24markets 2025 Review: Everything You Need to Know

Executive Summary

24markets is an online CFD and forex trading broker. It has gotten mixed reviews from traders. This 24markets review will look at what the platform offers, its good points, and problems based on user feedback and features.

The broker says it provides many different trading services. It gives access to forex, commodities, indices, stocks, and cryptocurrencies through MetaTrader 5 and web trading platforms. Users say the platform's main strengths are its easy-to-use interface and many different assets. This might make it good for traders who want variety in their investments.

But this 24markets review must also talk about big problems that users have mentioned. These include slow customer service and issues with fund safety. User reviews show mixed experiences - some like how easy the platform is to use, while others worry about withdrawing money and getting help from support.

24markets seems to target retail traders who want forex and CFD trading across many asset types. The platform offers good features for trading tools and asset variety, but potential users should think carefully about the reported problems before investing.

Important Notice

Regional Entity Differences: This review uses available information about 24markets. We did not find complete regulatory details for different areas. Traders should check regulatory status in their region before opening accounts.

Review Methodology: This evaluation uses user feedback analysis, platform feature assessment, and public information. All ratings and conclusions come from these sources and represent an independent analysis of the broker's services and user experiences.

Rating Framework

Broker Overview

24markets works as an online CFD and forex trading broker. It competes in the retail trading market. The company is based in South Africa and focuses on providing complete trading services across multiple asset classes.

The broker's business model centers on giving traders access to global financial markets. It uses advanced trading platforms and diverse investment opportunities. The platform's main offering includes forex pairs, commodities, stock indices, individual stocks, and cryptocurrency CFDs.

According to available information, 24markets wants to serve both new and experienced traders. It provides accessible trading technology combined with a broad range of tradeable instruments.

Trading Infrastructure: 24markets provides the industry-standard MetaTrader 5 platform alongside proprietary web-based trading solutions. The MetaTrader 5 integration shows the broker knows that professional-grade trading tools are important. The web platform offers accessibility for traders who prefer browser-based solutions.

This dual-platform approach in our 24markets review shows an attempt to serve different trader preferences and technical needs. The broker offers trading across five major asset categories: foreign exchange pairs, commodities including precious metals and energy products, major stock indices, individual company stocks, and cryptocurrency CFDs.

This variety allows traders to build different portfolios and take advantage of different market conditions across asset classes.

Regulatory Status: We did not find specific regulatory information in available source materials. This may impact trader confidence and should be checked independently by potential clients.

Deposit and Withdrawal Methods: We did not find detailed information about funding methods in the reviewed materials. Potential clients need to ask the broker directly for specific payment options and processing times.

Minimum Deposit Requirements: We did not find specific minimum deposit amounts in available sources. This suggests potential clients should contact the broker directly for account opening requirements.

Bonuses and Promotions: According to Forex Bonuses, 24markets offers trading bonuses and promotional activities. However, we did not find specific terms and conditions in the available information.

Tradeable Assets: The platform provides access to forex currency pairs, commodity CFDs, stock index CFDs, individual stock CFDs, and cryptocurrency CFDs. This offers traders variety opportunities across major asset classes.

Cost Structure: We did not find detailed information about spreads, commissions, and other trading costs in the source materials. This represents a significant information gap for this 24markets review.

Leverage Ratios: We did not find specific leverage offerings in available sources. This information is crucial for risk management and should be checked with the broker.

Platform Options: 24markets offers MetaTrader 5 and web-based trading platforms. This provides both professional-grade and accessible trading solutions.

Geographic Restrictions: We did not find information about regional trading restrictions in source materials.

Customer Support Languages: We did not find specific language support details in available sources.

Detailed Rating Analysis

Account Conditions Analysis

Unfortunately, we did not find complete information about 24markets' account structure in the source materials reviewed for this analysis. This represents a big limitation in providing a complete 24markets review. Account conditions are basic to trader decision-making.

Typically, forex brokers offer multiple account tiers with different minimum deposits, spreads, and features. Without specific details about 24markets' account types, minimum funding requirements, or special account features such as Islamic accounts, potential traders cannot properly assess whether the broker's offerings match their needs and trading capital.

