Kaerm IM 2025 Review: Everything You Need to Know

Summary

This detailed kaerm im review shows troubling facts about this forex broker. Traders should think carefully before choosing this platform. Kaerm IM started in 2023 and says it is a major player in forex trading. The company claims it has raised over $3 billion for different projects and manages more than $4 billion in assets for governments and businesses. But the truth looks very different.

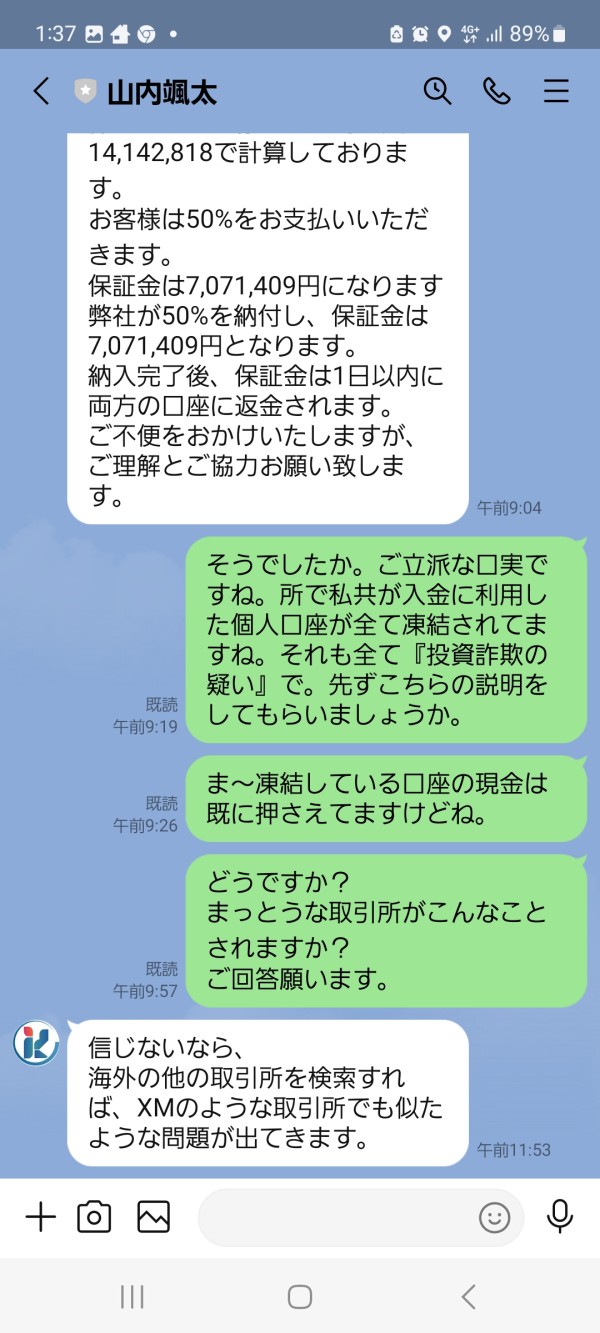

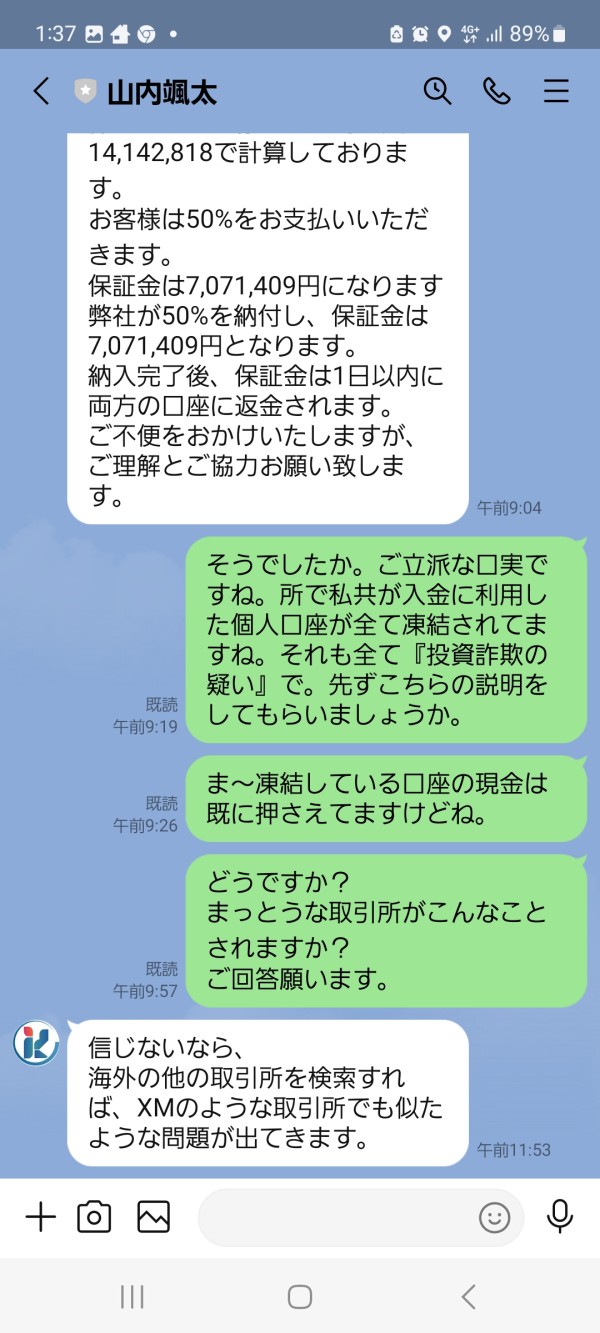

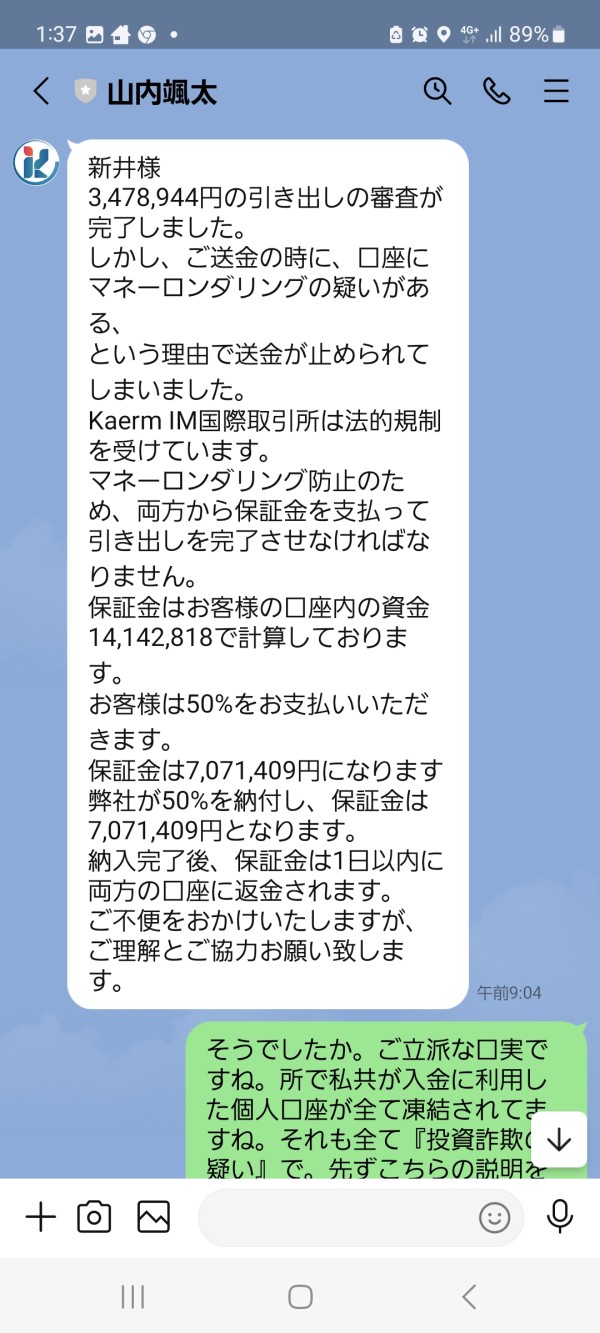

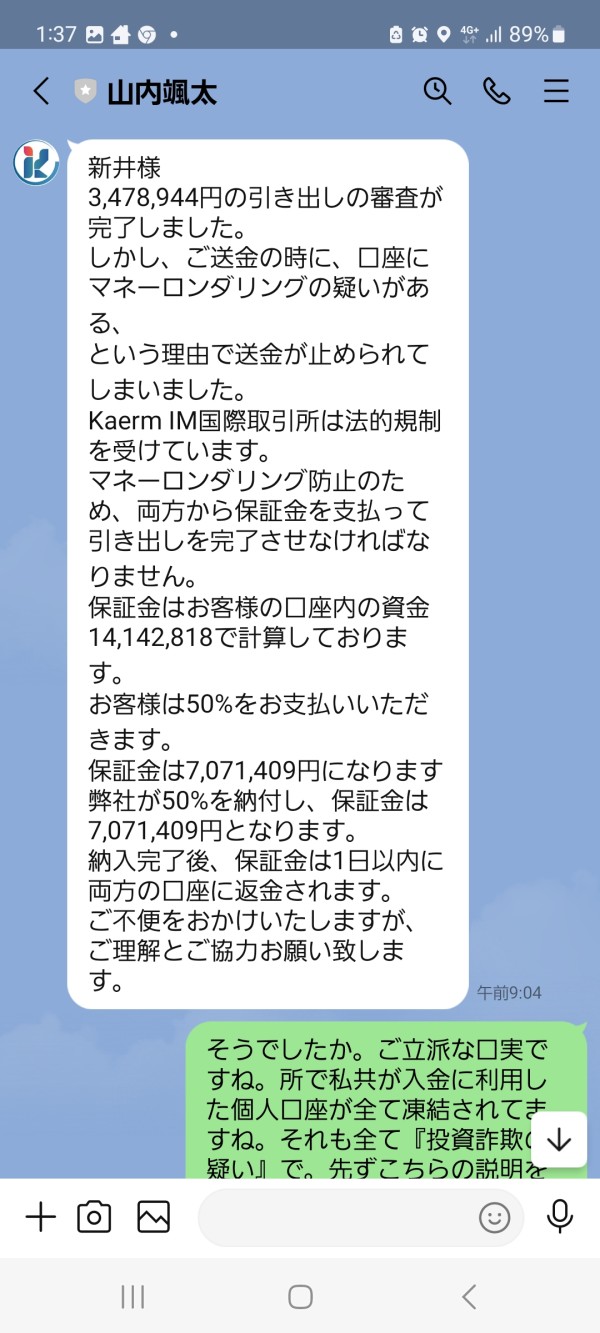

WikiFX gives Kaerm IM a very low rating of 1.17 out of 10. Six users have filed complaints against this platform. The broker gets marked as high-risk because it uses unclear trading rules. These rules might allow market manipulation, price control, and forced liquidation practices. The platform lets you trade forex, cryptocurrencies, commodities, indices, and precious metals. However, the bad user feedback and regulatory problems are much bigger concerns than these trading options.

The broker seems to target high-risk investors who want forex and cryptocurrency exposure. But the serious warning signs mean any potential clients should be extremely careful.

