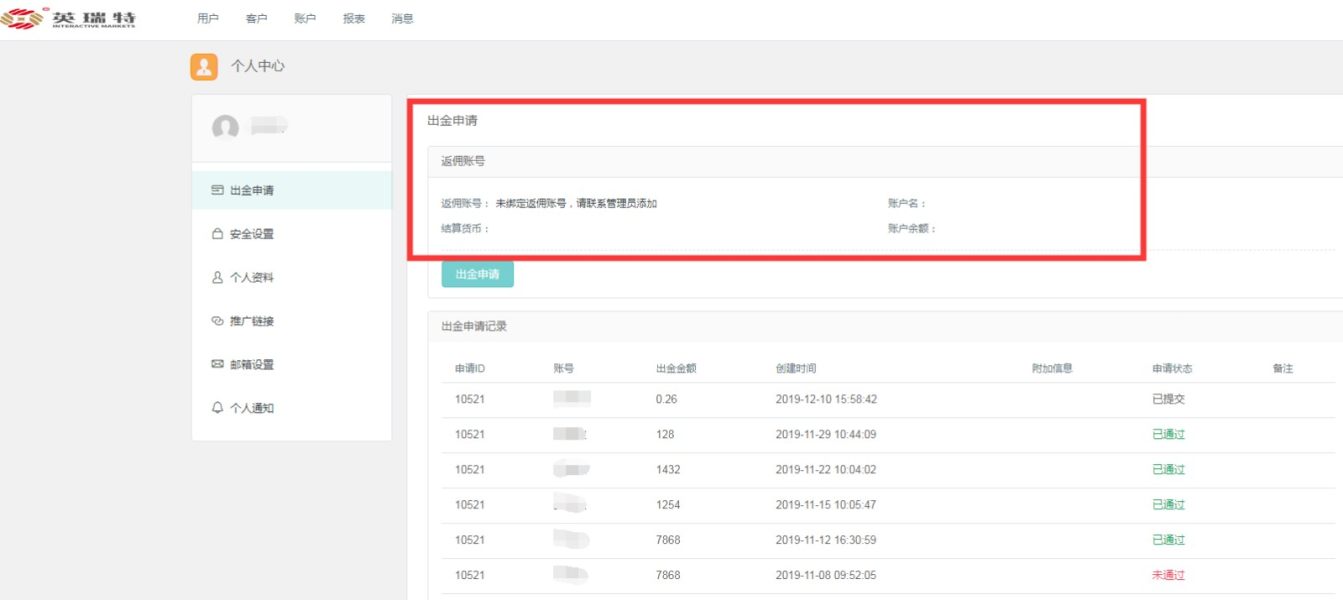

Deposit and Withdrawal Methods: The platform supports various funding methods including bank transfers, wire transfers, and ACH deposits. Withdrawal processing typically occurs within standard banking timeframes, though specific methods may vary by region and account type.

Minimum Deposit Requirements: Account minimums vary by account type and jurisdiction. Some accounts require no minimum deposit while others may require higher thresholds for specific features or trading permissions.

Promotional Offers: Interactive Brokers occasionally offers promotional rates or incentives for new accounts. These tend to be more conservative compared to retail-focused brokers, reflecting the platform's professional orientation.

Tradeable Assets: The platform provides access to stocks, ETFs, options, futures, forex, bonds, mutual funds, and cryptocurrencies across global markets. This extensive asset coverage represents one of the broadest offerings in the industry.

Cost Structure: Interactive Brokers is known for competitive pricing with tiered commission structures. The broker offers both per-share and per-trade pricing models, with institutional clients often receiving volume-based discounts.

Leverage Options: Margin requirements and leverage ratios comply with regional regulations. Different ratios are available for various asset classes and account types.

Platform Selection: Primary platforms include Trader Workstation for advanced users, IBKR Mobile for mobile trading, and simplified web-based interfaces for basic trading needs.

