ajman tadawul 2025 Review: Everything You Need To Know

Abstract

The ajman tadawul review shows a broker with serious red flags about legitimacy and regulatory oversight. This broker has many user complaints and appears to operate in a questionable manner that raises significant concerns about its business practices. ajman tadawul offers high leverage up to 1:400 and commission-free trading. These features might look attractive to traders who want aggressive risk management options. However, many reports on various platforms cite scam-related issues and poor satisfaction that overshadow these attractive offerings completely. The broker has an unclear background and lacks clear regulatory information. This contributes to a very negative overall evaluation of their services and trustworthiness. ajman tadawul seems to target traders who can handle high risks and are willing to gamble with their investments. Several online sources, including fraudrecoveryexperts and dnbforexpriceaction, report that the platform fails to meet basic transparency standards. This has prompted many experts to warn potential investors about the serious risks involved. The ajman tadawul review shows that investors should be extremely careful and check all risks before getting involved with this broker.

Important Considerations

When looking at ajman tadawul, you need to know about potential cross-regional compliance issues. The broker's regulatory information is missing, which raises concerns about legal and financial problems for traders in different regions that could be very serious. This lack of clear jurisdiction shows they don't follow established regulatory standards. This review uses user feedback and online data from various platforms to form its conclusions. The evaluation tries to be complete, but it may not cover every part of the broker's operations since information is limited. Potential traders should know that the available information comes mainly from user testimonials and third-party reports. This could give an incomplete picture of how the broker actually performs in real trading situations. Using these sources shows why you need to do careful personal research and check all important details before putting any money at risk.

Scoring Framework

Broker Overview

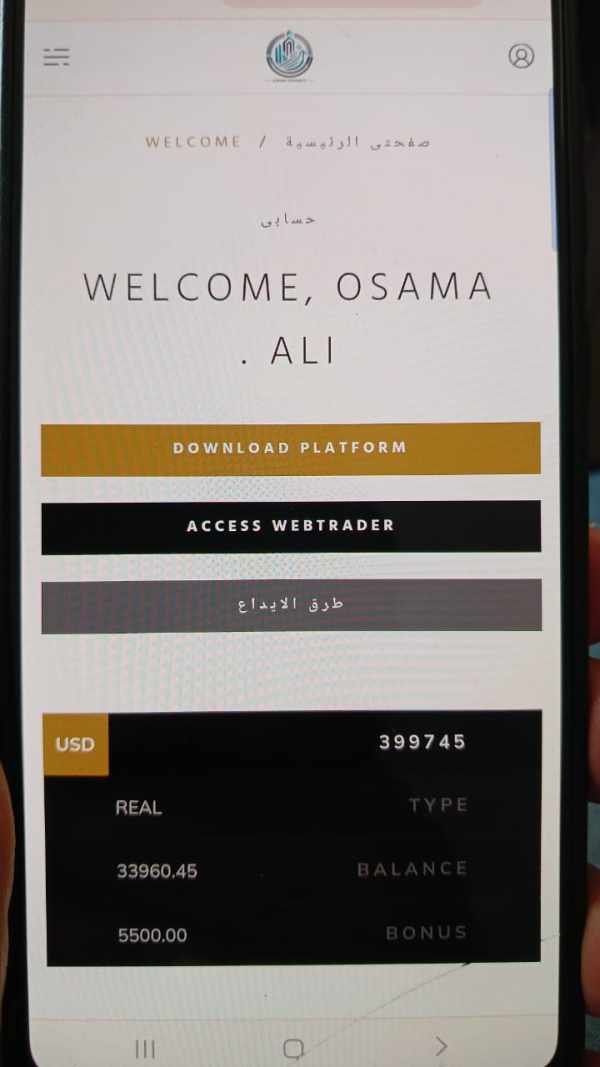

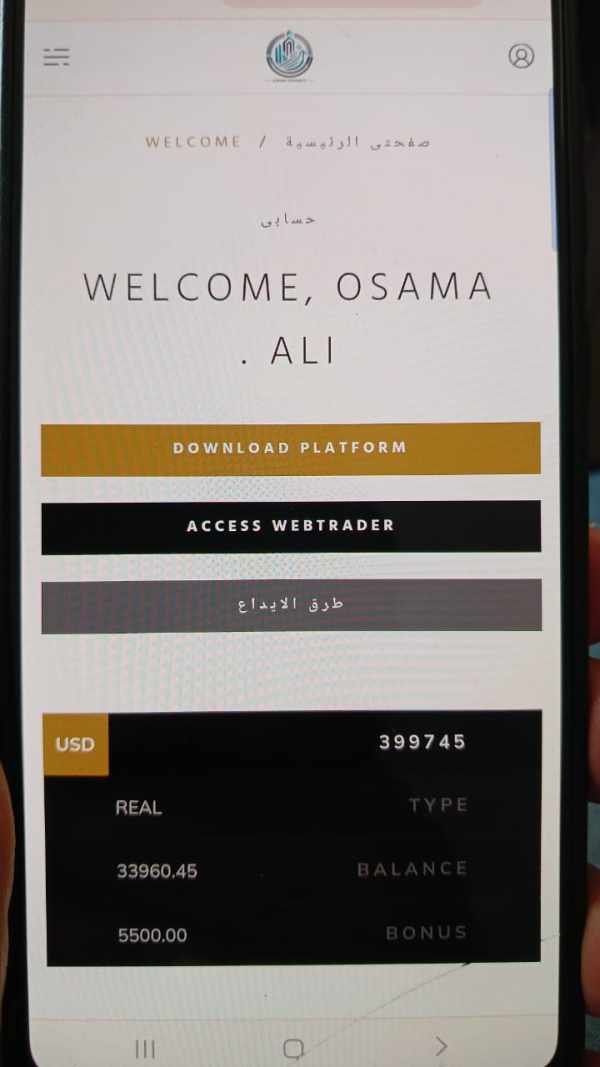

ajman tadawul was founded in 2023. The broker is a new player in financial markets with headquarters in the United States that tries to position itself as important in forex and stock trading. It offers different account types for various trading styles. The business model focuses on easy access to global markets with high leverage options up to 1:400 and commission-free trading. However, the broker lacks clear operational data and verified regulatory backing, which is a critical problem for potential clients. Public information suggests the broker markets itself as modern, but key details about operations remain unclear and hard to verify.

The broker targets forex and stock traders by using high leverage and zero commissions to appeal to risk-taking traders. The lack of detailed information about specific trading platforms makes the overall picture more complicated and concerning for potential users. The broker presents itself as versatile for various asset classes, but it lacks transparency about regulatory oversight and detailed account requirements. This ajman tadawul review uses multiple user reports and expert testimonials to show that while some features seem appealing, potential clients should be very careful about the serious risks of using this platform.

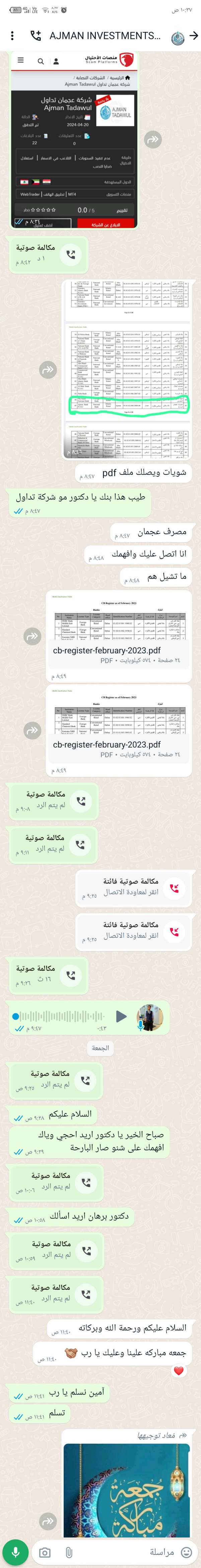

ajman tadawul's regulatory jurisdiction remains unclear. No specific regulatory body is mentioned in available data, which leaves the broker without clear oversight that traders need for protection. This lack of accountability creates serious concerns for traders who need regulatory safeguards to protect their investments and makes it hard to verify if the broker's practices are legitimate.

