Darwinex 2025 Review: Everything You Need to Know

Summary

This darwinex review gives you a complete look at Darwinex. The company started in 2012 and has its main office in London. Darwinex works differently than most brokers because it acts as both a broker and a tech company that helps traders build proven track records through their smart platform.

The company mixes blockchain technology with automated trading solutions. This gives traders a unique way to trade forex and CFDs. Darwinex charges a competitive 15% success fee and follows rules from both the UK's FCA and Spain's CNMV.

The platform works best for intermediate and advanced traders who want tech tools to improve their trading skills and build solid trading histories. The broker lets you trade forex, indices, and commodity CFDs, but some key details about account conditions and user feedback are hard to find in public information. The broker focuses on tech-driven solutions and clear fee structures, which makes it interesting for traders who like innovation and regulatory protection.

However, you should know that complete information about certain trading conditions and user experiences may require direct contact with the broker.

Important Disclaimers

Darwinex registers in both the United Kingdom and Spain, so different regulatory requirements may apply depending on where you live. UK clients get FCA oversight, while Spanish operations follow CNMV regulations. This dual-jurisdiction setup may result in different levels of investor protection and different terms of service.

This evaluation uses publicly available information and market feedback. The review does not include specific user ratings or detailed complaint data because comprehensive user feedback databases were not available during the research process. Potential traders should do additional research and consider requesting updated information directly from Darwinex before making investment decisions.

Overall Rating Framework

Broker Overview

Darwinex started in 2012 as an innovative financial technology company with its headquarters in London. The company positions itself uniquely in the financial services sector, operating not just as a traditional broker but as a complete technology provider focused on helping traders develop and showcase proven trading records.