Important Notice

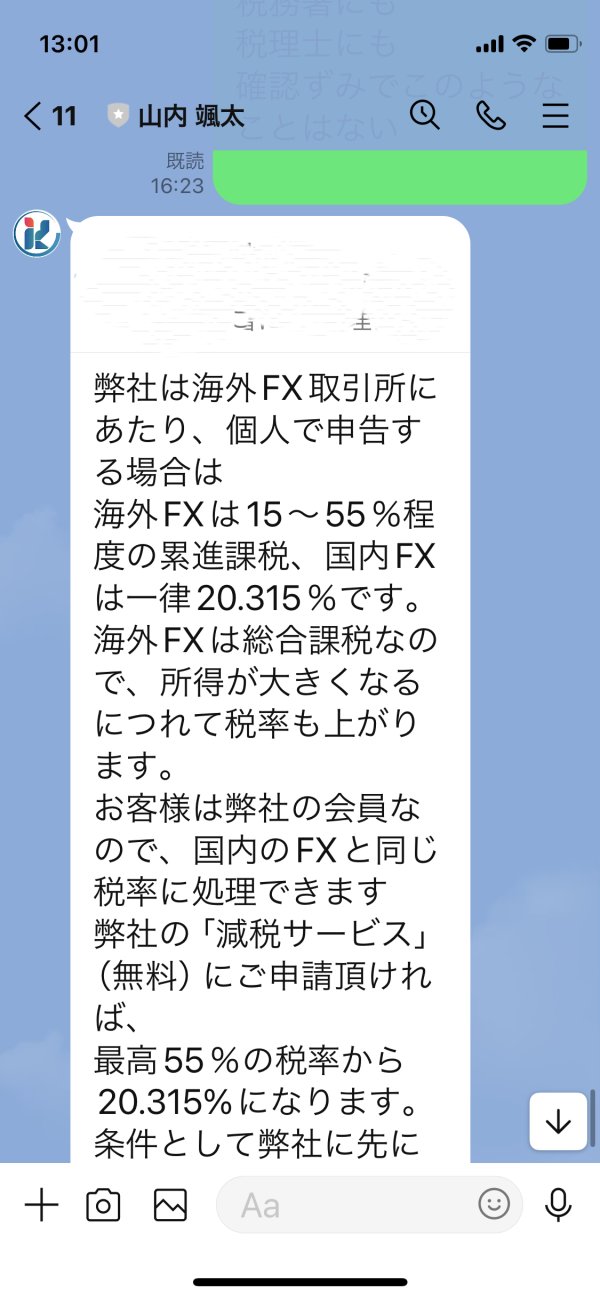

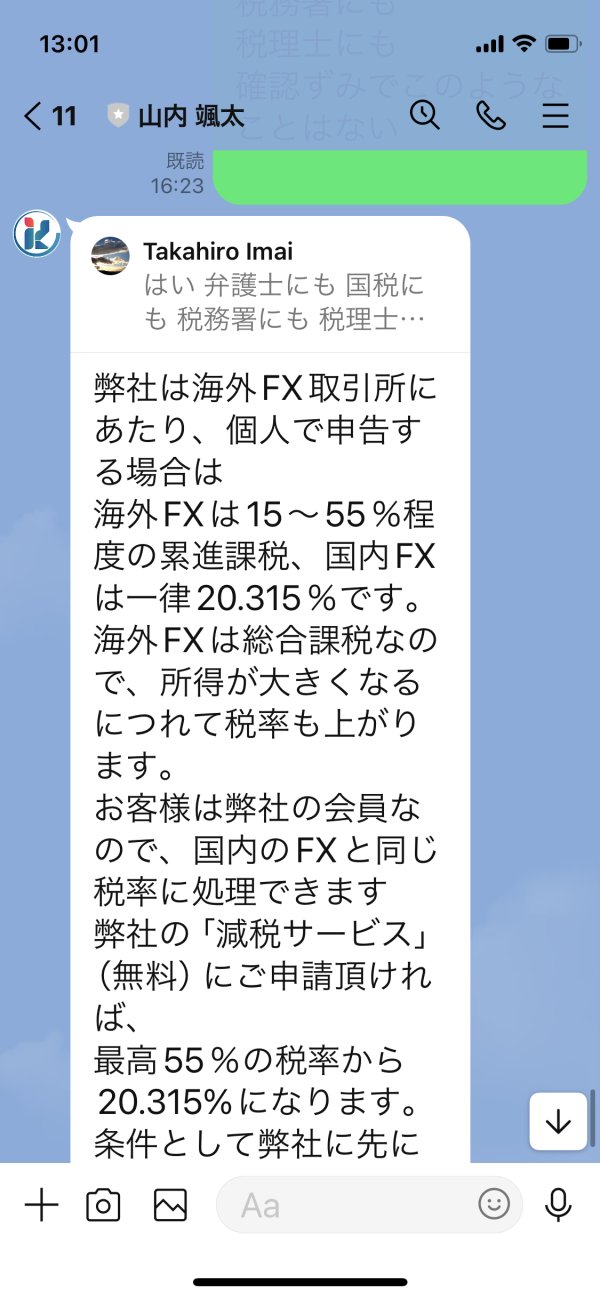

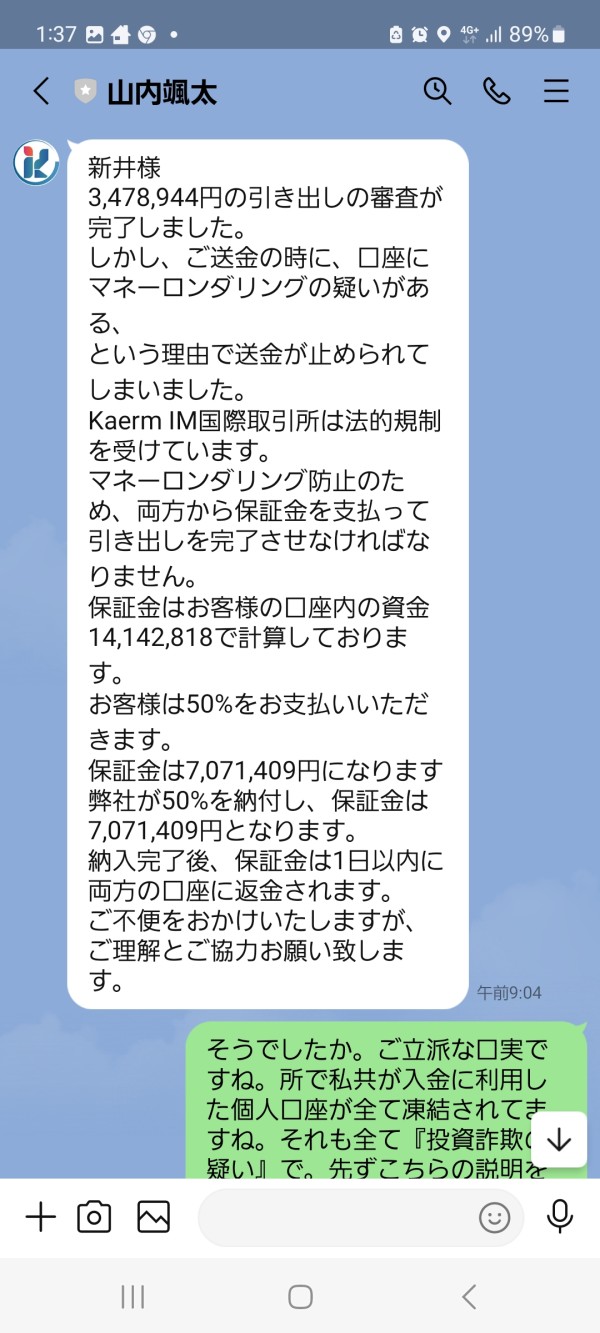

Kaerm IM works under United States Financial Crimes Enforcement Network regulation with license number 31000255528484. But other major regulatory bodies do not watch over this broker, which may hurt investor confidence and protection. The regulatory framework looks weak compared to industry standards. This could leave traders with fewer options when problems happen.

We based this review on public information and user feedback from sources like WikiFX and TraderKnows. Our method looks at regulatory compliance, customer service quality, trading experience, and overall trustworthiness. This gives traders a complete assessment of the broker.

Rating Overview

Broker Overview

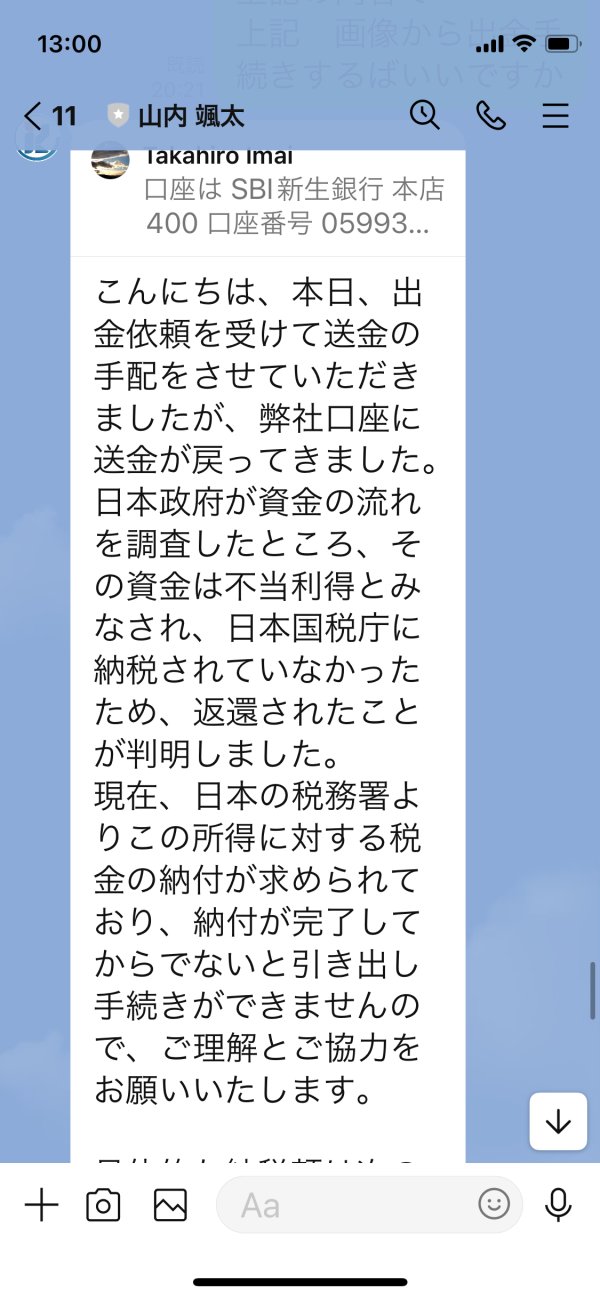

Kaerm IM appeared in the forex trading world in 2023 as a United States-based platform. The company is new but makes big claims about its money success. It says it has raised over $3 billion for major projects in recent years. The broker also claims it manages more than $4 billion in assets for governments and businesses, trying to look like a major institutional player.