The absence of clear account condition information may show either limited transparency in marketing materials or gaps in publicly available information. Future traders should directly contact 24markets to get detailed account specifications. This includes any premium account benefits, minimum deposit requirements, and account-specific trading conditions.

This information gap significantly impacts our ability to provide a complete evaluation of the broker's competitiveness in the retail trading market. Account flexibility and accessibility are crucial factors for trader satisfaction.

24markets shows strength in its platform offerings. It particularly shines through providing MetaTrader 5, which is widely seen as an industry-standard professional trading platform. User feedback shows that the platform interface is generally user-friendly. This suggests that the broker has successfully put MT5's capabilities in an accessible way.

The MetaTrader 5 platform provides advanced charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and complete order management features. This professional-grade platform access represents a significant positive aspect of the 24markets offering. This is particularly true for traders who require advanced analysis and execution tools.

Additionally, the broker offers web-based trading solutions. These provide accessibility for traders who prefer browser-based platforms or need to trade from devices where software installation is not possible. This dual-platform approach shows an understanding of diverse trader needs and technology preferences.

However, we did not find information about additional research resources, market analysis, educational materials, or proprietary trading tools in the source materials. These extra resources often set brokers apart in competitive markets. Their absence from available information may show either limited offerings or insufficient marketing of these services.

