DefcoFX 2025 Review: Everything You Need to Know

Executive Summary

DefcoFX is a newly established offshore forex broker. It has entered the competitive trading landscape with a focus on providing high leverage trading opportunities across multiple asset classes. This defcofx review examines a broker that operates through the MetaTrader 5 platform. It offers trading in currencies, cryptocurrencies, indices, metals, energies, and stocks. According to available information, DefcoFX maintains low spreads. The broker does not charge deposit or withdrawal fees, though blockchain fees may apply for certain transactions.

The broker appears to target traders seeking high leverage opportunities and diversified asset exposure in an offshore regulatory environment. With a user rating of 79, DefcoFX presents a neutral overall evaluation in the current market landscape. While the platform offers modern trading infrastructure through MT5, the limited transparency regarding specific trading conditions and regulatory details requires careful consideration from potential clients.

Important Notice

DefcoFX operates as an offshore broker. This means traders from different regions may experience varying levels of legal protection and regulatory oversight. The regulatory landscape for offshore brokers can differ significantly from onshore, heavily regulated entities. This review is based on publicly available information and user feedback. It aims to provide an objective assessment of DefcoFX's services and offerings. Potential traders should conduct their own due diligence and consider their local regulations before engaging with any offshore broker.

Rating Framework

Broker Overview

DefcoFX emerged in 2024 as a new player in the offshore forex brokerage sector. It established its operations with a focus on providing high leverage trading opportunities. The broker positions itself as a modern trading platform catering to traders seeking access to multiple asset classes through a single trading interface. Based on available information, DefcoFX operates from an offshore jurisdiction, which allows it to offer more flexible trading conditions compared to heavily regulated onshore brokers.

The company's business model centers around providing access to global financial markets through the popular MetaTrader 5 platform. DefcoFX offers trading across six major asset categories: currencies, cryptocurrencies, indices, precious metals, energy commodities, and individual stocks. This diversified approach allows traders to build comprehensive portfolios and take advantage of various market opportunities from a single account. The broker's emphasis on low spreads and fee-free deposits and withdrawals suggests a competitive pricing structure designed to attract cost-conscious traders.

According to available sources, DefcoFX maintains regulatory compliance. However, specific details about licensing and oversight remain limited in public documentation. This defcofx review finds that while the broker offers modern trading infrastructure and diverse asset access, the relative newness of the company and limited regulatory transparency may require additional consideration from potential clients.

Regulatory Status: DefcoFX operates under offshore regulations. However, specific licensing details and regulatory body information are not comprehensively detailed in available sources. The broker appears to maintain compliance with applicable financial services regulations in its jurisdiction of operation.

Deposit and Withdrawal Methods: According to available information, DefcoFX does not impose fees on deposits or withdrawals. This makes it attractive for traders concerned about transaction costs. However, blockchain fees may apply for cryptocurrency-related transactions, which is standard practice in the industry.

Minimum Deposit Requirements: Specific minimum deposit amounts are not detailed in the available source materials. This leaves potential traders without clear guidance on initial funding requirements.

Bonus and Promotions: Current promotional offerings and bonus structures are not specified in the reviewed materials. This suggests either limited promotional activity or lack of detailed information availability.

Tradeable Assets: DefcoFX provides access to six major asset categories including foreign exchange pairs, cryptocurrencies, stock indices, precious metals, energy commodities, and individual equity securities. This comprehensive selection allows for portfolio diversification across traditional and alternative investment vehicles.

Cost Structure: While the broker advertises low spreads, specific spread ranges, commission structures, and overnight financing rates are not detailed in available sources. The overall fee transparency appears limited, which may concern traders seeking detailed cost analysis.

Leverage Options: DefcoFX offers high leverage trading. However, exact leverage ratios for different asset classes are not specified in the reviewed materials.

Platform Options: The broker exclusively utilizes MetaTrader 5. This provides traders with access to advanced charting tools, automated trading capabilities, and comprehensive market analysis features.

Geographic Restrictions: Specific country restrictions and availability limitations are not detailed in available source materials.

Customer Support Languages: Available customer service languages are not specified in the reviewed documentation.

