Voco Markets 2025 Review: Everything You Need to Know

Executive Summary

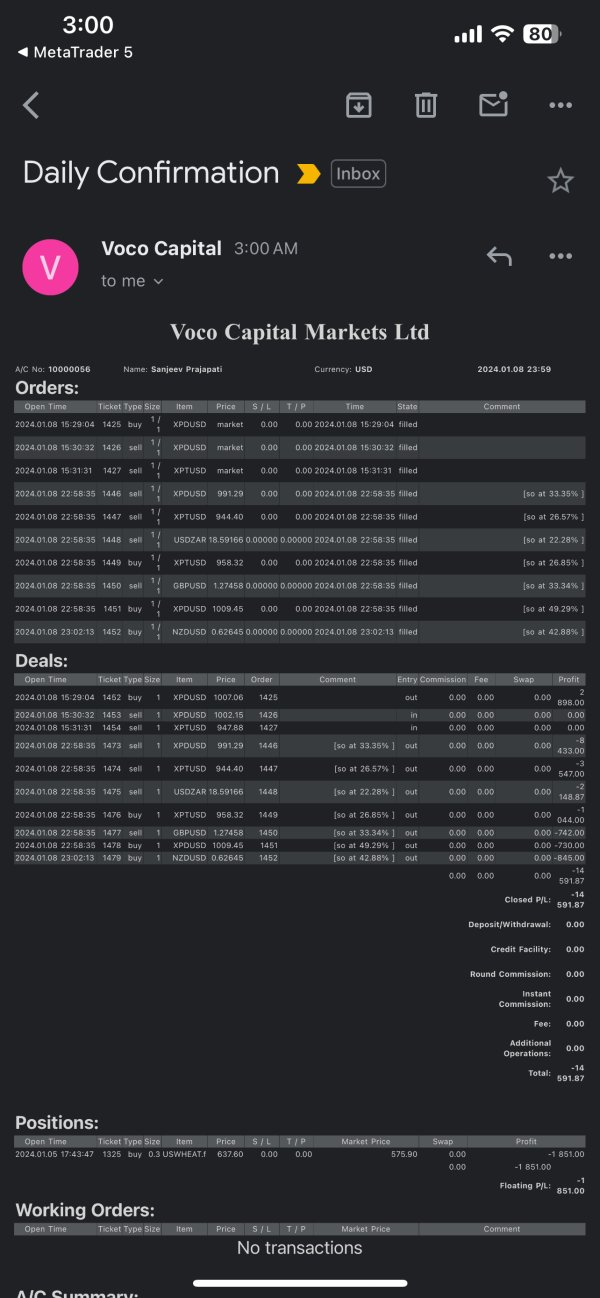

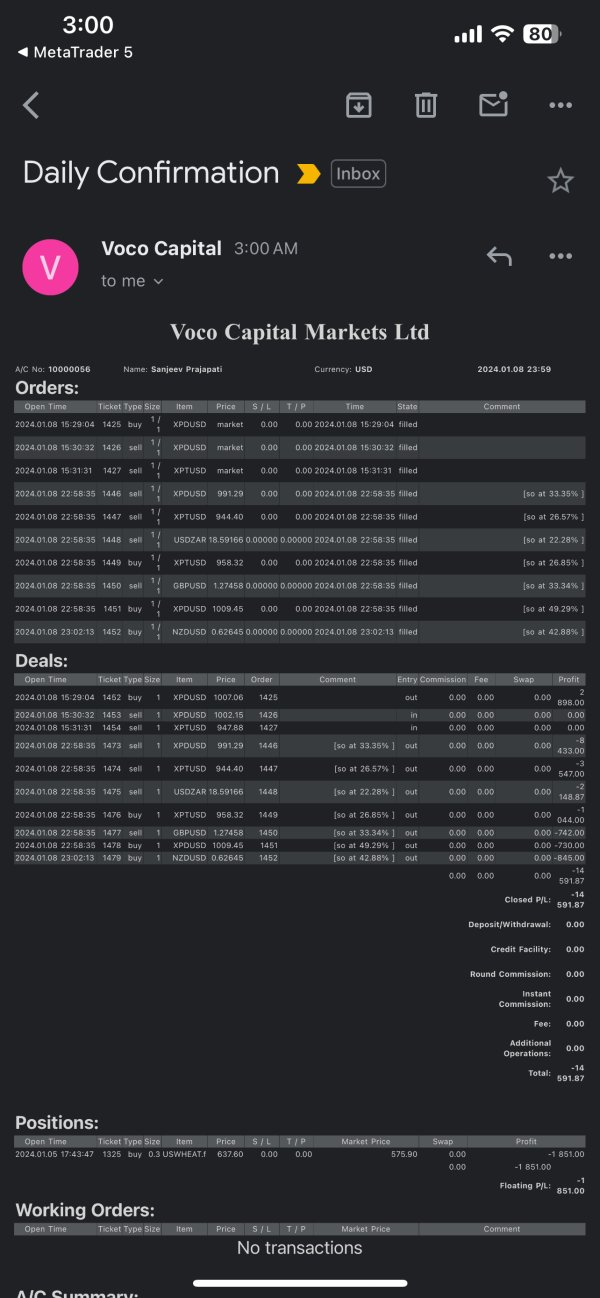

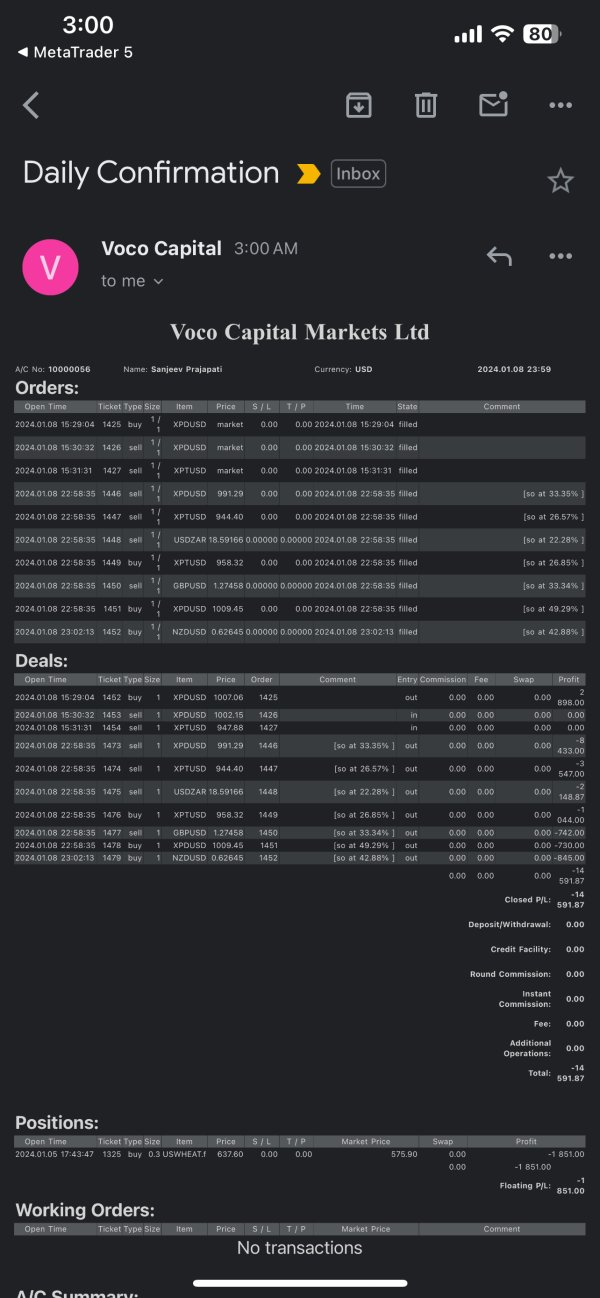

This comprehensive voco markets review reveals concerning findings about this relatively young brokerage firm. Voco Markets operates from the Comoros Islands without proper regulatory licensing, placing it in an unregulated status that raises significant red flags for potential traders. According to WikiFX, the broker receives a troubling score of 1 out of 10. This indicates extremely low credibility within the forex community.