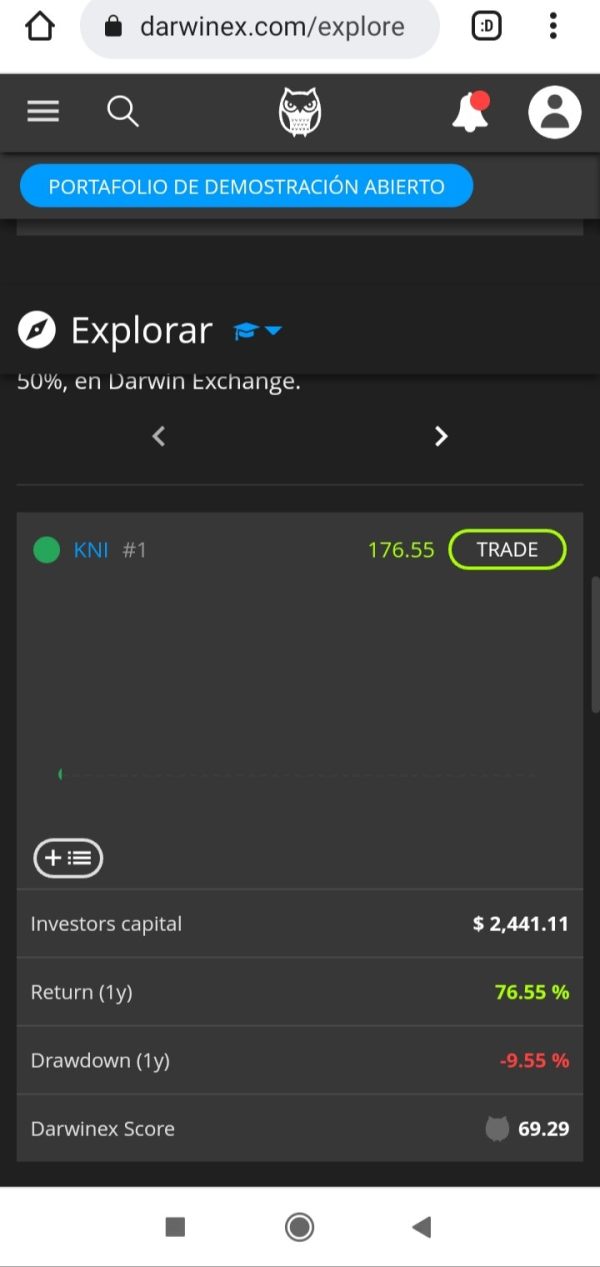

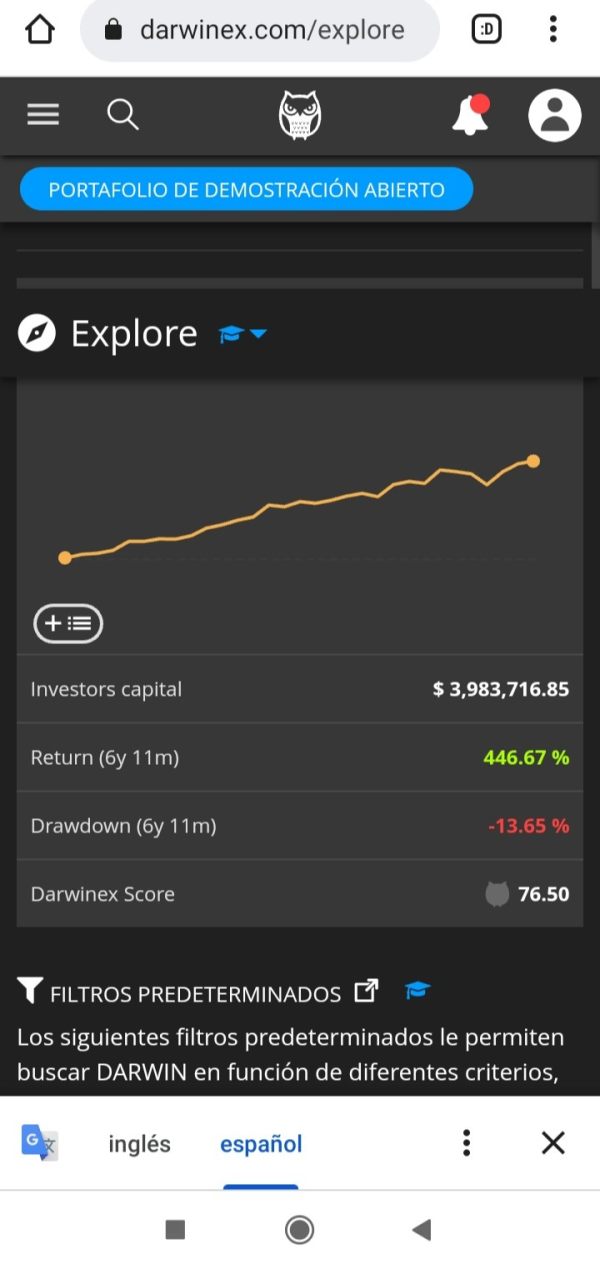

This distinctive approach sets Darwinex apart from conventional brokerage models because they emphasize the integration of advanced technology solutions with traditional trading services. The company's primary business model revolves around providing technological infrastructure that enables traders to build credible, blockchain-verified trading histories. This approach appeals particularly to serious traders who understand the value of transparent performance tracking and wish to establish professional trading credentials.

