Executive Summary

This kanak capital markets review gives you a complete look at this brokerage firm. The company has made itself a top global online trading platform. It started in 2012 and has its main office in Mauritius, where it follows the rules of the Mauritius Financial Services Commission (FSC) with license number GB24203407. The broker lets you trade stocks, forex, indices, and commodities. You can get leverage up to 3000:1.

The company just won "Best Online Trading Platform for Multi-Asset Brokerage" at the Forex Traders Summit 2025. This shows the company is getting more respect in the industry. Users say withdrawals happen very fast, with some people getting their money in just 4 hours. The platform works mainly for global online traders who want high-leverage trading.

But this review found big gaps in information about trading rules, fees, and platform details. Users say good things about getting their money out and making trades, but there isn't enough information about the full trading terms for new clients to think about.

Important Notice

This review uses public information and user feedback from different sources. Kanak Capital Markets works mainly under Mauritius law, which might give different protections to users in other countries. The company's rules outside Mauritius aren't explained in the materials we found, which could affect international clients' legal options.

We looked at public information, user stories, and industry reports. Since there isn't much detailed information about specific trading conditions and platform features, this review focuses on facts we could check while pointing out areas where we don't have complete information.

Overall Rating Framework

Company Overview

Kanak Capital Markets started in 2012. The company calls itself "a leading global online trading platform and trading provider." It's based in Mauritius and follows the rules of the Mauritius Financial Services Commission (FSC), holding license number GB24203407. The company focuses on giving multi-asset trading services to clients around the world, especially those who want high-leverage trading.

The broker just won "Best Online Trading Platform for Multi-Asset Brokerage" at the Forex Traders Summit 2025 in Dubai. This shows the industry is starting to notice them more. Reports say this award was "selected by a panel of industry experts" and recognizes the company's "strong performance in delivering versatile, high-speed trading platforms tailored to the needs of modern traders."

You can trade four main types of assets: stocks, forex, indices, and commodities. The company says they offer "over 150+ instruments in different asset classes" with "24/5 pricing on important indices and commodities." They also have an Introducing Broker (IB) program that offers "competitive IB commission rates" to partners who want to bring more clients to Kanak Capital Markets.

Regulatory Jurisdiction: Kanak Capital Markets follows the rules of the Mauritius Financial Services Commission (FSC) with license number GB24203407. Mauritius is known as a good place for financial services, but the protections might be different from major financial centers.

Deposit and Withdrawal Methods: The available payment methods aren't explained in the materials we found. But users say withdrawals work well, and bank transfers are available.

Minimum Deposit Requirements: The company doesn't say what the minimum deposit amounts are. This is a big gap in information for people thinking about opening accounts.

Promotional Offers: There's no information about welcome bonuses, trading rewards, or special deals in the materials we could find.

Tradeable Assets: You can trade stocks, forex, indices, and commodities on the platform. The company says they offer "over 150+ instruments in different asset classes." Energy products are specifically mentioned as part of what you can trade.

Cost Structure: Commission rates, spread information, and fee schedules aren't explained in available materials. This makes it hard for potential clients to compare costs when reading this kanak capital markets review.

Leverage Ratios: You can get maximum leverage of 3000:1. This is one of the highest leverage offers in the retail trading market.

Platform Options: The company offers online trading platforms you can download for desktop and mobile. But they don't say which specific platforms (MT4, MT5, or their own) they use.

Geographic Restrictions: There's no information about which countries can't use the service or regional limits.

Customer Support Languages: The company doesn't say which languages their customer service supports.

Detailed Rating Analysis

Account Conditions Analysis (Score: 6/10)

The account conditions at Kanak Capital Markets show both good and bad points based on what we know. The biggest feature is the maximum leverage of 3000:1, which puts the broker among those offering very high leverage ratios. This level of leverage can attract experienced traders who want maximum capital efficiency, but it also makes risk much higher.

But big gaps in information make it hard to fully judge account conditions. We don't know the minimum deposit requirements, so potential clients can't understand what barriers they face to start. Also, we don't know about different account types, so traders can't see if the broker offers accounts with different benefits or special accounts like Islamic accounts for Muslim traders.

