Is Millennium safe?

Business

License

Is Millennium Safe or Scam?

Introduction

Millennium, a name that has emerged in the forex market, positions itself as a broker offering a variety of trading instruments including forex, cryptocurrencies, and commodities. In a rapidly evolving financial landscape, traders must approach new brokers with caution, as the potential for scams remains high. It is crucial for traders to thoroughly evaluate the legitimacy of any brokerage before committing their capital. This article investigates Millennium's regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks. The analysis is based on information gathered from reputable financial review sites and regulatory bodies, aiming to provide a comprehensive overview of whether Millennium is safe or a potential scam.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a fundamental aspect of its credibility. Millennium is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory framework. This raises significant concerns regarding the safety of traders' funds. The absence of stringent oversight can lead to increased risks, particularly in terms of fund protection and operational transparency.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Saint Vincent and the Grenadines | Unverified |

The lack of a valid license from a reputable regulatory authority such as the FCA (UK) or ASIC (Australia) indicates that Millennium does not meet the necessary standards for investor protection. Furthermore, warnings have been issued by the Spanish financial regulator, CNMV, against Millennium, highlighting its unregulated status and the associated risks. Brokers operating without proper regulation can often engage in dubious practices, making it imperative for traders to consider these factors seriously when evaluating whether Millennium is safe.

Company Background Investigation

Millennium's corporate history reveals a lack of transparency that is concerning for potential investors. The company claims to operate from the UK, but its registration in an offshore jurisdiction raises questions about its legitimacy. There is limited information available regarding the ownership structure and the management team behind Millennium, which further complicates the assessment of its trustworthiness.

The absence of detailed disclosures about the company's operations and the individuals behind it can be a red flag. A reputable broker typically provides clear information about its management team and their professional backgrounds. In Millennium's case, this information is either absent or unreliable, indicating a potential lack of accountability. This opacity is a significant factor when determining if Millennium is safe for trading, as it may suggest that the broker is not committed to maintaining high standards of operational integrity.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its reliability. Millennium offers various account types with different minimum deposit requirements, which may seem appealing at first glance. However, the overall fee structure raises concerns. For instance, the minimum deposit to open a trading account is relatively high, which could deter new traders.

| Fee Type | Millennium | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 2.5 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Millennium appear to be above average compared to industry standards, which can significantly affect trading profitability. Additionally, information regarding commissions and overnight interest rates is either vague or not provided, raising suspicions about hidden fees that may not be disclosed upfront. Such unclear pricing structures can lead to unexpected costs for traders, making it crucial to assess whether Millennium is safe in terms of its trading conditions.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. Millennium's approach to fund security is questionable, particularly given its lack of regulation. It is unclear whether the broker employs segregated accounts to protect client funds, which is a standard practice among reputable brokers.

Moreover, the absence of investor protection mechanisms and negative balance protection policies further exacerbates concerns about fund safety. Historical data on Millennium does not provide any assurance regarding past incidents of fund mismanagement or disputes, which is often a telling sign of a broker's reliability. This lack of clarity around fund safety measures raises significant red flags, suggesting that traders should be wary of whether Millennium is safe for their investments.

Customer Experience and Complaints

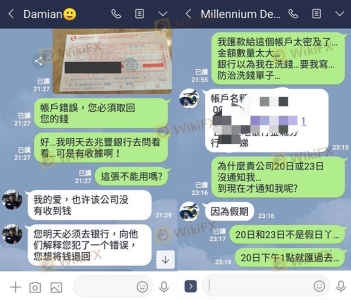

Customer feedback is an invaluable resource when assessing a broker's reliability. Reviews for Millennium predominantly highlight negative experiences, with common complaints including difficulties in withdrawing funds, lack of communication, and hidden fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Communication Gaps | Medium | Poor |

| Hidden Fees | High | Poor |

For instance, multiple users have reported that after making initial deposits, their attempts to withdraw funds were met with delays or outright refusals. Such patterns indicate a troubling trend that raises questions about the broker's operational practices and commitment to customer service. The overall sentiment among clients suggests that Millennium may not prioritize the interests of its traders, further contributing to the skepticism surrounding whether Millennium is safe.

Platform and Trade Execution

The performance of a trading platform is critical to a trader's success. Millennium claims to offer a user-friendly platform, but reviews indicate that its execution quality may not meet industry standards. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

Moreover, the lack of transparency regarding the platform's technology and potential manipulative practices raises further concerns. A reliable broker should provide clear information about its trading infrastructure to instill confidence in its clients. The absence of such details about Millennium's platform leads to skepticism about its reliability and whether Millennium is safe for traders.

Risk Assessment

Using Millennium as a trading platform presents several risks that traders should carefully consider. The absence of regulation, high fees, and negative customer experiences contribute to a high-risk environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from reputable authorities |

| Financial Risk | High | High spreads and unclear fee structures |

| Operational Risk | Medium | Negative customer feedback and complaints |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Millennium. Seeking out regulated alternatives with transparent practices and positive customer feedback can provide a safer trading experience.

Conclusion and Recommendations

In conclusion, the evidence suggests that Millennium may not be a safe option for traders. The lack of regulation, negative customer experiences, and questionable trading conditions raise significant concerns about the broker's legitimacy. Traders should be particularly cautious when considering whether Millennium is safe, as the potential for financial loss is high.

For those looking to trade in the forex market, it is advisable to choose brokers that are well-regulated and have a proven track record of customer satisfaction. Alternatives such as brokers regulated by the FCA or ASIC can offer a more secure trading environment. Ultimately, exercising due diligence and prioritizing safety can help traders avoid potential scams and protect their investments.

Is Millennium a scam, or is it legit?

The latest exposure and evaluation content of Millennium brokers.

Millennium Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Millennium latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.