Account Conditions Analysis

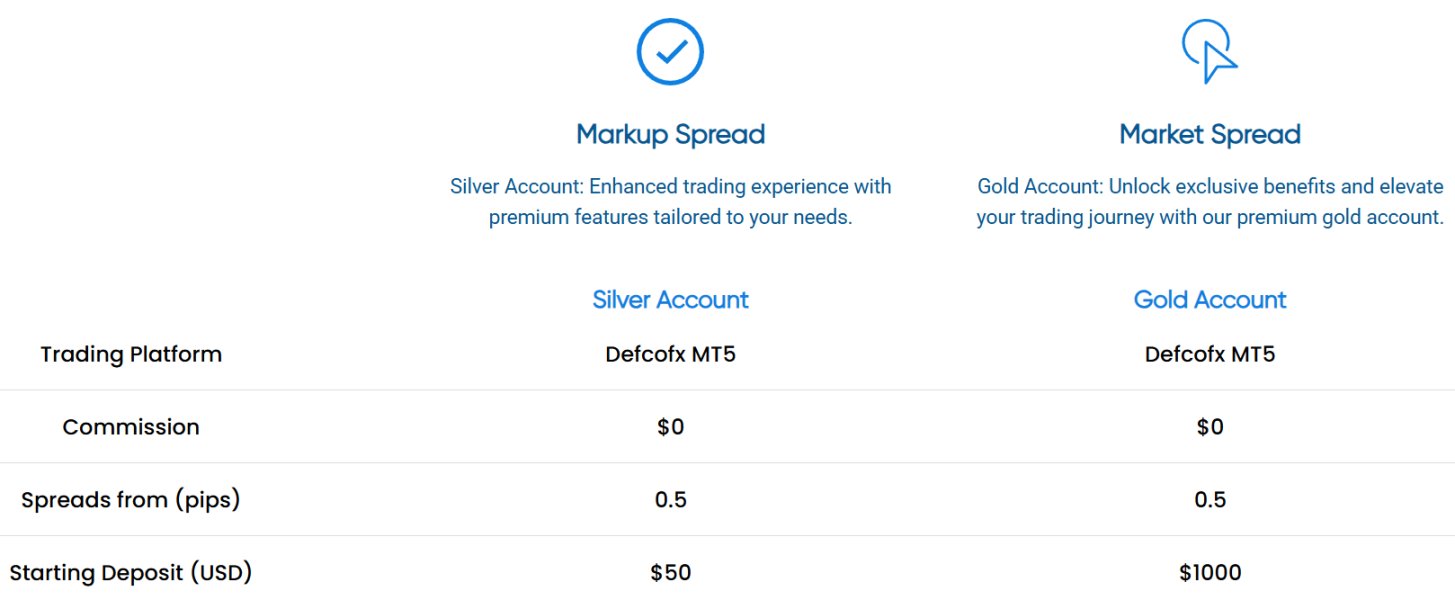

The account structure and conditions at DefcoFX remain largely undisclosed in available public information. This presents a significant transparency gap for potential clients. Without specific details about account types, minimum deposit requirements, or tier-based benefits, traders cannot make fully informed decisions about account selection. This lack of detailed account information is particularly concerning for a broker operating in the competitive forex market where transparency typically builds trust.

Most established brokers offer multiple account types designed for different trader profiles. These range from beginner-friendly accounts with lower minimum deposits to professional accounts with enhanced features and reduced costs. The absence of such information in this defcofx review suggests either limited account variety or insufficient public disclosure of account terms.

The account opening process, verification requirements, and approval timeframes are also not detailed in available sources. Modern traders expect streamlined onboarding with clear documentation requirements and reasonable processing times. Without this information, potential clients cannot assess whether DefcoFX meets contemporary account opening standards.

Special account features such as Islamic accounts for Sharia-compliant trading, demo accounts for practice, or managed account options are not mentioned in available materials. These features have become standard offerings among reputable brokers. Their absence or lack of disclosure may indicate limited service sophistication.

DefcoFX's trading infrastructure centers around the MetaTrader 5 platform. This represents a solid foundation for modern trading operations. MT5 provides comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. The platform's multi-asset trading capability aligns well with DefcoFX's diverse instrument offering across currencies, cryptocurrencies, indices, metals, energies, and stocks.

However, beyond the core MT5 platform, additional trading tools and resources are not detailed in available source materials. Modern brokers typically supplement their primary platforms with proprietary tools, market research, economic calendars, and educational resources. The absence of information about such supplementary offerings suggests either limited additional tool availability or insufficient disclosure of available resources.

Research and analysis capabilities, which are crucial for informed trading decisions, are not specifically outlined in reviewed materials. Traders increasingly expect access to market commentary, technical analysis, fundamental research, and real-time news feeds. Without clear information about these resources, potential clients cannot assess DefcoFX's analytical support capabilities.

Educational resources, including webinars, tutorials, trading guides, and market education materials, are not mentioned in available documentation. Given the broker's apparent targeting of diverse trader types, the absence of educational resource information may indicate a gap in client support services.

Customer Service and Support Analysis

Customer service capabilities and support infrastructure at DefcoFX are not detailed in available source materials. This represents a significant information gap for potential clients. Modern forex trading requires reliable, responsive customer support given the 24-hour nature of global markets and the technical complexity of trading platforms.

Standard customer service expectations include multiple contact channels such as live chat, email support, and telephone assistance. The availability of these channels, response times, and service quality are not documented in reviewed materials. This lack of customer service transparency makes it difficult for traders to assess whether DefcoFX can provide adequate support during critical trading situations.

Multilingual support capabilities, which are essential for international brokers, are not specified in available information. Given the global nature of forex trading, the absence of clear language support details may concern non-English speaking traders or those preferring support in their native languages.