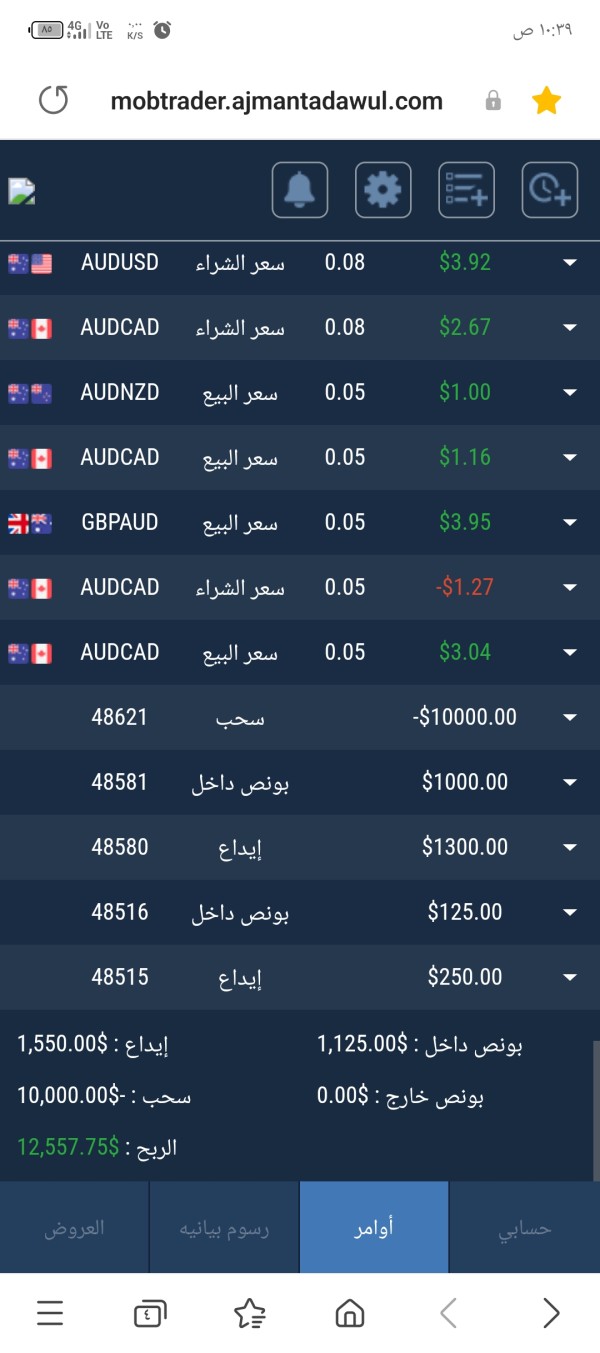

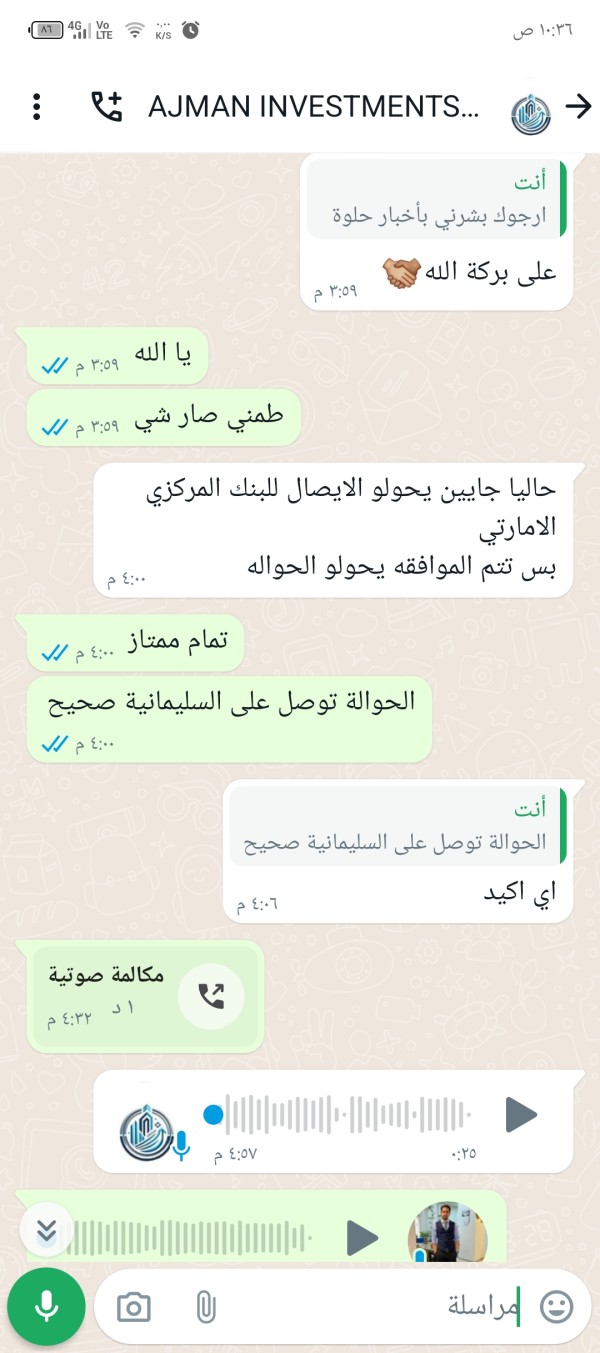

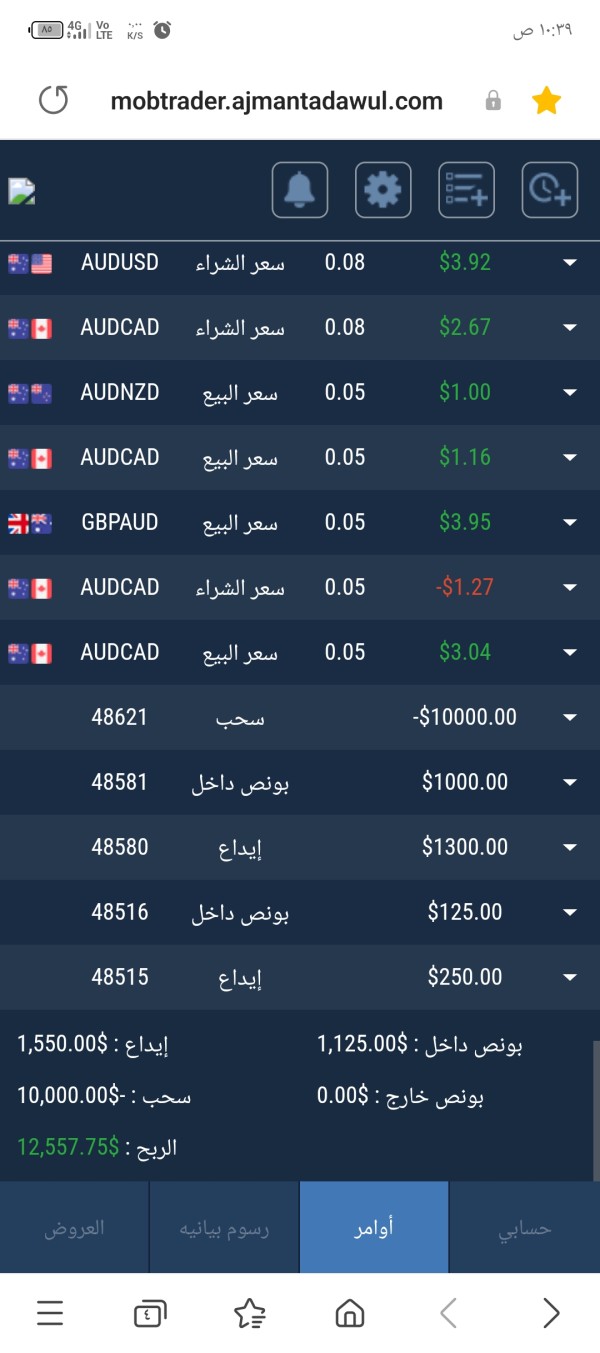

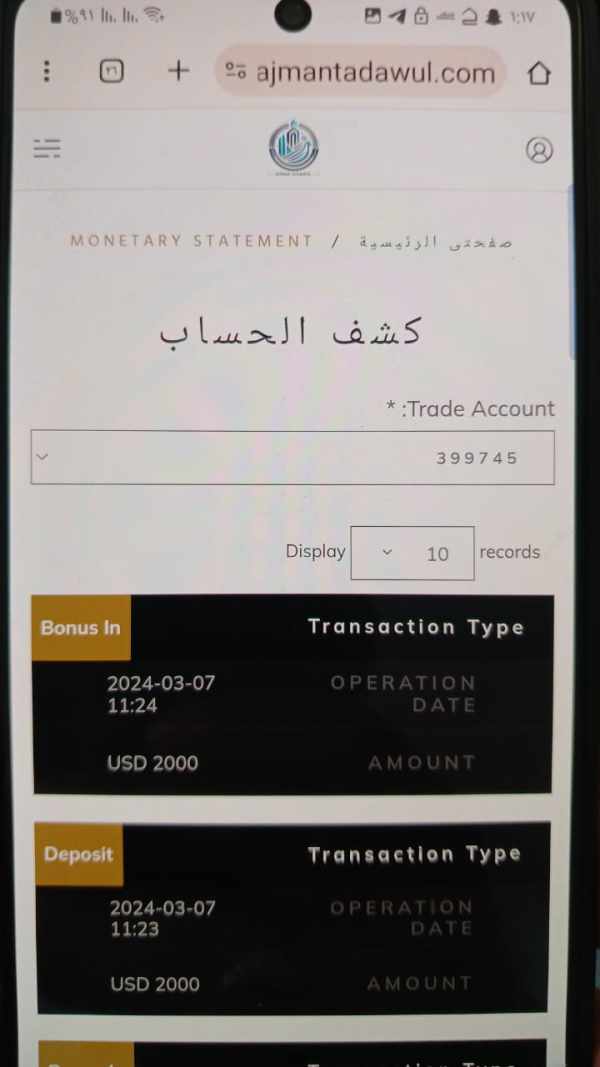

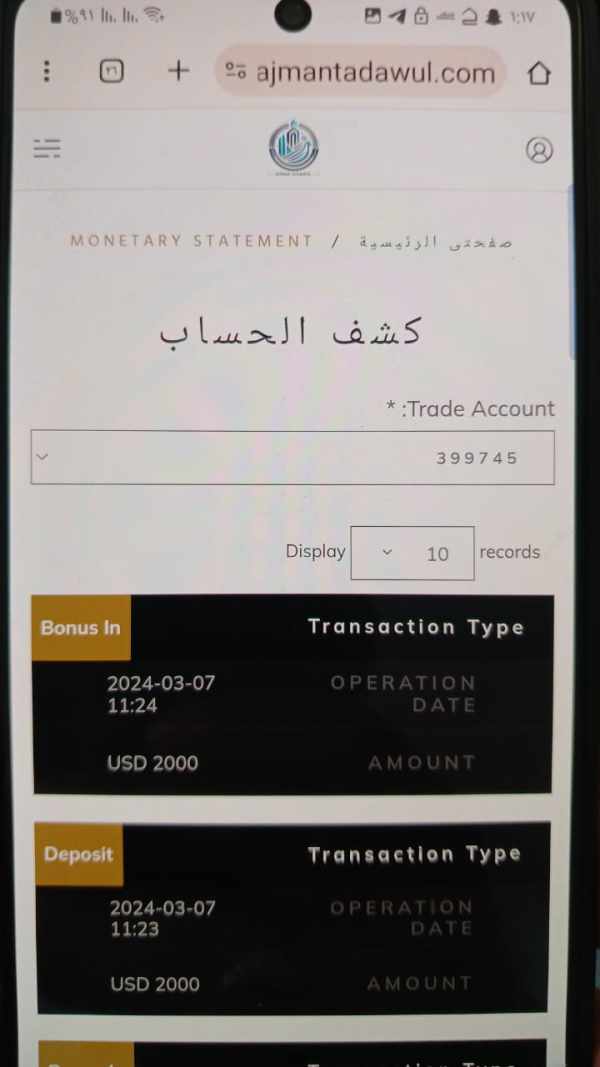

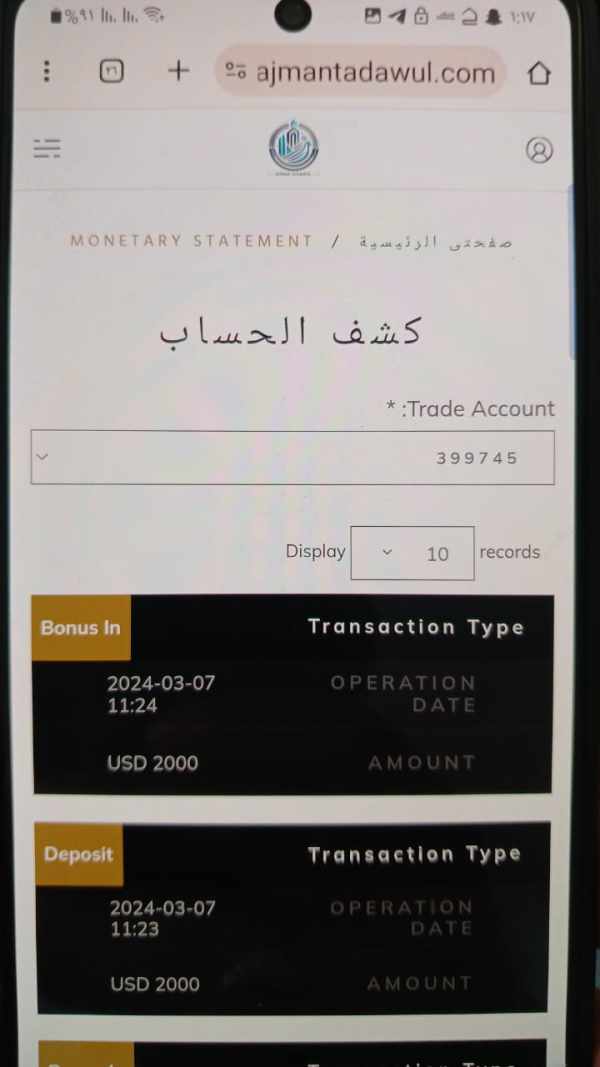

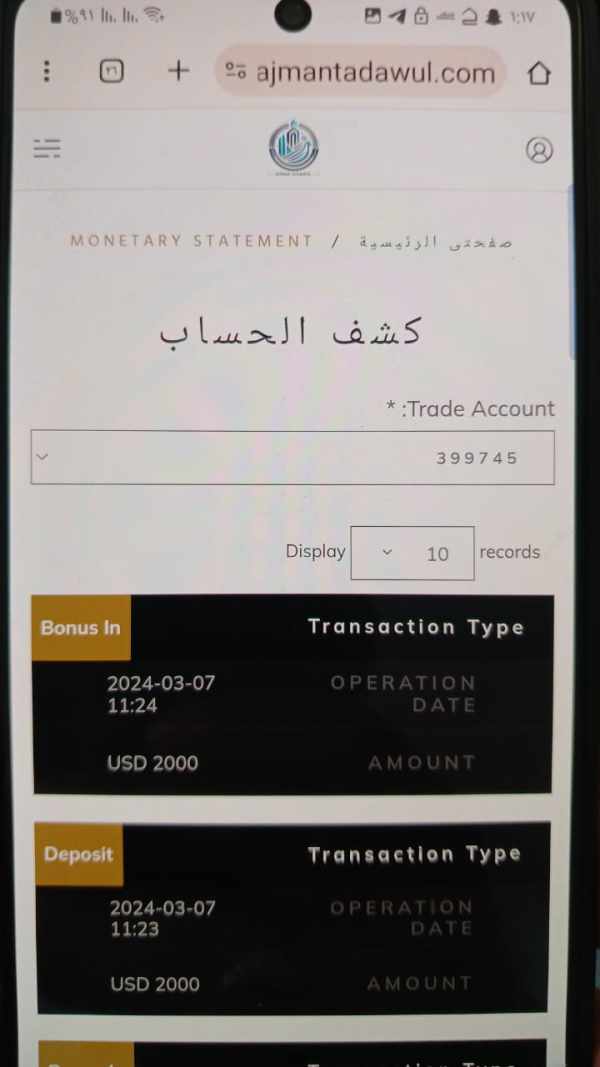

There is little detailed information about deposit and withdrawal methods in public sources. The reviewed sources don't provide specifics about available payment methods or typical processing times, which adds to the broker's operational opacity and makes planning difficult for traders. No details were provided about minimum deposit requirements either. This missing information prevents