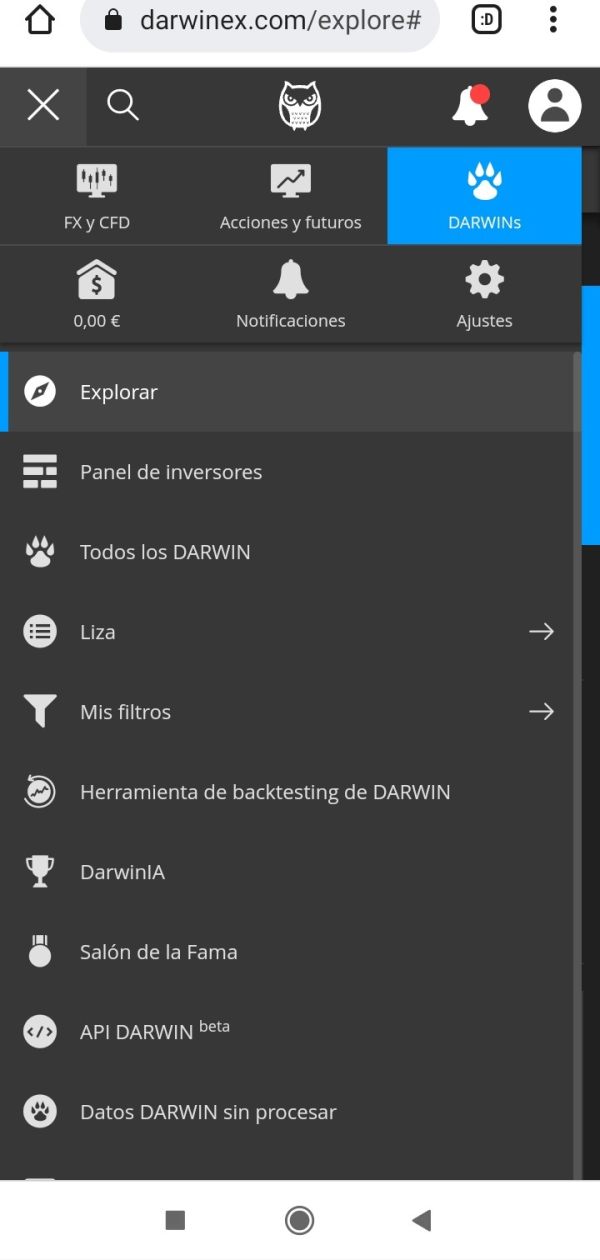

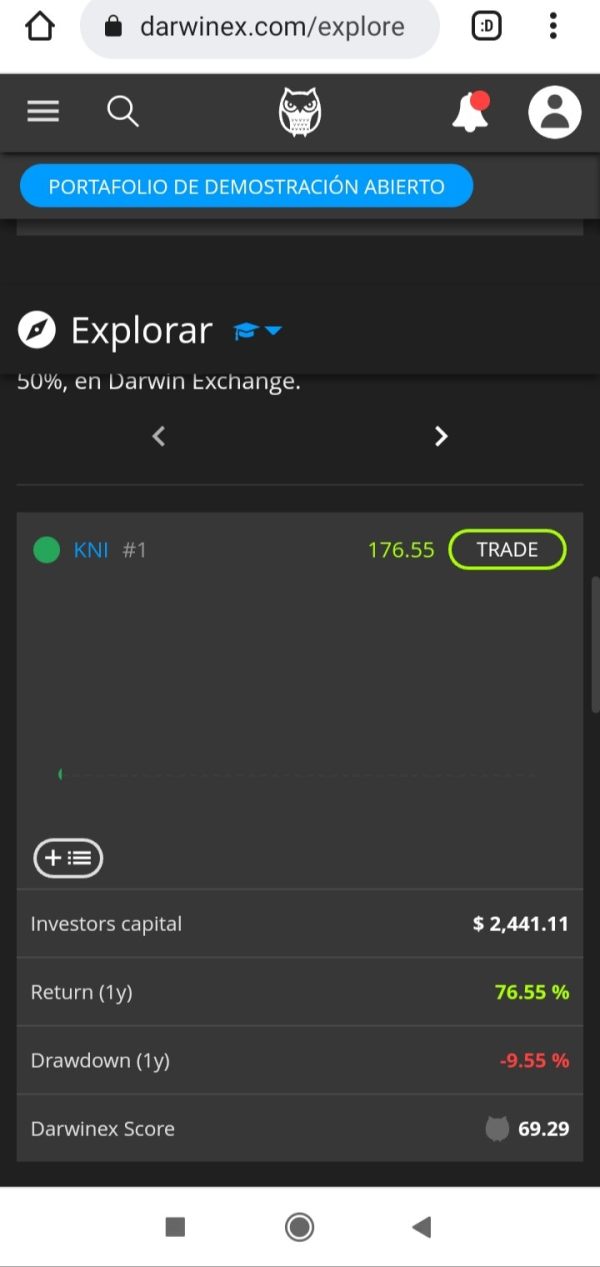

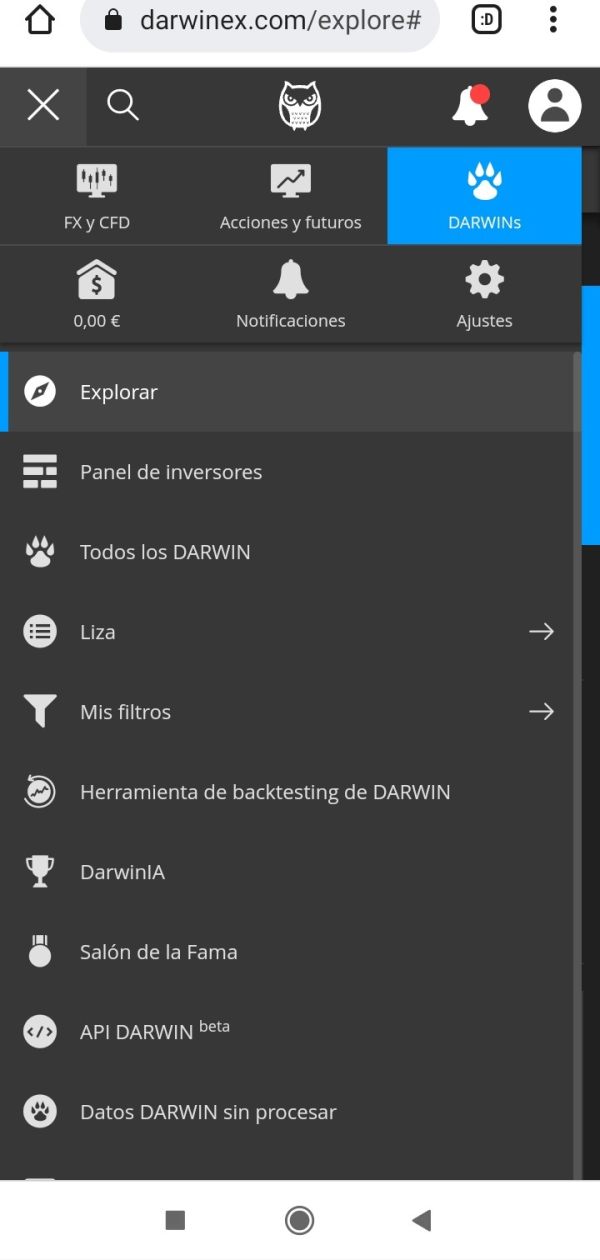

Darwinex's commitment to technology-driven solutions reflects the evolving landscape of modern financial markets, where data verification and algorithmic trading play increasingly important roles. Regarding trading capabilities, this darwinex review reveals that the broker provides access to multiple asset classes including foreign exchange markets, global indices, and commodity CFDs.

The platform operates under dual regulatory oversight, maintaining compliance with both the Financial Conduct Authority (FCA) in the United Kingdom and the Comisión Nacional del Mercado de Valores (CNMV) in Spain. This dual-jurisdiction approach provides traders with robust regulatory protection while enabling the company to serve a broader European client base effectively.

Regulatory Framework: Darwinex operates under strict regulatory oversight from two major European financial authorities. The FCA regulation provides UK-standard investor protections, while CNMV oversight ensures compliance with Spanish financial regulations, offering clients comprehensive regulatory coverage across key European markets.

