Is SUPER safe?

Pros

Cons

Is Super Forex Safe or a Scam?

Introduction

Super Forex is an online foreign exchange broker that has garnered attention in the trading community. With a focus on providing a diverse range of trading instruments, including forex, CFDs, and cryptocurrencies, Super Forex aims to attract traders from various backgrounds. However, as with any financial service, it is crucial for traders to exercise caution and conduct thorough evaluations of the brokers they choose to work with. The forex market is rife with opportunities, but it also harbors risks, including the potential for scams and unregulated entities. This article aims to provide an objective assessment of Super Forex's legitimacy, safety, and overall trustworthiness. Our evaluation is based on comprehensive research, including regulatory scrutiny, company background analysis, trading conditions, customer feedback, and risk assessments.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety and legitimacy. Super Forex operates under the supervision of the International Financial Services Commission (IFSC) in Belize. However, the quality of regulation can vary significantly between different jurisdictions. Heres a summary of the regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | IFSC/60/292/TS/16 | Belize | Verified |

While being regulated by the IFSC provides some level of oversight, it is essential to note that this body is considered a tier-3 regulator. This means that the regulatory requirements are less stringent compared to top-tier regulators like the FCA in the UK or ASIC in Australia. Although Super Forex has maintained its license, there have been several complaints and reports regarding its operational practices. The lack of a robust regulatory framework raises concerns about investor protection and the potential for fraudulent activities. Therefore, traders should approach Super Forex with caution and consider the implications of trading with a broker regulated in a less stringent jurisdiction.

Company Background Investigation

Super Forex was established in 2013 and is owned by Superfin Corp., based in Belize. The company has positioned itself as a global broker, offering services to traders in over 150 countries. However, the offshore nature of its operations raises questions about transparency and accountability. The management teams background is another critical aspect to consider. While the company claims to have a professional team, specific details about the qualifications and experience of its executives are not readily available, which can be a red flag for potential investors.

In terms of transparency, Super Forex does provide some information on its website, including details about its services and trading conditions. However, the lack of comprehensive disclosures regarding its financial health, ownership structure, and management team can make it difficult for traders to assess the broker's reliability. Overall, while Super Forex has a presence in the market, its offshore status and limited transparency warrant a cautious approach.

Trading Conditions Analysis

Understanding the trading conditions offered by Super Forex is essential for assessing its overall value proposition. The broker claims to provide competitive spreads and various account types, but it is crucial to analyze the actual costs involved in trading. Heres a comparison of core trading costs:

| Cost Type | Super Forex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 0.5 pips |

| Commission Model | No commission | Varies |

| Overnight Interest Range | 2% | 1-2% |

While the spreads may appear competitive, the absence of a commission model can often lead to hidden costs embedded in the spread. Additionally, the overnight interest rates seem to be on the higher end of the spectrum, which can significantly impact traders who hold positions longer than a day. Traders should carefully review the terms and conditions to understand any additional fees that may apply, such as withdrawal fees or inactivity fees, which could further affect their trading profitability.

Client Fund Safety

Client fund safety is a paramount concern for any trader. Super Forex claims to implement various measures to ensure the security of client funds. These include segregated accounts, which are intended to keep client funds separate from the broker's operational funds. However, the lack of a specific investor protection scheme or compensation fund is concerning. In the event of insolvency, traders may find it challenging to recover their funds.

Moreover, while Super Forex has not reported any significant historical issues related to fund safety, the absence of a strong regulatory framework means that traders may have limited recourse in case of disputes or financial mishaps. Therefore, it is advisable for potential clients to weigh these risks carefully before committing their funds to Super Forex.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. Reviews of Super Forex reveal a mixed bag of experiences, with some users praising its trading platform and customer support, while others express frustration over withdrawal issues and unresponsive customer service.

Heres a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

| Account Closure Issues | High | Unresolved |

A notable case involved a trader who reported being unable to withdraw funds after meeting the necessary trading volume requirements. The trader claimed that their account was suddenly closed without explanation, leading to considerable frustration. Such incidents highlight the importance of thorough due diligence when selecting a broker.

Platform and Execution

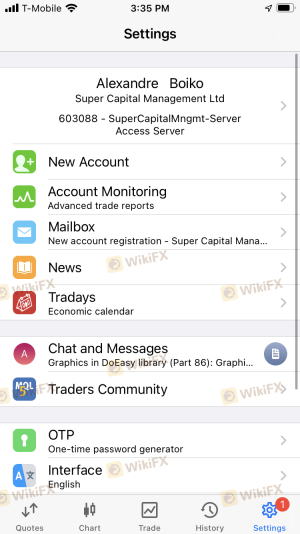

The trading platform offered by Super Forex is based on the widely-used MetaTrader 4 (MT4), which is known for its user-friendly interface and robust trading tools. However, the platform's performance and execution quality are critical factors in determining the overall trading experience.

Users have reported mixed experiences regarding order execution, with some experiencing slippage during volatile market conditions. Additionally, there have been claims of rejected orders under certain circumstances, which can be detrimental to traders relying on timely executions. The lack of transparency surrounding these issues raises concerns about the broker's operational integrity.

Risk Assessment

When considering trading with Super Forex, it is essential to evaluate the associated risks. Heres a summary of the key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Weak regulatory oversight increases fraud risk. |

| Fund Safety Risk | Medium | Lack of investor protection schemes. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

To mitigate these risks, traders should consider using risk management strategies, such as setting stop-loss orders and limiting the amount of capital allocated to any single trade. Additionally, it may be wise to start with a demo account to familiarize oneself with the platform before trading with real money.

Conclusion and Recommendations

In conclusion, while Super Forex presents itself as a viable option for forex trading, several factors warrant caution. The broker's regulatory status, company transparency, and customer feedback indicate that potential traders should approach with care. Although there are no overt signs of fraud, the combination of weak regulatory oversight and reported customer complaints suggests that Super Forex may not be the safest choice for all traders.

For those considering trading with Super Forex, it is advisable to conduct further research and consider alternative brokers with stronger regulatory backing and better customer service records. Reliable alternatives include brokers regulated by top-tier authorities like the FCA or ASIC, which offer more robust investor protection and transparency. Ultimately, the decision to trade with Super Forex should be made with a clear understanding of the associated risks and a commitment to safeguarding ones investments.

Is SUPER a scam, or is it legit?

The latest exposure and evaluation content of SUPER brokers.

SUPER Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SUPER latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.