The most alarming aspect of our investigation involves multiple user reports of substantial financial losses, with one documented case involving $7,000. These reports have led many in the trading community to question whether Voco Markets operates as a legitimate brokerage or represents a potential scam operation. The lack of regulatory oversight combined with negative user feedback creates a highly risky environment for traders. This makes the platform dangerous for most investors.

Given the current evidence, Voco Markets appears suitable only for investors who fully understand and accept extremely high-risk investment scenarios. The absence of proper licensing, combined with documented user losses and poor industry ratings, makes this broker unsuitable for most retail traders seeking reliable trading conditions and fund security.

Important Notice

Regional Regulatory Differences: Voco Markets is registered in the Comoros Islands but operates without valid licensing from recognized financial authorities. Users should carefully consider the legal implications and risks associated with trading through an unregulated entity, as regulatory protections typically available through licensed brokers are absent.

Review Methodology: This evaluation is based on comprehensive analysis of user feedback, industry reports, and available public information. Due to the broker's unregulated status, official company data verification remains limited, and traders should exercise extreme caution when considering this platform.

Overall Rating Framework

Broker Overview

Voco Markets presents itself as a forex and CFD brokerage. Comprehensive information about its establishment date and corporate background remains largely unavailable through official channels. The company operates from the Comoros Islands, a jurisdiction known for hosting numerous offshore financial entities with varying degrees of legitimacy. The broker's business model and operational structure lack transparency, which is concerning for potential clients seeking reliable trading partnerships.

According to available industry reports, Voco Markets has gained attention primarily due to negative user experiences rather than positive trading outcomes. The broker's young market presence, combined with its offshore registration, suggests a business model that may prioritize regulatory arbitrage over client protection. This voco markets review finds that the company's operational transparency falls significantly below industry standards expected from reputable brokers. Most established firms provide much more detailed information about their services.

The lack of detailed information about trading platforms, asset offerings, and basic account structures raises additional concerns about the broker's commitment to providing comprehensive trading services. Most established brokers provide extensive information about their operations, regulatory compliance, and service offerings, while Voco Markets maintains an unusually low profile in these critical areas.

Regulatory Status: Voco Markets operates from the Comoros Islands without holding valid licenses from recognized financial regulatory authorities. This unregulated status means traders lack standard protections available through licensed brokers, including compensation schemes and regulatory oversight.

Deposit and Withdrawal Methods: Specific information regarding funding methods, processing times, and associated fees remains undisclosed in available documentation. This creates uncertainty about basic operational procedures.

Minimum Deposit Requirements: The broker has not published clear information about minimum deposit amounts across different account types. This makes it difficult for potential clients to assess accessibility and entry requirements.

Promotional Offers: No verified information exists regarding bonus structures, promotional campaigns, or special offers that might be available to new or existing clients.

Tradeable Assets: The range of available instruments, including forex pairs, commodities, indices, and other CFD products, has not been clearly specified in accessible materials.

Cost Structure: Critical pricing information including spreads, commissions, overnight fees, and other trading costs remains unavailable. This prevents accurate cost analysis for potential traders in this voco markets review.

Leverage Options: Maximum leverage ratios and margin requirements across different asset classes have not been disclosed. This limits traders' ability to assess risk management parameters.

Platform Options: Information about trading platforms, whether proprietary or third-party solutions like MetaTrader, remains unspecified in available resources.

Geographic Restrictions: Specific countries or regions where services may be restricted or prohibited have not been clearly outlined.

