Wise was co-founded in 2011 by Kristo Käärmann and Taavet Hinrikus, initially to tackle the exorbitant fees associated with international money transfers. The company quickly established itself as a market leader in the UK, currently processing over £9 billion in transfers monthly across 160 countries. In 2021, Wise made headlines with a direct listing on the London Stock Exchange, highlighting its rapid growth and fintech prominence.

However, the recent £6.8 billion valuation indicates a notable decrease from its IPO value as the company grapples with regulatory challenges and a rise in negative customer reviews. The rebranding from TransferWise to Wise signifies its expanded offering that goes beyond money transfers, including multi-currency accounts used by over 10 million users.

Wises flagship services include international money transfers and multi-currency accounts, allowing users to hold and convert 40+ currencies. Unlike traditional banks that offer higher exchange rates laden with hidden fees, Wise provides services at the mid-market rate, which makes it particularly appealing for individuals and SMEs. The platform allows for ease of transfers globally and supports transfers via direct bank deposits, debit, or credit cards.

Despite its user-friendly platform, Wise has limitations for users needing to transfer larger sums; it avoids providing personalized service, which some users may prefer.

Wise maintains regulatory compliance in various regions, namely the FCA in the UK and ASIC in Australia, which ensures operational integrity. However, the ongoing FCA investigation into CEO Kristo Käärmanns tax issues casts a shadow on its governance. The scrutiny could translate to reputational damage and operational restrictions moving forward.

- Verify Licensing: Check Wise's licensing status with regulatory authorities such as FCA, ASIC, and FinCEN.

- Review Financial Reports: Analyze Wises publicly available financial statements for compliance and transparency.

- Client Testimonials: Read user reviews to gauge experiences related to fund security and service reliability.

Industry Reputation and Summary

While generally viewed as a reputable company in the fintech industry, growing complaints, especially in the past year, may have repercussions on its standing. Continuous monitoring of the business landscape and customer experiences is crucial for users.

2. Trading Costs Analysis

Advantages in Commissions

Wise is celebrated for offering low-cost services, with a commission structure that averages around 0.5% per transaction. This pricing approach permits users to see what they are actually paying without hidden fees.

The "Traps" of Non-Trading Fees

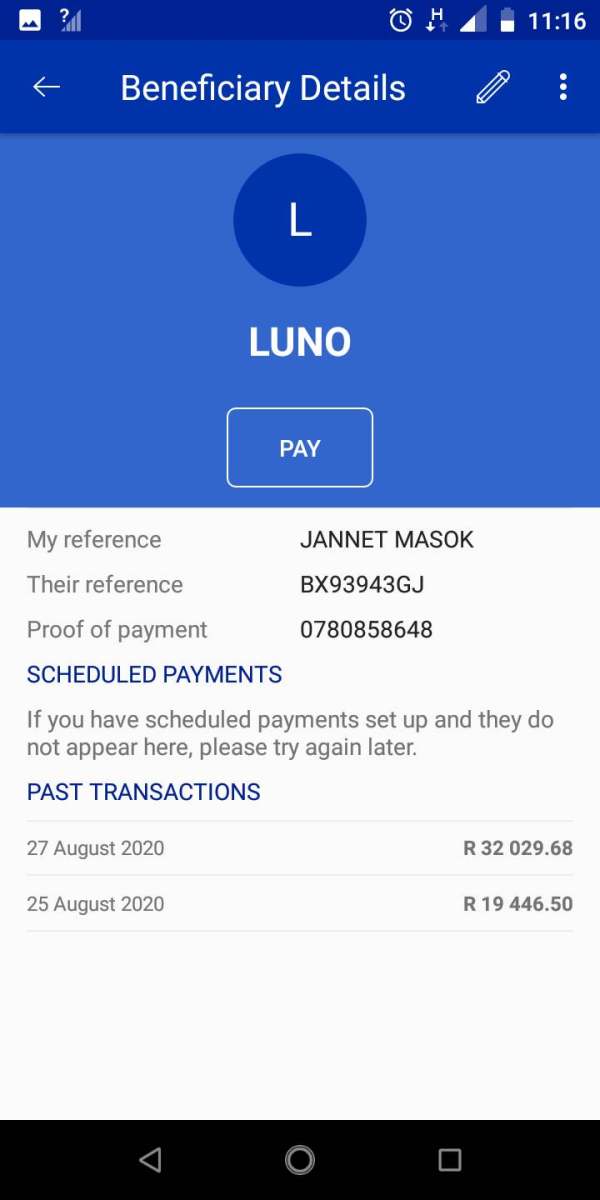

Despite its transparent pricing, several customers have noted hidden charges associated with withdrawal and currency conversion. For instance, some users reported unexpected fees tied to credit card payments, ranging up to 2% for various currency conversions.