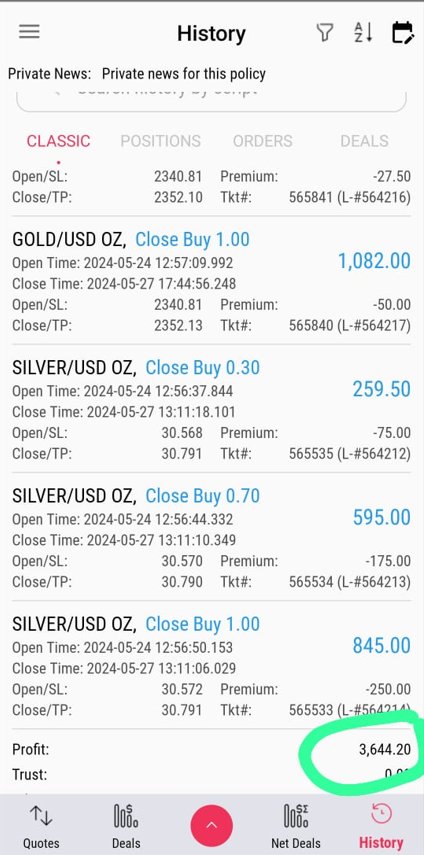

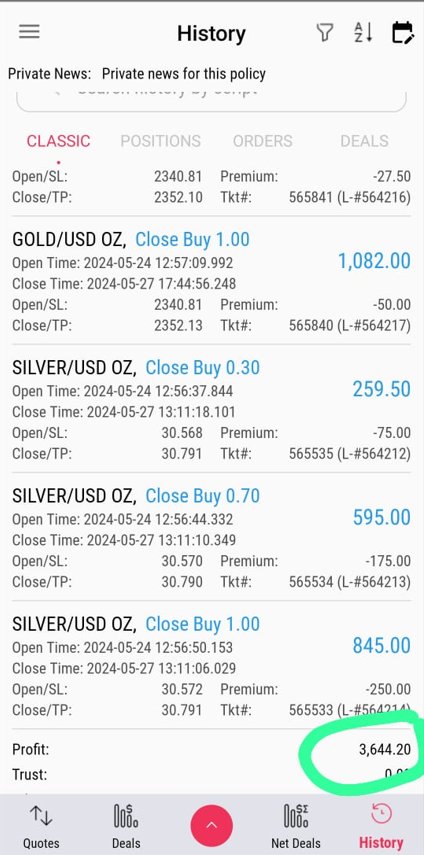

User feedback shows that putting money in and taking money out works well. One person said they successfully withdrew $22,000 within 4 hours. This shows that basic account operations work properly, but we still don't understand the bigger account structure.

The company's IB program suggests some level of account sophistication. They mention offering "competitive IB commission rates" and partnership opportunities. But without detailed account information, this kanak capital markets review can't give a complete evaluation of account conditions.

The trading tools and resources at Kanak Capital Markets are hard to judge because we don't have enough information. The company says it operates as a multi-asset trading platform with access to "over 150+ instruments," but they don't give specific details about trading tools, analysis resources, and educational materials.

The platform claims to offer "high-speed trading platforms tailored to the needs of modern traders." This suggests some level of good technology. But without knowing about charting abilities, technical analysis tools, or automated trading support, traders can't tell if the platform meets their analysis needs.

Research and market analysis resources aren't explained in available materials. Many competing brokers give daily market updates, economic calendars, and research reports, but we don't know what Kanak Capital Markets offers in this area. We also don't have information about educational resources for traders who want to learn and develop their skills.

The company mentions providing "24/5 pricing" on major instruments. This shows real-time market data is available during standard trading hours. But we don't know about the depth of market data, quote accuracy, and additional analysis features.

Customer Service and Support Analysis (Score: 7/10)

Customer service performance at Kanak Capital Markets gets a relatively good assessment based on user feedback we found. The most important positive sign comes from user stories about fast withdrawal processing, with one client saying they got substantial funds within 4 hours of asking for them.

This quick turnaround time suggests efficient back-office operations and responsive customer service for money transactions. According to the user testimonial, "the funds were received within 4 hours of time in my registered bank account," showing streamlined withdrawal procedures that many traders care about when picking a broker.

But we don't have detailed information about customer service channels, availability hours, and support quality. We don't know about live chat, phone support, email response times, or multilingual support capabilities, which limits how well we can judge the service.