Customer Support Languages: Available language support for customer service interactions has not been documented in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions offered by Voco Markets remain largely mysterious, with virtually no publicly available information about account types, features, or requirements. This lack of transparency immediately raises concerns about the broker's commitment to client service and regulatory compliance. Legitimate brokers typically provide detailed account specifications, including different tiers of service, minimum deposit requirements, and special features designed to accommodate various trader profiles. The absence of such basic information makes it impossible for potential clients to make informed decisions.

The absence of information about Islamic accounts, professional trading accounts, or beginner-friendly options suggests either a very limited service offering or a deliberate lack of transparency. Most reputable brokers offer multiple account types with clearly defined benefits, costs, and eligibility requirements. The failure to provide such basic information makes it impossible for potential clients to make informed decisions about account selection. This creates significant barriers for traders seeking appropriate account options.

User reports indicate significant financial losses, with one documented case involving $7,000, suggesting that whatever account conditions exist may not adequately protect client interests. The lack of clear terms and conditions, combined with reported losses, indicates that account holders may face unexpected risks or unfavorable trading conditions that are not properly disclosed upfront.

This voco markets review finds that the absence of transparent account information, combined with negative user experiences, makes the account conditions unsuitable for most traders seeking reliable and well-documented trading environments.

The trading tools and resources available through Voco Markets remain completely undocumented in accessible materials. This represents a significant red flag for potential clients. Professional forex brokers typically offer comprehensive suites of analytical tools, market research, educational resources, and trading automation capabilities. The absence of any information about these critical trading components suggests either a severely limited platform or a lack of commitment to providing professional trading services.

Modern forex trading requires access to technical analysis tools, economic calendars, market news feeds, and educational materials to help traders make informed decisions. The complete absence of information about such resources indicates that Voco Markets may not provide the infrastructure necessary for successful trading. This limitation particularly affects new traders who rely on educational content and experienced traders who require sophisticated analytical capabilities. Without proper tools, traders cannot perform adequate market analysis.

The lack of information about trading platforms compounds the tools and resources problem. Without knowing whether the broker offers MetaTrader 4, MetaTrader 5, or proprietary platforms, potential clients cannot assess the availability of expert advisors, custom indicators, or automated trading strategies. This uncertainty makes it impossible to evaluate the technical capabilities required for modern forex trading.

Given the complete absence of documented tools and resources, combined with the broker's questionable regulatory status, traders seeking professional-grade trading infrastructure should look elsewhere for more transparent and better-equipped alternatives.

Customer Service and Support Analysis (Score: 1/10)

Customer service information for Voco Markets is notably absent from available documentation. This creates serious concerns about the broker's commitment to client support. Professional brokers typically provide multiple contact channels, including phone support, email assistance, live chat capabilities, and comprehensive FAQ sections. The lack of publicly available customer service information suggests either inadequate support infrastructure or a deliberate attempt to limit client contact options.

The absence of documented support hours, available languages, and response time commitments makes it impossible for potential clients to assess whether they will receive adequate assistance when needed. This is particularly concerning given the complex nature of forex trading, where timely support can be crucial for resolving technical issues, account problems, or trading disputes. Traders need reliable support to address urgent trading concerns.

User reports of financial losses, including the documented $7,000 case, raise additional questions about the broker's responsiveness to client concerns and dispute resolution procedures. Legitimate brokers typically have established procedures for handling client complaints and resolving trading issues, but no such information is available for Voco Markets.

The combination of missing customer service information and negative user experiences suggests that clients may face significant challenges when seeking assistance or attempting to resolve problems. This lack of support infrastructure represents a major risk factor for traders considering this broker.

Trading Experience Analysis (Score: 2/10)

The trading experience offered by Voco Markets appears severely compromised based on available user feedback and the lack of transparent operational information. User reports indicate significant financial losses, with documented cases including a $7,000 loss that has led to fraud allegations against the broker. These reports suggest that the trading environment may be designed to favor the house rather than providing fair and transparent trading conditions.

