Olymptrade 2025 Review: Everything You Need to Know

Executive Summary

This Olymptrade review gives you a complete look at one online trading platform that gets mixed reactions from traders. Olymptrade started in 2014 and works as a platform where you can trade many different things like forex, stocks, commodities, indices, and binary options. The platform has a user rating of 3.7 out of 5 based on 497 customer reviews, and 73% of people who reviewed it say they would recommend the service.

The platform does well because it offers many different assets and has a simple trading interface. This might work well for traders who want to spread their investments across different areas. However, our analysis shows big gaps in information about who watches over the platform and how clear they are about their operations, which makes us question if the platform is trustworthy in the competitive forex market.

Olymptrade focuses on traders who want to invest in many different assets, especially those who want to try binary options along with regular forex and CFD trading. Most users seem happy with the basic features, but concerns about unclear regulations and mixed user feedback mean that potential clients should be careful about what they expect.

Important Disclaimers

Regional Entity Differences: Olymptrade's regulatory status changes a lot depending on where you live. The information we have doesn't give clear details about which regulatory authorities watch over the platform's operations in different regions. You should check what regulatory status applies to your location before you start using the platform.

Review Methodology: This review is based on a thorough analysis of user feedback, market reports, and information that's available to the public. Our way of checking things uses multiple sources of information to give you balanced insights, though some details about how the platform works are limited because we don't have all the information we need from the materials we looked at.

Rating Framework

Broker Overview

Olymptrade started in the online trading world in 2014. The platform positions itself as a complete trading service designed to serve users around the world who want different investment opportunities. The company works by providing trading services for many different assets, and it focuses on making trading easy for both new and experienced traders through its own trading interface.

The company's main approach centers on offering many different things you can trade including foreign exchange pairs, individual stocks, various commodities, major indices, and binary options. Information from Forex Peace Army and other review platforms shows that Saledo Global LLC operates Olymptrade, though we don't have many details about the company's structure in the materials we can access.

Olymptrade uses its own trading platform instead of the MetaTrader systems that most established forex brokers use. This Olymptrade review notes that while the platform offers multiple types of assets, the lack of detailed regulatory information in sources we can easily find presents a big concern for potential users who want to check the service's credibility and compliance standards.

Regulatory Oversight: The materials we have don't specify which regulatory authorities supervise Olymptrade's operations. This represents a big information gap for traders who care about regulatory compliance and investor protection measures.

Deposit and Withdrawal Methods: We don't have specific information about available payment methods, processing times, and fees in the source materials. You'll need to ask the platform directly for complete details.

Minimum Deposit Requirements: The available information doesn't specify exact minimum deposit amounts. This typically changes based on account type and where you live.