Customer Service and Support Analysis

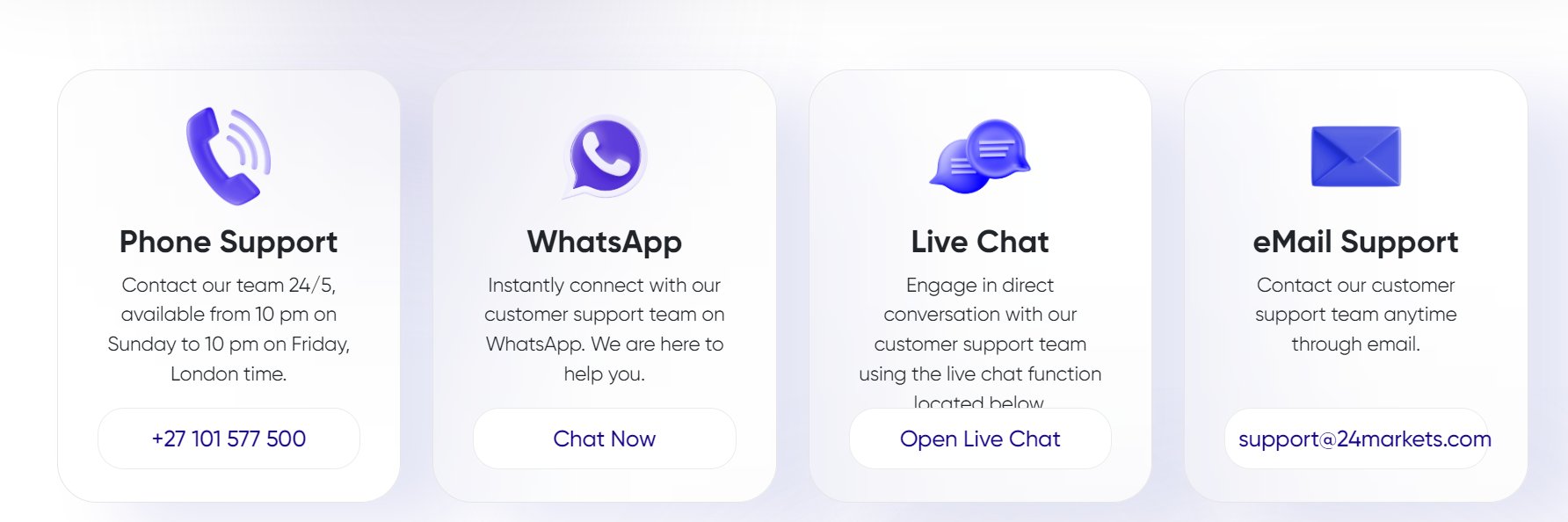

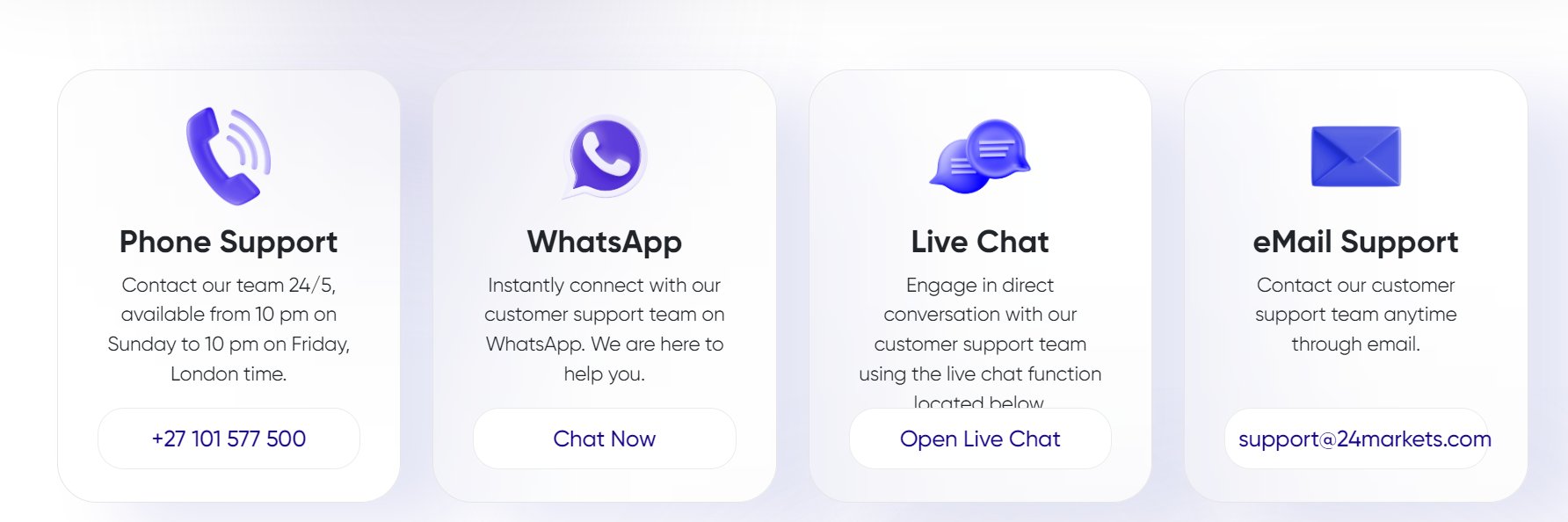

Customer service represents a significant concern area for 24markets based on available user feedback. Multiple user reviews show issues with customer service responsiveness. Some traders report delayed responses to questions and concerns about the professionalism of support interactions.

According to user reviews, the customer service team's response times do not meet trader expectations. This is particularly true in situations requiring urgent help with account or trading issues. This is especially concerning in forex trading, where market conditions can change rapidly and timely support can be crucial for resolving trading-related problems.

User feedback suggests that when traders encounter difficulties, particularly regarding fund withdrawals or account access, the support team's help has been inadequate. Some reviews show frustration with the level of expertise shown by customer service representatives. This suggests potential training or resource allocation issues within the support department.

The lack of detailed information about customer service channels, availability hours, and multilingual support capabilities further adds to these concerns. Professional forex brokers typically provide multiple contact methods, extended support hours, and multilingual assistance to serve their international client base effectively.

Trading Experience Analysis

The trading experience with 24markets appears to be mixed based on available user feedback. Users have generally reported that the platform operates with reasonable stability. The MetaTrader 5 implementation appears to function as expected for most trading activities.

Platform performance seems adequate for standard trading operations. Users have not reported significant technical issues or system downtime problems. The interface design gets positive feedback for its accessibility. This suggests that both new and experienced traders can navigate the platform effectively.