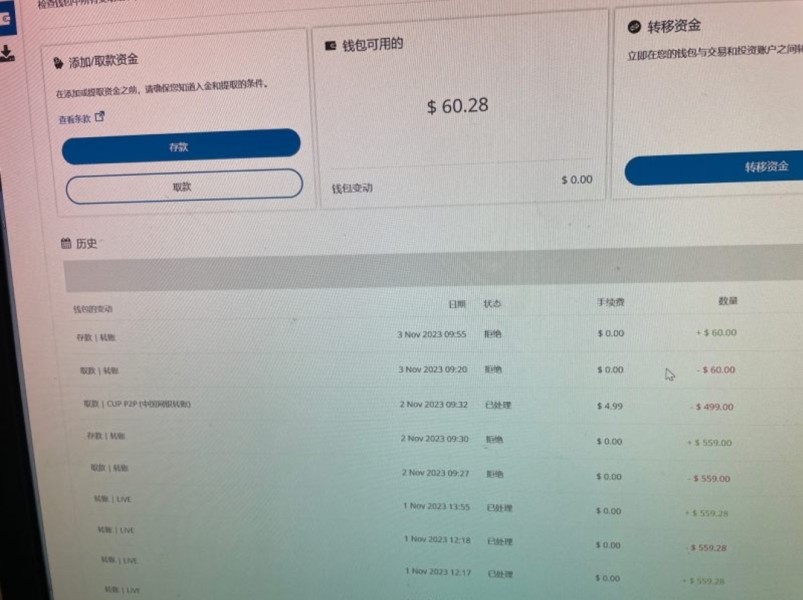

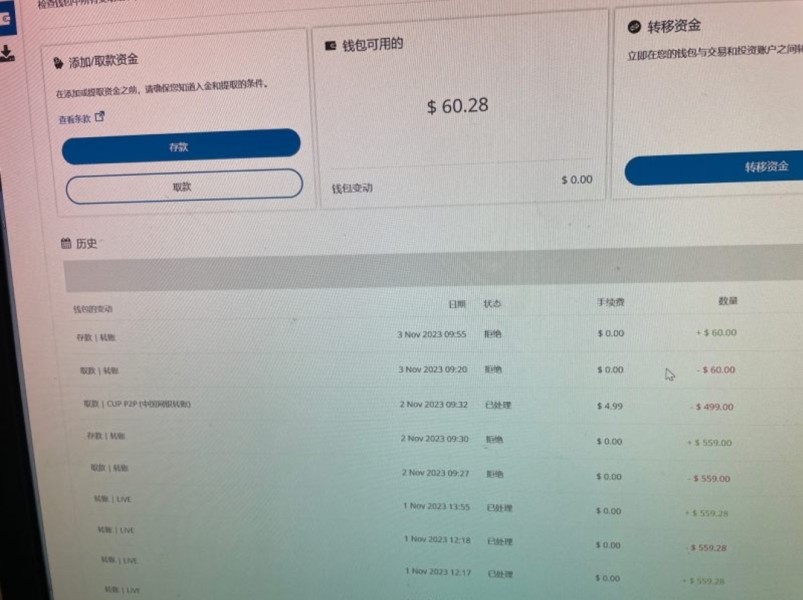

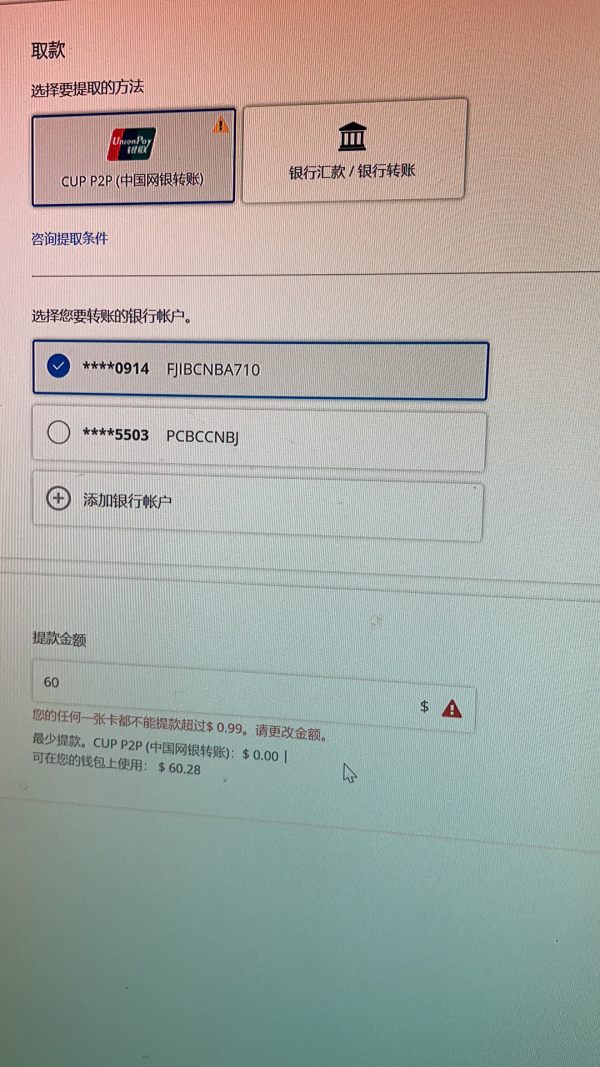

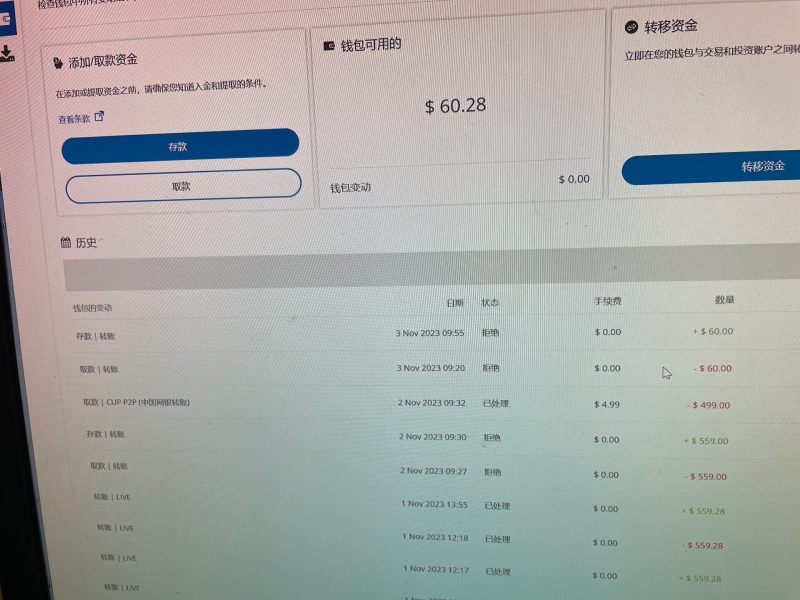

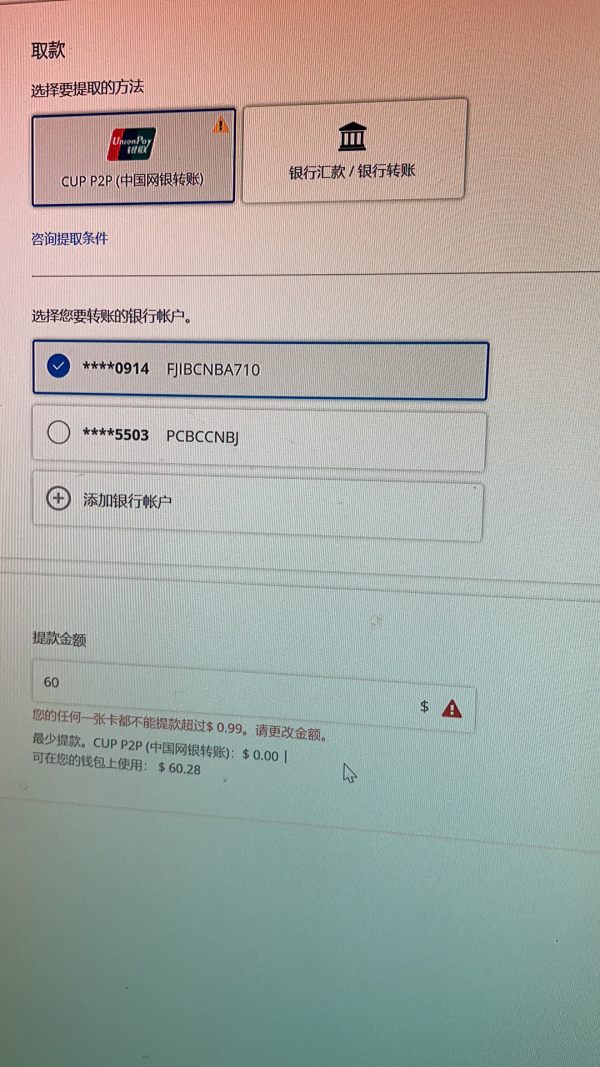

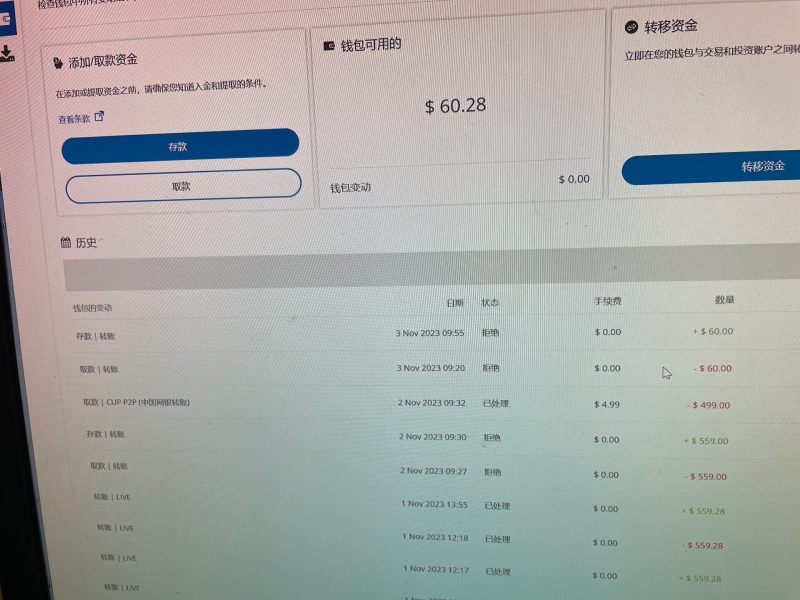

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods was not detailed in available sources. This means potential clients need to inquire directly with the broker for current payment processing options.

Minimum Deposit Requirements: The exact minimum deposit amount required to open an account with Darwinex was not specified in accessible documentation. This suggests that requirements may vary by account type or jurisdiction.

Promotional Offers: Current bonus structures or promotional campaigns were not detailed in available materials. This indicates that Darwinex may focus more on service quality than promotional incentives.

Available Trading Assets: The broker provides access to foreign exchange pairs, global stock indices, and commodity contracts for difference (CFDs). This offers a focused but comprehensive range of popular trading instruments suitable for diverse trading strategies.

