POEMS 2025 Review: Everything You Need to Know

Summary: The POEMS brokerage, established over 40 years ago, has maintained a strong reputation in Singapore's financial landscape, offering a wide array of investment products and competitive commission rates. However, some users have noted high inactivity fees and a complex interface that may deter beginners.

Note: Its important to highlight that POEMS operates under different entities in various regions, which may affect user experience and regulatory oversight. This review aims for fairness and accuracy by drawing from multiple sources.

Rating Breakdown

How We Rate Brokers: We assess brokers based on a comprehensive analysis of user feedback, expert opinions, and factual data regarding their offerings.

Broker Overview

Founded in 1996, POEMS (Phillip's Online Electronic Mart System) is Singapore's first online trading platform, developed by PhillipCapital. The brokerage has evolved significantly over the years, now offering access to 26 global exchanges and over 40,000 financial products. POEMS provides a variety of trading platforms, including the user-friendly POEMS 2.0 and the advanced POEMS Pro. It is regulated by the Monetary Authority of Singapore (MAS), ensuring a level of security and trust for its users.

Detailed Review

Regulatory Regions

POEMS is primarily regulated in Singapore under the Monetary Authority of Singapore (MAS). While it has expanded its operations internationally, users should be aware of the different regulatory frameworks that may apply based on their location.