potential traders from understanding their upfront financial commitments and planning accordingly.

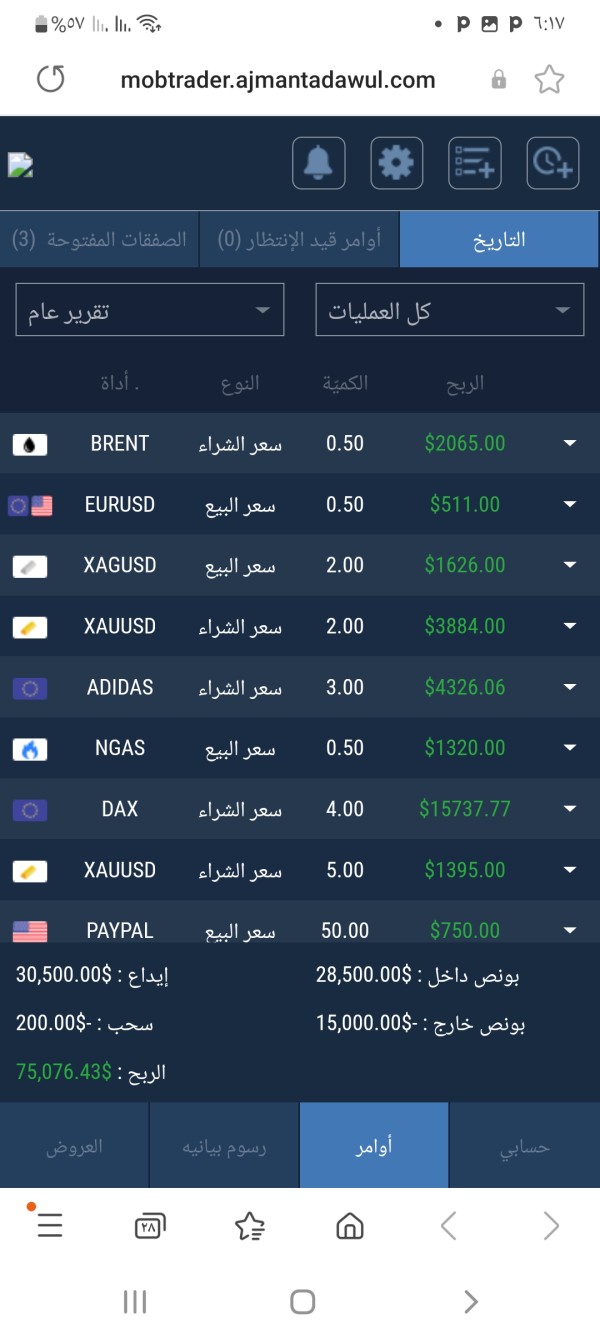

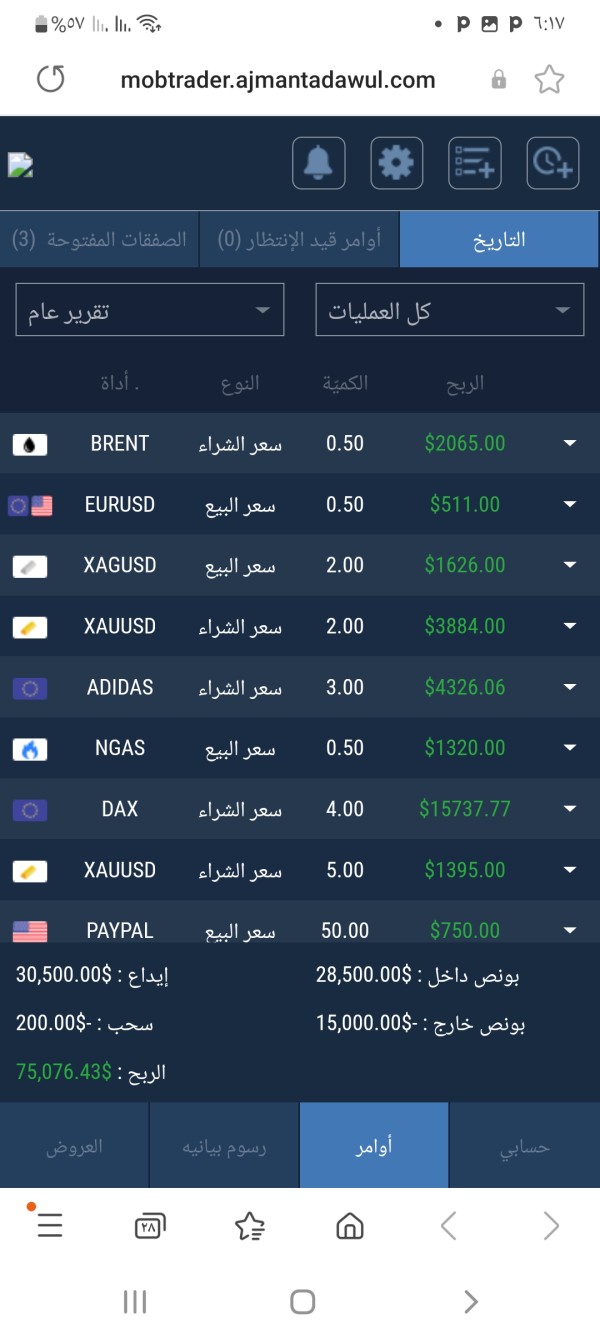

The promotion of bonuses and special offers is another area where data is surprisingly limited. No mention of any bonus or promotional activity exists, which leaves traders without knowledge of potential financial incentives that might be available. The asset classes for trading are mainly limited to forex and stocks according to user reports. The cost structure is noted as commission-free, but details about spreads or hidden fees are not disclosed, which could negatively affect cost predictability for users who need to plan their trading expenses.

One clearly communicated feature is the leverage ratio, advertised at up to 1:400. This high leverage offers considerable potential reward but comes with significantly increased risk that traders must carefully consider. Information on specific trading software or platforms remains undisclosed according to the review. No details have been provided about regional restrictions or preferred languages for customer support. This ajman tadawul review shows that while some attractive features exist, critical operational aspects remain largely unspecified or marked as "information not mentioned" in available sources.

