Saracen Markets 2025 Review: Everything You Need to Know

Summary

Saracen Markets is a new forex broker. It has made a name for itself as a key player in Islamic finance since it started in late 2018. This saracenmarkets review shows a company that has become a leader in Shariah-compliant trading. The broker has won awards twice for its services. It works with STP and ECN execution models, offers leverage up to 1:500, and provides multiple account types including VIP accounts, professional accounts, and sub-accounts.

The data shows Saracen Markets has 299 total user reviews with a Trust Score of 58. This means it has moderate trust in the market. The platform mainly serves traders who want Islamic-compliant financial services and those interested in high-leverage trading. But regulatory information is unclear in available documents, which may worry potential clients who care about regulatory oversight. The broker offers trading in currency pairs, commodities, global indices, and stocks. This makes it good for different trading strategies.

Important Notice

Users must check Saracen Markets' legal status and compliance requirements in their own countries because regulatory information is limited. Different regions may have different regulatory rules that could affect service availability and investor protection measures.

This review is based on detailed analysis of user feedback, market data, and public company information. Potential clients should do their own research before making trading decisions, especially about regulatory compliance and fund security measures.

Rating Framework

Broker Overview

Saracen Markets started in late 2018. It has quickly become a major player in the Shariah-compliant finance industry. The company built its reputation by providing Islamic-compliant financial services while using STP (Straight Through Processing) and ECN (Electronic Communication Network) execution models. This approach aims to remove conflicts of interest between the broker and its clients. It creates a more transparent trading environment.

Company information shows Saracen Markets has won awards twice. This shows its commitment to excellence in the Islamic finance sector. The broker's main business model focuses on providing transparent and fair trading conditions that follow Islamic financial principles. This makes it especially attractive to Muslim traders seeking compliant investment opportunities.

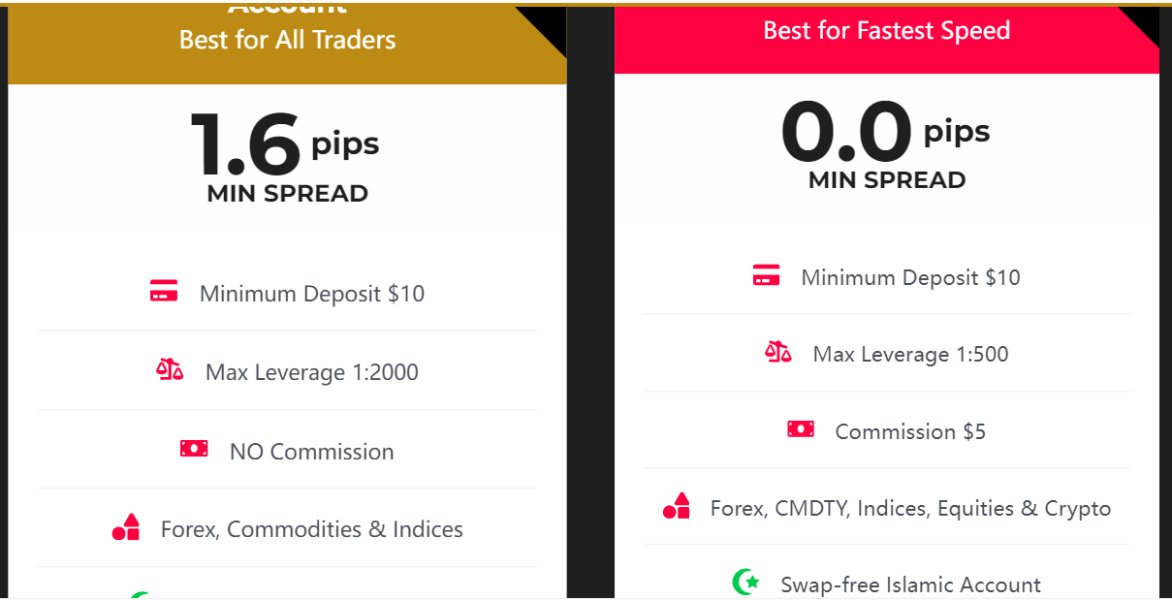

The broker offers many tradeable assets including currency pairs, commodities, global indices, and stocks. This saracenmarkets review finds that while the company has built a solid foundation in the Islamic finance space, specific details about trading platforms and regulatory oversight remain limited in available documentation. The maximum leverage of 1:500 puts the broker in a competitive position in the high-leverage trading segment. However, traders should know about the risks involved.