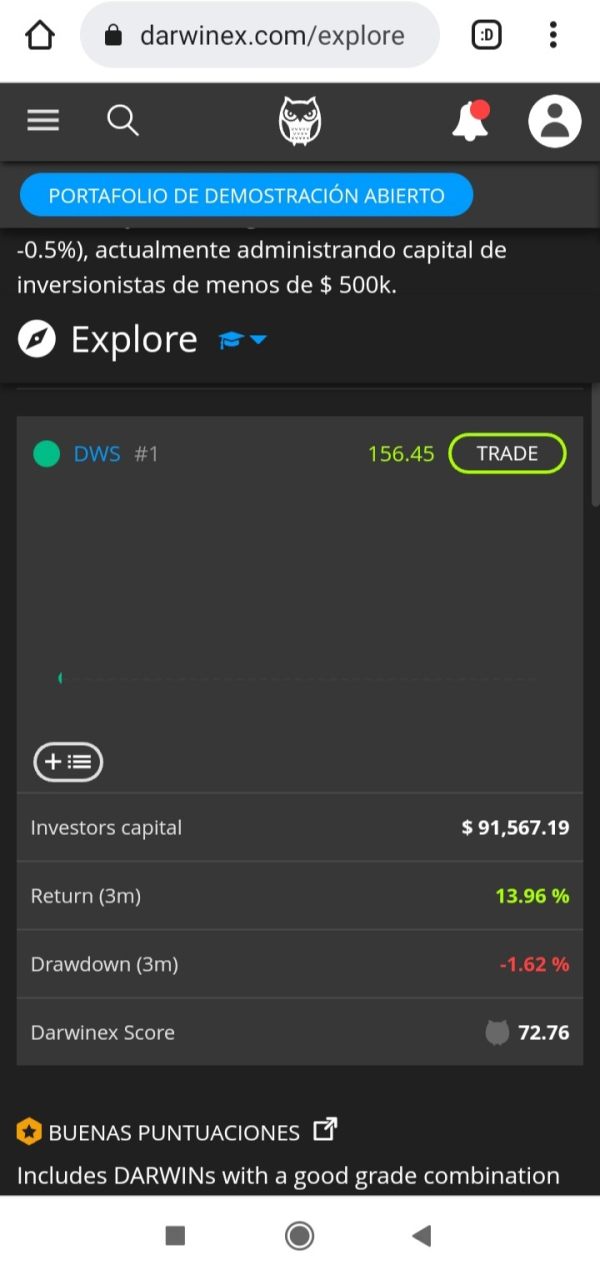

Cost Structure: Darwinex implements a performance-based fee model with a 15% success fee on profitable trades. This darwinex review notes that specific spread information and additional trading costs were not detailed in available sources, requiring direct inquiry for complete cost analysis.

Leverage Ratios: Maximum leverage ratios available to traders were not specified in accessible documentation. These likely vary based on asset class, account type, and regulatory jurisdiction.

Trading Platform Options: While automated trading capabilities are confirmed, specific platform software details were not provided in available materials.

Geographic Restrictions: Specific country restrictions or availability limitations were not detailed in accessible sources.

Customer Support Languages: Available customer service languages were not specified in reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions evaluation for Darwinex presents a mixed picture due to limited available information about specific account features and requirements. While the broker's 15% success fee structure is clearly communicated and appears competitive compared to traditional commission models, crucial details about account types, minimum deposits, and opening procedures remain unclear from publicly available sources. The absence of detailed information about various account tiers or special account features makes it challenging for potential traders to fully assess whether Darwinex's offerings align with their specific needs.

This darwinex review found no specific mention of Islamic accounts, professional trader classifications, or other specialized account types that many brokers typically offer to accommodate diverse trader requirements. The account opening process details were not comprehensively covered in available materials, leaving questions about verification requirements, documentation needs, and approval timeframes.

For traders seeking transparency in account conditions before committing to a broker relationship, this information gap represents a significant limitation that would require direct communication with Darwinex representatives to resolve.

Darwinex demonstrates a stronger performance in the tools and resources category, primarily due to its emphasis on technological innovation and automated trading capabilities. The broker's commitment to providing automated trading platforms suggests a focus on serving technically sophisticated traders who value advanced trading infrastructure over basic retail trading tools. The integration of blockchain technology into their platform represents a forward-thinking approach to trade verification and record-keeping, potentially offering traders enhanced transparency and credibility in their trading performance documentation.