Detailed Scoring Analysis

2.6.1 Account Conditions Analysis

The ajman tadawul review shows significant problems when assessing account conditions. The broker doesn't provide detailed information about account types that traders would expect to see from a legitimate operation. There is a clear absence of specifics on minimum deposit requirements. This lack of transparency affects account opening procedures and makes potential investors feel uncertain about initial financial commitments they need to make. Essential details like spread information and Islamic account options remain undisclosed to potential clients. Traders have reported cases where advertised benefits didn't match account realities, which led to dissatisfaction and mistrust of the broker's promises.

ajman tadawul falls short compared to established brokers that offer clearly defined account tiers with transparent terms and conditions. Users have complained about lengthy and unclear registration processes that waste their time. Some noted that promised features were never fully realized after they opened accounts. This feedback, documented on platforms like fraudrecoveryexperts and dnbforexpriceaction, negatively affects perceptions of the broker's reliability and trustworthiness. The insufficient transparency and missing information in account conditions significantly lower ajman tadawul's appeal for experienced traders who know what to expect.

The ajman tadawul review shows moderate performance in tools and resources, earning 5 out of 10 in this area. The broker claims to support diverse trading strategies, but available information doesn't list specific trading tools or analytical software that traders expect from modern brokers. There is a clear lack of detail about research and educational resources supposedly available to clients. Critical features like automated trading support remain completely unaddressed in their marketing materials.

The absence of detailed descriptions of market analysis tools is particularly concerning given how important these resources are in today's fast-paced markets. Investors looking for technical analysis, research updates, or basic educational content may find that ajman tadawul falls short of reasonable expectations for a modern broker. Some traders appreciate the simplicity of commission-free trading, but the lack of robust educational tools or comprehensive market news feeds is a significant drawback that limits their trading potential. The reliance on generic claims without clear, demonstrable features leaves users questioning the overall quality and utility of available resources. This information gap puts ajman tadawul at a disadvantage compared to transparent brokerage services that offer rich, user-friendly platforms with comprehensive tools.