One user comment suggests that negative reviews might come from client trading losses rather than service problems. They said "these reviews are wrong and i guess those people lost their money due to their greediness." While this is just one person's view, it shows that at least some clients have positive service experiences.

Trading Experience Analysis (Score: 6/10)

The trading experience at Kanak Capital Markets shows good signs based on limited feedback we found. User testimonials suggest good trade execution, with one client mentioning successful completion of multiple trades through the platform's "Equity manager" service.

Platform stability seems adequate based on user feedback showing smooth trading operations. The company's recent industry award for "Best Online Trading Platform for Multi-Asset Brokerage" suggests industry experts recognize platform performance, but we don't have specific performance numbers.

You can download trading platforms for desktop and mobile devices, which shows accessibility across different trading environments. But we don't have information about specific platform features, order types, execution speeds, or slippage statistics, which limits technical evaluation of the trading environment.

The high leverage offering of 3000:1 gives significant trading flexibility for experienced traders. But this also increases risk exposure substantially. The platform's claim of offering "over 150+ instruments" suggests reasonable market coverage across the advertised asset classes of stocks, forex, indices, and commodities.

This kanak capital markets review notes that while basic trading functionality seems to work based on user feedback, we can't fully evaluate the trading experience without detailed platform specifications.

Trust and Reliability Analysis (Score: 7/10)

Kanak Capital Markets shows several positive trust signs, but some transparency gaps limit how well we can judge reliability. The company operates under regulation from the Mauritius Financial Services Commission (FSC) with license number GB24203407, providing regulatory oversight and client protection frameworks established by Mauritian financial law.

The recent industry recognition as "Best Online Trading Platform for Multi-Asset Brokerage" at the Forex Traders Summit 2025 represents third-party validation of the company's operations. According to reports, this award was "selected by a panel of industry experts," suggesting professional recognition within the trading industry.

User testimonials provide additional trust indicators, especially about fund security and withdrawal reliability. The reported successful withdrawal of $22,000 within 4 hours shows that client funds are accessible and withdrawal processes work as expected. This user also mentioned putting in "even bigger amount" later, showing continued confidence in the platform.

But certain transparency elements that make trust stronger aren't detailed in available materials. We don't have information about fund segregation, insurance coverage, financial reporting, or audit procedures. The company's operational history since 2012 shows some stability, but we don't have detailed track record information.

We didn't find significant negative regulatory actions or widespread client complaints in available sources. This suggests stable operations, but we need broader information access for comprehensive reputation assessment.

User Experience Analysis (Score: 6/10)

User experience evaluation at Kanak Capital Markets is based mainly on limited testimonial feedback. We don't have comprehensive usability information available. The most significant positive user experience indicator relates to financial operations, with clients reporting smooth withdrawal processes and rapid fund transfers.

Platform accessibility seems adequate with downloadable applications available for multiple devices. This suggests consideration for user convenience across different trading environments. The company's emphasis on providing "high-speed trading platforms" shows focus on performance aspects that affect user experience.

But we don't have details about critical user experience elements in available materials. Information about registration procedures, account verification processes, platform navigation, or interface design isn't specified. These factors significantly impact overall user satisfaction but can't be evaluated based on available information.

The user testimonial suggesting that negative reviews come from "greediness" rather than platform issues gives one perspective on user experience. But this represents limited feedback. The same user's decision to increase their deposit after initial positive experiences suggests satisfaction with platform performance.

We don't have descriptions of account management features, customer portal functionality, and self-service capabilities in available materials. For a comprehensive kanak capital markets review, these elements would typically factor significantly into user experience assessment, but current information limitations prevent detailed evaluation.

Conclusion

This kanak capital markets review shows a broker with several notable strengths alongside significant information gaps that potential clients should carefully consider. The company's FSC regulation, recent industry award, and positive user feedback about withdrawal processing suggest legitimate operations with functional core services. The extremely high leverage of 3000:1 and multi-asset trading capabilities work well for traders seeking flexible, high-risk trading opportunities.

But the substantial lack of detailed information about trading conditions, fee structures, and platform specifications creates evaluation challenges. Potential clients should talk directly with the broker to get comprehensive details about costs, account types, and platform features before making trading decisions.

Kanak Capital Markets appears most suitable for experienced traders comfortable with high-leverage environments. They should also be willing to do thorough research given the limited publicly available information about specific trading terms and conditions.