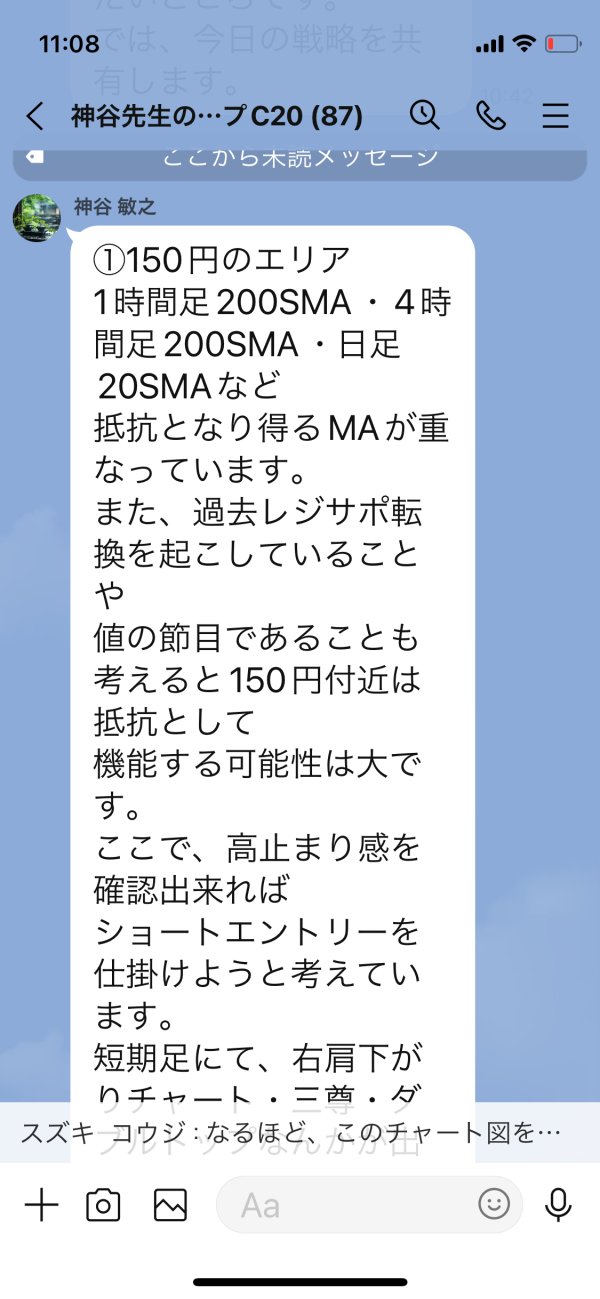

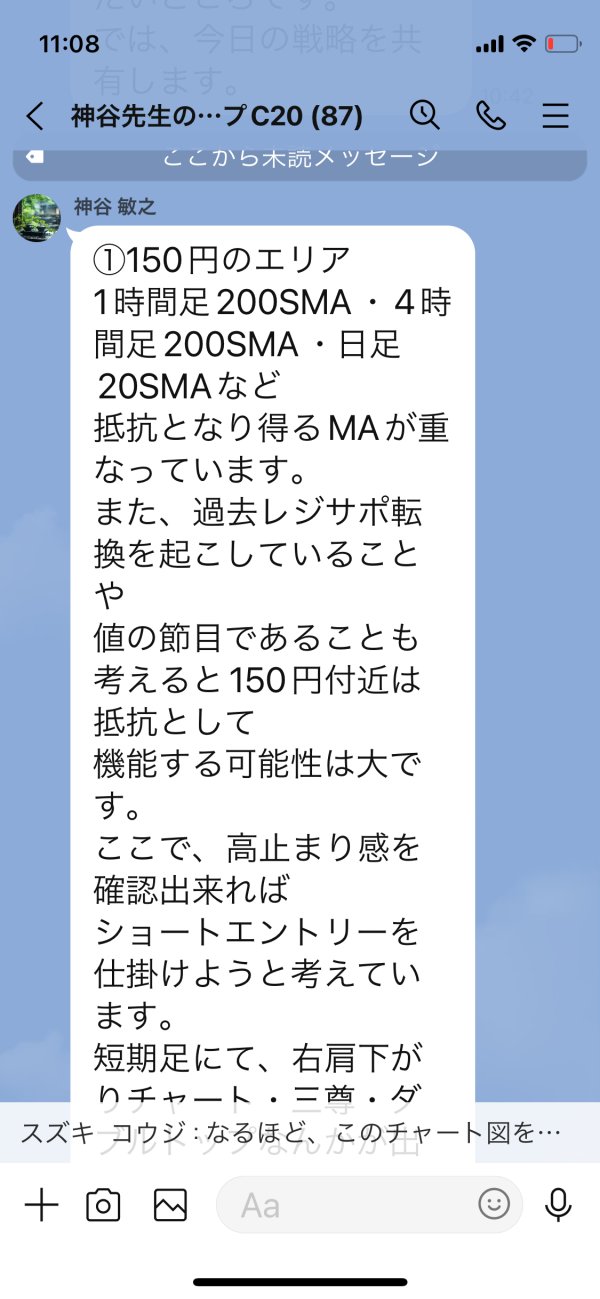

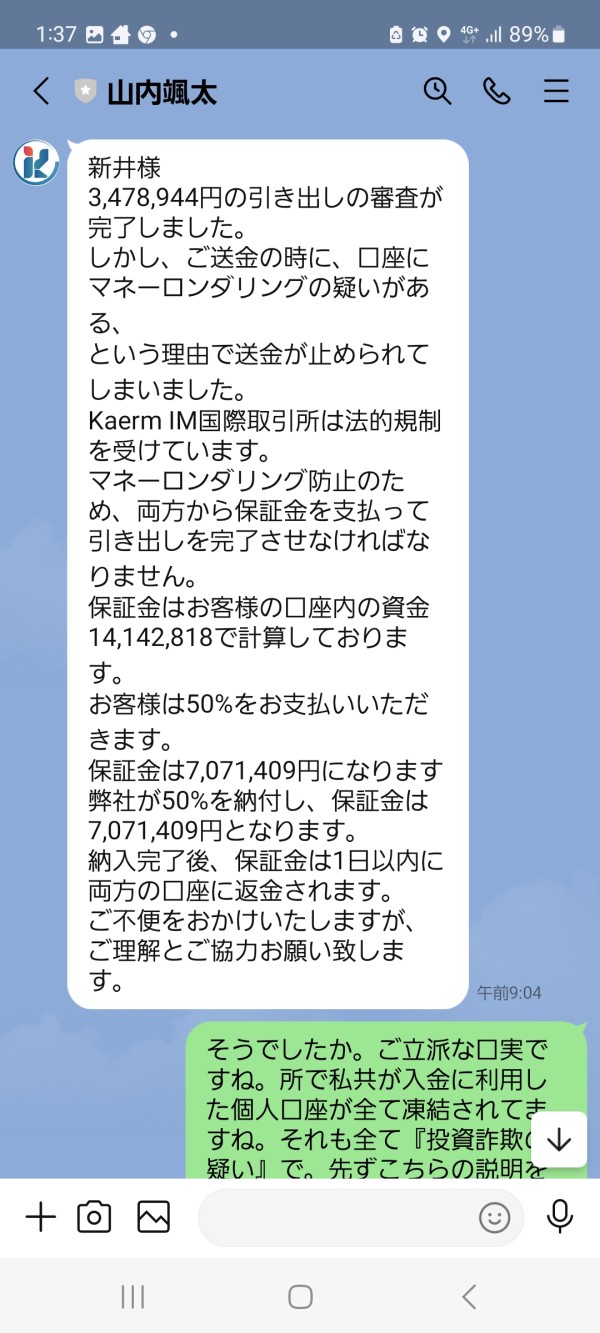

The company focuses on forex trading services along with other financial products. It targets investors who can handle higher risks. TraderKnows reported in May 2024 that the platform uses "highly unclear rules" that might let brokers do questionable things. These include market manipulation, price control, and forced liquidation of client positions.

Kaerm IM offers trading in many asset types including traditional forex pairs, cryptocurrencies, commodities, market indices, and precious metals. This wide selection tries to attract different market groups, but the quality and reliability of these services are very questionable based on user feedback. The platform works under United States Financial Crimes Enforcement Network oversight with license number 31000255528484. This is a basic level of regulatory compliance compared to stricter oversight bodies.

Regulatory Jurisdiction: Kaerm IM works under United States Financial Crimes Enforcement Network supervision with license number 31000255528484. This regulatory framework mainly focuses on anti-money laundering compliance rather than complete trading oversight.