Regulatory Status: Current information does not name specific regulatory authorities that oversee Saracen Markets operations. Potential clients should verify regulatory compliance in their jurisdiction before proceeding.

Deposit and Withdrawal Methods: Specific payment methods and processing procedures are not detailed in available documentation. User feedback shows the dashboard mainly serves for deposit and withdrawal functions.

Minimum Deposit Requirements: Exact minimum deposit amounts for different account types are not listed in current documentation. This would require direct contact with the broker.

Bonuses and Promotions: No specific promotional offers or bonus structures are mentioned in available information sources.

Tradeable Assets: The platform gives access to currency pairs, commodities, global indices, and stocks. It offers diverse trading opportunities across multiple asset classes.

Cost Structure: While specific spread and commission details are not provided in available documentation, this saracenmarkets review notes that user feedback suggests areas for improvement in cost transparency and information access.

Leverage Ratios: Maximum leverage reaches 1:500. This puts the broker in the high-leverage category suitable for experienced traders seeking amplified market exposure.

Platform Options: Specific trading platform details are not explained in current documentation. This requires further investigation for potential clients.

Regional Restrictions: Geographic limits on service availability are not specified in available materials.

Customer Service Languages: Supported languages for customer service are not detailed in current documentation.

Detailed Rating Analysis

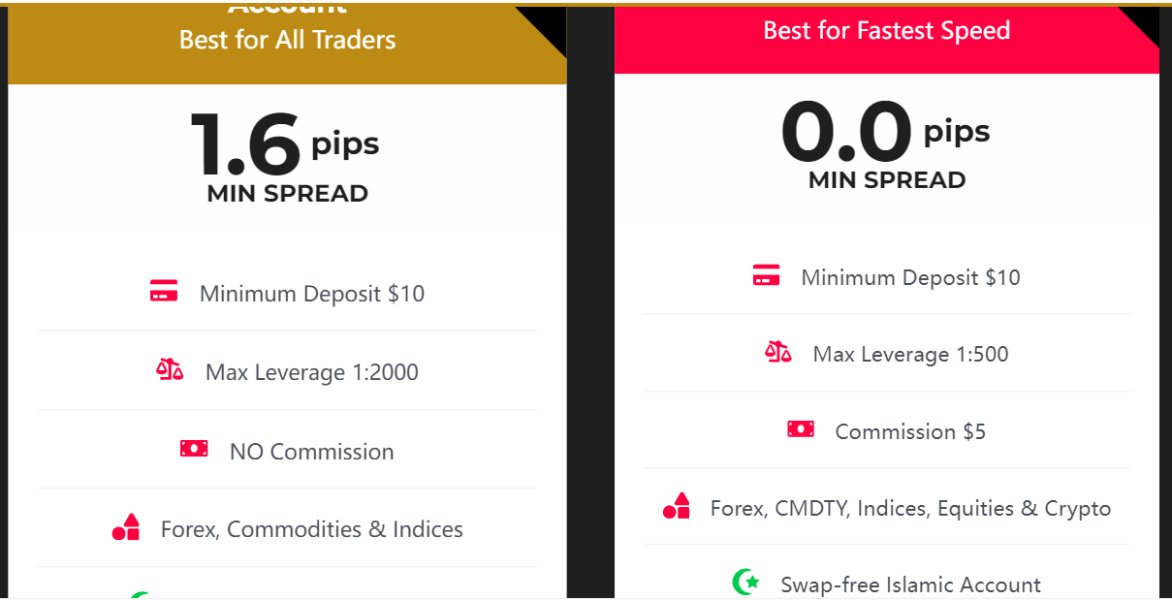

Account Conditions Analysis (6/10)

Saracen Markets shows solid account condition offerings through its multiple account types. These include VIP accounts, professional accounts, and sub-accounts. This variety serves different trader segments and experience levels. It provides flexibility for various trading strategies and capital requirements. The Islamic-compliant nature of these accounts especially appeals to Muslim traders seeking Shariah-compliant investment opportunities.

However, this saracenmarkets review finds major gaps in publicly available information about specific account features. Minimum deposit requirements, spread structures, and commission schedules are not clearly detailed in current documentation. This lack of transparency may create uncertainty for potential clients trying to evaluate account suitability and cost-effectiveness.

The account opening process and verification procedures are not well documented in available materials. This could impact user experience during onboarding. While the broker's focus on Islamic finance principles suggests attention to ethical trading practices, more detailed account specifications would help client decision-making abilities.