2.6.3 Customer Service and Support Analysis

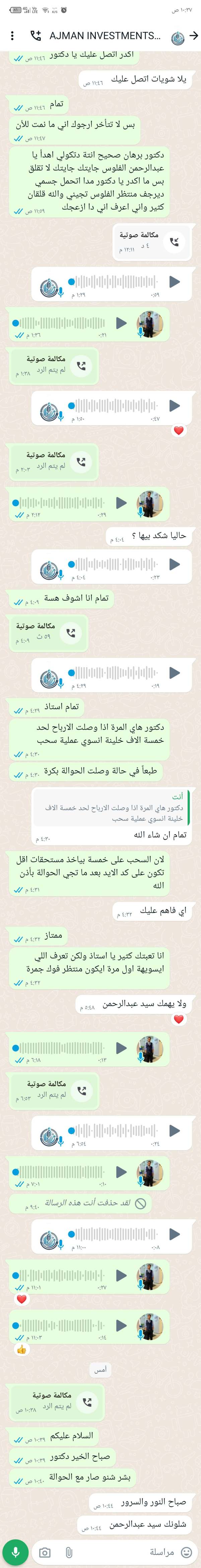

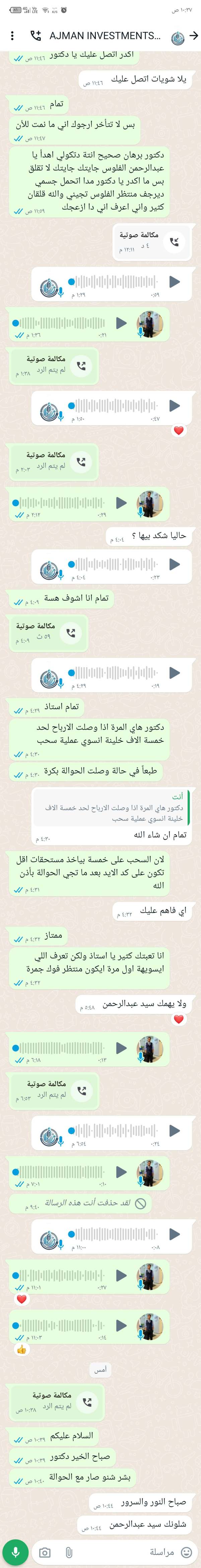

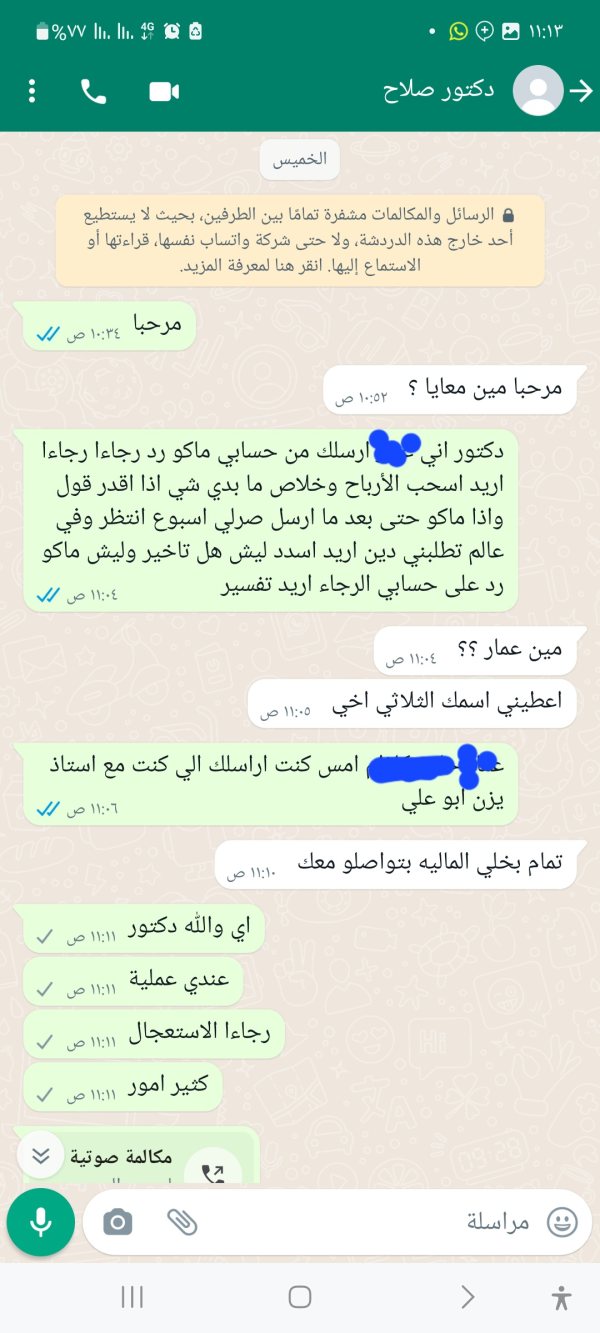

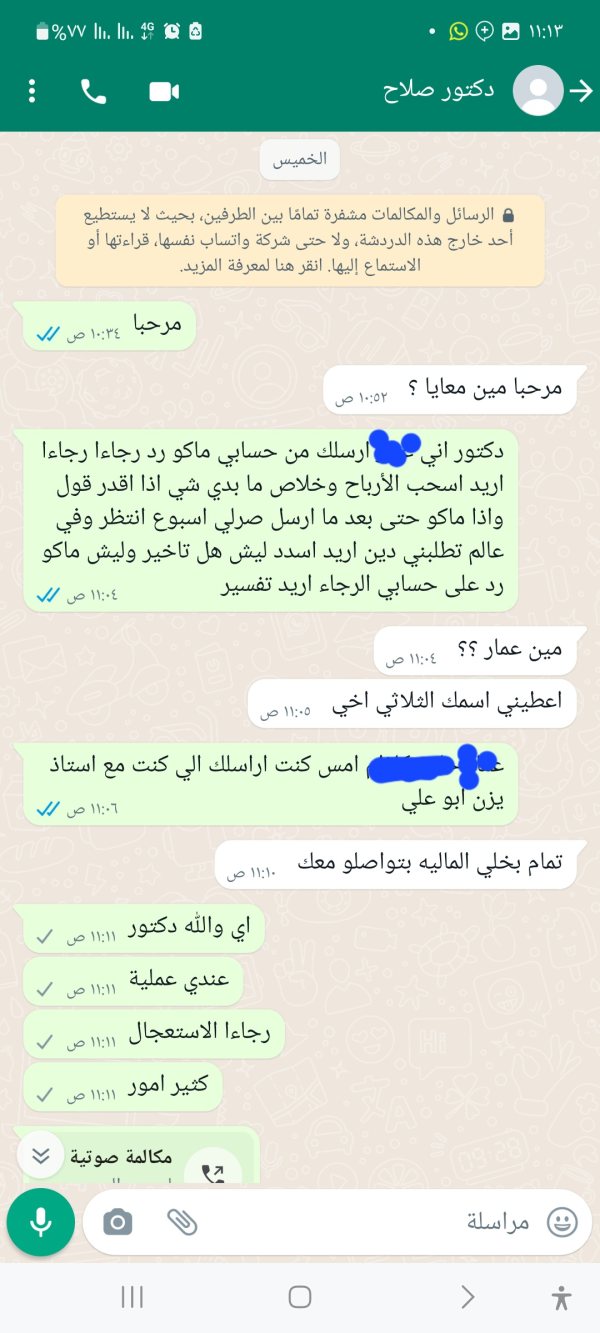

The ajman tadawul review consistently finds numerous problems in customer service and support. There is little to no detailed information about communication channels available for customer support, which makes it hard for traders to get help when needed. Users frequently report long response times and overall lack of proactive engagement from the support team. Multiple clients mention that it takes far too long to get timely assistance, especially during urgent market situations when quick responses are critical.

The lack of adequate 24/7 customer service, combined with unspecified operational support hours, further hurts the broker's credibility with traders who need reliable support. The absence of clearly described multi-language support options creates additional challenges for international traders who may not speak English fluently. The broker fails to provide detailed information about after-hours support or escalation procedures. This compounds the issue and leaves traders to handle potential technical or financial concerns without adequate help when they need it most. Negative user testimonials from various online sources show repeated instances of unresolved queries and delayed responses. These consistent issues highlight a significant gap in service quality that could be harmful to traders in volatile market conditions.

2.6.4 Trading Experience Analysis

The trading experience offered by ajman tadawul appears suboptimal in several important areas according to this ajman tadawul review. The platform's stability, speed, and execution quality are not explicitly detailed, which forces traders to rely on user testimonials that indicate frequent issues like order execution delays and potential re-quotes. The lack of transparent information about user interface, available order types, and overall platform functionality undermines trader confidence significantly.

Some users reported that the absence of commission charges initially created an appealing environment for trading. However, technical shortcomings and unstable performance ultimately damage the overall trading experience and make it frustrating to use. Critical aspects like mobile trading capabilities and trading software efficiency remain largely unaddressed in available information. This lack of detailed operational and technical information means traders might suffer from unpredictable execution quality that could cost them money. In fast-moving markets, a robust and reliable platform is essential for success. ajman tadawul's vague descriptions create a significant barrier to building trust among users who need reliable performance. The limited information provided doesn't inspire confidence and forces traders to seek alternative, more established platforms where performance metrics are transparent and verifiable.

2.6.5 Trustworthiness Analysis

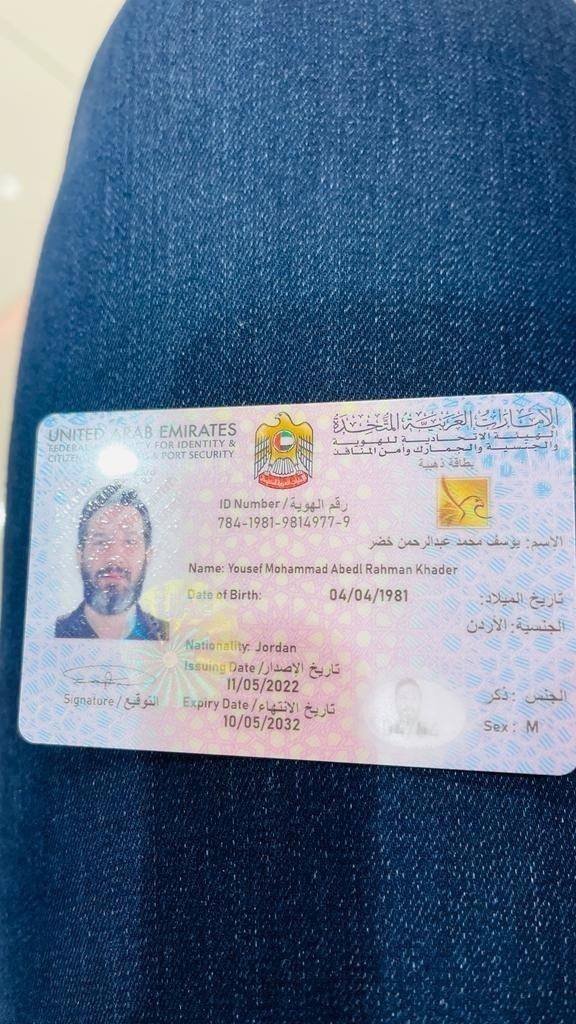

Trustworthiness is the most critical metric for any brokerage, and the ajman tadawul review paints a very concerning picture in this area. The broker's lack of registration with any reputable regulatory agency is a core issue that severely undermines investor confidence and safety. With no clear oversight from a recognized regulatory body, clients are left vulnerable to potential fraud and unethical practices that could result in significant financial losses.