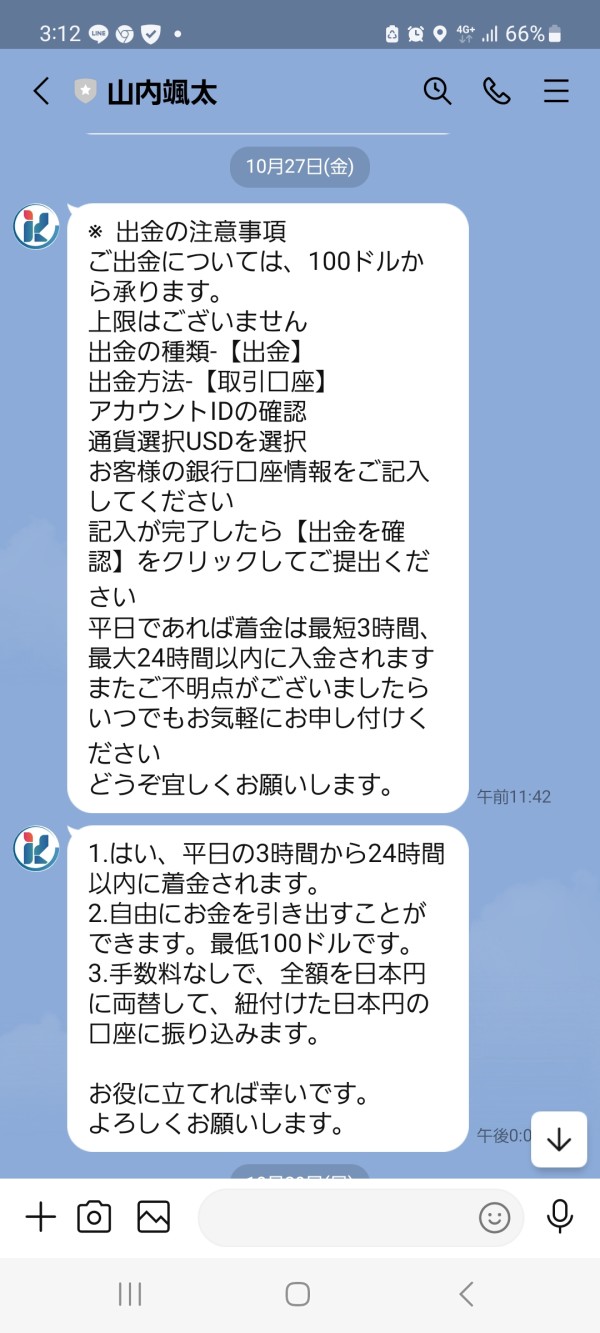

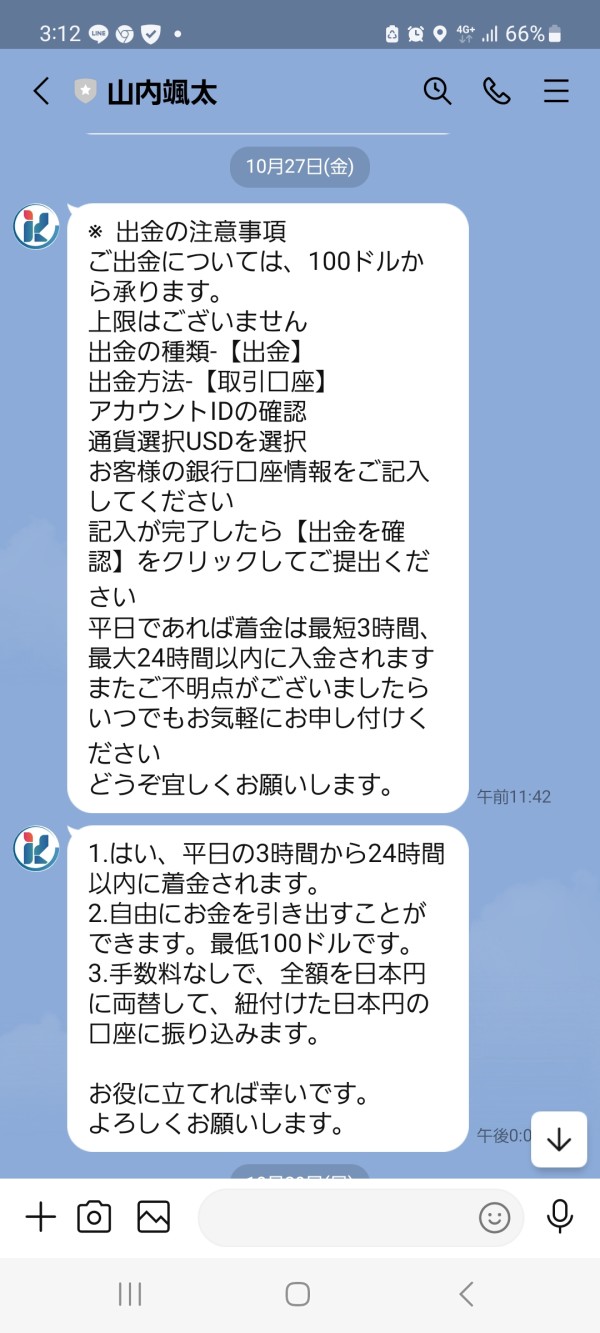

Deposit and Withdrawal Methods: The available deposit and withdrawal methods are not explained in documentation. This creates a big transparency gap for potential clients.

Minimum Deposit Requirements: The broker does not specify minimum deposit requirements in available resources. This makes it hard for traders to know entry barriers.

Bonuses and Promotions: No information about promotional offers or bonus structures is available in current documentation.

Tradeable Assets: The platform supports trading in forex currency pairs, cryptocurrencies, commodities, market indices, and precious metals. This offers a fairly diverse selection of financial instruments.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not available in current documentation. This creates uncertainty about the total cost of trading with this broker.

Leverage Ratios: Specific leverage offerings are not detailed in available information. This leaves traders without crucial information about margin requirements.

Platform Options: The specific trading platforms offered by Kaerm IM are not detailed in available documentation.

Geographic Restrictions: Information about geographic limitations or restricted areas is not available in current documentation.

Customer Support Languages: Available customer service languages are not specified in current resources.

This kaerm im review shows major transparency problems since many basic trading details remain hidden or unavailable in public documentation.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions offered by Kaerm IM stay mostly hidden because the broker lacks transparency in giving specific details about their account structures. Available documentation does not specify what types of accounts are available or whether they offer different levels. It also does not explain what features might separate various account categories. This lack of clarity represents a major concern for potential traders who need clear information about account details before putting in funds.

The missing information about minimum deposit requirements makes the uncertainty around account conditions even worse. Professional traders typically expect clear disclosure of entry-level requirements, account maintenance fees, and any special conditions for different account types. The lack of such basic information suggests either poor communication practices or deliberate hiding of account terms.

Account opening procedures are not detailed in available resources. This leaves potential clients without understanding of verification requirements, needed documentation, or timeframes for account activation. There is also no mention of specialized account options such as Islamic accounts for Sharia-compliant trading. Reputable brokers typically offer this for diverse international clients.

The overall assessment of account conditions gets a poor rating because of the substantial lack of transparency and available information. This kaerm im review emphasizes that the broker's failure to clearly communicate basic account information represents a major red flag for potential clients seeking reliable trading partnerships.

Kaerm IM's offering of trading tools and resources stays largely undocumented in available public information. This creates uncertainty about the platform's capabilities. The broker claims to offer trading across multiple asset classes including forex, cryptocurrencies, commodities, indices, and precious metals. But the specific tools and analytical resources supporting these instruments are not detailed in current documentation.

Research and analytical resources form the backbone of informed trading decisions, but they are not mentioned in available materials. Professional traders typically expect access to market analysis, economic calendars, technical indicators, and fundamental research tools. The missing information about such resources suggests either limited offerings or poor communication of available features.

Educational resources are crucial for trader development and platform familiarization, but they are not referenced in current documentation. Reputable brokers typically provide comprehensive educational materials, webinars, tutorials, and market insights to support client success. The lack of visible educational commitment may indicate limited support for trader development.

Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, is not addressed in available information. This represents a significant gap for traders seeking advanced trading automation features.

The tools and resources dimension receives a below-average rating mainly because of the lack of available information rather than confirmed problems. But the transparency issues themselves represent a substantial concern for potential clients.

Customer Service and Support Analysis (2/10)

