Is BRIDGE MARKETS safe?

Software Index

License

Is Bridge Markets A Scam?

Introduction

Bridge Markets is a brokerage firm that positions itself within the forex market, claiming to offer a wide array of trading instruments including forex, cryptocurrencies, indices, and commodities. Established in 2022 and registered in the Marshall Islands, the broker aims to attract traders with low minimum deposits and high leverage options. However, the increasing number of unregulated brokers in the market raises concerns for potential investors. Traders should exercise caution and thoroughly evaluate the legitimacy of any forex broker before committing their funds. This article investigates Bridge Markets' regulatory status, company background, trading conditions, and customer experiences to determine whether it is a trustworthy brokerage or a potential scam.

Regulation and Legitimacy

When assessing the safety of a brokerage, regulation is a critical factor. Regulatory bodies ensure that brokers adhere to industry standards, which can protect traders from fraud and malpractice. Bridge Markets claims to be registered in the Marshall Islands and asserts compliance with local regulations. However, the Marshall Islands does not have a robust regulatory framework for forex trading, raising red flags regarding the broker's legitimacy.

| Regulatory Body | License Number | Regulating Area | Verification Status |

|---|---|---|---|

| None | N/A | Marshall Islands | Unregulated |

The absence of regulation means that there is no oversight of Bridge Markets' operations. Moreover, some sources indicate that the broker has made misleading claims about its regulatory status, including presenting itself as a registered entity with the National Futures Association (NFA) in the United States, which is unverified. This lack of credible regulation is a significant concern for traders, as it implies that customer funds may not be protected, and there is no recourse for disputes.

Company Background Investigation

Bridge Markets was founded in 2022, and its operations are based in the Marshall Islands. The company claims to be owned by Bridge Markets Ltd. However, a closer inspection reveals that there is no verifiable information regarding its registration in the Marshall Islands' official records. This lack of transparency raises questions about the firm's credibility and operational integrity.

The management team behind Bridge Markets has not been publicly disclosed, which further obscures the company's governance. Without information about the qualifications and experience of the management team, potential clients cannot assess the firm's expertise or reliability. Transparency in company ownership and management is essential for building trust, especially in the financial services sector.

Trading Conditions Analysis

Bridge Markets advertises attractive trading conditions, including high leverage of up to 1:500 and low minimum deposits starting at $20. However, the overall fee structure and potential hidden costs need careful examination.

| Fee Type | Bridge Markets | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | From 0.0 pips | 1.0 pips |

| Commission Model | Varies by account type | $3-$10 per lot |

| Overnight Interest Rates | Not disclosed | Varies |

The broker's claim of offering spreads from 0.0 pips may seem appealing, but it is crucial to verify how often traders can actually access these rates. Furthermore, the lack of clarity regarding overnight interest rates and commissions can lead to unexpected costs, which is a common tactic among unregulated brokers to obscure their true pricing.

Client Fund Safety

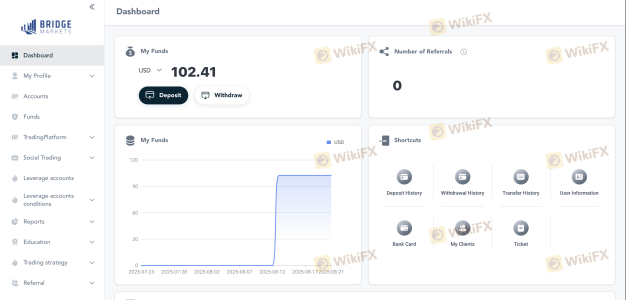

The safety of client funds is paramount for any trading platform. Bridge Markets does not provide clear information on how it safeguards client deposits. Key aspects such as fund segregation, investor protection schemes, and negative balance protection are crucial for ensuring the safety of traders' capital.

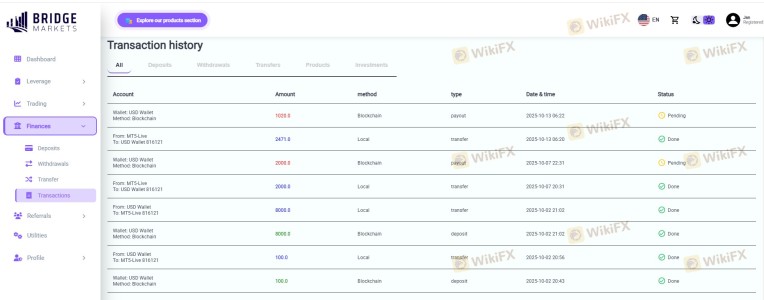

Without robust measures in place, clients may face substantial risks, particularly in the event of the broker's insolvency or operational issues. Historical complaints about the inability to withdraw funds and the lack of transparency in withdrawal processes further exacerbate concerns about the safety of funds held with Bridge Markets.

Customer Experience and Complaints

Customer feedback is often a reflection of a broker's reliability. Reviews about Bridge Markets are mixed, with numerous reports of withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Account Closure Issues | High | Unresolved |

| Poor Customer Support | Medium | Inconsistent |

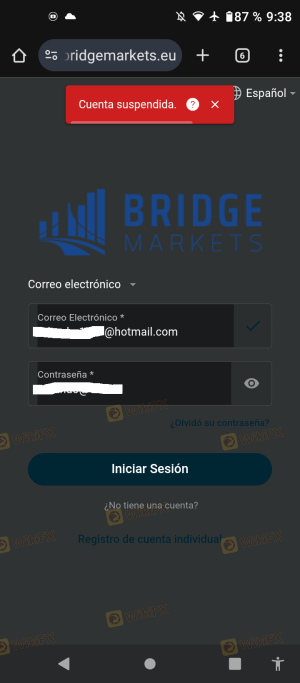

Several users have reported that their accounts were blocked without explanation, and attempts to contact customer support have often gone unanswered. Such complaints are significant warning signs that potential clients should consider before engaging with the broker.

Platform and Trade Execution

The trading platform offered by Bridge Markets is MetaTrader 5 (MT5), which is known for its advanced features and user-friendly interface. However, the platform's performance, including order execution quality and slippage rates, is crucial for traders. Reports of high slippage and rejected orders have surfaced, leading to concerns about the broker's execution reliability.

If traders consistently experience poor execution quality, it can severely impact their trading performance and profitability, indicating potential manipulation or operational inefficiencies on the broker's part.

Risk Assessment

Given the findings from this investigation, the overall risk associated with trading with Bridge Markets appears substantial.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated, no oversight |

| Fund Safety Risk | High | Lack of transparency and protection |

| Customer Service Risk | Medium | Poor support and unresolved complaints |

| Execution Risk | Medium | Reports of slippage and rejected orders |

To mitigate these risks, potential clients are advised to conduct thorough due diligence, seek out regulated brokers, and consider using demo accounts to test services before committing real funds.

Conclusion and Recommendations

In conclusion, the investigation into Bridge Markets reveals several concerning factors that suggest it may not be a safe or reliable trading platform. The lack of regulation, questionable company background, and numerous complaints about customer service and fund safety raise significant red flags.

Traders looking to engage in forex trading should be cautious and consider alternative options. For those seeking reliable and regulated trading environments, brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback are recommended. Companies such as IC Markets, Pepperstone, or OANDA offer robust trading conditions and regulatory protection that can provide traders with a safer trading experience.

Is BRIDGE MARKETS a scam, or is it legit?

The latest exposure and evaluation content of BRIDGE MARKETS brokers.

BRIDGE MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BRIDGE MARKETS latest industry rating score is 2.08, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.08 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.