Support availability hours, particularly during major market sessions and volatile trading periods, are not outlined in reviewed documentation. Traders need confidence that assistance will be available during their active trading hours, especially for urgent technical or account-related issues.

Problem resolution procedures, escalation processes, and support quality metrics are also absent from available materials. Without information about how DefcoFX handles client concerns and resolves trading-related issues, potential clients cannot assess the broker's commitment to customer satisfaction and problem resolution.

Trading Experience Analysis

The trading experience at DefcoFX centers around the MetaTrader 5 platform. However, specific performance metrics and execution quality data are not provided in available source materials. MT5 generally offers robust trading functionality, but the actual trading experience depends heavily on the broker's infrastructure, server quality, and execution policies.

Platform stability and uptime, which are crucial for consistent trading operations, are not documented in reviewed materials. Traders require reliable platform access, especially during high-volatility periods when trading opportunities and risks are elevated. Without performance data, potential clients cannot assess DefcoFX's technical reliability.

Order execution quality, including execution speeds, slippage rates, and requote frequency, are not detailed in available sources. These factors significantly impact trading profitability, particularly for scalping and high-frequency trading strategies. The absence of execution quality metrics makes it difficult to evaluate DefcoFX's suitability for different trading approaches.

Mobile trading capabilities, while presumably available through MT5's mobile applications, are not specifically addressed in reviewed documentation. Modern traders increasingly rely on mobile platforms for monitoring positions and executing trades while away from desktop systems.

The overall trading environment, including server locations, infrastructure quality, and technology investments, remains undisclosed in available materials. This defcofx review finds that without detailed trading experience information, potential clients must rely primarily on the general capabilities of the MT5 platform rather than DefcoFX-specific enhancements or optimizations.

Trust and Safety Analysis

DefcoFX's trust and safety profile presents mixed signals based on available information. The broker maintains some form of regulatory compliance, though specific licensing details, regulatory body oversight, and compliance measures are not comprehensively detailed in reviewed materials. This regulatory opacity is concerning for traders seeking maximum protection and oversight.

The user rating of 79 suggests moderate confidence among existing clients. However, this score falls below typical industry averages for well-established brokers. Without access to detailed user feedback and review content, it's difficult to assess the specific factors contributing to this rating or identify common user concerns.

Fund safety measures, including client fund segregation, insurance coverage, and banking relationships, are not specified in available sources. These protections are fundamental for trader confidence, particularly given the offshore nature of DefcoFX's operations where regulatory protections may differ from onshore jurisdictions.

Company transparency, including management information, financial reporting, and corporate governance details, appears limited in public documentation. Established brokers typically provide comprehensive company information to build trust and demonstrate operational legitimacy.

The broker's track record and industry reputation remain difficult to assess given its recent establishment in 2024. Without historical performance data, regulatory actions, or industry recognition, traders must rely on limited available information to gauge DefcoFX's reliability and long-term viability.

User Experience Analysis

User experience assessment for DefcoFX is constrained by limited available feedback and detailed user testimonials in reviewed materials. The overall user rating of 79 provides some indication of client satisfaction levels. However, this score suggests room for improvement compared to industry-leading brokers that typically achieve higher ratings.

Interface design and platform usability rely primarily on the MetaTrader 5 platform's standard functionality. Any DefcoFX-specific customizations or enhancements are not detailed in available sources. MT5 generally provides a comprehensive but complex trading environment that may require learning curves for new users.

Account registration and verification processes are not detailed in reviewed materials. This makes it impossible to assess the efficiency and user-friendliness of onboarding procedures. Modern traders expect streamlined, digital-first processes with clear requirements and reasonable completion timeframes.

Fund management experiences, including deposit and withdrawal processes, are only partially addressed in available information. While the broker advertises no fees for deposits and withdrawals, the actual user experience with funding operations, processing times, and any practical limitations are not detailed.

The absence of detailed user feedback in reviewed materials prevents comprehensive assessment of common user satisfaction factors or frequently reported issues. This limitation makes it difficult to identify DefcoFX's strengths and weaknesses from an actual user perspective.

Conclusion

DefcoFX presents itself as a modern offshore forex broker offering high leverage trading across multiple asset classes through the established MetaTrader 5 platform. While the broker demonstrates some appealing features, including diverse tradeable instruments, competitive fee structures, and contemporary trading technology, significant information gaps limit the ability to provide a comprehensive assessment.

The broker appears most suitable for experienced traders comfortable with offshore regulatory environments and seeking high leverage opportunities across traditional and alternative assets. However, the limited transparency regarding specific trading conditions, regulatory details, and user experiences suggests that potential clients should proceed with careful consideration and thorough due diligence.

Primary advantages include the comprehensive asset selection, fee-free deposit and withdrawal policies, and modern MT5 platform access. Key concerns center around regulatory transparency limitations, insufficient customer service information, and the relative newness of the operation without established track record data.