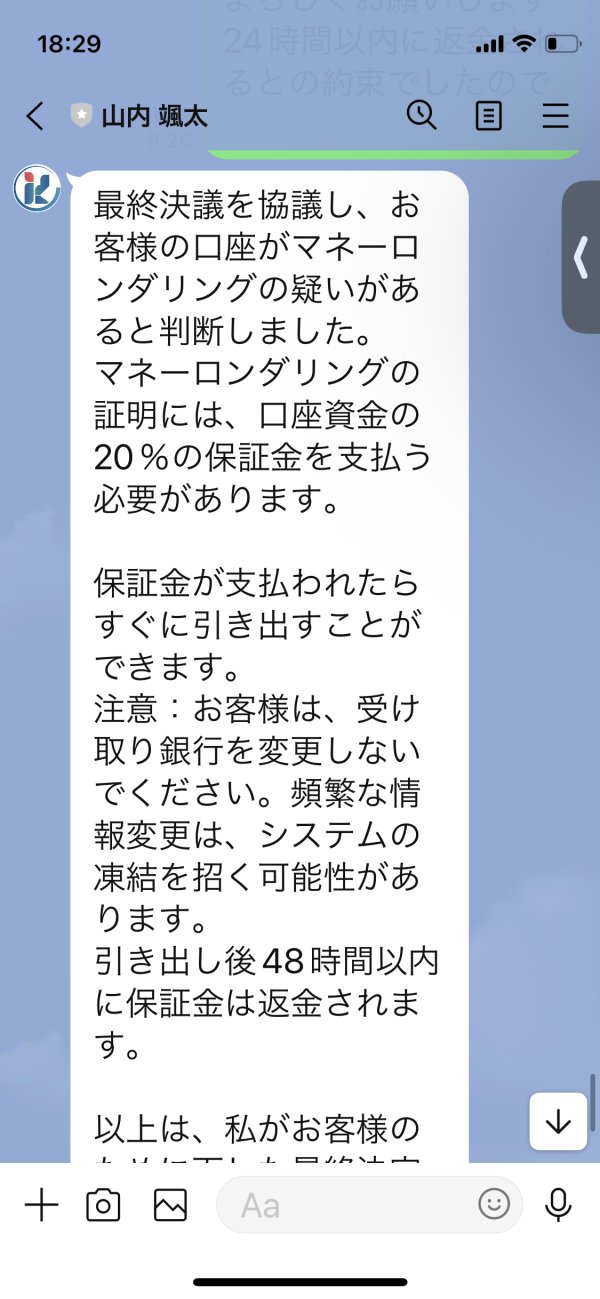

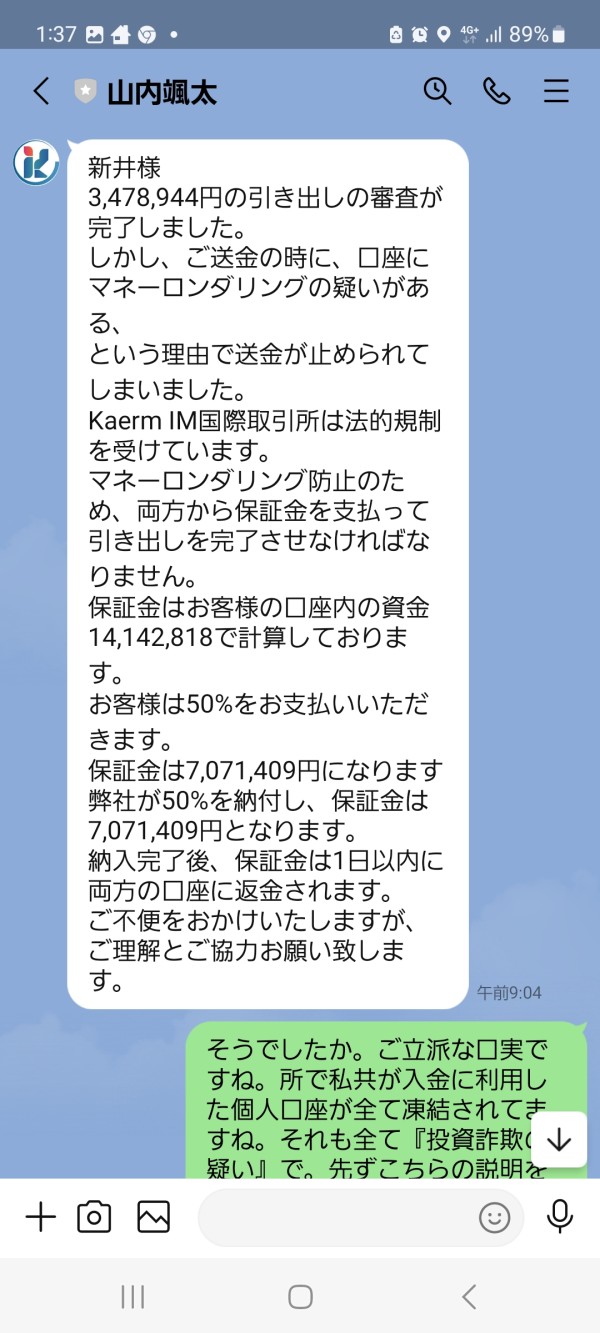

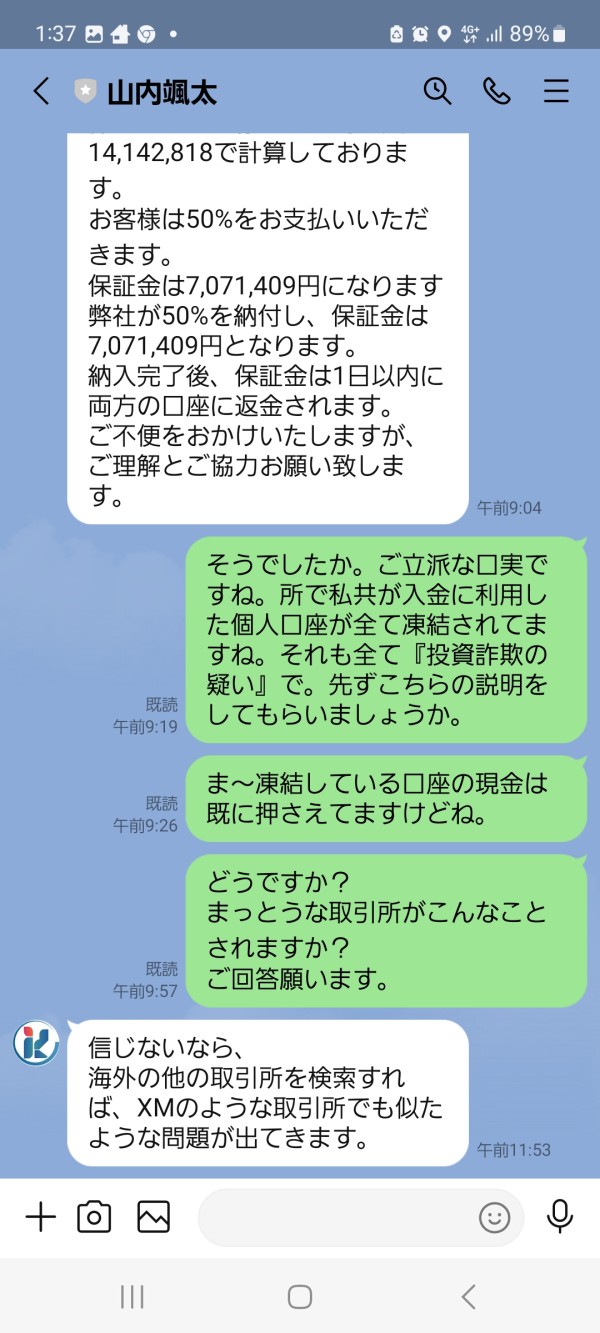

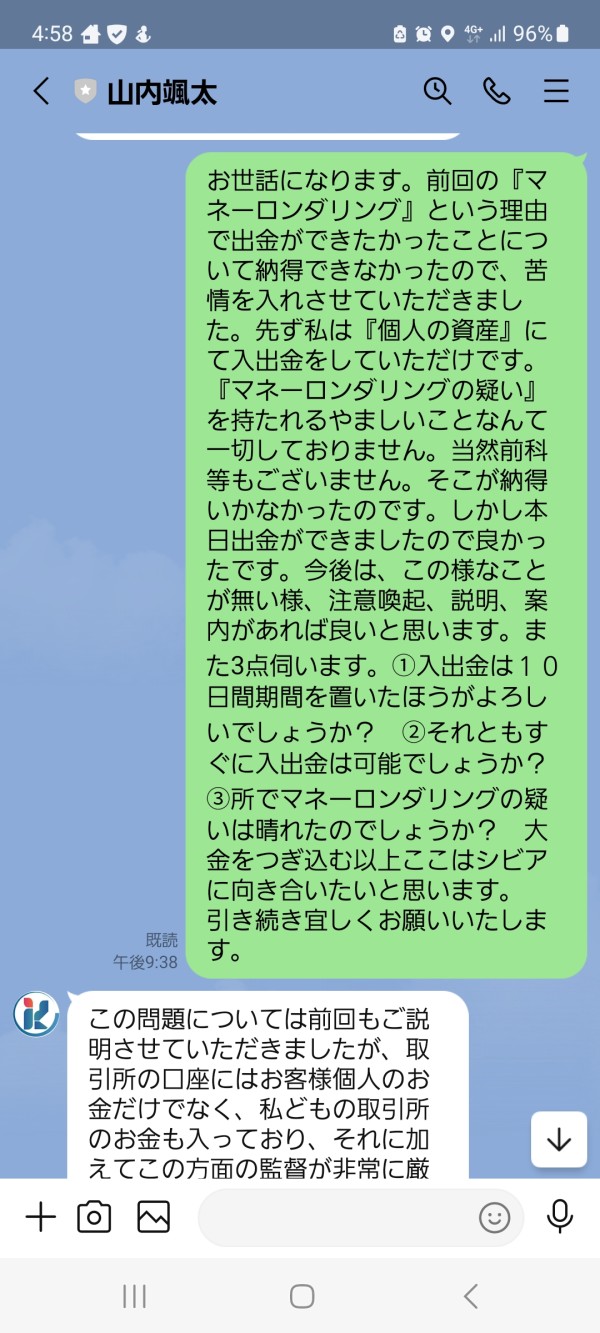

Customer service quality emerges as one of Kaerm IM's most problematic areas based on available user feedback and complaint data. WikiFX reporting shows the broker has accumulated 6 user complaints, which represents a concerning pattern for a relatively new platform established in 2023. This complaint ratio suggests significant issues with customer satisfaction and service delivery.

The specific customer service channels available to clients are not detailed in current documentation. This creates uncertainty about how traders can seek assistance when needed. Professional trading platforms typically offer multiple contact methods including live chat, phone support, email assistance, and comprehensive FAQ sections. The absence of clearly communicated support channels represents a significant service gap.

Response times and service quality appear problematic based on the accumulated complaint pattern. User feedback suggests that clients experience difficulties in resolving issues or receiving adequate support when problems arise. The negative feedback pattern indicates systematic issues with customer service delivery rather than isolated incidents.

Multilingual support capabilities are not specified in available documentation. This potentially limits accessibility for international clients. Professional brokers typically provide support in multiple languages to serve diverse global clients effectively.

Customer service hours and availability are not detailed in current resources. This leaves clients uncertain about when they can expect assistance. The overall customer service assessment receives a very poor rating because of the combination of accumulated complaints and lack of transparent service information.