Platform stability, execution speed, and order processing quality remain undocumented, making it impossible to assess the technical aspects of the trading experience. Professional traders require reliable platform performance, fast execution speeds, and transparent order processing to implement their strategies effectively. The absence of such information suggests that Voco Markets may not prioritize these critical technical requirements. This creates uncertainty about basic trading functionality.

The lack of information about trading conditions, including spreads, slippage, and execution policies, further compromises the trading experience evaluation. Without understanding these fundamental aspects, traders cannot assess whether the broker provides competitive and fair trading conditions or whether hidden costs and unfavorable execution practices may impact profitability.

This voco markets review finds that the combination of negative user reports and missing technical information creates a trading environment that appears unsuitable for serious traders seeking reliable and transparent trading conditions.

Trust and Safety Analysis (Score: 1/10)

Trust and safety represent the most critical concerns surrounding Voco Markets, with multiple factors contributing to a severely compromised credibility profile. The broker operates without valid licensing from recognized financial regulatory authorities, placing it in an unregulated status that eliminates standard client protections available through licensed entities. This regulatory gap means that traders lack access to compensation schemes, regulatory oversight, and dispute resolution mechanisms typically provided by legitimate financial authorities.

WikiFX's rating of 1 out of 10 for Voco Markets reflects the broader industry consensus regarding the broker's questionable credibility. Such low ratings from established industry monitoring services indicate significant concerns about the broker's legitimacy and operational practices. These ratings are typically based on regulatory status, user feedback, and operational transparency, all of which appear problematic for Voco Markets. The rating system helps traders identify potentially dangerous brokers.

User reports of substantial financial losses, including documented cases involving thousands of dollars, have led to fraud allegations within the trading community. These reports suggest that client funds may not receive adequate protection and that withdrawal requests may face significant obstacles. The pattern of reported losses indicates systemic issues rather than isolated incidents.

The absence of information about fund segregation, client money protection, and insurance coverage further undermines trust and safety. Legitimate brokers typically provide detailed information about how client funds are protected and what measures exist to safeguard trader deposits.

User Experience Analysis (Score: 1/10)

The user experience provided by Voco Markets appears fundamentally flawed based on available feedback and the broker's operational approach. Documented user reports consistently point to negative outcomes, with traders reporting substantial financial losses and questioning the broker's legitimacy. These experiences suggest that the platform may be designed to extract funds from users rather than provide genuine trading opportunities.

The lack of transparent information about basic operational aspects creates a poor user experience from the initial research phase. Potential clients cannot access clear information about account types, trading conditions, platform features, or basic service offerings. This opacity makes it impossible for users to make informed decisions about whether the broker meets their trading requirements. Traders need clear information to evaluate potential brokers effectively.

Registration and verification processes remain undocumented, suggesting that users may encounter unclear or problematic onboarding procedures. Professional brokers typically provide clear guidance about account opening requirements, verification timelines, and initial deposit procedures. The absence of such information indicates a substandard approach to client onboarding.

The overall user experience appears designed to minimize transparency while potentially maximizing the broker's ability to retain client funds. This approach contrasts sharply with legitimate brokers who prioritize client satisfaction, transparent operations, and positive user outcomes as key business objectives.

Conclusion

This comprehensive voco markets review reveals a broker that presents significant risks to potential traders across multiple critical areas. The unregulated status, combined with consistently negative user feedback and documented financial losses, creates a trading environment that appears unsuitable for most retail traders. The absence of regulatory oversight eliminates standard client protections, while reported user losses suggest systematic issues with the broker's operational model. These factors combine to create an extremely risky trading environment.

Voco Markets may only be appropriate for highly experienced traders who fully understand and accept extreme risk scenarios, though even such traders would likely find better opportunities with properly regulated alternatives. The lack of transparency regarding basic operational aspects, combined with poor industry ratings and fraud allegations, makes this broker unsuitable for traders seeking reliable and secure trading environments.

The primary disadvantages include unregulated status, poor credibility ratings, documented user losses, and lack of operational transparency, while no significant advantages have been identified through available documentation and user feedback.