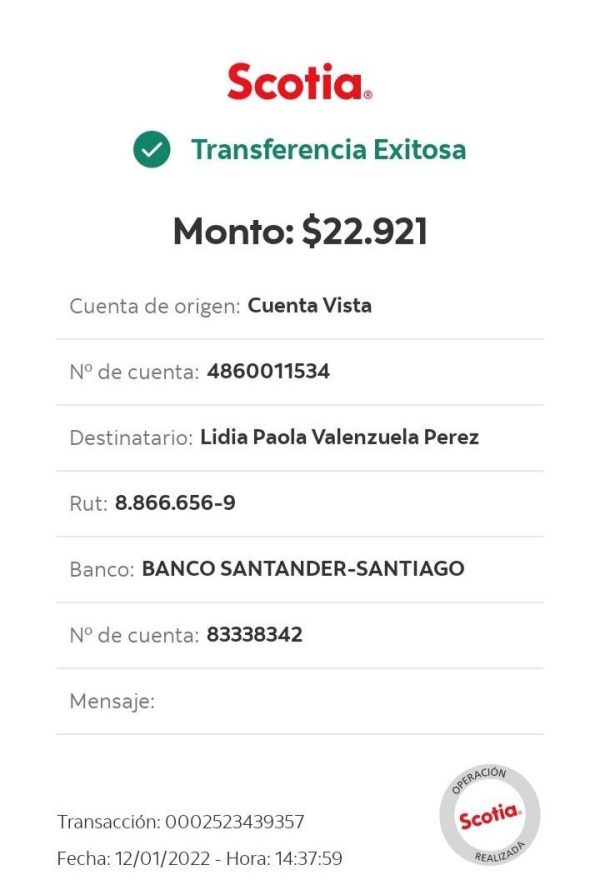

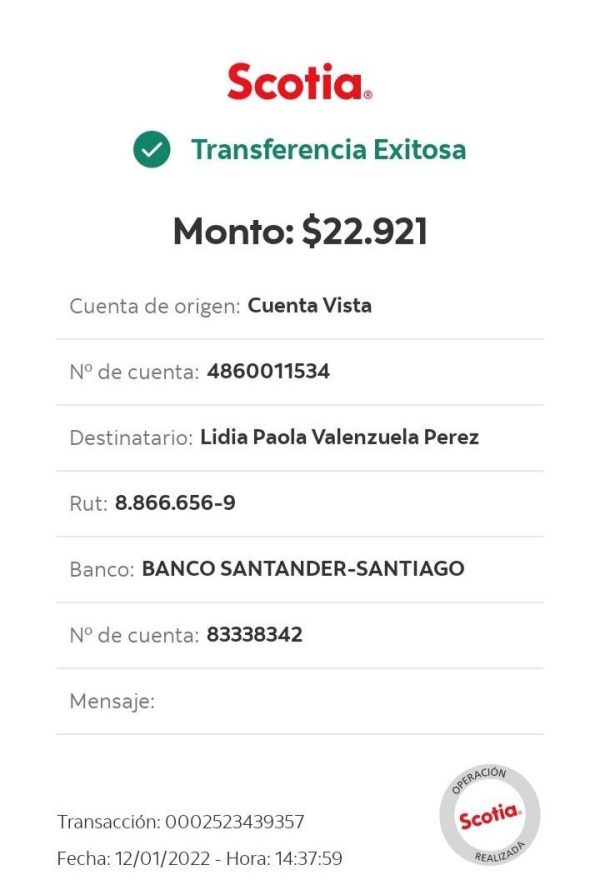

Deposit/Withdrawal Currencies and Cryptocurrencies

POEMS supports multiple currencies for deposits and withdrawals, including SGD, USD, HKD, AUD, and more. However, it does not currently support cryptocurrencies for trading. Users can fund their accounts via methods like PayNow, FAST, cheques, and bank transfers, with most options being free of charge.

Minimum Deposit

The minimum deposit requirement for opening a POEMS account is SGD 1,000, which is relatively standard among online brokerages in Singapore. This requirement can be a barrier for novice investors looking to start with smaller amounts.

POEMS frequently runs promotions, such as zero commission on certain trades and cash credits for new sign-ups. However, these promotions can vary, so users are encouraged to check the website for the latest offers.

Tradable Asset Classes

Investors at POEMS can trade a wide range of asset classes, including stocks, ETFs, unit trusts, bonds, CFDs, forex, and even gold. This variety allows for diversified investment portfolios, catering to different risk appetites and investment strategies.