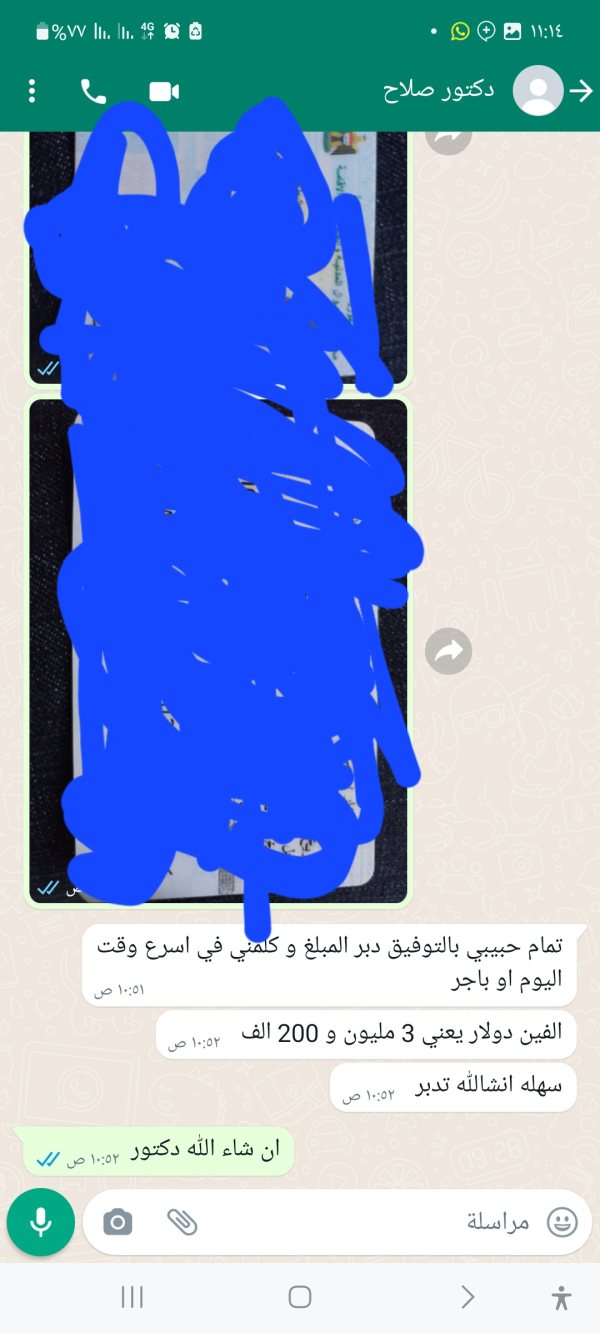

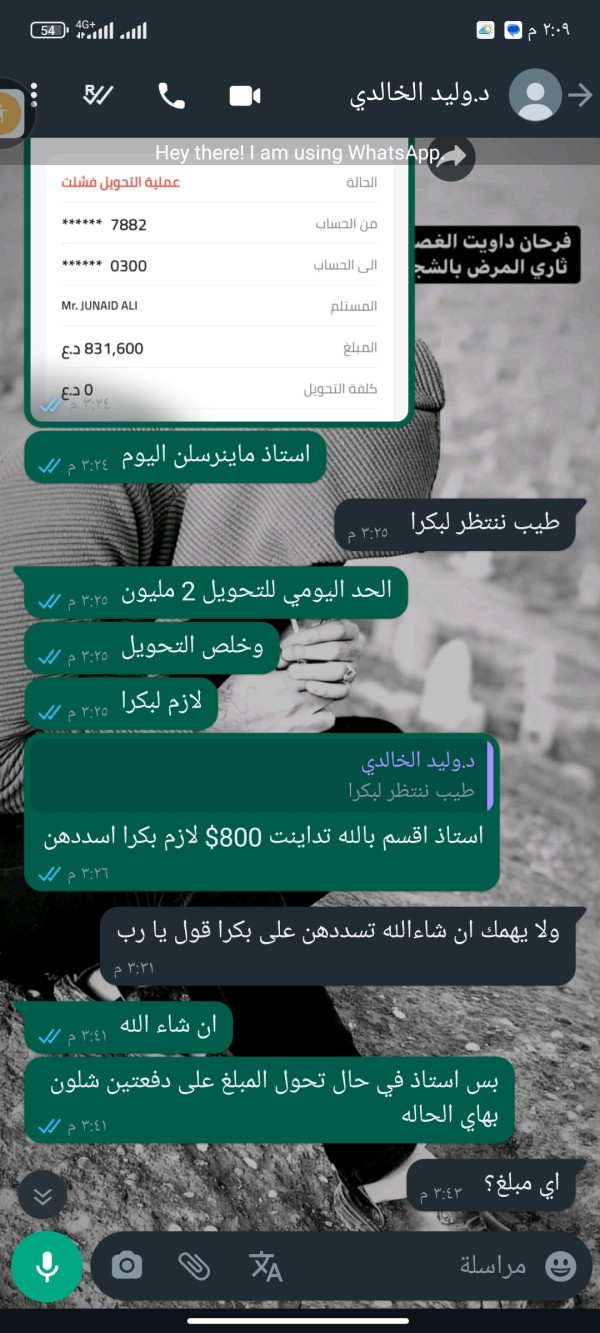

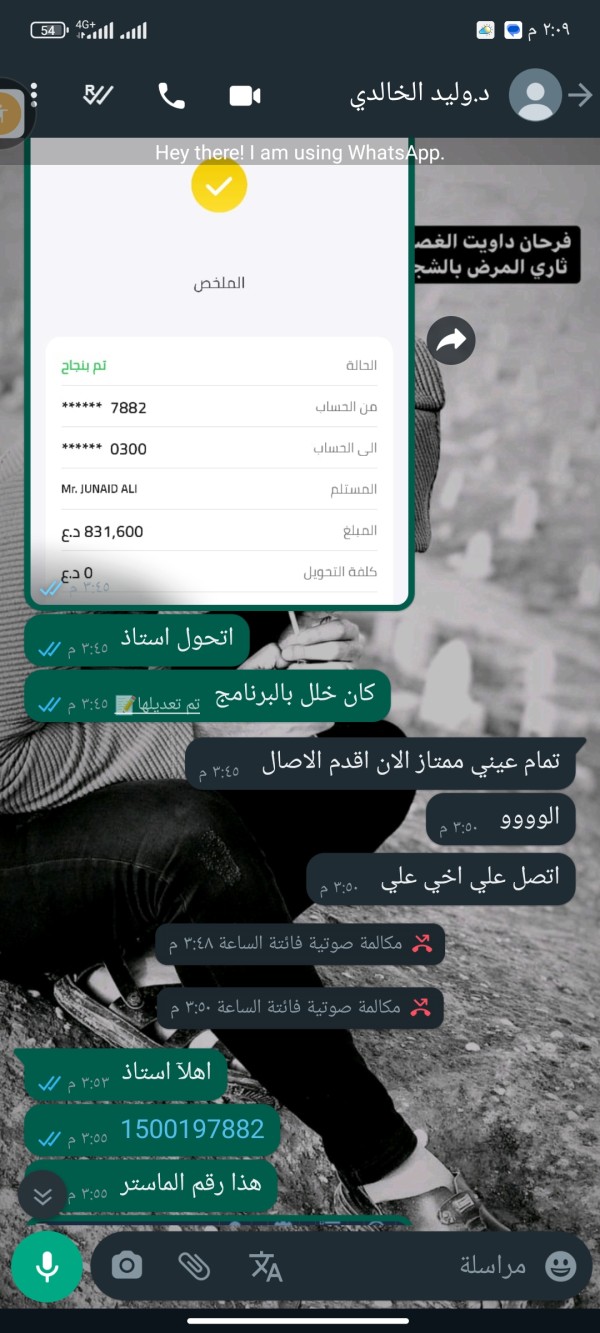

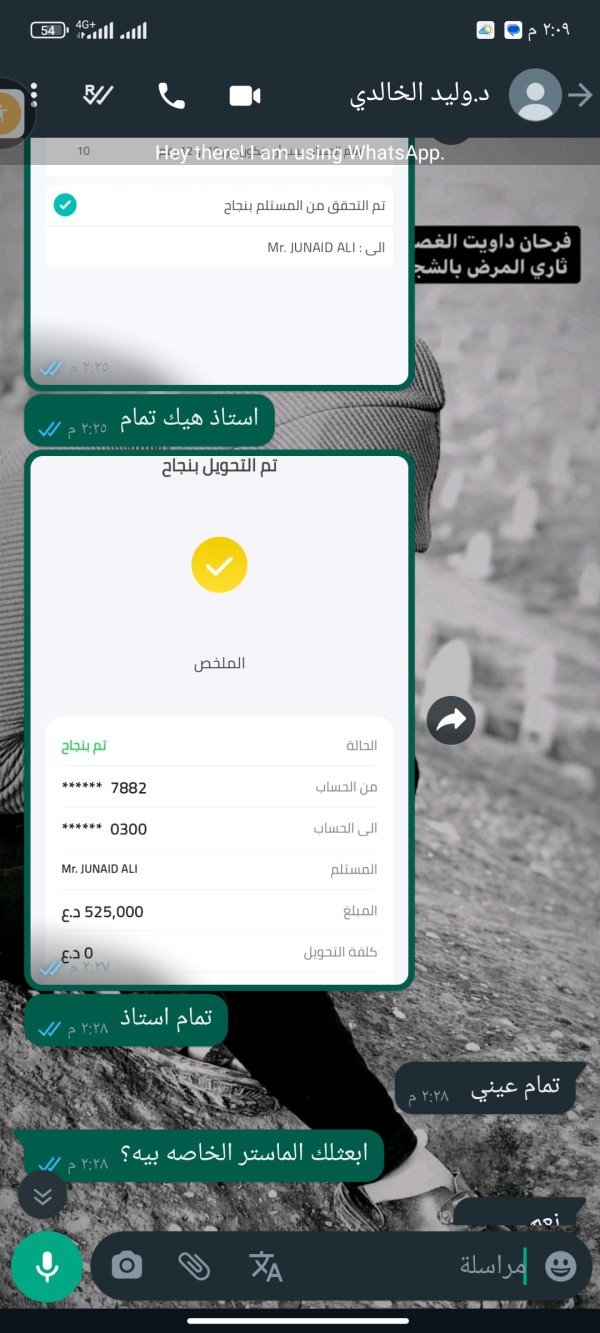

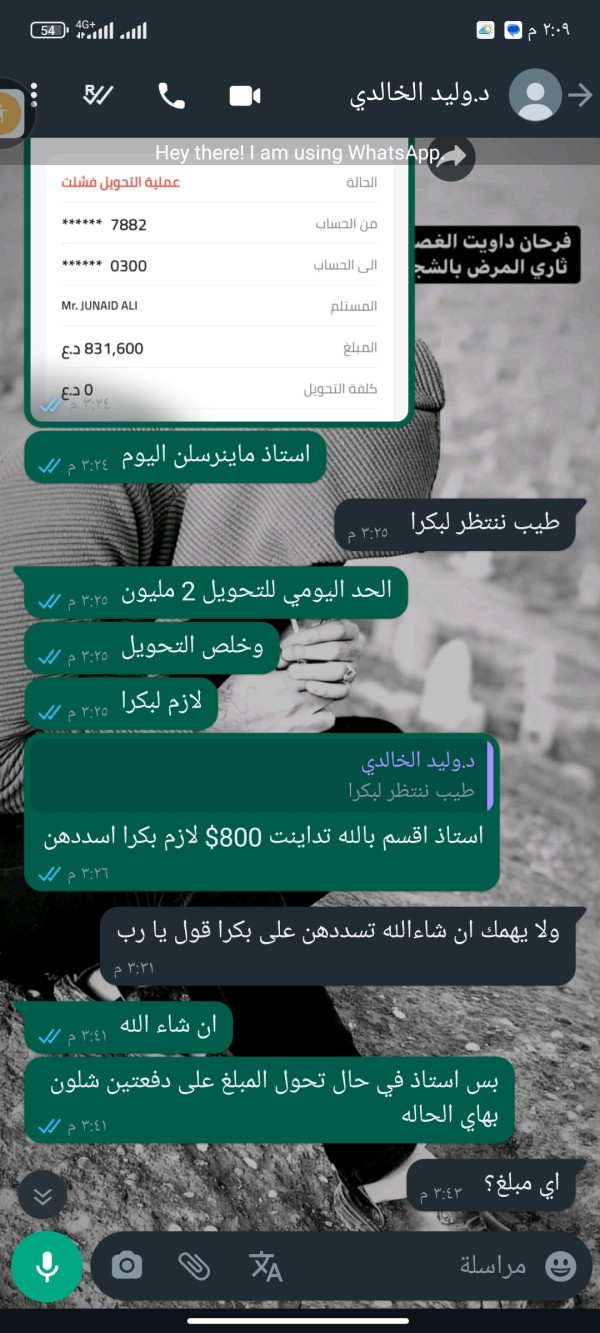

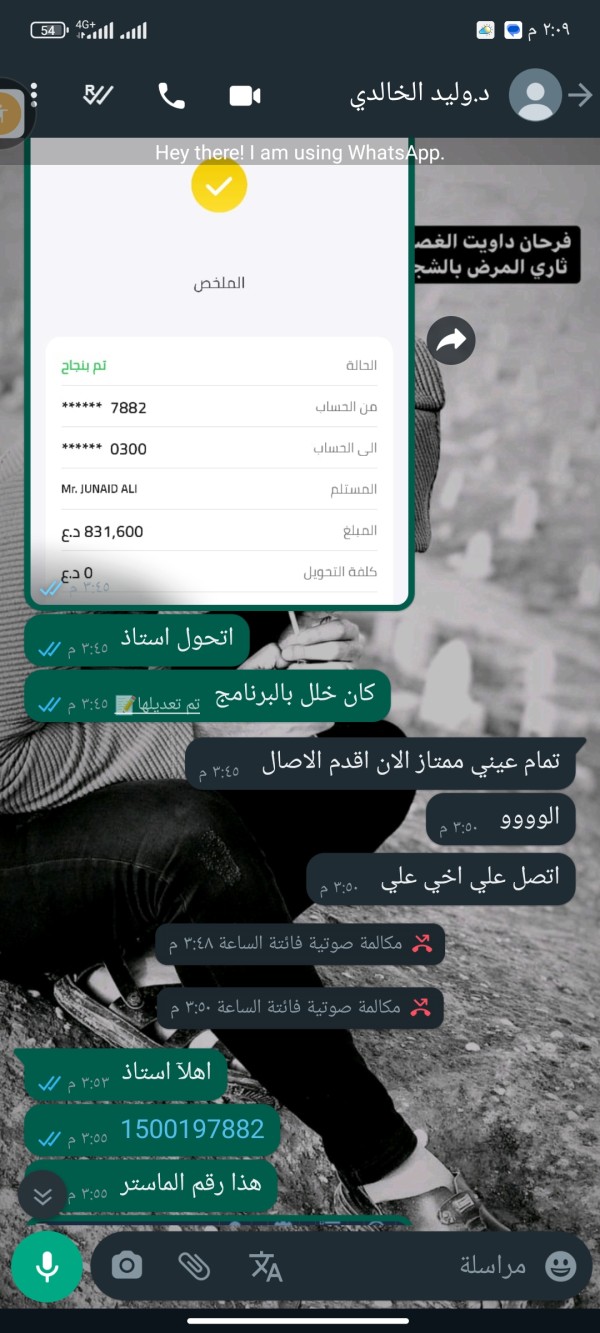

Multiple user reviews and reports have flagged instances where funds were mishandled and complaints were ignored by the support team. The overall transparency of company operations is questionable, with many users pointing out that crucial details about fund security measures and company policies remain undisclosed to clients. The broker has been associated with several scam allegations, as reported by sources such as fraudrecoveryexperts and dnbforexpriceaction. These negative indicators make it hard for even risk-tolerant traders to trust ajman tadawul with their investments and money.

The documented mishandling of customer concerns and absence of clear regulatory approval combine to create a very low trust score. Without proactive measures to assure fund safety and regulatory compliance, the broker's reputation remains severely compromised and continues to deteriorate. This further warns potential investors about the serious risks involved in choosing this broker over more established and regulated alternatives.

2.6.6 User Experience Analysis

User experience with ajman tadawul remains notably poor according to various reports and user feedback. Overall satisfaction among users is low, primarily due to issues with interface usability, registration processes, and deposit/withdrawal efficiency that create frustration. Many traders have expressed frustration over the lack of streamlined registration or verification procedures. This delays their ability to start trading and wastes valuable time in fast-moving markets.