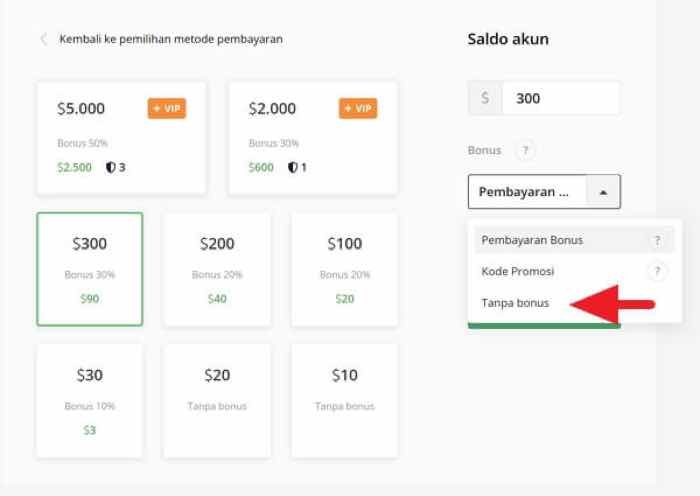

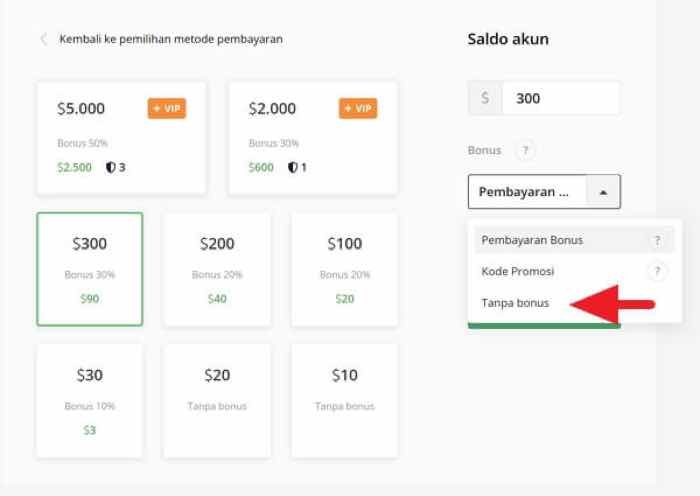

Promotional Offerings: The materials we can access don't outline details about bonus structures, promotional campaigns, or incentive programs for this Olymptrade review.

Available Trading Assets: The platform offers forex currency pairs, individual stocks, commodity instruments, major indices, and binary options. This gives traders diverse investment opportunities across different market sectors.

Cost Structure: The source materials don't detail specific information about spreads, commission rates, overnight fees, and other trading costs. This represents another area that needs direct verification.

Leverage Ratios: The available documentation doesn't specify maximum leverage offerings and risk management parameters.

Platform Technology: Olymptrade operates its own trading platform, which is different from industry-standard solutions like MetaTrader 4 or 5.

Geographic Restrictions: The accessible information doesn't outline specific regional limitations or restricted territories.

Customer Support Languages: The source materials don't specify available language support options.

Comprehensive Rating Analysis

Account Conditions Analysis (Score: 5/10)

Our evaluation of Olymptrade's account conditions shows big information limitations that impact how well we can assess the platform. The materials we have don't provide complete details about different account levels, their features, or specific requirements for opening and maintaining accounts. This lack of transparency about account structures represents a notable concern for traders who want to understand their options before committing to the platform.

We don't know the minimum deposit requirements, which usually serve as an important factor when choosing a broker. Without clear information about entry-level investment requirements, potential users can't properly assess whether the platform fits their financial capabilities and trading goals. The absence of details about account verification processes, required documentation, or time frames for account activation makes the evaluation process even more complicated.

The available materials don't mention specialized account features, such as Islamic accounts for traders who need Sharia-compliant trading conditions. This represents a potential limitation for traders with specific religious or cultural requirements. The overall lack of detailed account information in this Olymptrade review suggests that interested traders would need to contact the platform directly to get essential account-related details, which may not align with the transparent business practices expected in the forex industry.

Olymptrade offers multiple asset classes including forex, stocks, commodities, indices, and binary options. This shows a commitment to providing diverse trading opportunities. However, we don't know much about the quality and sophistication of specific trading tools based on available information.

We don't have detailed information about research and analysis resources, which represents a significant gap in our assessment. Modern traders typically expect access to market analysis, economic calendars, news feeds, and technical analysis tools to support their trading decisions. Without clear documentation of these resources, it becomes difficult to evaluate whether Olymptrade provides adequate analytical support for informed trading.

The accessible materials don't specifically outline educational resources, which are increasingly important for trader development and platform differentiation. We're uncertain about the availability and quality of educational content, webinars, tutorials, or market insights. Additionally, information about automated trading support, expert advisors, or algorithmic trading capabilities is not available, which limits our understanding of the platform's technical sophistication and appeal to advanced traders.

Customer Service and Support Analysis (Score: 5/10)

Our evaluation of Olymptrade's customer service capabilities faces significant limitations due to insufficient information in the available materials. The accessible documentation doesn't detail critical aspects of customer support, including available communication channels, operating hours, and response time commitments. This lack of transparency about support infrastructure raises concerns about the platform's commitment to customer service excellence.

The source materials don't specify multi-language support capabilities, which are essential for international trading platforms. Given the global nature of forex trading, the absence of clear information about language support options may indicate limitations in serving diverse international clientele effectively. Response time guarantees and service level commitments, which distinguish professional brokers from basic service providers, are not documented.

