Is SABLE safe?

Pros

Cons

Is Sable Safe or a Scam?

Introduction

Sable, a relatively new entrant in the forex market, has been making waves among traders looking for innovative trading solutions. Established in 2024 and based in the United Kingdom, Sable presents itself as a modern trading platform catering to a diverse range of traders. However, the importance of thoroughly evaluating forex brokers cannot be overstated, as the potential for scams and fraudulent activities is prevalent in the industry. Traders must be cautious and conduct comprehensive research before engaging with any broker to protect their investments. This article aims to assess whether Sable is a safe trading option or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory landscape is a critical aspect of assessing whether Sable is safe for traders. A regulated broker is typically subject to strict oversight, which helps protect clients' funds and ensures fair trading practices. Unfortunately, Sable operates without any regulatory oversight, which raises significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a valid regulatory framework means that traders have no recourse to regulatory bodies in case of disputes or issues. This lack of oversight can lead to unethical practices, including difficulties in fund withdrawals and hidden fees. Moreover, the historical compliance of the broker is also questionable, as there are no records indicating that Sable has ever been regulated by reputable authorities such as the Financial Conduct Authority (FCA) in the UK or others. Therefore, it is essential for potential clients to exercise extreme caution when considering Sable as a trading platform.

Company Background Investigation

Sable was founded in 2024, making it a relatively new player in the forex market. While the company claims to provide a modern trading experience, its brief history raises questions about its stability and reliability. The ownership structure remains unclear, as there is limited information available about the individuals behind the company. This lack of transparency can be a red flag for potential investors.

Additionally, the management teams background and experience are crucial in determining the broker's credibility. Unfortunately, Sable has not provided sufficient information regarding the qualifications of its leadership, which further complicates the evaluation of its trustworthiness. Transparency in a broker's operations and ownership is vital for building trust with clients, and Sable's current level of disclosure does not inspire confidence.

Trading Conditions Analysis

Understanding the trading conditions offered by Sable is essential for evaluating its overall value to traders. The broker claims to offer competitive trading costs, but the lack of clarity regarding fees and spreads raises concerns.

| Fee Type | Sable | Industry Average |

|---|---|---|

| Spread on Major Pairs | Not Specified | 1-2 pips |

| Commission Structure | Not Specified | $5-$10 per lot |

| Overnight Interest Range | Not Specified | 0.5%-2.0% |

The absence of clear information on spreads and commissions makes it challenging for traders to assess the overall cost of trading with Sable. Potential clients should be wary of brokers that do not provide transparent fee structures, as this can lead to unexpected costs that diminish profitability. Additionally, any unusual or hidden fees can be a significant concern, particularly for inexperienced traders who may not be aware of the intricacies of trading costs.

Client Funds Security

The security of client funds is a paramount concern for any trader. Sable's approach to safeguarding client assets is crucial in determining whether it is a safe trading option. Unfortunately, Sable does not appear to have robust measures in place for fund protection.

The absence of fund segregation and investor protection schemes raises alarms about the safety of deposits. Traders should be particularly cautious when dealing with unregulated brokers, as they may not have the necessary safeguards to protect client funds. Furthermore, any historical issues related to fund security or disputes could indicate a pattern of negligence that potential clients should be aware of.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the real-world experiences of traders using Sable. Reviews and testimonials often reveal common patterns of complaints that can indicate potential issues with the broker.

| Complaint Type | Severity | Company Response |

|---|---|---|

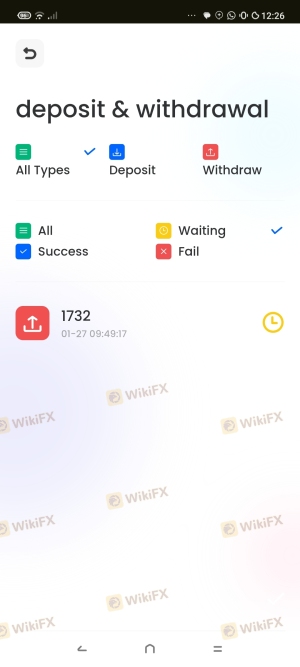

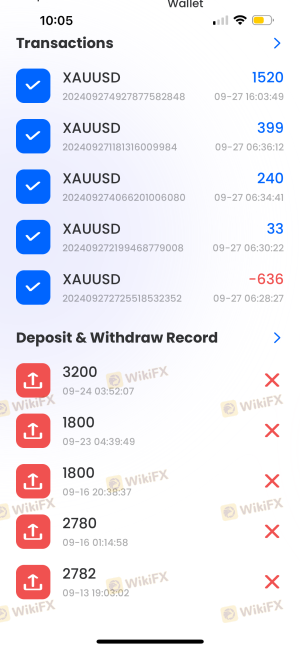

| Withdrawal Issues | High | Slow response |

| Poor Customer Support | Medium | Limited channels |

| Account Restrictions | High | Delayed resolutions |

Numerous users have reported difficulties in withdrawing funds, which is a significant red flag. Complaints about poor customer support further exacerbate concerns, as traders rely on timely assistance when issues arise. The severity of these complaints suggests that Sable may not be adequately equipped to handle customer needs, which could lead to frustration and financial loss for traders.

Platform and Execution

The performance and reliability of a trading platform are critical factors for any trader. Sable's platform is designed to provide a seamless trading experience, but the quality of execution is equally important. Traders have reported mixed experiences regarding order execution, with some experiencing slippage and rejected orders.

A platform that frequently experiences technical issues can significantly impact traders' ability to capitalize on market opportunities. Furthermore, any indications of platform manipulation should be thoroughly investigated, as this could signal deeper issues within the broker's operations.

Risk Assessment

Engaging with Sable presents several risks that potential traders should consider before making any commitments.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for fund loss |

| Operational Risk | Medium | Technical issues with the platform |

The lack of regulation and oversight is a primary concern, as it leaves traders vulnerable to unethical practices. Additionally, the potential for financial loss due to withdrawal issues and poor customer support further compounds the risks associated with trading with Sable. Traders should approach this broker with caution and consider implementing risk mitigation strategies, such as limiting the amount of capital invested.

Conclusion and Recommendations

In conclusion, based on the gathered evidence, Sable raises several red flags that suggest it may not be a safe trading option. The absence of regulatory oversight, unclear trading conditions, and numerous customer complaints indicate a broker that could pose significant risks to traders.

Therefore, it is advisable for traders, especially those who are inexperienced or risk-averse, to approach Sable with caution. If you are considering trading in the forex market, it may be prudent to explore alternative brokers that are well-regulated and have a proven track record of transparency and customer support.

In summary, is Sable safe? The evidence points to a broker that may not be trustworthy, and potential clients should be vigilant in their research and decision-making processes.

Is SABLE a scam, or is it legit?

The latest exposure and evaluation content of SABLE brokers.

SABLE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SABLE latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.