Trading Experience Analysis (3/10)

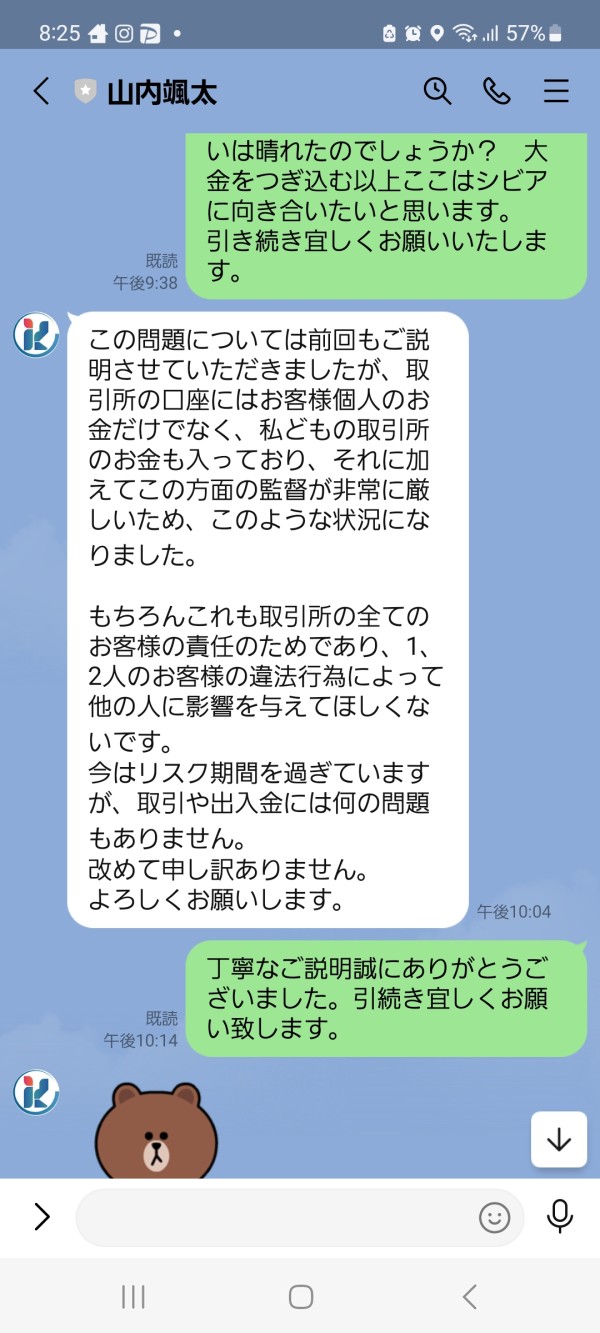

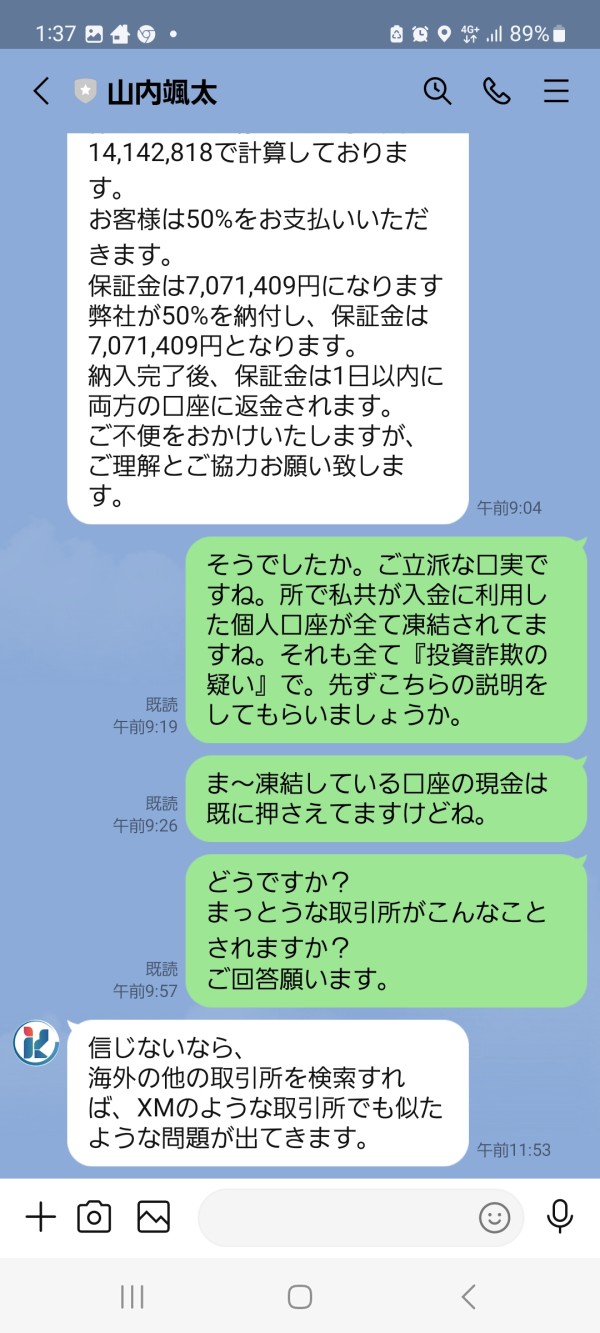

The trading experience offered by Kaerm IM faces substantial concerns based on available information and user feedback patterns. TraderKnows reporting shows the platform operates with "highly unclear rules" that potentially enable questionable practices. These include market manipulation, price control, and forced liquidation of client positions. These characteristics fundamentally undermine the integrity of the trading environment.

Platform stability and execution speed are not specifically addressed in available user feedback. But the overall negative sentiment and high-risk classification suggest potential issues with technical performance. Professional traders require reliable platform performance and consistent order execution to implement their strategies effectively.

Order execution quality appears compromised based on reports of potential market manipulation and price control practices. These allegations suggest that traders may not receive fair market pricing or transparent execution of their orders. This represents a fundamental breach of trading integrity.

Platform functionality and feature completeness are not detailed in available documentation. This creates uncertainty about the tools and capabilities available to traders. The lack of specific platform information makes it difficult to assess whether the trading environment meets professional standards.

Mobile trading capabilities are not addressed in current documentation. This represents a significant gap in modern trading accessibility. Most professional traders expect robust mobile platforms for managing positions and monitoring markets while away from desktop systems.

This kaerm im review emphasizes that the trading experience receives a poor rating mainly because of serious concerns about trading integrity and the lack of transparent information about platform capabilities.

Trust and Safety Analysis (1/10)

Trust and safety represent Kaerm IM's most critical weakness, earning the lowest possible rating because of multiple serious concerns identified in available reporting. The broker's regulatory status is technically valid through FinCEN licensing, but it provides limited protection compared to more comprehensive regulatory frameworks. Major financial oversight bodies offer better protection.

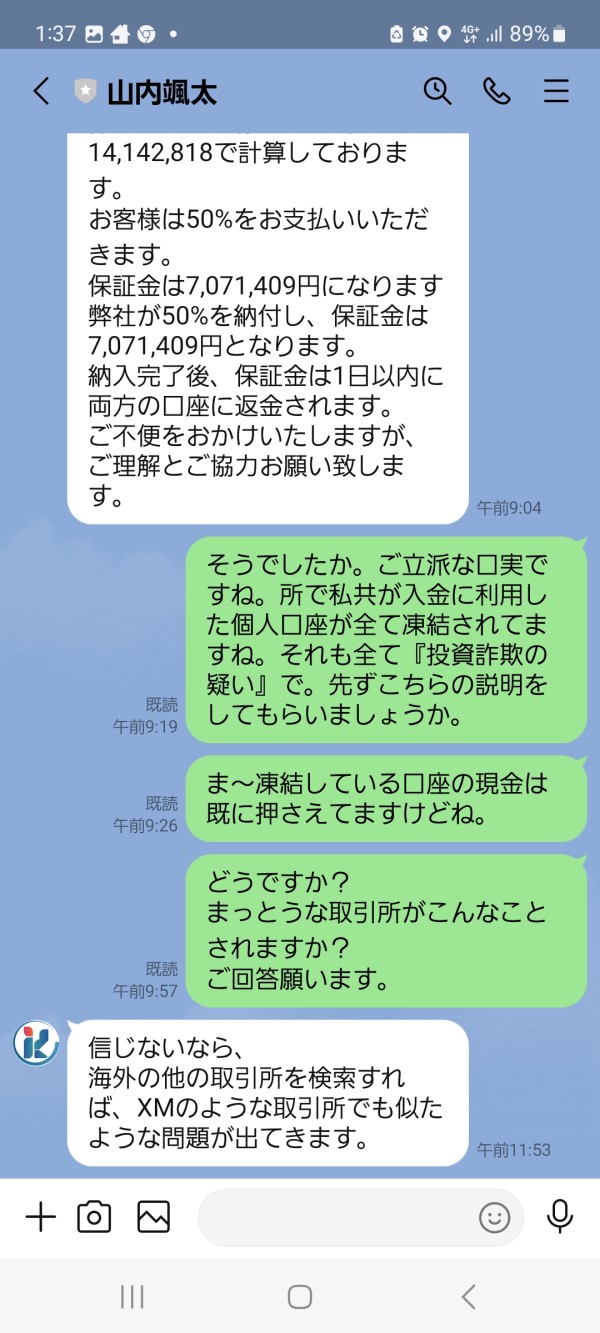

TraderKnows reporting shows Kaerm IM has been classified as "high risk" with allegations of operating under "highly unclear rules." These potentially enable market manipulation, price control, and forced liquidation practices. These characteristics represent fundamental violations of trading integrity and client protection principles.