User Complaint: "The fees aren't flat. When I send larger amounts, I notice how my costs begin to add up—sometimes it feels like I'm paying more than expected."

Cost Structure Summary

While the transparent fee structure is a strong selling point, potential users should be wary of additional costs linked to payment methods, as these can vary significantly depending on destinations and currencies involved.

Wise offers a robust online platform complimented with a well-designed mobile app, scoring highly in user satisfaction. However, it lacks advanced trading tools that some users might expect in a more comprehensive service.

The app is designed for user-friendliness, but lacks depth in terms of educational resources for users who may be less familiar with currency transfers. Moreover, it emphasizes transactional ease over comprehensive trading tools.

“Using the Wise app has made sending money easier. I can send transfers with just a few taps but found the lack of detailed guidance on other aspects frustrating.”

4. User Experience Analysis

User Experience

Apps and online platforms are generally well-received, with user experiences often characterized by efficiency. However, the lack of personal assistance and slow response times when users face issues is a cause for concern.

Common Issues Encountered

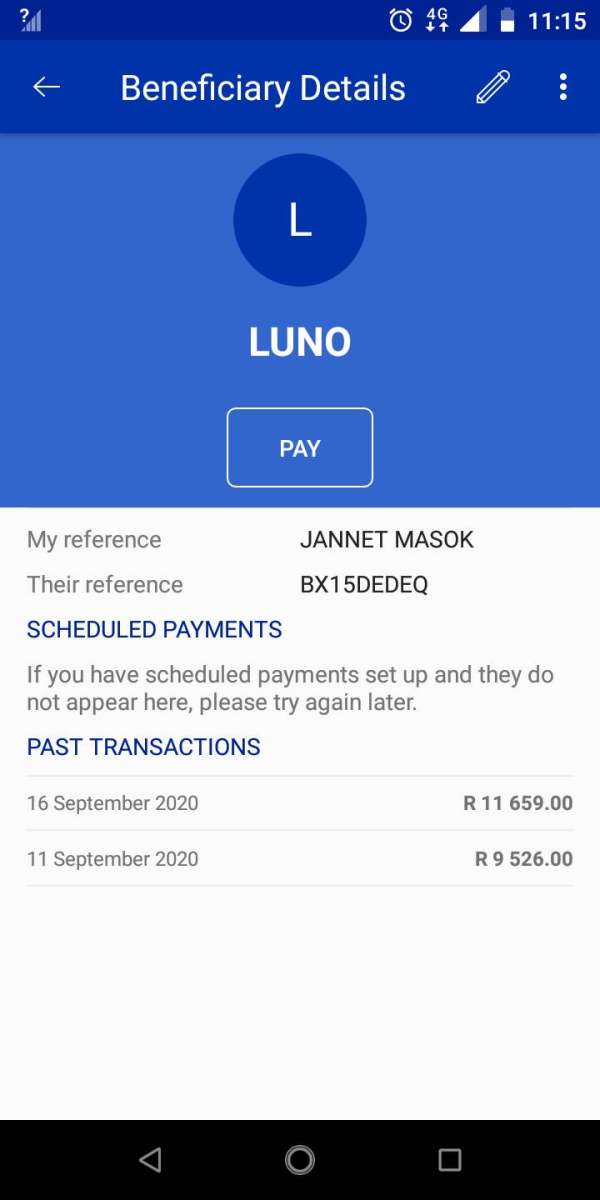

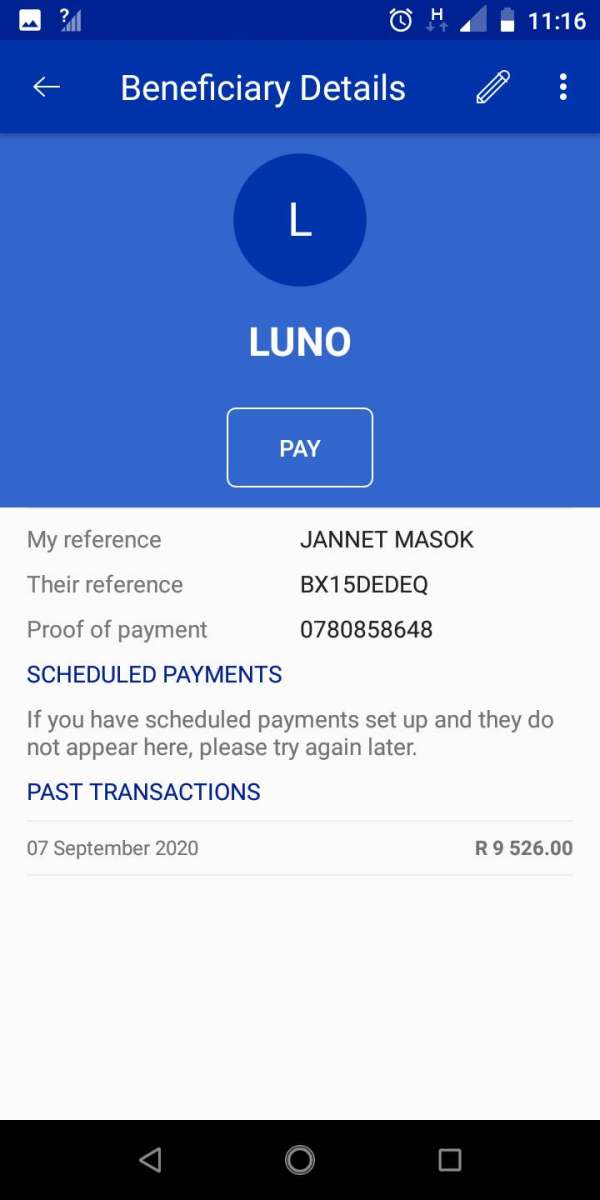

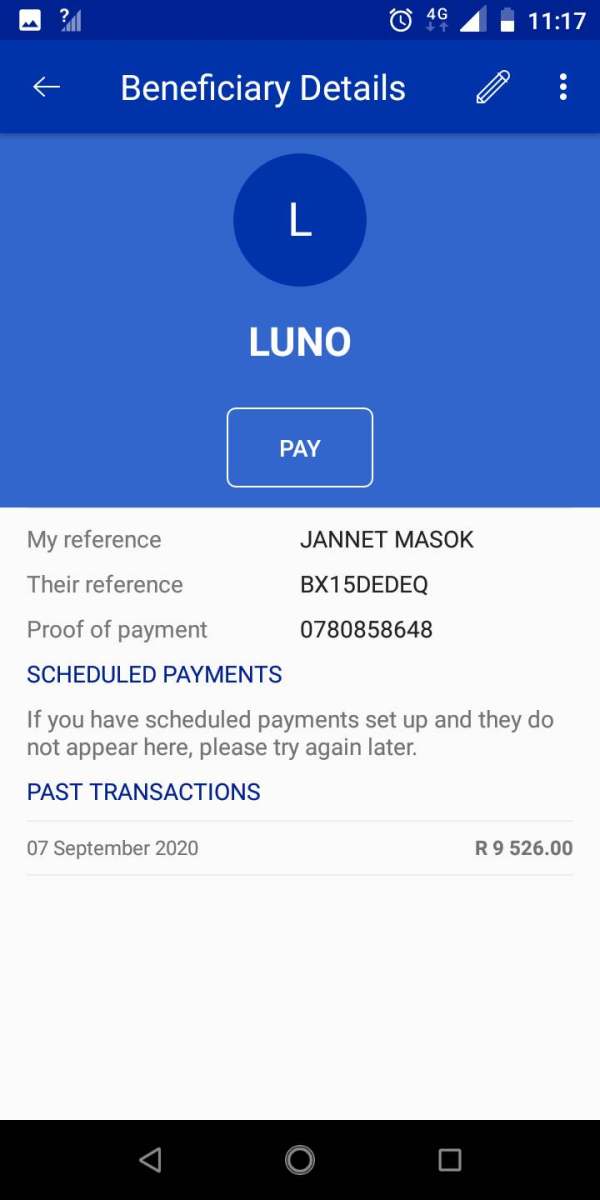

Due to rigorous verification requirements, many users report account freezes, leaving them unable to access funds for extended periods—adding unnecessary anxiety to users managing finances.

5. Customer Support Analysis

Overview

Wise provides customer support primarily through online platforms, with varying levels of satisfaction. Many users indicate that while initial responses may be quick, in-depth assistance can be lacking.

Service Discrepancies

Users frequently experience longer wait times for complex queries; however, basic issues tend to be resolved expediently. That said, the absence of an in-person support structure puts Wise at a disadvantage compared to some traditional banking services.

6. Account Conditions Analysis

Flexibility of Accounts

Wise offers flexibility regarding account types but is constrained in its offerings for high-value transfers. Account freezes reported by multiple users require vigilant management of personal information during transactions.

Documentation Required

“I was asked for excessive documents during my verification process, which made it cumbersome. I felt lost trying to keep track of the requirements.”

In conclusion, while Wise excels in providing transparent pricing and user-friendly services, it faces significant scrutiny along with mounting user dissatisfaction, primarily due to slow customer support and compliance hurdles. Users seeking to navigate loans or substantial investments might find themselves wanting in Wise's broad service scope, given the responsive yet often bureaucratic structure of its operations.

In light of these considerations, prospective users should carefully assess their needs against Wise's strengths and areas of concern to ensure a fit for their international financial needs going into 2025.