Geographic Restrictions: Services are available globally with some restrictions based on local regulations and compliance requirements in specific jurisdictions.

Customer Support Languages: Support is available in multiple languages including English, Spanish, French, German, and others. This depends on the regional office and service area.

This comprehensive interactive review indicates that while specific details may vary, Interactive Brokers maintains consistent core offerings across its global operations.

Detailed Rating Analysis

Account Conditions Analysis

Interactive Brokers offers multiple account types designed to accommodate different trader profiles and investment objectives. The broker provides individual, joint, retirement, and institutional accounts, each with specific features and requirements. According to available information, minimum deposit requirements vary significantly based on account type and geographic location.

Some basic accounts require no minimum while others may require substantial initial funding. The account opening process involves comprehensive documentation and verification procedures, reflecting the broker's institutional heritage and regulatory compliance standards. Users report that while the process is thorough, it can be more complex compared to retail-focused brokers.

The platform offers specialized account features including portfolio margin accounts for sophisticated traders. It also provides various retirement account options for long-term investors. Account holders gain access to advanced order types, pre-market and after-hours trading, and professional-level risk management tools.

The broker's account structure particularly benefits active traders who can take advantage of volume-based pricing tiers and advanced trading permissions. However, casual investors may find some account features unnecessarily complex for their needs. This interactive review suggests that while Interactive Brokers' account conditions favor experienced traders, the broker has made efforts to accommodate different user segments through varied account offerings and educational resources.

Interactive Brokers distinguishes itself through comprehensive trading tools and research resources. These rival those found at institutional trading firms. The flagship Trader Workstation platform provides advanced charting capabilities, real-time market data, sophisticated order management, and algorithmic trading features.

Users consistently praise the platform's depth and customization options. However, many note the significant learning curve required to master its full capabilities. The broker's research offerings include fundamental analysis, technical indicators, market scanners, and third-party research integration.

Risk management tools allow users to monitor portfolio exposure, set automated risk parameters, and analyze potential scenarios. The platform's analytical capabilities extend to options analysis, portfolio optimization, and performance attribution tools typically reserved for institutional clients. Educational resources include webinars, tutorials, and comprehensive documentation, though users report that the materials assume a higher baseline knowledge compared to beginner-focused brokers.

The broker's API access enables algorithmic trading and custom application development. This appeals to quantitative traders and institutional clients. Mobile applications provide core trading functionality with real-time data and order management, though the mobile experience necessarily simplifies the desktop platform's extensive feature set.

Overall, the tools and resources represent a significant strength for Interactive Brokers. This is particularly true for users who can fully utilize the platform's sophisticated capabilities.

Customer Service and Support Analysis

Interactive Brokers provides customer support through multiple channels including phone, email, live chat, and an online help center. Support availability varies by region, with major markets typically receiving extended hours coverage. User feedback on customer service quality presents a mixed picture.

Some users praise knowledgeable technical support while others report longer wait times during peak periods. The broker's support structure reflects its institutional heritage, with representatives generally demonstrating strong technical knowledge of trading platforms and market mechanics. However, some users report that support interactions can feel more procedural compared to the personalized service offered by smaller brokers.

The online help center provides extensive documentation and troubleshooting resources. Experienced users often find this sufficient for resolving common issues. Response times vary significantly based on inquiry type and urgency level, with technical platform issues typically receiving faster attention than general account questions.

The broker offers priority support tiers for higher-volume clients, reflecting its institutional client focus. Multi-language support is available in major markets, though the depth of support may vary by language and region. User reports suggest that while Interactive Brokers' support team is generally competent and knowledgeable, the service experience may not match the white-glove treatment offered by some premium brokers.

The support structure appears optimized for self-sufficient traders who can utilize available resources independently.

Trading Experience Analysis

The trading experience at Interactive Brokers centers around professional-grade platforms designed for active trading across global markets. Trader Workstation serves as the flagship platform, offering institutional-quality tools including advanced order types, algorithmic trading capabilities, and comprehensive market access. Users consistently highlight the platform's speed, reliability, and extensive customization options as major strengths.