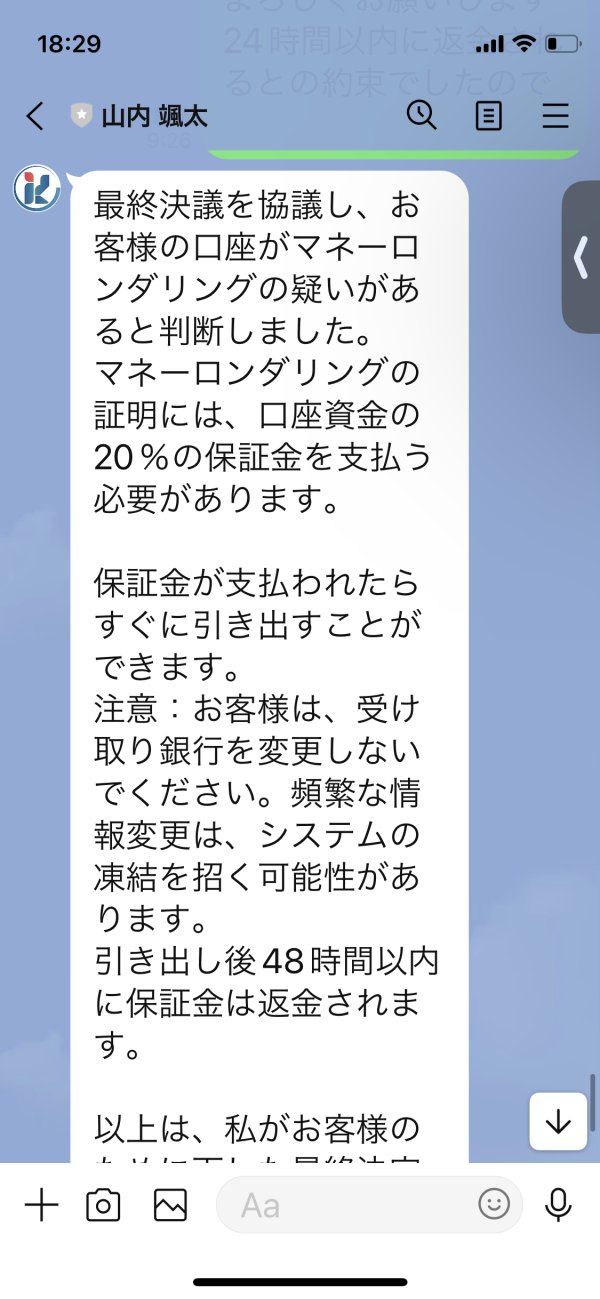

Fund safety measures are not detailed in available documentation. This creates uncertainty about client fund segregation, insurance protection, or other safeguards typically used by reputable brokers. The absence of transparent fund protection information represents a significant trust deficit.

Company transparency appears severely compromised with limited available information about management structure, financial reporting, or operational procedures. Professional brokers typically provide comprehensive disclosure about their operations, leadership, and financial stability.

Industry reputation has been significantly damaged by the high-risk classification and negative user feedback patterns. The WikiFX rating of 1.17 out of 10 reflects extremely poor industry standing and user trust levels.

The trust and safety dimension receives the lowest possible rating because of the combination of regulatory concerns, operational transparency issues, and serious allegations about trading practices.

User Experience Analysis (2/10)

User experience assessment reveals significant dissatisfaction based on available feedback and rating data. The WikiFX rating of 1.17 out of 10 represents extremely poor user satisfaction. This indicates that the vast majority of users who have interacted with the platform report negative experiences.

Overall user satisfaction appears critically low based on the accumulated complaint pattern and poor ratings across evaluation platforms. The 6 complaints registered on WikiFX for a relatively new broker suggest systematic issues with user experience delivery rather than isolated problems.

Interface design and usability are not specifically addressed in available user feedback. But the overall negative sentiment suggests potential issues with platform accessibility and user-friendliness. Modern traders expect intuitive interfaces and streamlined navigation for effective trading activities.

Registration and verification processes are not detailed in available documentation. This creates uncertainty about the onboarding experience for new clients. Professional platforms typically provide clear, efficient account opening procedures with transparent verification requirements.

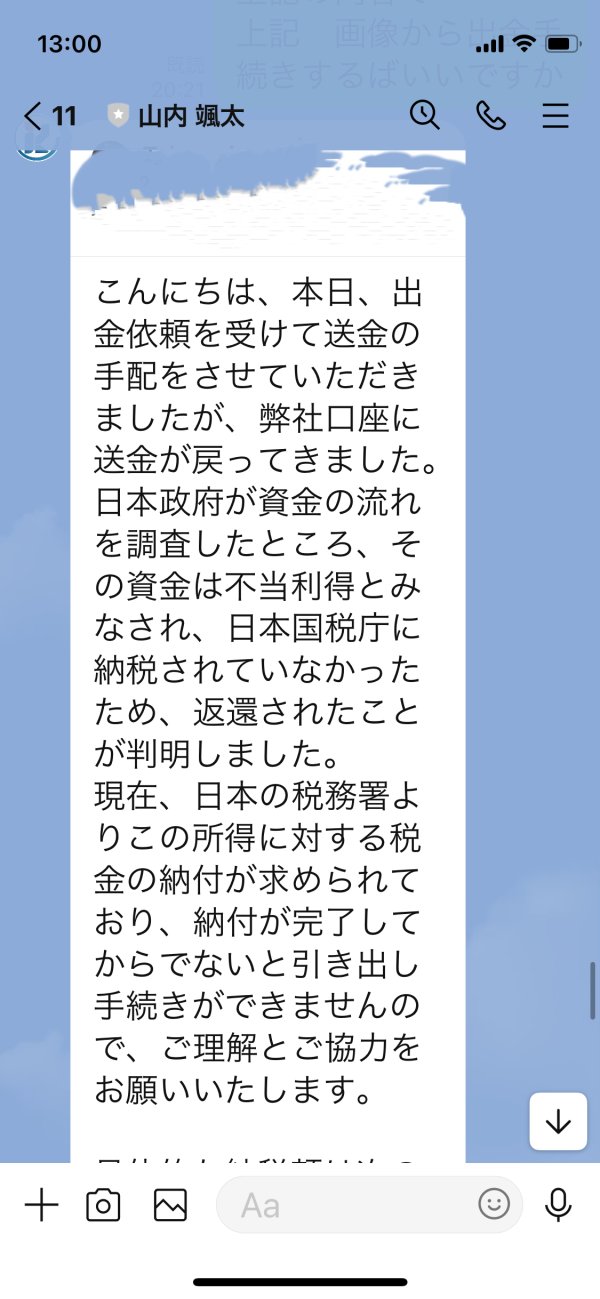

Fund operation experiences are not specifically documented in available user feedback. But the overall negative sentiment and complaint patterns suggest potential issues with deposit and withdrawal processes.

Common user complaints appear to center around the platform's reliability and integrity based on the high-risk classification and negative feedback patterns. The user experience dimension receives a very poor rating because of the overwhelming negative feedback and extremely low satisfaction ratings across evaluation platforms.

Conclusion

This comprehensive kaerm im review reveals a forex broker that presents significant risks and concerns for potential traders. Kaerm IM's performance across all evaluation dimensions falls well below industry standards. It has particularly alarming issues in trust and safety, customer service, and overall user experience.

The broker offers a diverse range of tradeable assets including forex, cryptocurrencies, commodities, indices, and precious metals. But these offerings are overshadowed by serious concerns about operational integrity and regulatory adequacy. The platform may potentially appeal to extremely high-risk investors seeking alternative trading opportunities. But such engagement would require accepting substantial risks regarding fund safety and trading fairness.

The primary advantages include asset diversity and FinCEN regulatory compliance. The significant disadvantages include poor user ratings, multiple complaints, high-risk classification, operational opacity, and serious allegations regarding trading practices. Based on this analysis, traders are advised to exercise extreme caution and consider more established, transparently regulated alternatives for their forex trading needs.