The platform's design and functionality are not sufficiently explained, which leaves users uncertain about how to navigate available tools and resources effectively. The overall user interface appears outdated and insufficiently intuitive, particularly given expectations established by modern fintech platforms that users are accustomed to. Difficulties with fund transfers and perceived neglect in addressing scam-related complaints contribute to overall negative sentiment among users. Comments across multiple online discussion boards and complaint sites indicate that while some traders might accept high-risk trading conditions, the experience provided by ajman tadawul doesn't meet baseline standards expected in today's competitive markets.

Consistent negative feedback about customer service and clarity of operational details further increases user dissatisfaction. This suggests significant room for improvement in terms of overall client experience and service quality that the broker has not addressed.

Conclusion

ajman tadawul's overall evaluation is markedly negative, with the broker facing significant scrutiny over regulatory shortcomings, poor customer service, and widespread fraud allegations. While high leverage of 1:400 and commission-free trading are attractive features, these positives are overwhelmed by inherent risks and operational opacity that make the broker unsuitable for most traders. This ajman tadawul review suggests that the broker is not recommended for traders with low risk tolerance who value safety and transparency. Prospective investors should consider the substantial drawbacks, including incomplete regulatory transparency and repeated negative user experiences, before engaging with this platform that has shown consistent problems across multiple areas of operation.