Order execution quality receives generally positive feedback. The broker's smart routing technology is designed to optimize fills across multiple market centers. The platform supports complex trading strategies including multi-leg options trades, basket trading, and conditional orders.

Real-time market data coverage spans global markets with minimal latency, supporting active trading strategies that require timely information. The mobile trading experience provides core functionality with real-time data and order management, though power users often prefer the desktop platform for complex trades. Platform stability is generally strong, with users reporting minimal downtime during regular market hours.

The broker's technology infrastructure appears well-suited for high-frequency trading and large volume transactions. However, novice traders often find the platform overwhelming, with many features and options that require significant learning investment. The interactive review process reveals that while the trading experience excels for sophisticated users, beginners may struggle with the platform's complexity and extensive feature set.

Trust and Reliability Analysis

Interactive Brokers maintains strong regulatory oversight across multiple jurisdictions. The company operates under licenses from major financial authorities including the SEC, FINRA, FCA, and other regional regulators. The broker's regulatory compliance record appears solid, with no major recent violations or sanctions reported in available sources.

As a publicly traded company on NASDAQ, Interactive Brokers is subject to additional transparency and reporting requirements that enhance investor confidence. The broker's financial stability is supported by substantial capital reserves and conservative risk management practices. Client fund segregation follows regulatory requirements in each operating jurisdiction, with additional protections through SIPC insurance in the United States and equivalent programs in other regions.

The company's long operating history since 1978 and institutional client base provide additional credibility indicators. Industry recognition includes various awards for platform technology and cost competitiveness, though specific recent accolades were not detailed in available sources. The broker's reputation within professional trading communities remains generally positive, with particular recognition for technological innovation and market access capabilities.

Transparency in pricing and terms appears adequate, though some users report that the comprehensive fee structure can be complex to navigate initially. The broker's institutional heritage and regulatory compliance focus contribute to overall trustworthiness, though individual experiences may vary based on specific circumstances and expectations.

User Experience Analysis

The overall user experience at Interactive Brokers reflects the platform's institutional heritage and professional trader focus. Advanced users consistently praise the platform's comprehensive capabilities and customization options. However, beginners often report feeling overwhelmed by the extensive feature set and complex interface design.

The learning curve for new users is substantial, requiring significant time investment to master the platform's full capabilities. Interface design prioritizes functionality over simplicity, with dense information displays and numerous configuration options. Experienced traders appreciate the ability to customize layouts and access advanced tools, while casual investors may find the interface cluttered and intimidating.

The broker has made efforts to provide simplified interfaces for basic trading needs. However, these still require more technical knowledge than typical retail platforms. Account setup and verification processes are thorough but can be time-consuming, reflecting the broker's compliance-focused approach.

Users report that while the process ensures proper documentation, it may feel bureaucratic compared to streamlined retail broker onboarding. Educational resources are available but assume higher baseline knowledge than beginner-focused competitors. User feedback indicates high satisfaction among active traders who fully utilize the platform's capabilities, while occasional traders and beginners often struggle with complexity.

The mobile experience provides essential functionality but necessarily simplifies the desktop platform's extensive feature set. Overall user experience satisfaction correlates strongly with trading experience level and platform utilization depth.

Conclusion

Interactive Brokers presents a compelling option for experienced traders and institutional clients seeking professional-grade tools, extensive market access, and competitive pricing. The broker's strengths lie in technological sophistication, regulatory compliance, and comprehensive asset coverage across global markets. However, the platform's complexity and institutional focus may not suit casual investors or trading beginners.

The interactive review process reveals that Interactive Brokers excels in areas most important to active traders: low costs, advanced tools, and reliable execution. While customer service and user experience may not match specialized retail brokers, the platform's professional capabilities and established reputation make it a solid choice for serious traders. These users must be willing to invest time in mastering its extensive feature set.