FXPesa, operating under EGM Securities Limited, commenced its trading services in 2019 and quickly garnered recognition in the Kenyan forex landscape. Headquartered in Nairobi, Kenya, and regulated by the Capital Markets Authority (CMA), FXPesa stands out as the first licensed non-dealing online forex broker in the country. The brokers affiliation with the FCA in the UK further enhances its credibility, assuring clients of compliance with strict regulatory requirements intended to safeguard investor resources.

FXPesa specializes in forex and CFD trading, providing access to over 66 diverse currency pairs alongside various assets, including indices, commodities, and shares. Its commitment to enabling retail traders to access the forex market is exemplified by innovative local payment solutions, including the popular mobile payment platform M-Pesa. Recognizing the need for educational resources, FXPesa also offers a comprehensive suite of materials designed to help traders hone their skills.

FXPesa operates under stringent regulations from both the Capital Markets Authority (CMA) in Kenya and the UKs Financial Conduct Authority (FCA). However, potential traders ought to be conscious of the mixed perceptions regarding the reliability of its customer service and the availability of necessary protections such as the negative balance protection, which is typically expected from well-reputed brokers.

- Visit the CMA Website: CMA Kenya

- Search for FXPesa: Use the license number 107 to verify.

- Check FCA Regulation: Go to FCA UK and input reference number 528328.

- Review User Feedback: Fetch insights from reviews on platforms such as Trustpilot and Forex Peace Army.

- Examine Fee Structures: Review FXPesas site for comprehensive fee details.

Industry Reputation and Summary

Users generally recommend FXPesa for its unique position within the Kenyan market as a regulated broker. However, some complain regarding withdrawal processes and the responsiveness of customer service.

"While FXPesa facilitates easy deposit options, I faced delays during withdrawals." – User Feedback

Trading Costs Analysis

Advantages in Commissions

FXPesa's commission structure is partly designed to be favorable to traders, reflecting lower upfront costs. The Executive account has no commission on trades, with spreads starting at 1.4 pips, which can be competitive for retail traders.

The "Traps" of Non-Trading Fees

Despite its competitive pricing structure, FXPesa can incur higher spreads than some competitors, particularly when compared against brokers like HotForex, which offers a typical spread for EUR/USD at 1.2 pips. User frustrations have stemmed from withdrawal charges imposed by certain payment methods.

"The 1% charge on Skrill withdrawals felt unnecessary after enjoying fee-free deposits." – User Feedback

Cost Structure Summary

FXPesa presents a dual account system that distinguishes itself by offering features catered to both beginner and more seasoned traders, thereby creating a versatile cost structure. The pros of lower starting capital are often offset by the slightly elevated trading costs.

FXPesa offers trading capabilities through popular platforms like Metatrader 4 (MT4) and a proprietary trading platform, along with the upcoming Metatrader 5 (MT5). Each platform provides unique features aimed at both beginners and seasoned traders, enabling diverse trading strategies.

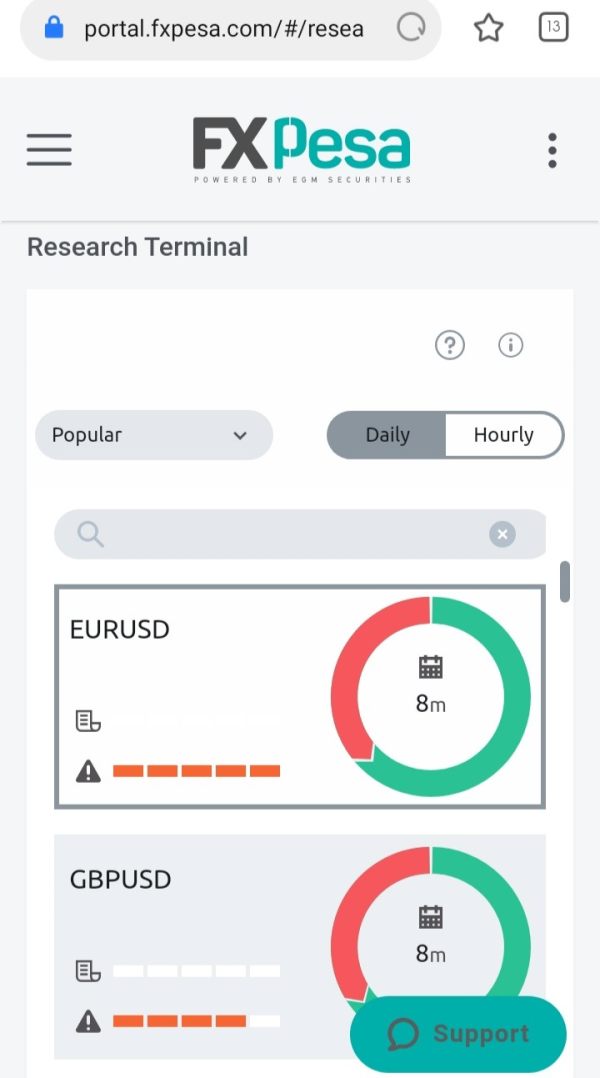

The selection of analytical tools, educational resources, and research publications stands out as a particular strength, aiding traders in making informed decisions. FXPesa's trade platforms also incorporate comprehensive functionalities, including advanced charting tools and automated trading features, which help streamline the trading experience.

Despite an overall positive reputation, some users find the lack of 24/7 support concerning, especially when encountering technical difficulties during trading hours.

"The functionality on MT4 was superb, but sometimes I wish support was more accessible." – User Feedback

User Experience Analysis

User Experience Summary

Clients have largely regarded FXPesa as user-friendly, particularly praised for its account creation and deposit processes. However, comments regarding the limited customer support hours underscore a potential area for improvement.

Customer Support Analysis

Customer Support Overview

Though customer support is available through various channels, including email, live chat, and phone, the hours are restricted from 7 AM to 9 PM, which might be limiting for traders operating across different time zones.

Account Conditions Analysis

Account Conditions Summary

FXPesa offers an array of account types, including an Executive account that allows traders to start with minimal deposits and a Premiere account that features lower spreads offset by commission fees. This balance of options makes FXPesa appealing to varying trader levels while keeping a key focus on educational support.

Conclusion

FXPesa presents a promising entry point into forex trading for Kenyan traders, combining a relatively low-cost entry barrier with a solid regulatory backing. However, prospective clients must thoroughly weigh the potential drawbacks, particularly the higher spreads and limited customer support hours, against the advantages. For beginner traders or those used to commission-free trading environments, FXPesa's platform warrants consideration as they navigate the complex landscape of forex trading.

This comprehensive assessment aims to provide potential FXPesa clients with an informed overview, ensuring they are well-equipped to make decisions aligned with their trading aspirations and risk tolerance.