However, we did not find specific information about critical trading execution factors such as slippage rates, requote frequency, and order execution speeds in the source materials. These factors are crucial for assessing the quality of the trading environment. This is particularly true for active traders or those using scalping strategies.

The absence of detailed performance metrics or user feedback about execution quality represents a limitation in this 24markets review. Additionally, we did not find information about mobile trading capabilities and cross-device synchronization. This is increasingly important for modern traders who require flexibility in their trading access.

Overall, while the basic trading functionality appears satisfactory, the lack of detailed performance information and mixed user experiences suggest that trading quality may vary. This depends on individual circumstances and trading styles.

Trustworthiness Analysis

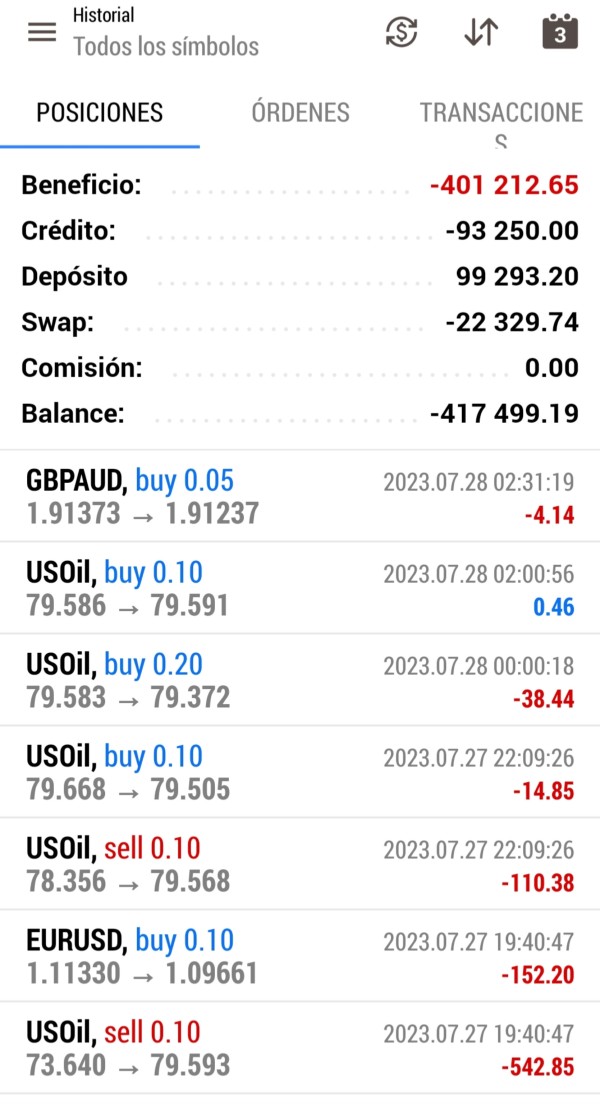

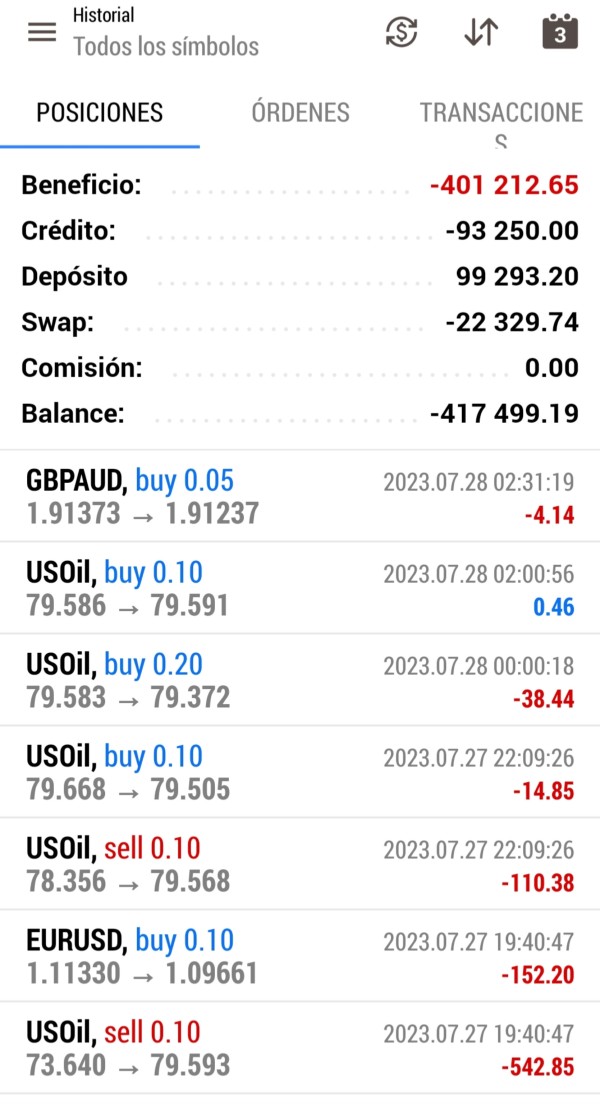

Trust and security represent significant concern areas for 24markets based on available user feedback and information gaps. Several users have expressed serious concerns about fund security. Some reviews suggest difficulties with withdrawal processes and question the broker's handling of client funds.

The absence of clear regulatory information in available sources is particularly concerning. Regulatory oversight is a basic factor in broker trustworthiness. Professional forex brokers typically prominently display their regulatory credentials and provide detailed information about client fund protection measures.

User reviews include serious allegations and concerns about the broker's practices. Some traders describe experiences that raised questions about the platform's legitimacy. These concerns are made worse by reports of high-risk warnings associated with the platform. This suggests that even official sources may have identified potential issues.

The lack of transparency regarding company ownership, regulatory status, and fund protection measures significantly impacts the trustworthiness assessment. Additionally, the absence of information about segregated client accounts, deposit insurance, or regulatory compensation schemes raises additional concerns about fund security.

These trust-related issues represent the most significant risk factors identified in this analysis. They should be carefully considered by any trader thinking about opening an account with 24markets.

User Experience Analysis