We don't know much about the quality of customer service interactions, problem resolution processes, and escalation procedures based on available information. The accessible materials don't prominently feature user feedback specifically addressing customer service experiences, making it difficult to assess real-world service quality. This information gap in our Olymptrade review suggests that potential users would need to test customer service responsiveness directly before committing to the platform.

Trading Experience Analysis (Score: 6/10)

The trading experience evaluation reveals mixed signals based on available user feedback and platform information. User reviews mention trading functionality, but the accessible materials don't quantify specific details about platform stability, execution speed, and order processing quality. The proprietary platform approach may offer unique features, but it also raises questions about industry-standard functionality and reliability.

The available documentation lacks detailed performance metrics about platform stability and execution speed, which are critical factors for successful trading outcomes. Without specific data about server uptime, latency measurements, or slippage statistics, traders cannot adequately assess the platform's technical reliability. Order execution quality, including fill rates and price accuracy, represents another area where detailed information would enhance evaluation capabilities.

The accessible materials don't thoroughly detail mobile trading capabilities, which are increasingly important for modern traders requiring flexibility and mobility. We don't know much about the quality of mobile applications, feature parity with desktop platforms, and mobile-specific functionality. Cross-platform synchronization and data consistency across different devices represent additional considerations that lack detailed coverage in this Olymptrade review.

Trust and Reliability Analysis (Score: 4/10)

Our trust and reliability assessment reveals significant concerns that impact Olymptrade's credibility within the competitive forex market. The absence of clear regulatory information in readily accessible materials represents a fundamental transparency issue that professional traders typically consider unacceptable. Regulatory oversight provides essential investor protections and operational standards that distinguish legitimate brokers from questionable operators.

Some user reviews specifically marked as "not recommended broker" indicate underlying trust issues within the user community. While not all negative feedback necessarily reflects platform deficiencies, the presence of explicit non-recommendation warnings suggests potential operational or service quality concerns that merit careful consideration. The lack of detailed information about fund security measures, segregated accounts, or investor protection schemes further compounds trust-related concerns.

Corporate transparency, including detailed company information, leadership profiles, and operational history, appears limited in the accessible materials. Professional forex brokers typically provide comprehensive corporate information to build trust and demonstrate legitimacy. The absence of such details in readily available sources may indicate either poor marketing practices or potential transparency issues that affect overall reliability assessment.

User Experience Analysis (Score: 6/10)

User experience evaluation shows moderate satisfaction levels based on available metrics, with a 3.7 rating from 497 reviews and 73% recommendation rate indicating generally acceptable performance. However, this moderate rating suggests room for improvement across various platform aspects. The mixed feedback pattern indicates that while many users find the platform satisfactory, significant portions experience issues that impact overall satisfaction.

The accessible materials don't detail interface design and usability assessments, limiting our ability to evaluate user interaction quality and platform intuitiveness. Registration and verification processes, which significantly impact initial user experience, lack detailed documentation regarding complexity, time requirements, or user-friendliness. These process details often determine whether new users successfully onboard or abandon the platform during initial setup.

The balance between positive and negative user feedback suggests that while Olymptrade provides functional trading services, it may not consistently meet user expectations across all service areas. This Olymptrade review doesn't thoroughly detail common user complaints and specific satisfaction drivers, indicating that potential users should carefully research recent user experiences before making platform commitments.

Conclusion

Olymptrade presents itself as a developing online trading platform with potential appeal for traders seeking multi-asset investment opportunities. The platform's strength lies in its diverse asset offerings, including forex, stocks, commodities, indices, and binary options, which may attract traders interested in portfolio diversification within a single platform environment. The moderate user satisfaction rate of 73% recommendations suggests that the platform provides functional basic services.

However, significant concerns about regulatory transparency and information availability limit its appeal to professional traders who prioritize compliance and operational clarity. The absence of detailed regulatory information, comprehensive account condition specifications, and transparent cost structures represents substantial gaps that potential users must consider carefully.

Olymptrade may be suitable for traders specifically interested in multi-asset trading who are willing to accept moderate service levels and conduct additional due diligence regarding regulatory compliance. However, traders who prioritize regulatory oversight, comprehensive platform information, and proven track records may find more suitable alternatives in the competitive forex market landscape.