Available documentation provides limited information about specific trading tools and analytical resources offered by Saracen Markets. The absence of detailed descriptions about research capabilities, market analysis tools, and technical indicators represents a major information gap for potential clients evaluating the platform's analytical capabilities.

Educational resources and learning materials are not mentioned in current documentation. This may hurt novice traders seeking comprehensive support during their learning journey. The lack of information about automated trading support, expert advisors, or algorithmic trading capabilities further limits the assessment of the platform's technological offerings.

Market analysis resources, economic calendars, and news feeds are not specifically addressed in available materials. This information deficit makes it hard for traders to assess whether the platform provides adequate fundamental and technical analysis support for informed trading decisions.

Customer Service and Support Analysis (5/10)

Customer service capabilities appear limited based on available user feedback and documentation. Support can be reached via email at support@saracenmarkets.com. However, specific response times and service quality metrics are not detailed in current materials. The availability of multiple communication channels beyond email remains unclear.

User feedback suggests that customer support responsiveness may be insufficient for some client needs. However, specific examples and resolution timeframes are not extensively documented. The absence of information about multilingual support capabilities may limit accessibility for international clients seeking assistance in their native languages.

Operating hours for customer service and availability across different time zones are not specified in available documentation. This lack of clarity about support accessibility could impact client satisfaction. This is especially true for traders operating in markets outside the broker's primary time zone.

Trading Experience Analysis (6/10)

The trading experience at Saracen Markets shows mixed results based on available user feedback. While the broker's STP and ECN execution models suggest commitment to transparent order processing, specific platform performance metrics and execution speed data are not detailed in current documentation.

User feedback shows potential concerns about platform functionality, particularly regarding dashboard information availability. Some clients have noted that the dashboard primarily serves deposit and withdrawal functions while lacking comprehensive market information. This could impact trading decision-making processes.

Platform stability and order execution quality require further evaluation. Specific performance benchmarks and slippage data are not provided in available materials. This saracenmarkets review notes that while the high leverage offering of 1:500 provides significant market exposure opportunities, traders should carefully consider risk management strategies.

Trust and Security Analysis (5/10)

Trust and security present mixed signals for Saracen Markets. The Trust Score of 58 indicates moderate trustworthiness within the industry. However, this falls short of premium broker standards. The company's award-winning recognition in the Islamic finance sector provides some credibility. However, specific award details are not explained.

Regulatory oversight information remains unclear in available documentation. This represents a major concern for security-conscious traders. The absence of specific regulatory authority mentions makes it difficult to assess investor protection measures and compliance standards that may apply to client funds and trading activities.

Fund security measures, segregated account policies, and deposit protection schemes are not detailed in current materials. This information gap makes it challenging for potential clients to evaluate the safety of their invested capital and the broker's commitment to regulatory compliance standards.

User Experience Analysis (5/10)

User experience evaluation reveals areas for improvement based on the 299 total reviews collected. While this review volume provides a reasonable sample size for assessment, user feedback indicates mixed satisfaction levels with platform functionality and information accessibility.

The dashboard functionality has received particular criticism from users who note its limited market information capabilities. Primary functions are restricted to deposit and withdrawal operations. This limitation could significantly impact trader productivity and decision-making efficiency. This is especially true for active traders requiring comprehensive market data access.

Registration and verification processes are not extensively detailed in available documentation. This makes it difficult to assess onboarding efficiency. User feedback suggests that interface design may lack necessary information density. This could affect overall trading experience quality. The broker's focus on Islamic compliance may appeal to specific user segments. However, broader market appeal could be limited by platform functionality constraints.

Conclusion

This comprehensive saracenmarkets review reveals a broker with solid foundations in Islamic finance but significant room for improvement in transparency and user experience. Saracen Markets has successfully positioned itself as a leader in Shariah-compliant trading services since 2018. It has earned industry recognition through two awards and maintains a moderate trust score of 58.

The broker best suits traders specifically seeking Islamic-compliant financial services and those comfortable with high-leverage trading up to 1:500. However, potential clients should carefully consider the limited regulatory information and platform functionality constraints before making trading decisions.

Key advantages include Islamic compliance, competitive leverage offerings, and multiple account types. Primary disadvantages include unclear regulatory oversight, limited platform information accessibility, and gaps in customer service documentation. Prospective clients should conduct thorough due diligence and verify regulatory compliance in their jurisdiction before proceeding with account opening.