User experience with 24markets presents a mixed picture. Feedback ranges from positive comments about platform usability to serious concerns about overall service quality. Users who focus primarily on the trading platform interface generally provide more positive feedback. They praise the accessibility and functionality of the trading tools.

The platform's design appears to successfully balance professional functionality with user-friendly navigation. This makes it accessible to traders with varying levels of experience. This positive aspect of the user experience suggests that 24markets has invested appropriately in platform development and user interface design.

However, the overall user experience is significantly impacted by the customer service and trust issues previously discussed. Users report frustration when attempting to resolve account issues or get support. This substantially takes away from the otherwise positive platform experience.

We did not find details about the registration and account verification processes in available sources. This represents another information gap that impacts the complete user experience assessment. Similarly, specific information about the funding and withdrawal experience was limited. However, user concerns suggest potential issues in these areas.

Based on available feedback, 24markets may be suitable for traders who prioritize platform functionality and asset diversity. It may not meet the needs of those requiring responsive customer support or those with concerns about regulatory oversight and fund security.

Conclusion

This 24markets review reveals a broker with notable strengths in platform technology and asset diversity. However, it has significant concerns regarding customer service and trustworthiness. The provision of MetaTrader 5 and multiple asset classes represents competitive advantages. This is particularly true for traders seeking variety and professional-grade tools.

However, the concerns raised about customer service responsiveness, fund security, and the absence of clear regulatory information represent substantial risk factors. Potential traders must carefully consider these issues. The mixed user feedback suggests that experiences with 24markets may vary significantly depending on individual needs and circumstances.

24markets may be most suitable for experienced traders who prioritize platform functionality and can conduct thorough research regarding regulatory status and fund protection. New traders or those requiring responsive customer support may want to consider alternative brokers with stronger track records in these areas. They should wait until 24markets addresses the identified concerns.