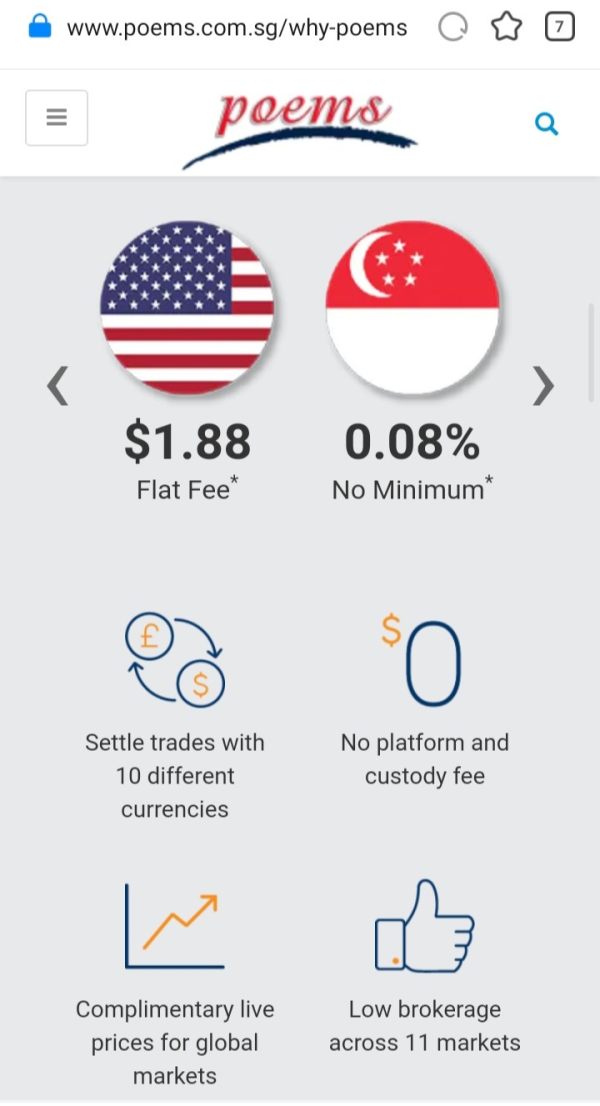

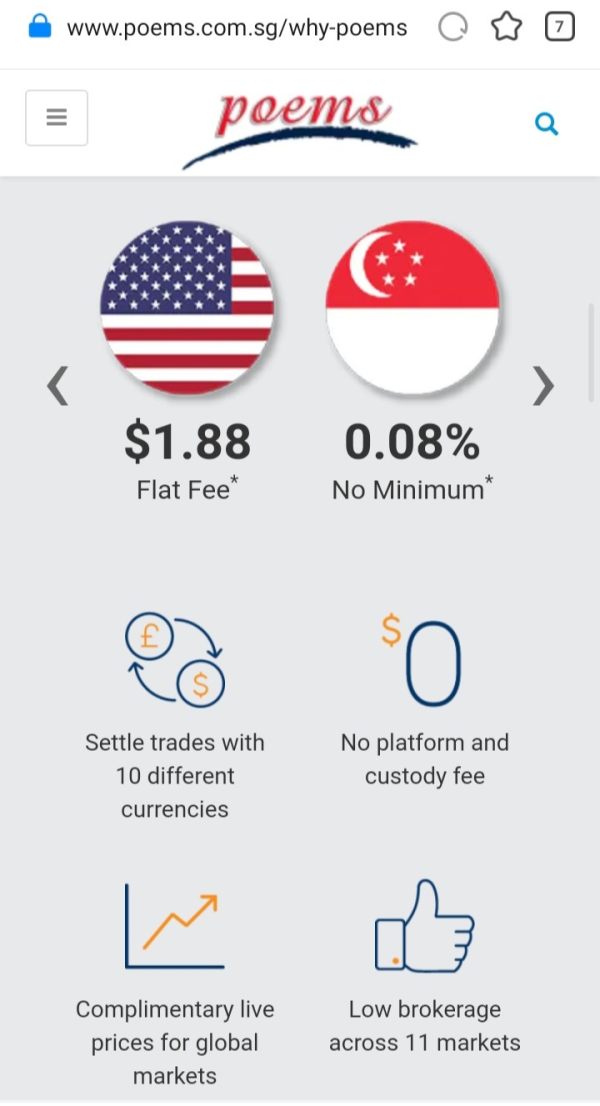

Costs (Spreads, Fees, Commissions)

POEMS offers competitive commission rates, starting from 0.08% for the Singapore market (minimum SGD 8) and $0 for the US market. However, the brokerage does impose a quarterly inactivity fee of SGD 15 for cash plus accounts, which can be a downside for less active traders. Additionally, some users have expressed concerns about the complexity of the fee structure, particularly for those new to trading.

Leverage

POEMS allows for leverage on certain products, but the specifics can vary based on the asset class and account type. Users should carefully review the terms associated with leverage to understand the risks involved.

POEMS provides access to several trading platforms, including the POEMS 2.0 desktop version, mobile apps, and the advanced POEMS Pro platform for more experienced investors. These platforms are equipped with various tools and resources to facilitate trading, including advanced charting features and market insights.

Restricted Regions

While POEMS primarily serves Singaporean investors, it has expanded its reach to several countries. However, users from certain regions may face restrictions, particularly in relation to regulatory compliance.

Available Customer Service Languages

POEMS offers customer support in English, which is the primary language for its operations. However, support may be limited for non-English speakers, which could impact the user experience for some investors.

Repeat Rating Breakdown

Detailed Breakdown

Account Conditions

POEMS offers two main account types: the Cash Plus account and the Cash Management account. The Cash Plus account is designed for lower-cost trading, while the Cash Management account is linked to the Central Depository Pte Ltd (CDP) for easier management of stocks. However, the inactivity fee for the Cash Plus account can be a deterrent for casual investors.

The brokerage provides a robust suite of tools and resources, including educational materials, webinars, and market insights. The user interface, however, has received mixed feedback, with some users finding it complex and not very intuitive.

Customer Service and Support

Customer service at POEMS is generally rated positively, but some users have reported longer wait times for support. The availability of multiple contact methods, including phone and email, adds convenience.

Trading Experience

While POEMS offers a wide range of trading options, the user experience can be hindered by the complexity of its platforms. Newer traders may find the learning curve steep, which could impact their overall trading experience.

Trustworthiness

With over 40 years in the industry and regulation by the MAS, POEMS is generally considered a trustworthy broker. However, potential users should be aware of reports indicating some customer dissatisfaction regarding fees and account management.

User Experience

The user experience at POEMS is mixed. While many users appreciate the extensive range of products and tools available, others have expressed frustration with the platform's complexity and the high inactivity fees.

In conclusion, POEMS remains a solid choice for investors looking for a comprehensive brokerage platform with a wide array of investment options. However, potential users should weigh the pros and cons carefully, particularly regarding fees and user experience, before making a decision.