This technological focus aligns well with current market trends toward algorithmic trading and systematic approach development. However, specific details about research resources, market analysis tools, and educational materials were not comprehensively covered in available sources.

The absence of information about fundamental analysis resources, technical analysis tools, or trader education programs limits the complete assessment of the broker's support infrastructure for trader development and market understanding.

Customer Service and Support Analysis (5/10)

The customer service evaluation for Darwinex faces significant limitations due to insufficient publicly available information about support channels, response times, and service quality metrics. Without access to specific customer service contact methods, operating hours, or multi-language support capabilities, it becomes challenging to assess the broker's commitment to client support adequately. The lack of detailed user feedback regarding customer service experiences further complicates this evaluation.

Professional brokers typically provide multiple contact channels including phone, email, live chat, and comprehensive FAQ sections, but specific details about Darwinex's support infrastructure were not readily available in reviewed materials. Response time expectations, problem resolution procedures, and escalation processes represent crucial aspects of customer service quality that remain unclear from available information.

This gap in publicly accessible service information may indicate that Darwinex relies more heavily on direct client communication rather than comprehensive public documentation of their support capabilities.

Trading Experience Analysis (5/10)

The trading experience assessment for Darwinex encounters significant challenges due to limited information about platform stability, execution quality, and overall user satisfaction with trading conditions. While the broker's focus on automated trading suggests sophisticated technological infrastructure, specific performance metrics and user experience data were not available in reviewed sources. Platform reliability, order execution speed, and slippage characteristics represent fundamental aspects of trading experience that directly impact trader success and satisfaction.

The absence of detailed information about these critical factors makes it difficult to provide a comprehensive assessment of what traders can expect when using Darwinex's trading environment. Mobile trading capabilities, platform customization options, and advanced order types availability also remain unclear from available documentation.

This darwinex review emphasizes that potential users seeking detailed trading experience information would need to request demonstrations or trial access directly from the broker to properly evaluate platform capabilities and performance characteristics.

Trust and Safety Analysis (7/10)

Darwinex demonstrates strong performance in the trust and safety category, primarily due to its robust regulatory framework and compliance with major European financial authorities. The dual oversight from both the FCA and CNMV provides traders with comprehensive regulatory protection that meets high European standards for financial services providers. FCA regulation ensures compliance with stringent UK financial conduct requirements, including segregated client funds, negative balance protection, and participation in the Financial Services Compensation Scheme.

Similarly, CNMV oversight provides Spanish regulatory protections and ensures adherence to MiFID II requirements across European Union markets. The company's establishment in 2012 demonstrates operational longevity in the competitive financial services sector, suggesting sustainable business practices and market acceptance.

However, specific information about additional safety measures such as insurance coverage, fund segregation details, or third-party auditing was not detailed in available sources, preventing a more comprehensive safety assessment.

User Experience Analysis (5/10)

The user experience evaluation for Darwinex faces substantial limitations due to insufficient publicly available user feedback and detailed interface information. Without access to comprehensive user reviews, satisfaction surveys, or detailed platform demonstrations, assessing the overall user experience becomes challenging and necessarily incomplete. Interface design quality, navigation ease, and overall platform usability represent crucial factors that directly impact trader satisfaction and effectiveness.

The broker's emphasis on technology and automated trading suggests potential sophistication in platform design, but specific user experience details require direct platform evaluation to assess properly. Registration and account verification processes, fund management procedures, and overall platform learning curves remain unclear from available documentation.

The absence of detailed user testimonials or independent platform reviews limits the ability to provide comprehensive guidance about what new users can expect when beginning their relationship with Darwinex.

Conclusion

This darwinex review reveals a broker with distinctive technological focus and solid regulatory foundations, though limited publicly available information prevents a complete assessment. Darwinex appears well-suited for intermediate to advanced traders who value innovative technology solutions and regulatory compliance over extensive educational resources or comprehensive public documentation. The broker's strengths include strong regulatory oversight from both FCA and CNMV, competitive 15% success fee structure, and commitment to technological innovation including blockchain integration.

However, the lack of detailed information about account conditions, user experiences, and specific trading terms represents a significant limitation for traders seeking comprehensive transparency before committing to a broker relationship. Darwinex would likely appeal most to technically sophisticated traders who appreciate automated trading capabilities and are comfortable conducting direct inquiries to obtain detailed service information.

Traders prioritizing extensive public documentation, comprehensive educational resources, or detailed user review availability might find other brokers more suitable for their research and decision-making processes.